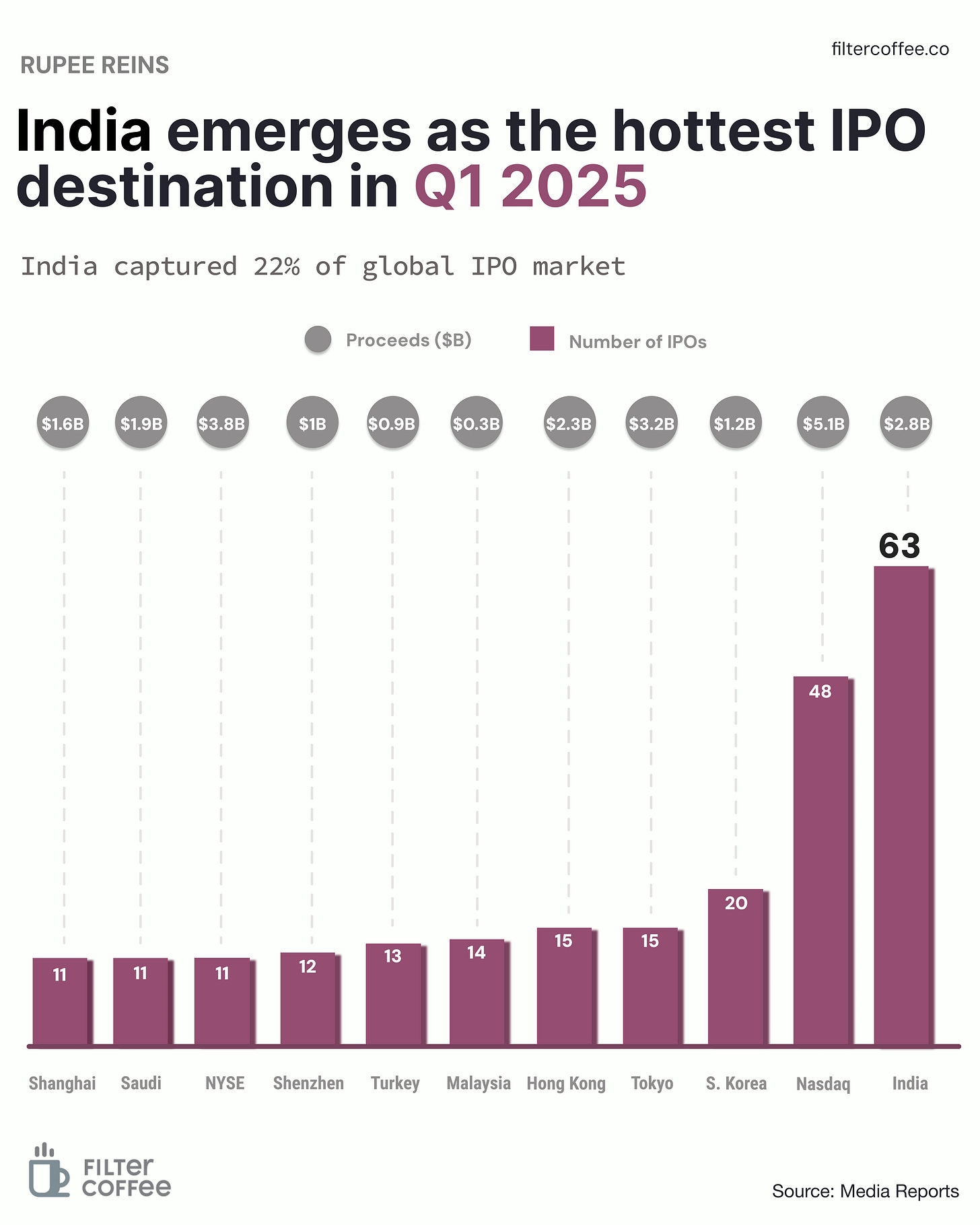

While global markets stayed cautious in Q1 2025, India went the other way, leading the world in IPO activity.

The deets: between January and March, India saw 62 IPOs raise $2.8 billion. This showed that investor appetite is alive and well, even as global markets stay jittery.

2024’s Blockbusters like Hyundai Motor’s ₹27,870 crore debut which was India’s biggest ever and Waaree Energies helped set the tone. Moreover, Hexaware Technologies’ $1 billion raise broke records for the largest Indian IT IPO, beating even TCS.

The how: India’s IPO boom is being powered by a mix of strong investor interest, simpler rules, and a supportive regulator.

Big theme: over 13 crore demat accounts and rising retail participation is at an all-time high, giving IPOs a strong domestic base.