Tata Power surges, ITC Hotels' solid Q4, Cochin Shipyard's big orders.

🗓 Morning, folks!

Markets bounced back strong, with a solid finish after a sharp start to the week. Sensex & Nifty ended more than 1% higher.

Cooling inflation, upbeat U.S. trade signals, and hopes of a rate-cut-friendly policy gave investors plenty to cheer. Talks of a potential India–U.S. trade deal lifted sentiment, with benchmark indices leading the charge.

💡 Spotlight: passenger vehicle sales hit a record high for April at 3.48 lakh units, up 3.9% YoY, powered by strong SUV demand. But two-wheeler sales slipped 16.7%, and three-wheelers dipped 0.7%, coming off a strong FY24 base.

Big picture: SUVs are doing the heavy lifting, while the rest of the auto market catches its breath.

Let’s hit it!

1 Big Thing: JSW eyes Dulux maker AkzoNobel India in ₹12,000 Cr deal 🎨

JSW Group is closing in on a deal to acquire a 75% stake in AkzoNobel India—the maker of Dulux paints—from its Dutch parent for around ₹12,000 crore.

Why it matters: this would mark JSW’s biggest move yet into the consumer-facing paints segment, where competition has intensified with new entrants like the Aditya Birla Group.

The acquisition would give JSW control of a national distribution network and the well-known Dulux brand, strengthening its hand in a sector still dominated by Asian Paints.

The deal setup: the deal is likely to be priced above AkzoNobel India’s ₹15,857 crore market value. To fund it, the Jindal family may sell 2% of JSW Infrastructure and bring in private equity partners.

Who else was in the race: JSW reportedly beat out final offers from Pidilite Industries and Indigo Paints, while earlier rounds saw interest from Blackstone.

The playbook: Sajjan Jindal is said to be personally leading negotiations, similar to his hands-on role during the 2022 Ambuja Cement bid, which was eventually trumped by the Adani Group. That ₹7 billion deal made Adani India’s second-largest cement player.

M&A momentum: JSW has been on an acquisition spree. Its renewable arm, JSW Neo Energy, is set to close a ₹12,468 crore deal for O2 Power this year. And in March, the group completed a ₹16,000 crore buyout of KSK Energy.

2. Tata Power charges up profits ⚡

1. Tata Power ends FY25 on a high-voltage note

Tata Power wrapped up the year with strong profits, record revenue, and big momentum in green energy.

By the numbers: Q4 profit jumped 25% YoY to ₹1,306 crore, while revenue rose 7% to ₹17,238 crore. FY25 revenue hit a record ₹64,502 crore, up 5% over last year.

What’s driving the charge: for the first time, Tata Power added over 1 GW of renewable capacity in a single year. That’s half of its 2 GW target for FY26. The rooftop solar business is scaling fast—1.5 lakh+ installations and 3 GW capacity. Its Tirunelveli plant delivered 3,291 MW in modules and 846 MW in solar cells this year.

Meanwhile, the Odisha distribution business is pulling its weight—profit tripled in Q4, and rose 43% for the full year.

While we’re on earnings...

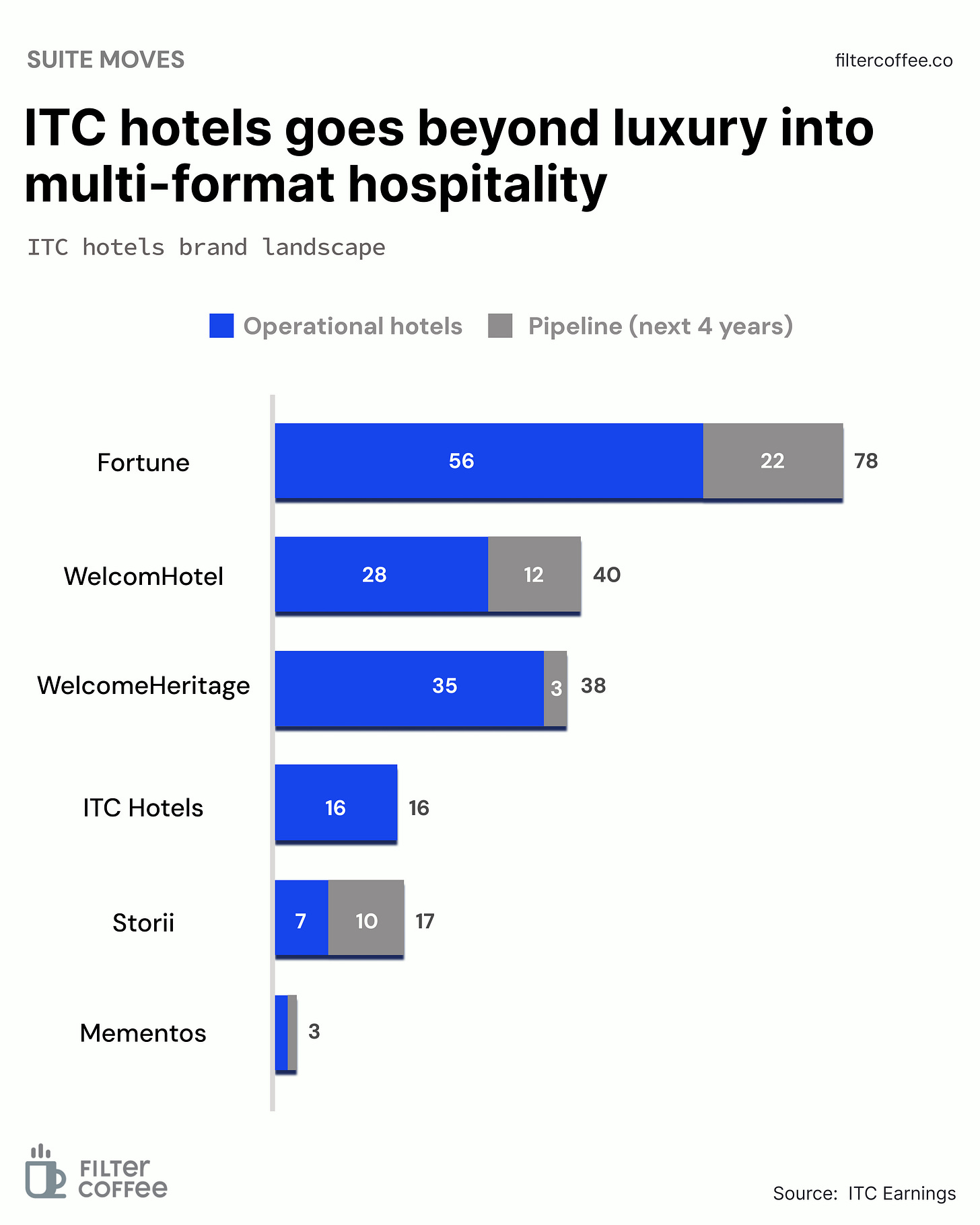

2. ITC Hotels stays steady, eyes expansion

ITC Hotels posted a solid Q4 in its first full year as a standalone company, and second quarterly report since the ITC demerger.

By the numbers:

- Profit: ₹207 crore, up 19% YoY

- Revenue: ₹1,043 crore, up 5.9% YoY

What’s happening: growth was modest this quarter, likely due to seasonal factors and a high base last year. Still, a nearly 20% profit jump in an off-season is a strong signal.

The company also approved a ₹328 crore investment to build a 200-room hotel in Visakhapatnam, fully funded through internal reserves and expected to open by 2029.

3. Tata AutoComp, Katcon sign a new deal 🚗

Tata AutoComp and Katcon Global have formed a joint venture to make lightweight composite parts for vehicles in the North American market.

What they do: Tata AutoComp is a subsidiary of the Tata Group, operating as its key automotive components arm, supplying parts to global vehicle manufacturers.

Katcon Global is a Mexico-based auto tech firm that specialises in exhaust systems, thermal insulation, and advanced composite materials.

The deets: the JV will focus on manufacturing advanced composite materials like strong, lightweight parts used in cars, trucks, tractors, off-road vehicles, and even non-auto segments.

Zoom out: globally, the advanced composites market is expected to reach $80+ billion by 2030, driven by demand in automotive, aerospace, and renewable energy sectors. For companies like Tata AutoComp, going lighter is the next big leap and this JV is a key step in that direction.

4. Stocks that kept us interested

1. Remsons races ahead with ₹300 cr deal 🚗

Remsons surged 14% after winning over ₹300 crore worth of orders from Stellantis North America, covering everything from smart cars to Jeeps.

The deets: Remsons makes control cables and automotive parts that help connect and operate key functions in vehicles like gears & brakes.

Remsons will supply control cables for Stellantis’ Smart Cars, Jeep models, and even three-wheelers. These are wires that connect pedals, gears, and brakes to ensure they respond properly when you drive.

These cables will be delivered over the next seven years, starting FY26. It’s a steady, long-term project, giving Remsons a major foothold in the North American auto market.

With automakers increasingly blending traditional mechanics with new tech, cable suppliers like Remsons are becoming more critical to global production lines.

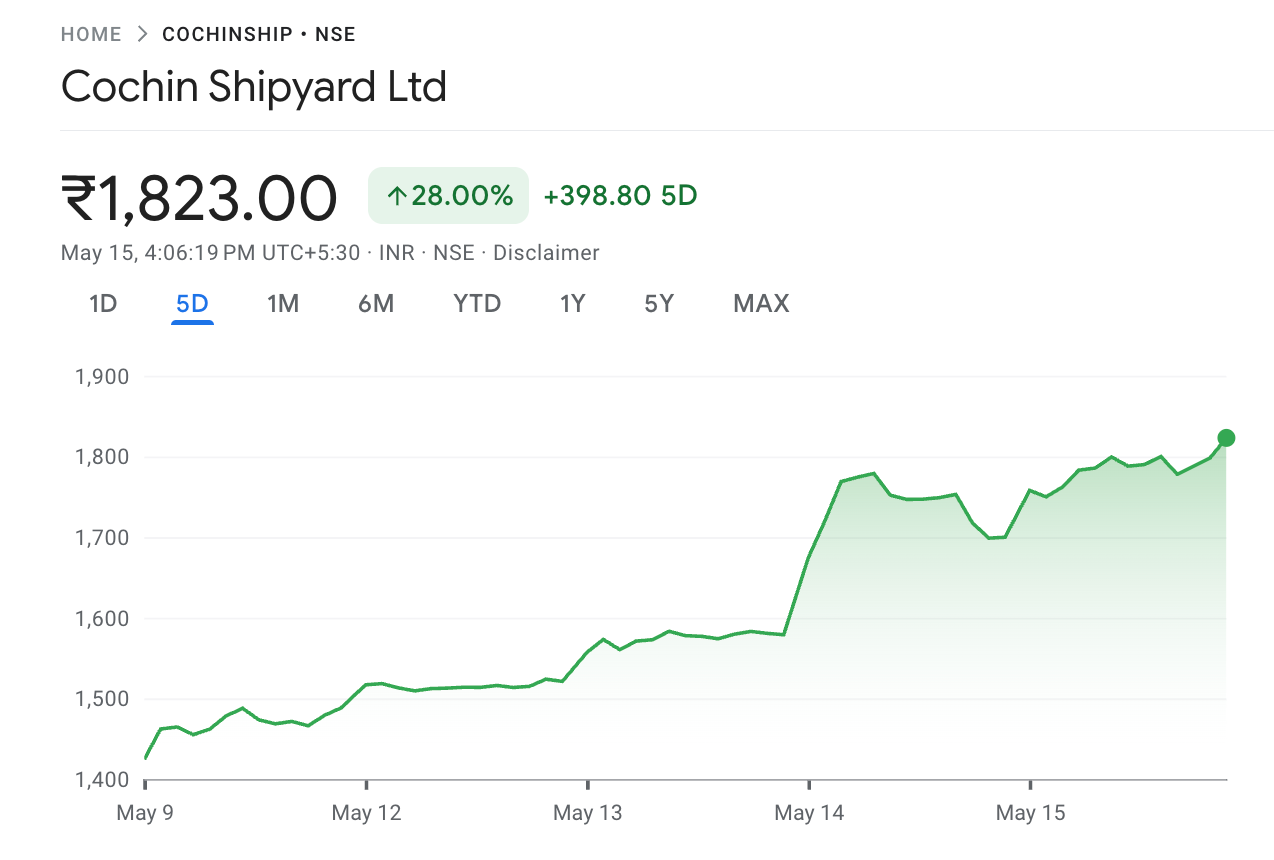

2. Cochin Shipyard jumps on mega project buzz 🚢

Cochin Shipyard surged over 7% after reports said it’s in talks with HD Hyundai for a potential ₹10,000 crore shipbuilding project.

What’s happening: post-market, the company clarified it’s exploring strategic partnerships with multiple global players, but discussions are still in early stages.

Cochin Shipyard, a government-owned company, handles commercial and defence shipbuilding. HD Hyundai—South Korea’s shipbuilding giant—is known for advanced cargo vessels, tankers, and offshore platforms.

Not the first move: back in Feb 2025, Cochin Shipyard signed an MoU with Maersk to explore shipbuilding and repair partnerships, part of a larger push to scale India’s maritime ecosystem.

Zoom out: the deal chatter fits neatly into the government’s Maritime India Vision 2030 and Amrit Kaal Vision 2047, both aiming to turn India into a top global shipping hub. Budget 2025–26 also backed the sector with incentives for ports and shipyards.

What else are we snackin’ 🍿

🖥️ Tech chapter: Wipro has partnered with Hachette UK to lead a digital transformation for one of the UK’s largest publishing houses.

⚡ Q-commerce streamlined: Unicommerce processed over 20 million quick commerce orders in FY25 via its Uniware platform.

🍎 Apple pushback: Trump told Tim Cook to limit Apple’s India factories to local demand and ramp up production in the U.S. after a tense exchange in Doha.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.