Nvidia hot on India, Eternal partners with OpenAI, and wealthtech startup bags funding.

🗓️ Morning, folks! ☀️

Markets kept the green streak alive for a third straight session, with Sensex and Nifty closing near the day’s high.

Reliance Industries, Tata Steel, and Axis Bank did the heavy lifting, pushing the benchmark higher. PSU banks stayed in rally mode for the third consecutive day.

Meanwhile, the real fireworks were in tobacco as ITC & Godfrey Phillips surged up to 20% on reports of a cigarette price hike, sparking strong stock-specific action.

💡 Spotlight: Big money lining up for India’s solar push 🌞

India’s solar sector is set to attract around ₹30,000 crore in investments. The goal is to build 50 GW of solar cell capacity by FY27.

This push is driven by new rules that, from June 1, 2026, require projects to use solar cells from the government’s approved ALMM list.

The expansion is led by players such as Waaree Energies, Adani Solar, Reliance Industries Ltd and ReNew Energy Global Plc, with capacities ranging from 2-10 GW being added across facilities.

Let’s hit it! 💪🏻

1 Big thing: Nvidia powers Reliance’s AI ambitions 🤖

Nvidia has partnered with Reliance and other Indian giants including L&T, TCS to supply its AI chips and software.

What’s cooking: think of Nvidia supplying the ‘engine,’ and Indian companies using it to create AI-driven products and solutions that can analyse data faster, automate tasks and improve efficiency.

Why it matters: India’s $283 billion IT services industry is facing pressure from foundational AI players like OpenAI and Anthropic, whose models can automate coding, analysis and documentation.

By partnering with Nvidia, Indian firms are trying to embed AI into their own offerings instead of being disrupted by it.

Big theme: the announcements came during the AI Impact Summit in India, where billion-dollar AI investment promises are flying in.

With MeitY-backed startups like BharatGen, Sarvam and CoRover building foundational models using Nvidia GPUs, India is positioning itself as a serious AI infrastructure and development powerhouse.

While we are on partnerships,

Eternal has expanded its partnership with OpenAI to embed AI deeper across Zomato, Blinkit, District, Hyperpure and even its internal systems.

What’s going on: Eternal will use OpenAI’s enterprise models and APIs to power smarter features across its apps and partner platforms. That includes:

- AI assistants for merchants and delivery partners to help with orders, inventory and daily decisions.

- Smarter search and discovery tools so customers find what they want faster.

- AI tools inside partner portals to improve operations and compliance.

On the backend, Eternal is integrating OpenAI’s advanced coding models like GPT-5.3-Codex into its internal automation platform called Stitch.

Stitch helps automate workflows across engineering and business teams and AI is expected to make it faster, reduce manual work and speed up product launches.

Even Nugget, Eternal’s AI-first venture, will use OpenAI models to accelerate product development. Plus, the two are launching a Partner Upskilling Program to train restaurants and delivery partners to use AI tools effectively.

2. Aurionpro up on global data centre win 🏗️

Shares of Aurionpro Solutions ended over 5%, after it announced an order from a global data centre developer.

The deets: the company is helping upgrade and expand a big data centre in Mumbai so it can handle more cloud and AI traffic.

The new contract is about upgrading and expanding an existing data centre in Mumbai instead of building a new one from scratch.

Why it matters: India currently has around 1.3-1.5 gigawatts (GW) of installed data centre capacity. This is expected to rise to roughly 1.7-1.8 GW by 2026-27 as new facilities become operational.

However, with AI, cloud computing and digital services growing rapidly, industry estimates suggest India may need over 4 GW by 2030, and some projections even point to 8 GW or more in the longer term.

3. Investors pour money into Stable Money 💸

Wealthtech startup Stable Money raised $25 million in a pre-Series C round, valuing the company at $175 million. The round was led by Peak XV Partners.

What does it do: Stable Money is an online platform that lets Indians invest in safe options like fixed deposits and bonds from over 200 banks and NBFCs, all in one place.

The why: the company aims to upgrade its platform and expand its range of savings products. It also plans to grow its team across key functions.

Zoom out: capital is pouring into India’s wealthtech sector. According to Entrackr, wealthtech startups raised over $634 million across 51 deals involving 39 companies during 2024 and 2025.

4. Food subsidy bill climbs again 🍞

After briefly cooling off, India’s food subsidy bill is rising once more. It stood at ₹2.72 lakh crore in FY23, fell to ₹2.11 lakh crore in FY24, but is budgeted to increase to ₹2.28 lakh crore in FY26 and ₹2.27 lakh crore in FY27.

Estimates even suggest it could cross ₹2.5 lakh crore by FY27.

The reason is surplus grain stocks and continued procurement at Minimum Support Prices (MSP). As the government keeps buying crops and maintaining large food buffers, subsidy costs remain elevated.

In simple terms, feeding the nation and supporting farmers continues to come with a hefty price tag.

5. Stocks that kept us interested 🚀

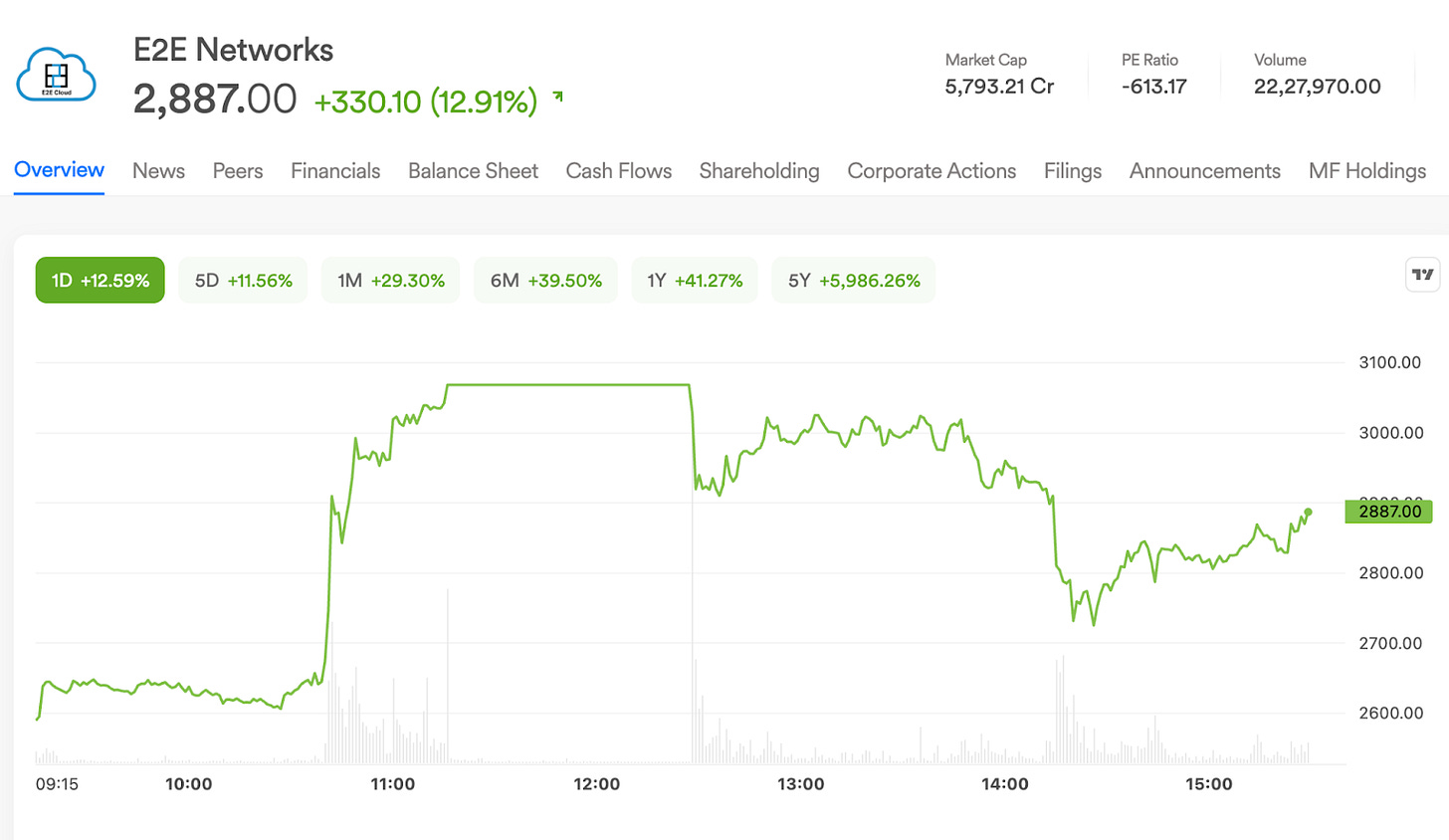

1. E2E Networks hit upper circuit on Nvidia tie-up ⬆️

Shares of E2E Networks hit nearly 12% after US chip giant Nvidia named it among a select group of next-gen cloud partners to help meet India’s fast-growing demand for AI computing power.

What’s the big deal: E2E plans to build a powerful Nvidia Blackwell GPU cluster on its TIR cloud platform, hosted at the L&T Vyoma Data Center in Chennai.

In simple terms, E2E is setting up a high-power AI server system using Nvidia’s latest chips at a data center in Chennai, so businesses can run faster and more advanced AI applications on its cloud platform.

The upgraded TIR platform will use Nvidia’s latest HGX B200 systems, along with enterprise software and Nemotron open models.

That means faster and more advanced AI development across sectors like healthcare, finance, manufacturing, agriculture and even agentic AI systems.

2. Why did the Narmada project boost Dilip Buildcon? 💰

Dilip Buildcon shares climbed 4% after the company emerged as the lowest bidder for a ₹668 crore project to build the Narmada Flood Protection Embankment.

In simple terms, Dilip Buildcon will design it, build it and deliver it.

Why does this matter: because when the monsoon hits hard, the Narmada can swell quickly. A strong embankment helps keep that water in check, reducing the risk of flooding in nearby towns and farmlands.

What else are we snackin’ 🍿

💊 Pharma play: Eli Lilly plans to make India a global supply hub as its weight-loss drug Mounjaro sees booming sales.

💪 EV push: Maruti launched its electric e Vitara at ₹10.99 lakh, with battery rental at ₹3.99 per km and free charging perks.

⬆️ In the green: Netweb shares rose 7% after launching NVIDIA-powered AI supercomputing systems, marking its entry into the fast-growing AI infrastructure solutions market.

📦 Cargo power: FedEx plans to invest ₹2,500 crore to build a large automated cargo hub at Navi Mumbai International Airport.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.