Sovereign AI infrastructure, energy security pact, and wholesale inflation uptick.

🗓️ Morning, folks! ☀️

Markets staged a smart comeback today. After opening weak, Sensex & Nifty ended at day’s high.

Heavyweights did the heavy lifting. Reliance Industries, HDFC Bank, Axis Bank, and ITC powered the rally, with Reliance stealing the show, surging over 2% from its intra-day lows in the final hours of trade.

The recovery mood spilled across the Street, with broader sentiment firming up as benchmark indices held strong into the close.

💡Spotlight: prices heat up at wholesale level 📈

India’s wholesale inflation rose to 1.81% in January from 0.83% in December.

The jump was largely driven by food and factory-level costs. Food inflation moved up to 1.41% from 0%, led by a sharp 6.78% rise in vegetable prices.

Prices of eggs, meat, and fish also accelerated to 3.66%, nearly triple the previous month.

Meanwhile, core inflation (which excludes food and fuel) climbed to 3.2% month-on-month, up from 2%.

Why it matters: wholesale inflation reflects input costs for businesses. If factory-level prices keep rising, companies may either absorb the hit to margins or pass it on to consumers.

Let’s hit it!

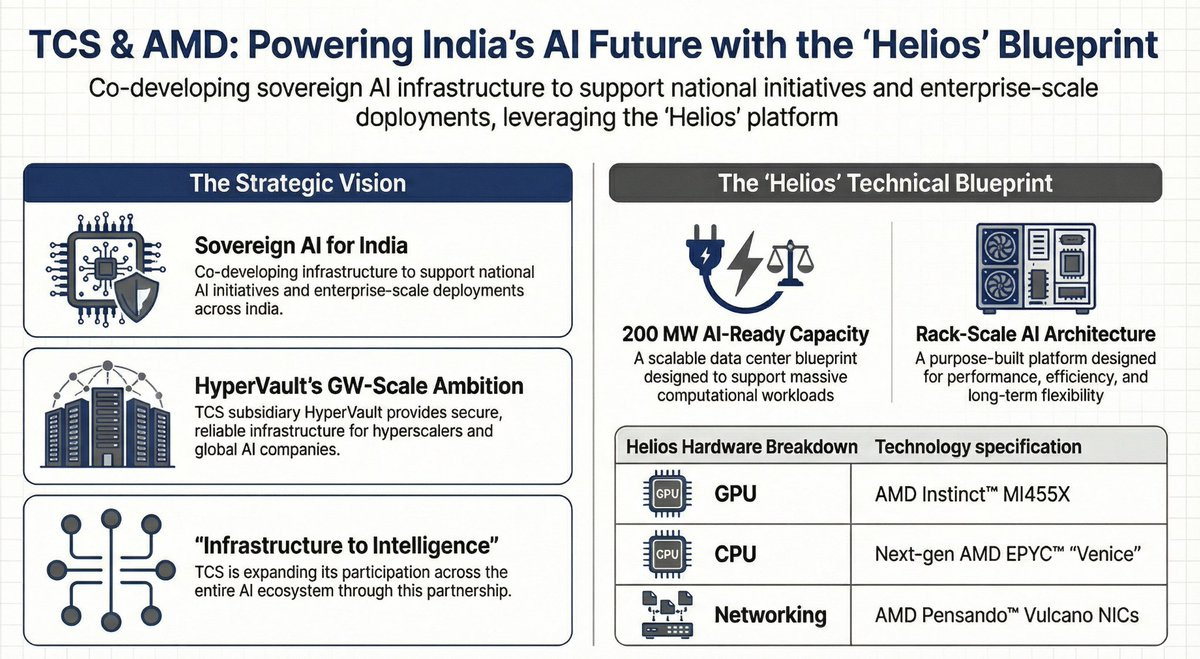

1 Big thing: Why are AMD and TCS building something called Helios? 🤖

AMD and TCS are teaming up to build and deploy a next-gen AI data centre architecture called Helios in India.

Here’s what’s cooking. the partnership will be executed through TCS’s subsidiary HyperVault AI Data Center Limited and includes an AI-ready blueprint that can scale up to 200 megawatts.

In simple terms, that amount is enough to run large-scale AI systems for big companies and cloud players.

Helios is designed to handle heavy-duty AI training and inference for hyperscalers, AI startups and large enterprises operating in India.

AMD brings the AI chips and compute muscle, while TCS handles the data centre design, integration and deployment.

Why it matters: companies are moving from small AI pilots to full-scale AI deployment. That means they need massive computing power, secure infrastructure and local data control.

Big theme: this announcement lands as India doubles down on AI capacity. Under the IndiaAI Mission, the government has committed over ₹10,000 crore to boost domestic AI compute.

With global AI summits and policy conversations intensifying in India, projects like Helios signal that the country wants to build its own sovereign AI backbone.

2. NALCO forges crucial energy alliance 🔋

NALCO signed a deal with NLC India Ltd (NLCIL) to collaborate on a 1,080 MW thermal captive power project and renewable energy development.

In simple terms, a 1,080 MW thermal captive power project means a large power plant that will generate electricity mainly for NALCO’s own factories instead of buying power from outside.

For context, NALCO is a Navratna PSU and one of India’s key aluminium producers. Power is a major cost in aluminium making, so securing steady and affordable electricity is critical.

What’s going on: the agreement creates a framework for long-term power tie-ups and coal supply arrangements. It also opens the door for future joint project development, covering both thermal and green energy solutions.

Why it matters: aluminium production needs huge amounts of electricity. If power is expensive or unreliable, profits get hit.

By partnering with NLCIL for a captive power project and coal tie-ups, NALCO reduces its dependence on outside suppliers, controls costs better, and protects margins in the long run.

3. ixigo’s next destination? Spain 🚅

Online travel platform ixigo is buying a majority stake in Spain-based Trenes for about ₹125 crore, strengthening its presence in the European train booking market.

Founded in 2013, Trenes operates an online platform for train ticket bookings, mainly in Spain, with some presence across Southern Europe.

The deets: ixigo will buy 60% of Trenes, with the option to purchase the remaining stake later.

What will Ixigo get: this is ixigo’s first major international acquisition, marking its entry into Europe, the global benchmark for rail travel.

It plans to combine Trenes’ strong rail partnerships and presence in Spain with its own AI-driven technology to scale faster across Europe.

The market opportunity: Spain recorded 549 million rail passengers in 2024, showing the sheer size of demand. Trenes operates across Spain and Southern Europe, enabling multi-operator bookings.

4. Anthropic to double down on India business 🤖

AI firm Anthropic has officially announced its Bengaluru office, calling India its second-largest market for Claude.ai.

The deets: companies like Air India are using Claude Code to build custom software, while Cognizant is rolling it out to 350,000 employees globally.

Claude Code’s run-rate revenue has crossed $2.5 billion, and Anthropic’s total revenue run rate stands at $14 billion. Enterprise subscriptions have quadrupled this year, with business users now driving over half of Claude Code revenue.

Zoom out: nearly half of Claude usage in India involves heavy-duty computer and math tasks, building apps, modernising systems and shipping production software.

Anthropic is now launching partnerships across enterprise, education and agriculture, while working to improve AI performance in 10 major Indian languages, including Hindi, Tamil and Bengali.

5. India’s young founders raise billions 🚀

India’s startup story is getting younger and bigger. According to the latest data, youth-led startups have collectively raised billions of dollars, with Ritesh Agarwal’s OYO Prism topping the chart at $3,700 million in funding.

The list also features names like CARS24 ($1,300 Mn), Uniphore ($987 Mn), OfBusiness ($890 Mn), Zetwerk ($859 Mn), Perplexity ($915 Mn) and Improbable ($930 Mn).

The takeaway: Indian founders in their 20s and 30s are building companies at global scale spanning quick commerce, AI, SaaS, manufacturing and social platforms.

6. Stocks that kept us interested 🚀

1. Deep Industries bags ₹148 crore Oil India drilling order 🛢️

Deep Industries has secured a ₹148 crore domestic contract from Oil India to deploy a 1000 HP mobile drilling rig in Assam and Arunachal Pradesh.

Deep Industries operates in oilfield services, offering drilling, gas compression, and project management solutions.

All about the deal: the contract will run for four years and involves hiring out a high-powered mobile drilling rig package for upstream exploration work.

Drilling rigs are used to dig deep into the earth to explore and extract crude oil or natural gas.

This contract helps Oil India increase exploration and production in the northeast, which is one of India’s key oil-producing regions

What else are we snackin’ 🍿

🛣️ Overseas order: Ashoka Buildcon has won a $45.2 million (₹375+ crore) road construction contract in the Republic of Liberia.

🤖 AI powerplay: Blackstone has invested $1.2 billion in Neysa, an AI cloud platform marking one of the largest private bets in India’s AI infrastructure space.

🌐 Global UPI: VIYONA Fintech has partnered with EFICYENT to enable international acceptance of India’s UPI across select global markets.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.