Defence stocks on fire, DMart disappoints, and Trump rescues Adani

🗓 Morning, folks!

The market ended the day on a high, hitting its best closing level of 2025, with the Nifty above 24,450. Sensex and Nifty gained nearly 0.5% each.

But the real party was in the broader markets, where the midcap index jumped 2%.

One of the big reasons was drop in crude oil prices.

Think of it like this, if oil gets cheaper, companies like Indian Oil, BPCL, and HPCL spend less on raw materials and make more profit. Even paint makers and airlines cheered the drop, because lower oil prices mean cheaper inputs and better profit margins.

💡 Spotlight: the orange man’s got a new enemy and that is foreign films.

Trump just proposed a 100% tariff on movies made outside the US. That means if you’re watching a Korean drama or a Shah Rukh Khan flick in America, it might soon cost as much as a Broadway ticket.

Let’s hit it!

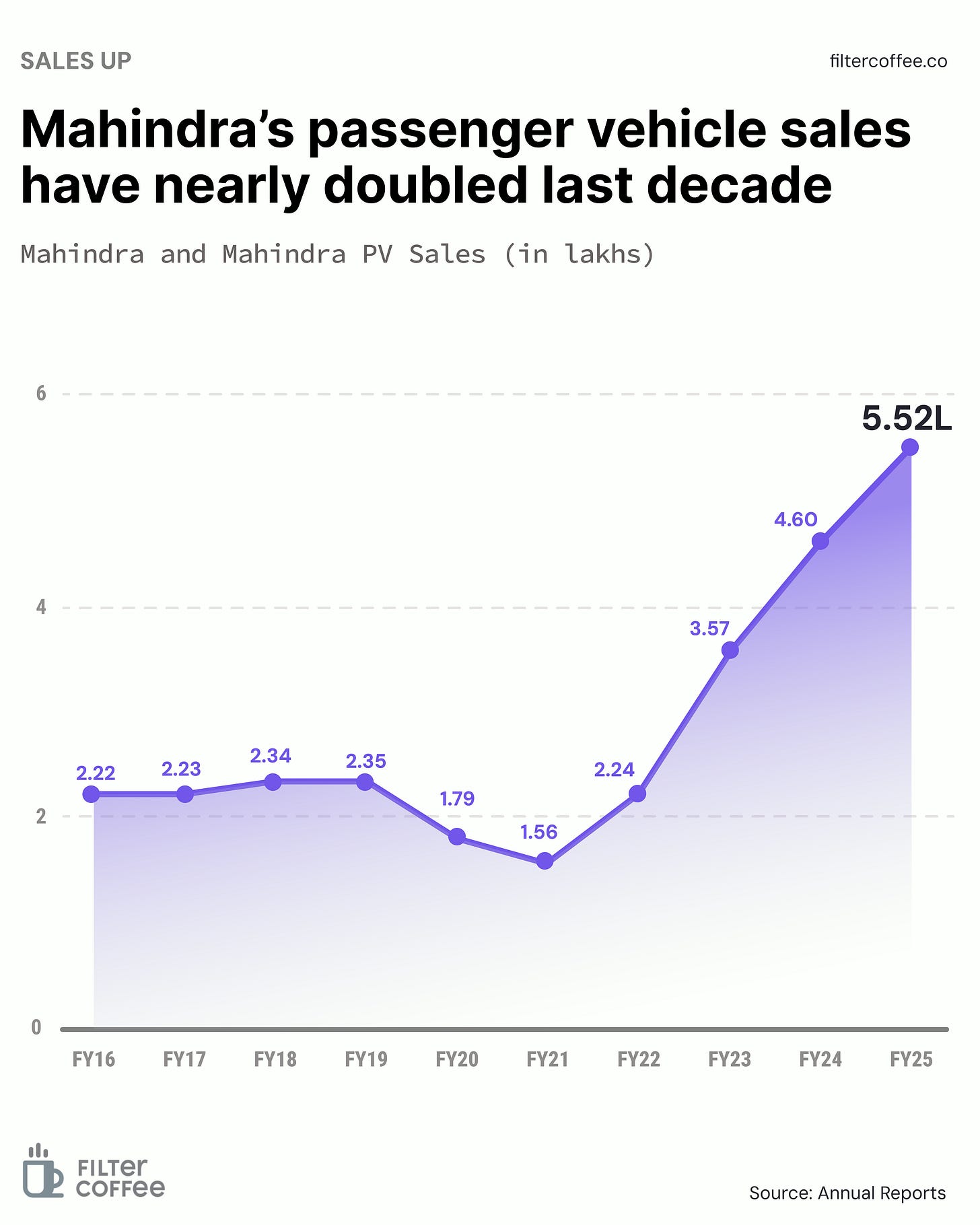

1 Big Thing: Mahindra hits top gear on Q4 earnings 📈

Mahindra & Mahindra's beat the street in Q4, delivering strong numbers across the board.

By the numbers:

- Net profit up 19.6% at ₹2,437 cr vs ₹2,000 cr (YoY)

- Revenue up 24.5% at ₹31,353 cr vs ₹25,183 cr (YoY)

The deets: M&M saw solid demand across its product lineup.

During the quarter, total vehicle sales grew 18% YoY to 2.53 lakh units, while tractor sales rose 23% YoY to 87,138 units.

Zoom out: M&M’s earnings tell us rural demand is alive and well, because tractors are a strong proxy for farm activity and rural income. On the other hand, SUVs continued to perform well in urban markets, with models like the Scorpio-N, XUV700, and Thar leading the charge.

The EV market witnessed significant growth, with passenger EV sales reaching 99,004 units in 2024, a 20% increase from the previous year.

Investors cheered the strong Q4 performance, sending the stock up nearly 3% in a show of confidence.

While we are on earnings,

DMart shared its Q4 results, and even though more people shopped, the profits didn’t go up much.

Net profit dipped 2% YoY, despite store growth and rising revenues.

Total revenue for FY25 came in at ₹59,358 crore, up from ₹50,789 crore last year.

Bottomline: DMart is still pulling in the crowds, but rising costs and competitive heat are eating into its profits.

2. Avaada makes a clean power play ☀️

Avaada Group is preparing for a ₹4,000–5,000 crore IPO for its solar module manufacturing unit.

The deets: Avaada Group is a clean energy company that develops solar, wind, green hydrogen, and sustainable fuel projects across India and global markets.

The why: the company is planning a 5 GW integrated solar module and cell plant in Uttar Pradesh, and the fresh capital will support this major capex push.

Why it matters: Avaada is betting big on becoming a full-stack renewable powerhouse, spanning solar, wind, green hydrogen, and ammonia.

It recently launched a 1.5 GW solar module plant in Dadri and is investing over ₹65,000 crore in renewable and hydro storage projects across Maharashtra and MP.

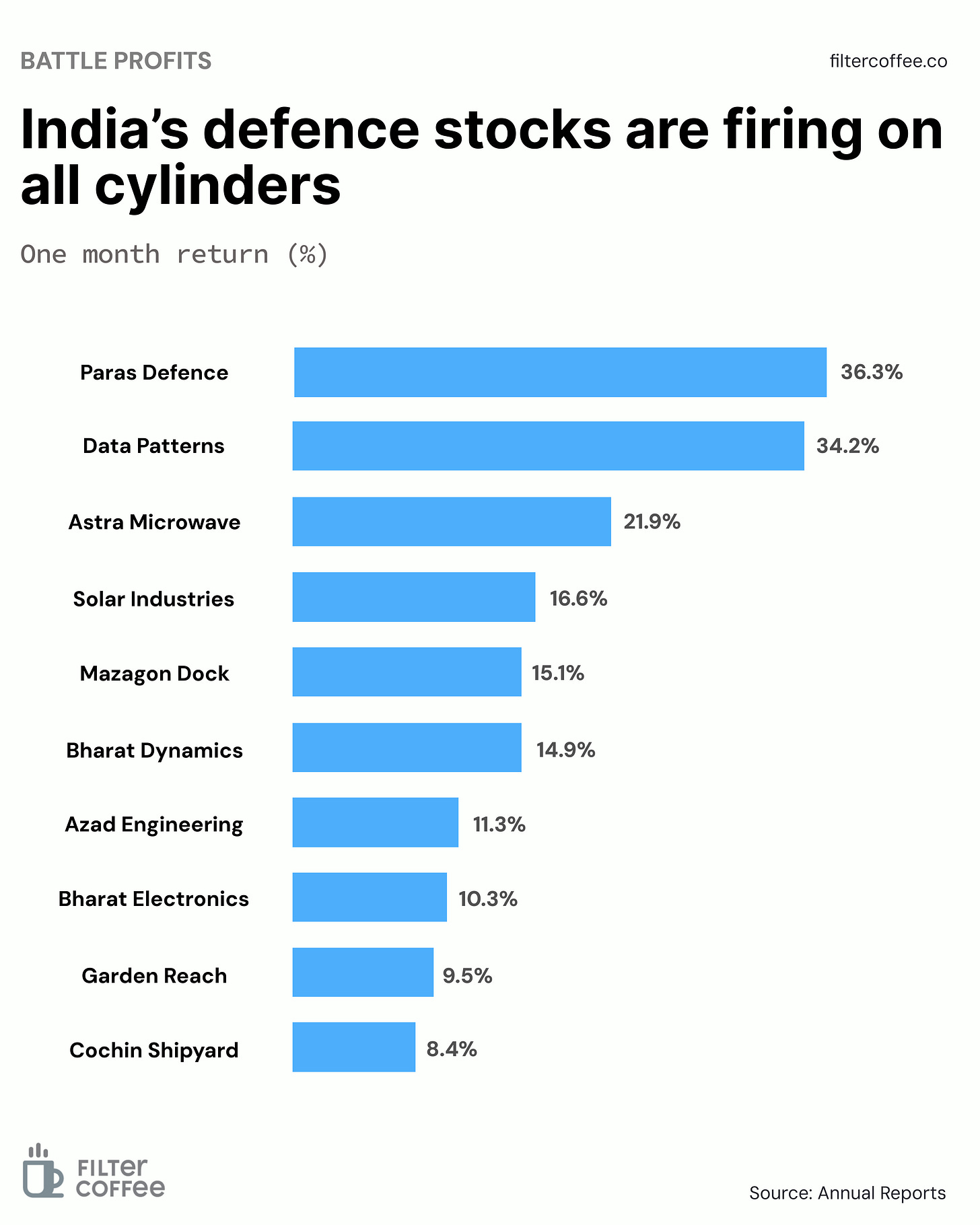

3. Defence stocks are going full throttle 🚀

Defence stocks are having their moment with the Nifty India Defence index hitting an all-time high.

The index soared nearly 7% last week, beating the flat Nifty 50.

With India-Pakistan tensions flaring up again and a wave of government orders rolling in, investors are locking in on the sector like it's radar-guided.

The deets: FY25 ended with a record ₹2.1 trillion worth of defence contracts—nearly double the previous high. And 92% of them went to Indian companies.

Just February and March alone cleared ₹1 trillion in deals. In March, the MoD signed off on ₹54,000 crore in capital buys—everything from BrahMos missiles to Netra aircraft and T-90 tank engines.

Big theme: big players like Bharat Dynamics are on track to double revenue, Solar Industries could see a 30% bump, and smaller names like Paras Defence clocked up to 90% profit growth in FY25.

Not just these but India's defence stocks are on a tear across the board:

4. Evera picks up where BluSmart left off 🚖

Electric cab startup Evera is taking over 1,000 cabs from BluSmart, which recently shut down services across NCR, Bengaluru, and Mumbai.

So far, it’s already taken possession of 220 cars and is in talks with lenders to lease the rest. Evera is also onboarding BluSmart’s drivers—150 already hired, with more expected soon.

Why it matters: BluSmart’s exit left a gap in EV ride-hailing. Evera is filling it fast, especially around Delhi airport, where it plans to scale daily B2C trips from 200 to 2,000.

The company is also ramping up its B2B game and doubling down on the airport cab market—where demand is high and margins are better.

Zoom out: as India’s EV mobility race heats up, Evera’s quick grab of BluSmart’s fleet could give it a serious head start.

5. Stocks that kept us interested 🚀

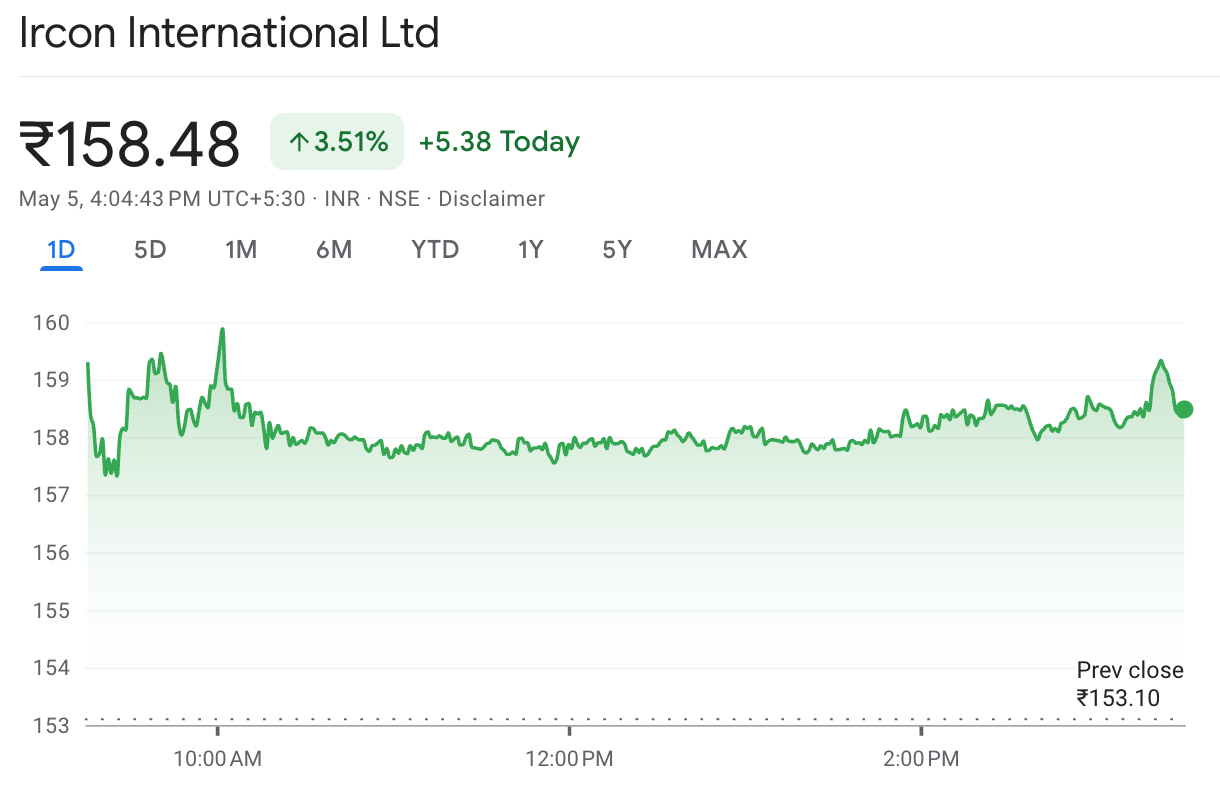

1. IRCON’s hydro power win in the hills 🏗️⚡

IRCON shares surged nearly 4% after the company won a fresh order worth ₹458 crore.

The deets: IRCON International is a government-owned engineering and construction company that builds large infrastructure projects, especially in railways and transport.

This new order is from North Eastern Electric Power Corporation Limited for the Tato-I Hydro Electric Project in Arunachal Pradesh.

The ₹458 crore contract involves civil construction work, everything from tunnels, pipelines, and surge shafts to the power house and all support structures.

Zoom out: the Tato-I Hydro Electric Project is a part of India's effort to tap the massive hydropower potential of the Northeast, particularly Arunachal Pradesh, which alone holds over 40% of India’s total hydro potential.

2. Apollo Micro expands into weapons & global defence markets

Apollo Micro Systems acquired a 100% stake in IDL Explosives for ₹107 crore in an all-cash deal.

The deets: Apollo Micro Systems builds advanced electronic systems for India’s defense, aerospace, and space sectors. IDL Explosives, on the other hand, manufactures industrial and military-grade explosives used in mining, infrastructure, and defense applications.

The why: with this deal, Apollo plans to integrate explosives into its defense product line. It can now develop and offer a broader range of systems used in missiles, heavy artillery, and high-impact weapons.

The move also opens the door to drone-based systems, warheads, and autonomous weapons. It improves Apollo’s chances of landing large-scale, high-budget defense contracts.

Apollo’s stock jumped 7% after the deal was announced.

What else are we snackin’ 🍿

🗣️ Adani rescue: Gautam Adani’s team reportedly met with Trump administration officials to discuss dropping bribery-related charges in a US investigation.

🚗 JLR returns: Tata Motors rose after reports that JLR may have resumed US exports, following Trump’s rollback of the 25% auto import tariff.

🛢️ Takedown: Shell, Reliance, and ONGC have finished India's first project to safely remove old oil and gas structures from the sea. The cleanup took place at the Tapti gas fields in the Arabian Sea.

💥 DRDO’s new mine: DRDO and the Indian Navy just successfully tested the Multi-Influence Ground Mine, a made-in-India naval mine designed to secure Indian waters.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.