Crypto rallies, $8 billion merger, and India's EV push.

🗓 Morning, folks! It’s a new week.

💡 Spotlight: Trump boosts crypto bets

Crypto is flexing again. Bitcoin roared back above the $117,000 mark, sparking sharp rallies in major altcoins like Ethereum, Ripple, and Solana, which climbed up to 11% on Friday.

The surge came after a bold move by the U.S. President Donald Trump, who signed an executive order to allow crypto into 401(k) retirement plans.

In simple words, U.S. President Donald Trump has signed an order that could let people invest in crypto through their regular retirement savings accounts.

The order pushes regulators to clarify investment rules, potentially unlocking the $8.9 trillion retirement market.

Meanwhile, in some alternate techverse, Tesla’s Elon Musk fired a playful warning at Microsoft’s Satya Nadella, that OpenAI might just “eat” his company alive, timed perfectly with Sam Altman’s blockbuster GPT-5 rollout across Microsoft’s platforms.

Clapping back at Musk’s “eat Microsoft alive” quip, Satya Nadella said, “People have been trying for 50 years, that’s the fun! Every day you learn, innovate, partner, and compete. Can’t wait for Grok 4 on Azure and bring on Grok 5!”

Let’s hit it!

1 Big thing: IPO fest on Dstreet 💰

1. BLS Polymers to expand with fresh ₹145 cr IPO ♻️

BLS Polymers has filed papers with SEBI for an all-fresh issue of 1.7 crore shares, aiming to raise around ₹145 crore.

What they do: BLS Polymers makes polymer compounds, the raw material that coats and insulates wires, cables, and industrial pipelines to protect them from damage.

Zoom out: BLS competes with listed players like Kingfa Science & Technology, DDev Plastiks Industries, and Plastiblends India in India’s growing polymer market, driven by rising demand in infrastructure and industrial projects.

2. Varmora Granito plans a market debut

Varmora Granito, a tiles and bathware marker, has filed DRHP with SEBI for a ₹400 Cr IPO.

Rajkot-based Varmora Granito makes high-quality tiles and bathware, offering products like glazed vitrified, polished vitrified, and ceramic tiles.

The deets: the proposed IPO includes a fresh issue worth ₹400 crore and an OFS of 5.24 crore shares by promoters and investor Kastura Investments.

Zoom out: India’s ceramics and tiles sector has been growing steadily, fuelled by housing demand, infrastructure upgrades, and exports. With a strong domestic retail network and focus on premium finishes, Varmora’s IPO adds to the list of building-materials players tapping capital markets to fund growth.

3. Silver Consumer Electricals Files for ₹1,400 Cr IPO

Silver Consumer Electricals, a Rajkot-based electrical consumer durables maker, has filed DRHP with SEBI for a ₹1,400 Cr IPO.

SCEL makes pumps, motors, fans, lighting, agri equipment, and other consumer electricals, operating India’s largest single-location, vertically integrated plant in Rajkot with robotic automation and backward integration.

The deets: the IPO comprises a fresh issue of up to ₹1,000 crore and an OFS of ₹400 crore by promoter Vinit Dharamshibhai Bediya.

4. Transline Technologies files IPO papers

Transline Technologies, a technology solutions provider specialising in security and surveillance systems, has filed DRHP with SEBI for its IPO.

The company designs, develops, and deploys integrated security and surveillance systems, biometric authentication platforms, and AI-driven software products.

The deets: the IPO will be an entirely offer-for-sale of up to 16.2 million equity shares by promoters and shareholders.

2. Paramount finds new plot in Skydance merger 🎥

Skydance Media and Paramount Global have officially completed their long-awaited $8 billion merger, creating a new standalone entertainment company: Paramount, a Skydance Corporation.

The deal, years in the making, marries Skydance’s modern production muscle and technology expertise with Paramount’s century-old film and TV library, global distribution network, and iconic brands like CBS, MTV, and Nickelodeon. It’s also a financial lifeline for Paramount, which has been under pressure from debt, sliding cable revenues, and a costly pivot to streaming.

Why it matters: for the past decade, Paramount has been in survival mode, losing ground as audiences ditched cable and cinemas for Netflix, YouTube, Disney+, and Prime Video. Skydance brings fresh leadership, stronger balance sheets, and a modern production pipeline, assets Paramount has struggled to build on its own.

Backdrop: the merger comes amid internal turbulence. Just last month, Paramount paid $16 million to settle a lawsuit with U.S. President Donald Trump over a controversial 60 Minutes interview, stirring tensions inside CBS News and reigniting editorial independence concerns.

Now, with streaming competition still intensifying, Paramount is betting that this reboot, backed by Skydance’s resources, can keep it from being written out of Hollywood’s future.

3. Torrent Gas sets sights on street 🔥

Torrent Gas is considering an initial public offering that may raise about $450 million.

Torrent Gas is authorised to develop city gas distribution infrastructure and supply compressed natural gas to vehicles as well as piped natural gas to industrial, commercial and residential users.

What’s happening: the company said that an IPO could value it at around $3 billion, depending on how global trade tensions play out. However, talks are still taking place.

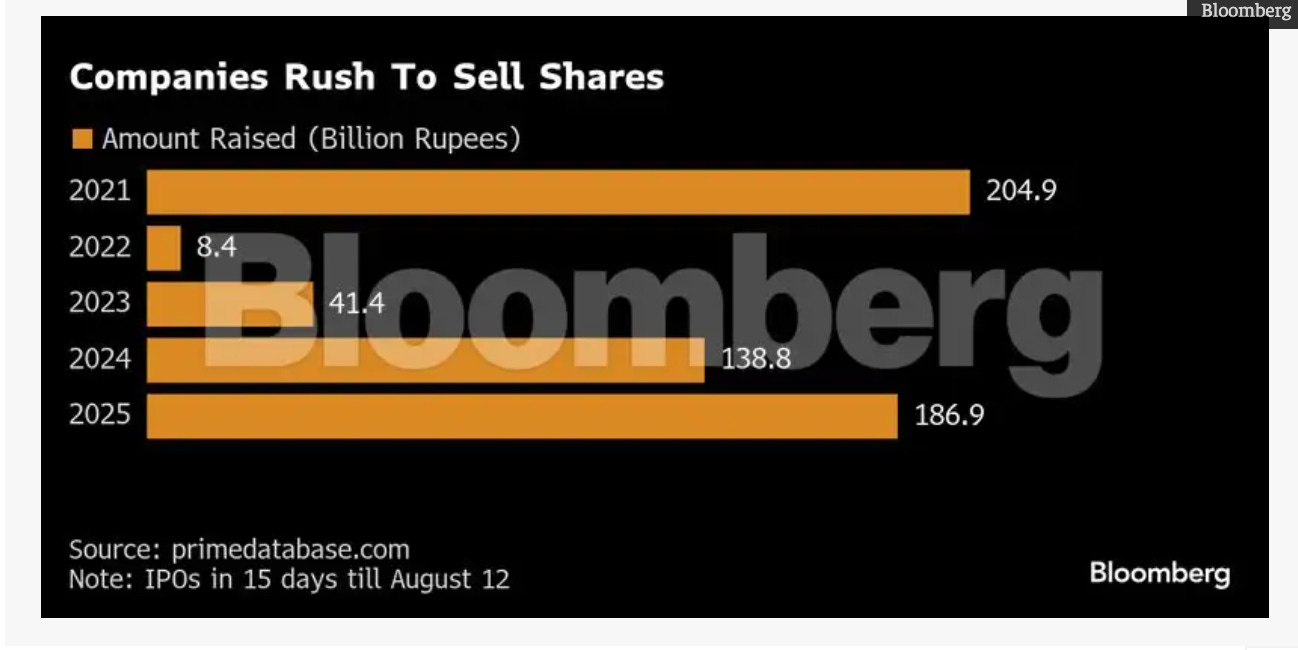

Zoom out: India’s IPO pipeline is on fire. Companies are making a last-minute sprint to the public markets, looking to woo global investors before a key August 12 deadline. In just two weeks, over a dozen firms have launched or announced IPOs worth ₹187 billion ($2.1 billion).

Bottomline: if successful, Torrent Gas’s IPO could be a catalyst, not just for CGD companies, but for a wider wave of infra and utility-focused listings. It also gives investors access to a critical but underrepresented part of India’s energy value chain.

4. Outzidr gets ₹27 crore push to go brick and mortar 👗

Outzidr has raised ₹27 crore in pre-series A round led by RTP Global with participation from existing partner Stellaris Venture Partners.

Outzidr is a fashion brand that sells affordable and trendy apparel targeting Gen Z women. The company uses a test-and-scale approach to grow where they release new styles in small batches and then double down on bestsellers.

The why: the startup will be using the fresh funds to launch their first physical store in March 2026.

The big picture: with contemporaries like Littlebox and Tryo also receiving funding in the past week, competition for Outzidr is stiff. But with India/s fast fashion market projected to grow at a CAGR of 16.7% there remains ample opportunity to scale and capture the market.

In other news ☕

This one’s been a long time coming ☕️

If you’ve been with Filter Coffee a while, you know we love a sharp business story. But some markets are too big, too culturally rooted, and too interesting to squeeze into a daily brief.

The kind of stories that might not make headlines every day, but become hard to ignore once you see the numbers.

That’s why we’re launching Market Bites, our new weekly deep dive into the companies and markets shaping India’s future. The first issue is live.

We’re still tuning this into its best form, so if you’ve got thoughts, feedback, or even a better name, we’re all ears ☕

What else are we snackin’ 🍿

🗝️ Licence unlocked: RBI grants AU Small Finance Bank in-principle universal banking licence, the first such approval in a decade.

🔋EV push: India amended the PM E-DRIVE scheme, allocating ₹10,900 crore to boost EV adoption, manufacturing, and charging infrastructure nationwide.

🛒 Quick collab: MapmyIndia is investing ₹25 crore in Zepto to deepen their partnership and enhance delivery efficiency and customer experience.

🇮🇳 Fuel shift: Indian Oil & BPCL bought 22M barrels of non-Russian crude for Sep-Oct delivery after US pressured India to halt purchases from Russia.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.