Defence stocks fly, Trump goes supersonic, and major earnings.

🗓 Morning, folks!

India’s defence stocks are in beast mode—and markets are taking notice.

💡 Spotlight: the Defence index has jumped 18% over the last six sessions, far outpacing the Nifty 50’s 3% rise in the same period. Top gainers include Cochin Shipyard, GRSE, MDL, HAL, Paras, Zen, and Data Patterns—some rising as much as 12% in a day.

Over the past month, the Nifty India Defence index is up 54%, compared to a 7% rise in the broader market. Strong order books, export momentum, and the government’s indigenisation push are fuelling the rally.

Let’s hit it!

1 Big Thing: Adani dives deep into undersea warfare ⚓

Adani Defence & Aerospace has signed a deal with US-based Sparton, a leading anti-submarine warfare (ASW) firm, to jointly develop and manufacture undersea warfare systems for India and global markets.

The deets: Sparton, owned by Israel’s Elbit Systems, will bring its proven ASW tech, while Adani will handle design, development, and local production for the Indian Navy.

The first product in focus?

- Sonobuoys—mission-critical devices used to detect, track, and locate submarines.

With this deal, Adani becomes the first private Indian company to offer indigenous sonobuoy solutions.

Why it matters: this marks a major step in India’s push to localise critical defence tech, especially in the strategic undersea domain. “In today’s maritime environment, this isn’t just strategy—it’s sovereignty,” said Jeet Adani, VP, Adani Enterprises.

Zoom out: Adani has been ramping up its defence play—partnering with Israel Weapon Industries to build rifles and machine guns, and Elbit Systems for Hermes drones and mini-missile drones. The undersea pact only deepens its foothold in India’s growing private defence ecosystem.

2. Cochin Shipyard steers into profit 🚢

Cochin Shipyard delivered a solid Q4, with profits up and repair revenues surging despite some shipbuilding hiccups.

By the numbers:

- Revenue rose 36.6% YoY to ₹1,757.65 crore from ₹1,286 crore

- Net profit grew 10% YoY to ₹287.18 crore vs ₹258.88 crore

- Operating margin fell to 23% from 29% YoY

What’s happening: the ship repair business did the heavy lifting this quarter, offsetting pressure from the shipbuilding side. The company’s been in the spotlight too, from the potential ₹10,000 crore HD Hyundai deal to a new partnership with Drydocks World in Dubai.

Zoom out: Cochin Shipyard has become a defence rally poster child post–Operation Sindoor. The stock is up 40% in a month and 1,500% over five years, firmly anchored in India’s maritime push.

While we are on earnings,

JSW Energy reported a strong Q4 as scorching demand boosted sales—even though margins cooled a bit.

By the numbers:

- Net profit: ₹408 crore, up 16.1% YoY

- Revenue: ₹3,189.4 crore, up 15.7% YoY

- EBITDA margin: 37.8%, down from 42.4%

What’s driving it: a hotter-than-usual March pushed electricity demand to 414 billion units, up 3.2% YoY—lifting the entire power pack, from JSW to Tata Power.

3. Trump lands a $200B UAE deal ✈️

President Trump just announced over $200 billion in new commercial deals between the U.S. and the United Arab Emirates—with aviation front and center.

The big one: a $14.5 billion aircraft deal between Boeing, GE Aerospace, and Etihad Airways.

Etihad is ordering 28 Boeing wide-body planes, including 787s and next-gen 777Xs, all powered by GE engines.

What it means: the deal boosts U.S. exports, supports domestic manufacturing, and deepens U.S.–UAE aviation ties. Etihad plans to add 20–22 aircraft in 2025 and scale its fleet to 170+ by 2030, mixing in Airbus A321LRs, A350s, and more 787s.

Why it matters: this is part of Abu Dhabi’s economic diversification, and for the U.S., it fuels aerospace growth and strengthens geopolitical ties. The White House called the 777X inclusion a strategic signal of deeper cooperation.

Zoom out: this comes right after Trump’s $96 billion Boeing deal with Qatar Airways and a U.S.–UK trade pact. For Trump, it’s a global business tour—and a push to reassert U.S. commercial dominance abroad.

4. Groww scoops up Fisdom in ₹1,280 Cr deal 💰

Fintech platform Groww is acquiring wealthtech startup Fisdom for $150 million (₹1,280 crore) in an all-cash deal, pending regulatory approval.

Why Fisdom: founded in 2015, Fisdom offers mutual funds, stocks, bonds, tax filing, and portfolio management. It boasts 1M+ active users and tie-ups with 15+ banks, including PNB and Indian Bank, giving it deep reach across Tier 2 and 3 cities.

What Groww gains: the deal gives Groww a foot in the full-stack wealth management game. With Fisdom’s distribution muscle and product range, Groww can go beyond DIY investing to offer advisory, tax, and PMS services, a big jump in product depth.

Zoom out: Fisdom had raised $42M from the likes of PayU and Quona Capital and was last valued at $102M in 2022. Groww is now acquiring it at a 50% premium.

This is Groww’s second big move after buying Indiabulls AMC in 2023.

5. Stocks that kept us interested 🚀

1. Bharat Electronics bags ₹572 cr orders

Bharat Electronics Ltd (BEL) has secured new defence orders worth ₹572 crore since April 7, including high-tech systems like drone detection (IDDIS), AI solutions for naval ships, software-defined radios, simulators, jammers, and comms gear.

This follows a ₹2,210 crore MoD contract last month for Electronic Warfare suites for the Indian Air Force’s Mi-17V5 helicopters, equipped with radar warning, missile approach, and countermeasure systems, co-developed with DRDO.

Why it matters: with conflict flaring along the western border, demand for home-grown defence tech has surged. BEL is firmly in the spotlight as India doubles down on Aatmanirbhar combat systems.

Stock check: BEL jumped 3.9% on Thursday, riding the broader defence rally after a renewed push for indigenisation in military hardware.

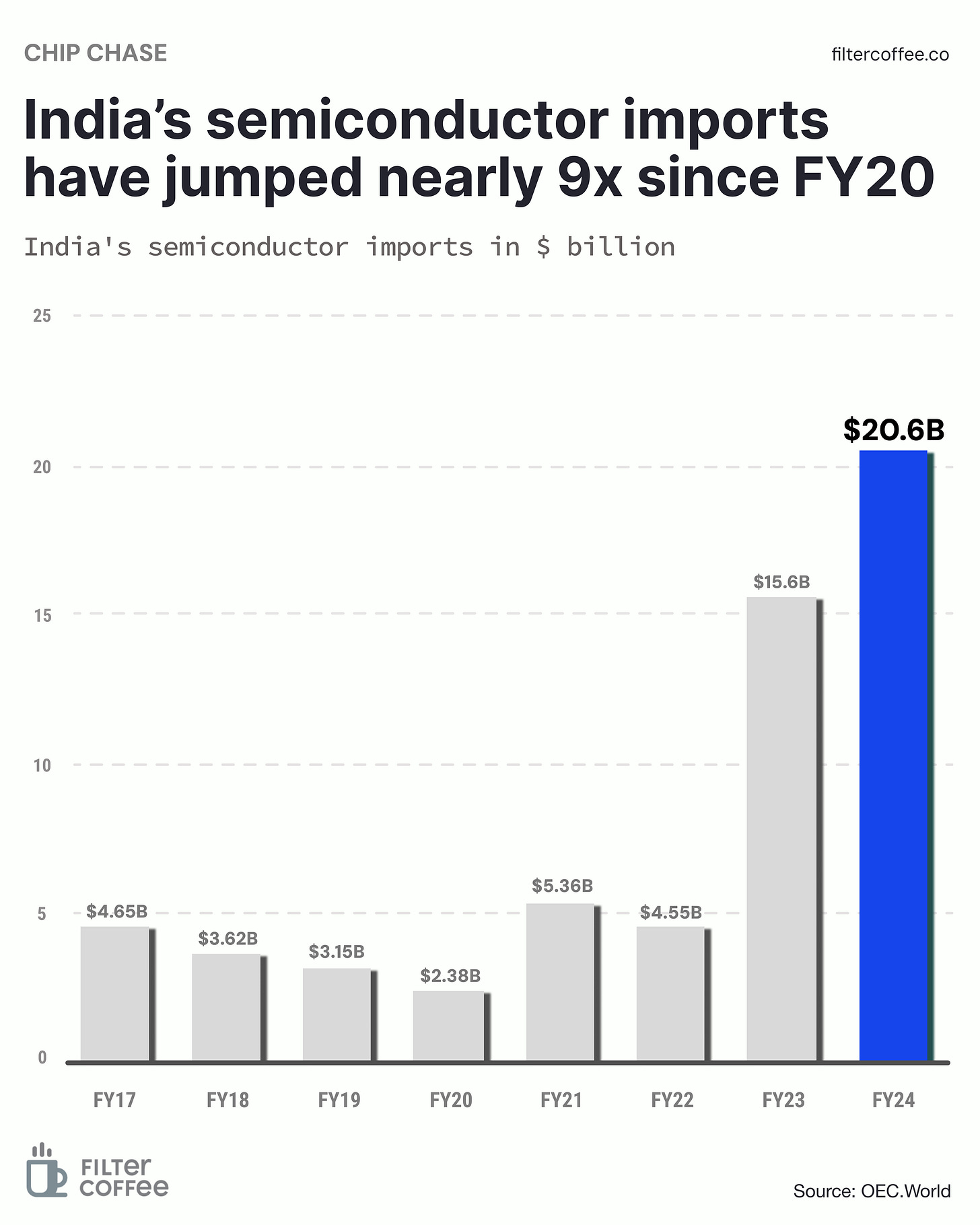

6. Story in data: Chip rush 📊

India’s semiconductor imports hit $20.6B in FY24, up from just $2.4B in FY20—a nearly 9x surge.

The jump mirrors India’s booming electronics and auto manufacturing, from EVs to smartphones. As factories scale up under Make in India, chips have become one of the country’s top import items. But it’s also a wake-up call: domestic chip production still lags far behind demand.

Bridging that gap is now a national priority.

What else are we snackin’ 🍿

🛫 Adani grounds Turkey: Adani Airports has terminated its ground handling deal with Turkey’s Celebi at Mumbai and Ahmedabad airports, citing rising India-Pakistan tensions.

💰 Forex shines: India’s forex reserves rose by $4.5 billion to hit $690.6 billion, their highest level in 7 months.

🏍️ India leads: India remained the world’s top market for electric three-wheelers in 2024, with sales rising nearly 20% to 7 lakh units, according to the IEA.

🛫 Apollo backs MIAL: Apollo Global is set to invest $750 million in Mumbai Airport bonds, part of Adani’s larger $1.5 billion funding plan for its airport business.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.