Brazil IT expansion, Danish café entry, and Green data centre push.

🗓️ Morning, folks! ☀️

Markets slipped on Thursday, with Sensex and Nifty ending nearly 1% lower as IT stocks took a beating.

Nearly 30 Nifty stocks closed in the red. Infosys, Tech Mahindra, TCS and Wipro were among the biggest losers. The Nifty IT index plunged over 5.5%.

In a big moment, TCS’ market cap fell below ₹10 lakh crore for the first time since December 2020.

💡Spotlight: Defence forces get a major upgrade

The Defence Acquisition Council has cleared the proposal to buy 114 Rafale fighter jets from France for the Indian Air Force and six P-8I maritime surveillance aircraft for the Navy.

Alongside the jets, the DAC also approved the acquisition of SCALP cruise missiles and additional P-8I aircraft to strengthen maritime surveillance.

This comes just a day after Vice Chief of Air Staff Air Marshal Nagesh Kapoor called the Rafale the “hero” of Operation Sindoor, signalling strong backing within the Air Force for more multi-role fighters.

Let’s hit it!

1 Big thing: Inflation rulebook gets a reset 📘

India has rolled out a brand-new retail inflation series, updating the base year to 2024 from 2012. Under the revised CPI, inflation for FY26 stands at 2.75%, compared to 1.33% in the previous month under the old series.

This is the first major CPI revamp in over a decade. And it changes more than just numbers.

Updating the base year simply means changing the reference year used to compare today’s prices, so inflation reflects how people spend money now instead of how they did years ago.

The shift: food no longer rules

For the first time, food’s weight in the CPI has dropped below 40%. Earlier, it was closer to 45%+ dominance in practical impact. Now, non-food items make up over 60% of the index.

That means inflation readings will be less vulnerable to sudden spikes in vegetables or cereals. Services, housing and discretionary spending will carry more weight.

New additions include wireless earphones, pet food, sanitisers, fitness bands and air purifiers.

Why it matters: this revision could make inflation look more stable going forward.

Short-term food shocks may not swing the headline number as sharply as before. Instead, trends in services, housing and lifestyle spending will drive the narrative.

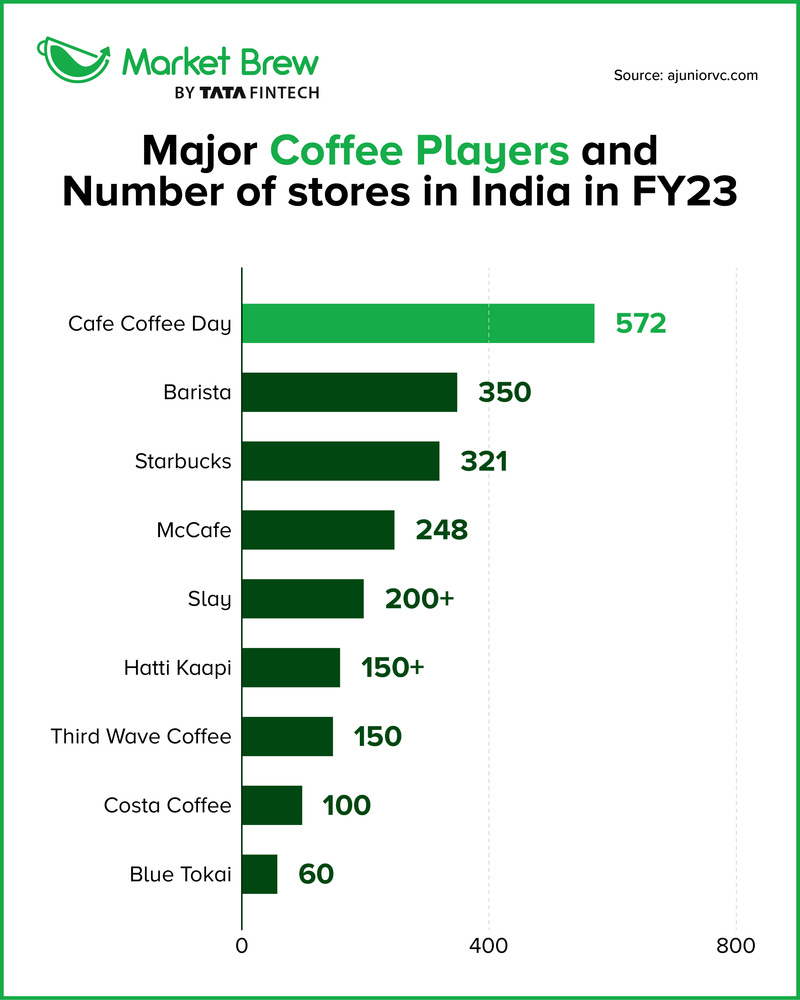

2. Aditya Birla’s Danish café play ☕

Aditya Birla New Age Hospitality (ABNAH) has signed a partnership with Danish café chain JOE & THE JUICE to bring the global brand to India. The first flagship store is expected to open in the second half of 2026.

JOE & THE JUICE is a trendy, global café brand that sells fresh juices, smoothies, coffee, and healthy sandwiches. It operates over 480 stores worldwide, especially in Europe and the US, and is popular with young, urban consumers.

Why it matters: Aditya Birla already runs high-end restaurant brands like Yauatcha and Hakkasan. But those are fine-dining. JOE & THE JUICE is different, it’s a scalable, everyday format that can open in malls, airports, and business districts.

Big picture: India’s café culture is booming. The organised café market is estimated at over ₹5,000–6,000 crore and is growing at 15–20% annually, much faster than traditional quick-service restaurants.

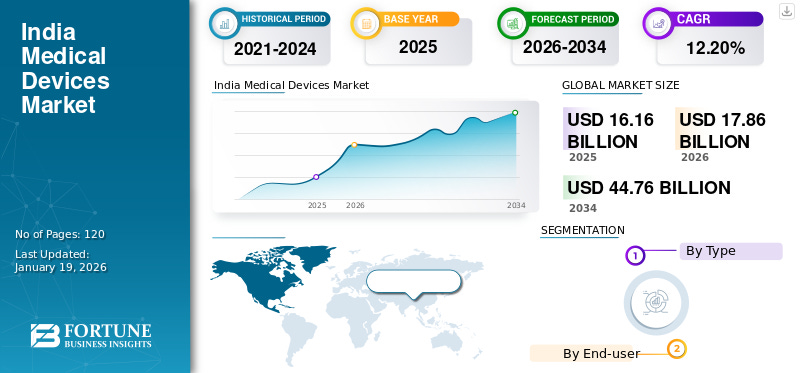

3. ECDS to build ₹780 crore medical tech plant in India 🩺

ECDS has announced plans to set up a medical equipment manufacturing unit in Ujjain with an initial investment of ₹780 crore.

Founded in 2016, the company is based in New Delhi and focuses on sustainable development technologies. It works to bring global expertise to Indian manufacturing in sectors like healthcare.

What’s the plan: the partnership with three South Korean firms in a 50:50 joint venture and plans an additional ₹1,250 crore investment within three years of starting operations.

The importance: ECDS’s first India plant will make advanced testing kits for diseases like cancer, kidney disorders and diabetes using nanofiber and biomass polymer technology.

Healthcare facilities generate over 6,600 tonnes of medical equipment waste globally every day. This project promotes cleaner manufacturing to help reduce that environmental impact.

While we are on deals,

Black Box announced that it has signed a deal worth ₹275 crore to acquire Brazilian technology firm 2S Brazilian Solutions Integrator.

Black Box, part of the Essar Group, provides IT and digital infrastructure solutions. It helps companies build and manage secure networks, data centers and modern digital workplaces.

2S Inovações Tecnológicas provides enterprise networking solutions in Brazil, including LAN, WAN, SD-WAN, Wi-Fi and IoT services.

In simple terms, Black Box is buying a local tech company in Brazil to expand its IT services business in Latin America and earn better margins.

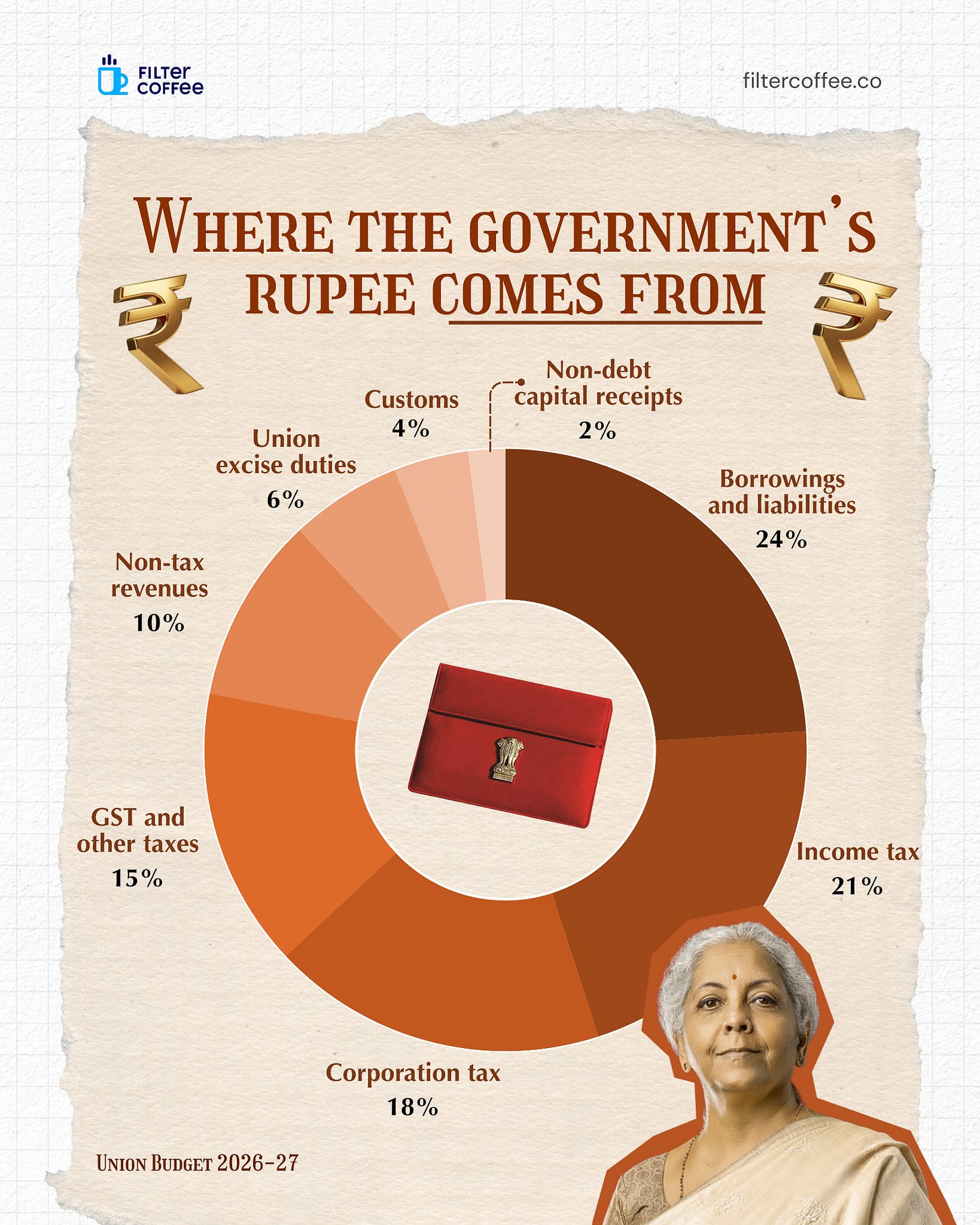

4. Breaking Down the Government’s Income💰

Every Rupee the government spends has a source. In the Union Budget 2026–27, the largest share, 24% came from borrowings and liabilities, meaning nearly one-fourth of spending is funded through debt.

Among tax revenues, income tax leads at 21%, followed by corporation tax at 18% and GST plus other taxes at 15%. Together, these form the backbone of the government’s revenue stream.

Beyond taxes, non-tax revenues contribute 10%, while union excise duties (6%) and customs (4%) add smaller but steady inflows. Non-debt capital receipts account for just 2%.

The breakdown shows a system where taxes fund the majority of operations, but borrowing remains a crucial pillar in bridging the gap between revenue and expenditure.

5. Stocks that kept us interested 🚀

1. All about Bondada’s data centres bet in Dubai 🔋

Bondada Engineering signed an agreement with Dubai-based Bryanston Renewables to build green-powered data centres in India and select global markets. The stock moved up 4% on the news.

Breaking it down: the plan is to develop data centres that run on renewable energy instead of traditional power sources.

Why it matters: data centres are power-hungry assets. Running them on green energy is means removal of long-term energy costs. This also aligns with global sustainability mandates.

For Bondada, this is a shift from being just an engineering player to participating in a high-growth, future-facing sector.

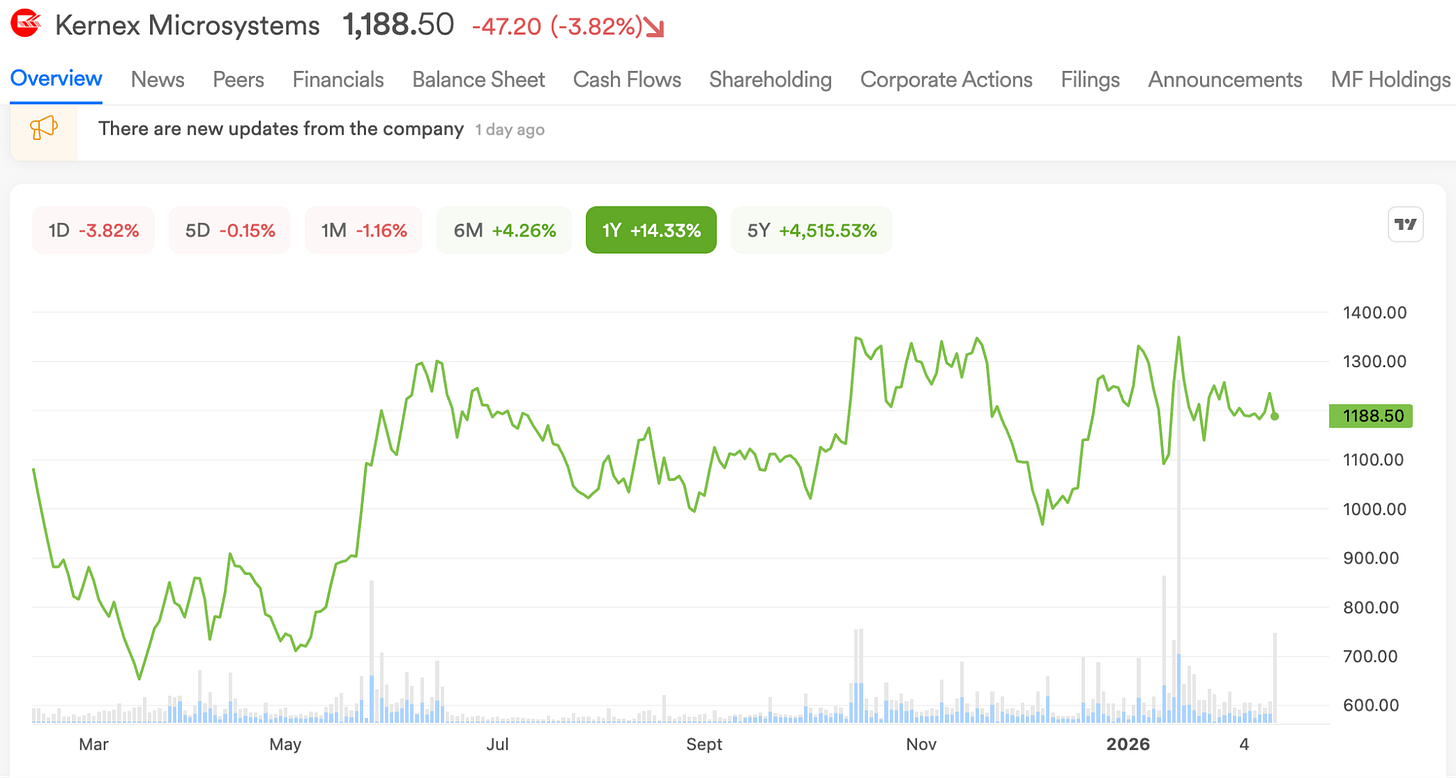

2. Kernex gets spotlight ₹411 crore KAVACH rail order 🚆

Kernex Microsystems bagged a ₹411 crore order from Banaras Locomotive Works (BLW). The contract is for supplying and installing 505 on-board KAVACH loco units.

The deets: the equipment must strictly meet the standards set by the Research Designs and Standards Organisation (RDSO), the technical authority of Indian Railways.

That makes this order critical. Kernex isn’t just supplying hardware. It has to deliver equipment that passes rigorous railway safety approvals before it can be installed on locomotives.

This comes just weeks after Kernex secured a much bigger ₹2,466 crore order from Chittaranjan Locomotive Works for 3,024 KAVACH units. Together, these wins significantly strengthen its order book.

What else are we snackin’ 🍿

🚗 Emission breather: M&M and Tata Motors get relief as small trucks stay out of stricter emission tests coming in 2027.

✈️ Leadership exit: Akasa Air’s CCO and co-founder Praveen Iyer resigns, marking another top-level departure at the airline.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚if you liked this issue.