Reliance’s Africa expansion, Infosys-Anthropic pact, and Delhivery’s EV boost.

🗓️ Morning, folks! ☀️

Markets closed in the green for the second straight session, helped by steady buying in index heavyweights and strong traction in broader markets.

Sensex and Nifty gained 0.2% each.

Stock-specific action stole the show. Infosys rose nearly 2% after its AI collaboration with Anthropic. On the flip side, Ola Electric slipped 3% after a Citi downgrade.

💡 Spotlight: India’s stealth jet race begins ✈️

Three Indian private sector giants including Tata Advanced Systems, an L&T-led consortium, and a Bharat Forge-led consortium have been shortlisted to build prototypes for India’s ambitious AMCA stealth fighter programme, per an Indian Express report.

The AMCA, or Advanced Medium Combat Aircraft, is India’s homegrown fifth-generation stealth jet. It will be a single-seat, twin-engine fighter with stealth coatings and internal weapons bays to reduce radar visibility.

Over 125 jets are planned, with induction targeted around 2035.

If this programme succeeds, India joins an elite club alongside the US (F-22, F-35), China (J-20) and Russia (Su-57), nations that operate fifth-generation fighters.

Let’s hit it! 💪🏻

1 Big thing: Infosys-Anthropic pact sparks IT comeback 🤖

IT stocks bounced back for the second straight session after Infosys announced a partnership with AI firm Anthropic. The stock ended nearly 2% reacting to this news.

What’s cooking: Infosys will integrate Anthropic’s AI model Claude, including its coding assistant Claude Code, into its own AI suite called Infosys Topaz.

In simple terms, Claude is an advanced AI chatbot that can write code, analyse data, draft documents and even assist with complex enterprise tasks.

Together, Infosys and Anthropic will build AI-powered tools for sectors like telecom, banking, manufacturing and software. They’re also setting up a dedicated Anthropic Center of Excellence to create customised AI agents for businesses.

Why this matters: instead of being disrupted by AI, Infosys is choosing to embed it directly into client services. That means helping companies automate workflows, modernise legacy systems and improve productivity using AI, rather than losing business to standalone AI tools.

2. Reliance heads to Nigeria 🇳🇬

Reliance Consumer Products (RCPL) has partnered with Nigeria’s Tropical General Investments (TGI) Group to set up a majority-owned joint venture, stepping into one of Africa’s biggest consumer markets.

TGI makes and sells everyday staples like rice and seasoning cubes, with brands such as Big Bull Rice and Terra reaching households across Nigeria.

Why this matters: Nigeria offers RCPL a strong launchpad in Africa. After expanding across the Middle East, South Asia and parts of Africa, Reliance is now looking to deepen its global footprint.

Through this joint venture, RCPL plans to roll out a wide range of its fast-moving consumer goods in Nigeria, leveraging TGI’s established factories and extensive distribution network to scale quickly.

While we are on deals 🤝,

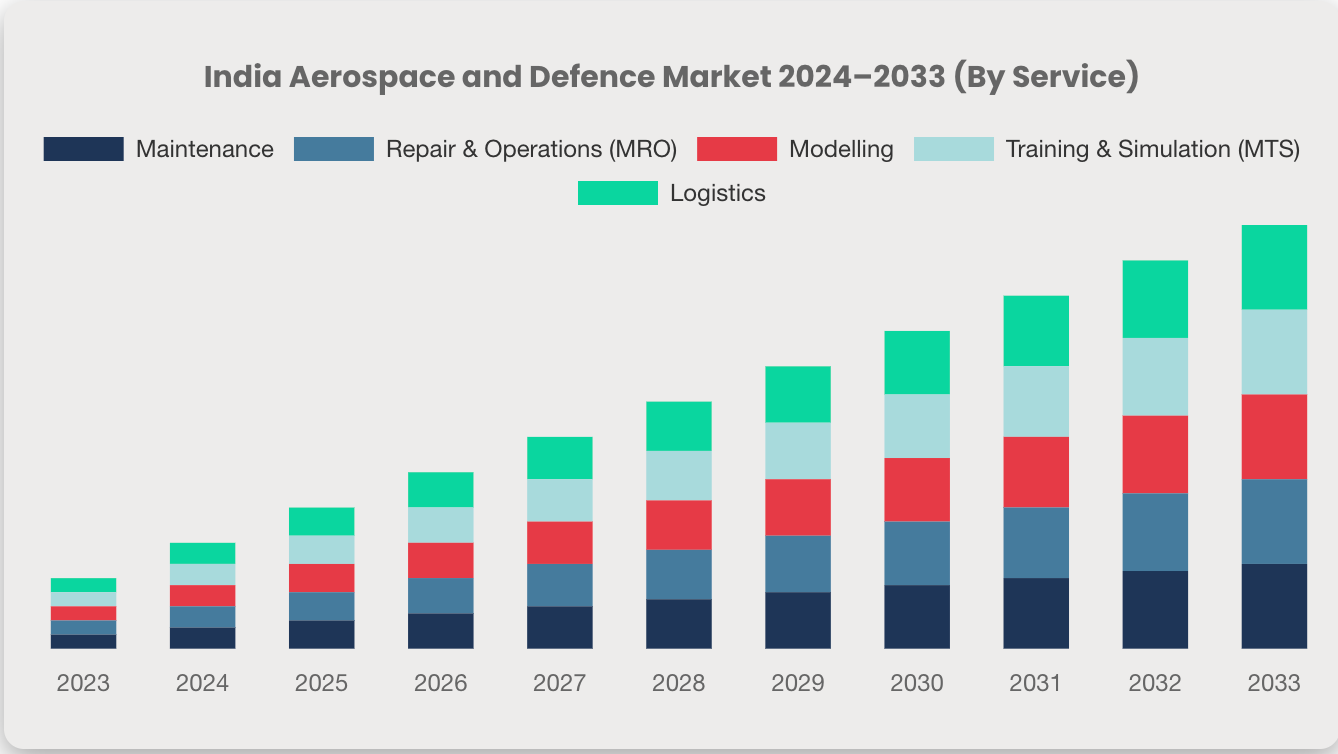

TVS Supply Chain shares gained after the company joined hands with Italy-based ALA Group to bet on India’s growing aerospace and defence supply chain.

ALA brings over 35 years of experience supplying parts and managing logistics for aerospace and defence companies across Europe and North America.

So, what’s the plan: TVS Supply Chain and ALA will work together to offer end-to-end supply chain services, covering everything from production to aftermarket support for aerospace and defence programmes.

Why now: India’s aerospace and defence market is estimated at around $28 billion and is seen as one of the most dynamic and profitable segments in industrial supply chains.

3. Adani’s $100 billion AI power play ⚡

Adani Enterprises plans to invest $100 billion by 2035 to build renewable energy-powered, AI-ready data centres across India. Adani Ent. gained nearly 3% following the newsbreak.

Basically, Adani wants to build massive data centres that run on green energy and are powerful enough to train and run advanced AI models.

Breaking it down: this $100 billion investment could trigger another $150 billion in related tech and cloud industries.

The roadmap builds on Adani Connex’s existing 2 GW capacity, expanding toward a 5 GW deployment.

For context, gigawatt-scale capacity is usually associated with power plants, not data centres. This signals hyperscale ambition.

Unlike traditional data centres that rely heavily on fossil-fuel grids, these facilities will be backed by Adani’s renewable energy assets like solar, wind and transmission networks.

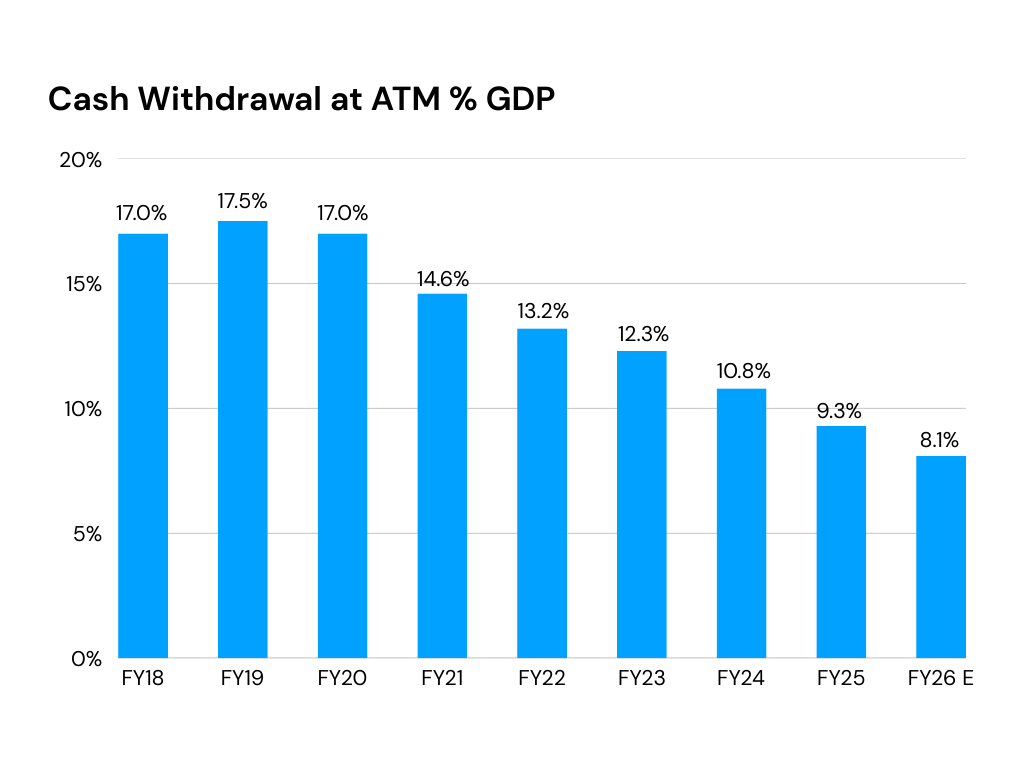

4. Everyone uses UPI, so why more cash? 💸

India is scanning QR codes like never before, yet cash is also piling up.

Currency in circulation has hit a record ₹40 lakh crore even as UPI touches ₹28+ lakh crore in monthly transactions.

While digital payments are powering new growth and banks trim ATM networks, people are still holding more cash, especially higher-value notes. The cash-to-GDP ratio is falling, showing digital dominance, but India isn’t going cashless, it’s using both.

5. Stocks that kept us interested 🚀

1. What helped Texmaco Rail surge 9% today? 🚆

Texmaco Rail shares jumped 9% in early trade after it bagged two fresh railway orders.

The deets:

- ₹219 crore Mumbai suburban signalling project

The order is from Mumbai Railway Vikas Corporation (MRVC) to design, supply, install, test and commission signalling systems.

This is part of a project to add and upgrade railway lines.

- ₹28 crore maintenance order from South Western Railway

There’s also a two-year contract for maintaining overhead electrification and power supply systems in the Mysore Division. The work spans 1,046 track kilometres, covering electrification infrastructure and related assets.

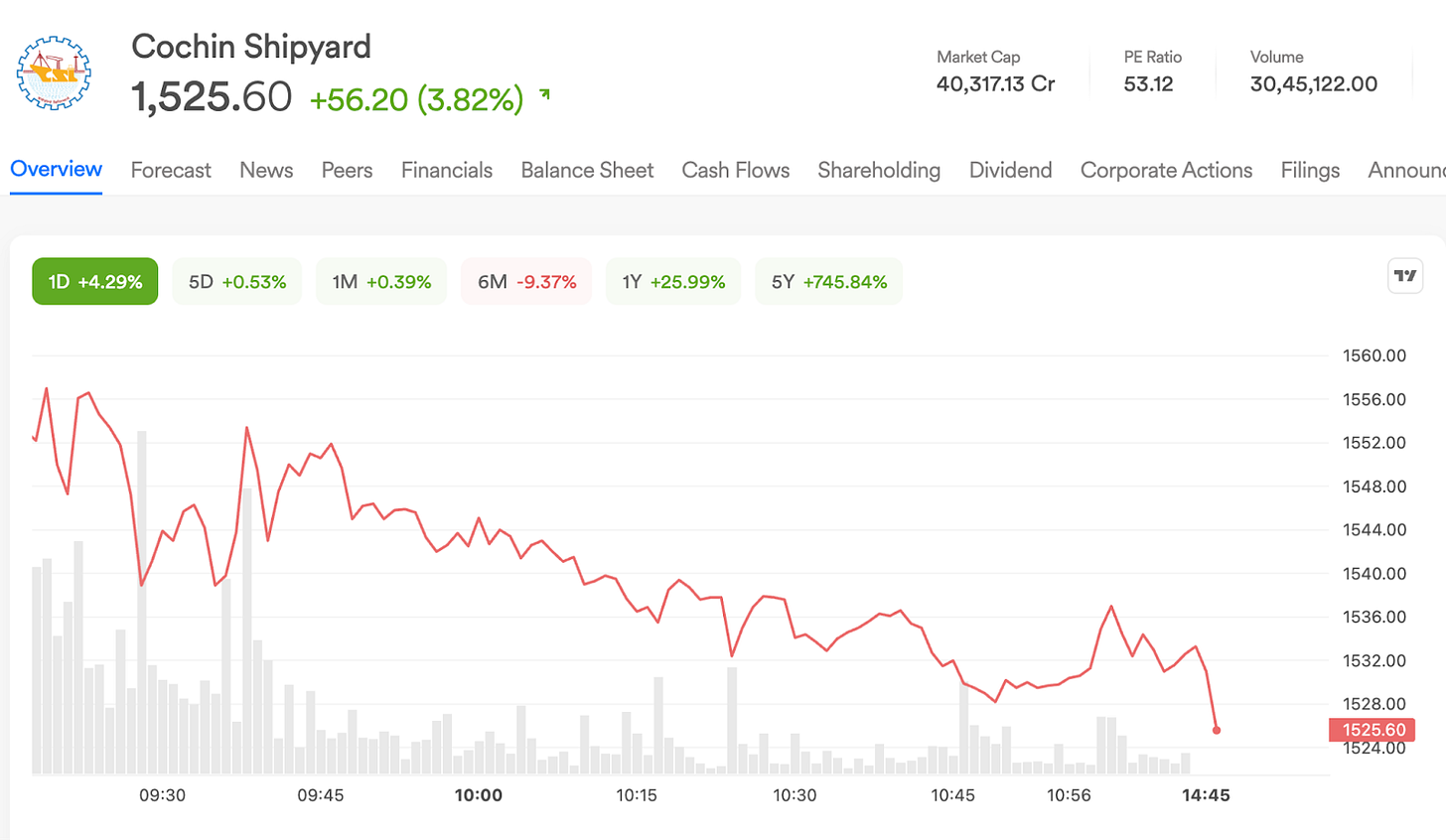

2. Cochin Shipyard gains on a big navy order 🚢

Cochin Shipyard gained nearly 4% on its plans to build five advanced vessels for the Indian Navy for ₹5,000 crore.

The deets: the company said it has emerged as the lowest bidder for a Defence Ministry tender to build the vessels for the Indian Navy.

These are modern ships designed to map the ocean floor and collect detailed underwater data. They will replace older vessels and come equipped with advanced sensors and better technology, making them more accurate, efficient, and better suited for today’s naval operations.

The timing: this deal comes right after India moved ahead with one of its biggest defence pushes, including plans to acquire 114 Rafale jets from France, with a significant role for the Navy.

What else are we snackin’ 🍿

🇫🇷 Deal talks: French President Emmanuel Macron met PM Modi in Mumbai to discuss AI cooperation & a potential multibillion-dollar Rafale fighter jet deal.

⚡ Green gears: Delhivery shares rose 3% after it partnered with RIDEV to add 150 EVs to its fleet, boosting its push toward cleaner, greener deliveries.

📜 License secured: ASK Asset & Wealth Management has received SEBI approval to begin operations as an investment manager in India’s mutual fund space.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.