Airtel wins, Sona gears up in China, and Jane Street is back.

🗓 Morning, folks!

Dalal Street wrapped up Monday on a positive note, with both the Nifty and Sensex staging a strong recovery to close near their day’s highs.

In the broader market, midcaps gained 0.5%, while smallcaps held steady.

Sector-wise, it was a mixed bag, auto, capital goods, private banks, power, realty, and metals revved up with 0.5-1% gains. But IT, PSU banks, oil & gas, and FMCG stocks hit a speed bump, slipping between 0.4-1%.

💡 Spotlight: Airtel dialed into the big leagues

Bharti Airtel just became India’s third most valuable company, edging past TCS with a market cap of ₹11.45 lakh crore.

The stock rose 1% on Monday, giving Airtel a ₹2,220 crore lead over TCS—marking the first time it’s locked in the No. 3 position since briefly overtaking TCS back in 2009.

At the top of the leaderboard? Reliance remains king, with a towering market cap of ₹19.3 lakh crore.

Let’s hit it!

1 Big thing: Eternal posts weak profit but strong revenue growth in Q1 📈

Eternal’s Q1 was a wild ride, profit took a nosedive however the numbers were better than street estimates pushing the stock up 7%.

By the numbers:

- Revenue: ₹7,167 crore, up 70% YoY and 23% QoQ

- Net profit: ₹25 crore, down 90% YoY, and 36% QoQ

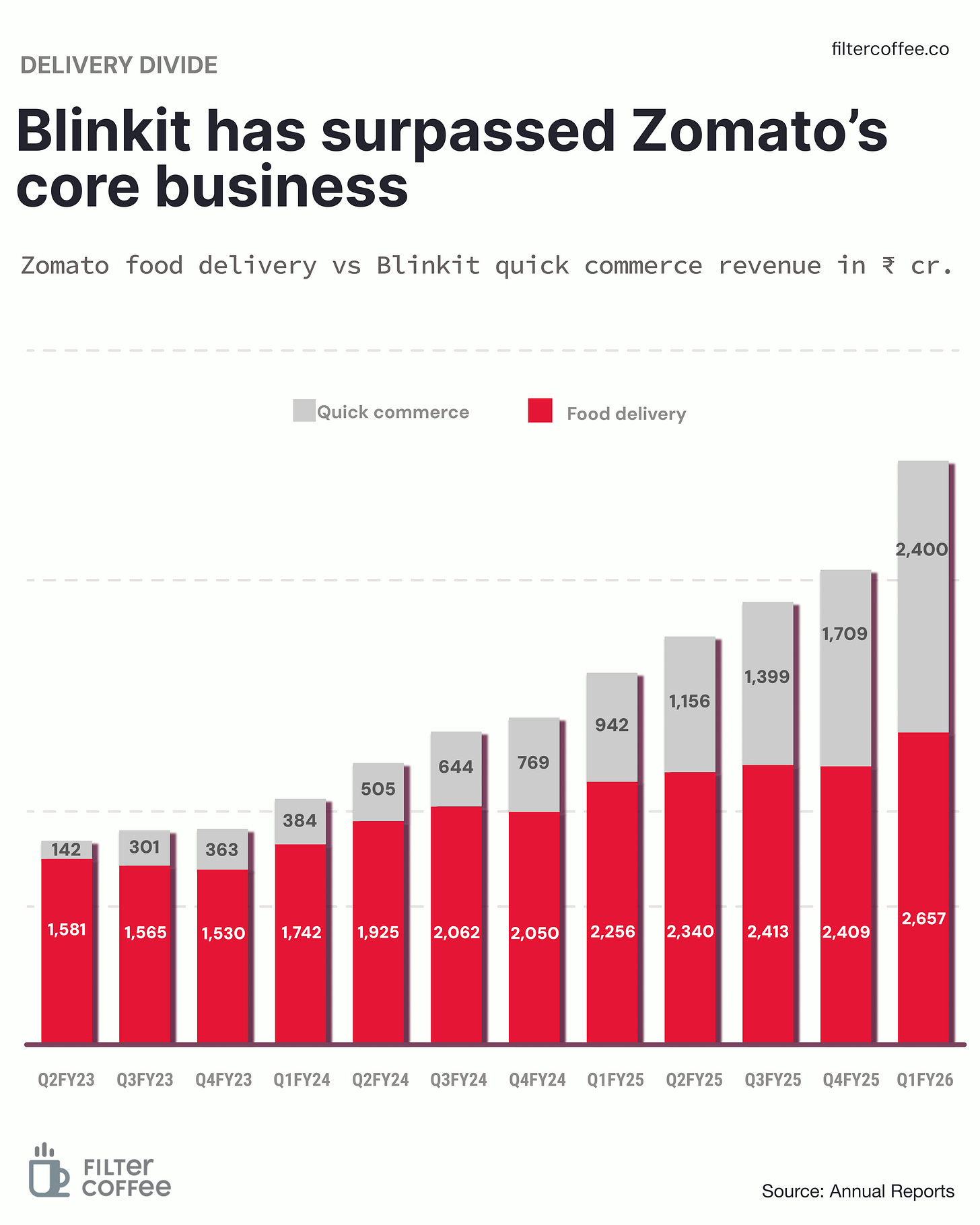

For the first time ever, Blinkit’s net order value beat food delivery, cementing its place as the company’s fastest-growing bet. The catch? Growth came at a cost, total expenses spiked 77% to ₹7,433 crore, as Eternal opened 243 new Blinkit stores in one quarter.

More stores = more orders = more burn.

Zoom out: Quick commerce is in full sprint. Zepto raised fresh capital. Swiggy Instamart is going all in. Amazon is quietly testing grocery plays again. Everyone’s chasing faster delivery, fatter baskets, and long-term loyalty.

Eternal’s bet is clear: build Blinkit now, worry about margins later. But with rising costs and competition flush with capital, the road to dominance won’t be smooth.

2. Sona Comstar gears up in China 🚗

Sona BLW Precision Forgings (Sona Comstar) gained over 1% after announcing a new joint venture in China, a move aimed at expanding its global EV and auto footprint.

The deets: Sona is partnering with Hubei-based Jinnaite Machinery (JNT) to build driveline systems for electric and internal combustion vehicles. The JV is set to begin operations in the second half of FY26.

Sona will invest $12 million for a 60% stake, retaining strategic control. JNT will contribute $8 million worth of assets and business, holding the remaining 40%. Sona leads on product strategy and engineering; JNT handles day-to-day operations and manufacturing.

JNT brings serious credentials, its precision components power cars, planes, trains, and ships, and its client list spans China, Europe, Japan, and North America.

Why it matters: Sona already supplies top carmakers worldwide and has deep expertise in high-efficiency, lightweight driveline parts, especially for EVs. The JV allows Sona to plug that expertise into China, the world’s largest auto market and a global EV manufacturing hub, without starting from scratch.

Zoom out: with Sona’s stock down 18% YTD, this deal gives the company a strategic shot in the arm, one that blends Indian engineering with Chinese scale. For investors, it might just be the global growth lever that gets Sona back in gear.

While we are on JVs,

Jio Financial and Allianz have joined forces to launch a 50:50 reinsurance JV in India, marking Allianz’s return after ending its 24-year partnership with Bajaj.

Reinsurance is insurance for insurers, helping them manage risk by covering part of the claims they might have to pay out.

The duo is starting with reinsurance but may expand into life and general insurance later.

The move puts them in direct competition with state-run GIC Re, which currently dominates the space.

4. Sun TV expands cricket empire with UK team buy 🏏

Sun TV board has approved the acquisition of a 100% equity stake in Northern Superchargers.

The deets: Northern Superchargers, a London-based cricket franchise, that competes in the Hundred, a professional league run by the England and Wales Cricket Board.

The deal is valued at approximately ₹1,161 cr and comes at a steep valuation of 53 times revenue.

Why this matters: this acquisition marks a strategic step for Sun TV in growing its international presence in sports and entertainment. The company already owns two major cricket teams, Sunrisers Hyderabad in the IPL and Sunrisers Eastern Cape in South Africa’s SA20 league.

Adding Northern Superchargers gives Sun TV a strong foothold in the UK, a key cricketing market, and further strengthens its position as a global player in franchise cricket.

While, we are on deals,

JSW Steel’s board has approved the acquisition of up to 100% equity in Saffron Resources.

Saffron Resources owns 887 acres of land in Odisha, and the acquisition is a part of the metals company’s strategy to secure strategic land assets, for around ₹680 cr.

Why this matters: the land assets will strengthen JSW’s resource base in Odisha, help the company for future expansion projects. The company has already secured over 2,950 acres for a 13.2 MT greenfield steel plant near Odisha’s Paradip, investing ₹65,000 crore.

5. Brigade’s hospitality arm heads to the public markets 💸

Brigade Hotel Ventures is set to launch its ₹749.6 crore IPO on July 24 to raise funds through a fresh issue.

The deets: the entire IPO is a fresh issue with no offer-for-sale component.

What they do: Brigade Hotel Ventures is a wholly owned subsidiary of Brigade Enterprises Ltd that began with branded serviced apartments and now operates across hospitality segments.

Zoom out: with travel demand rising, hospitality players like Brigade are expanding their footprint. This IPO could provide the capital needed to fuel further growth and strengthen their presence in key cities.

While we are on IPOs,

Engineering firm Oswal Energies has filed draft papers with SEBI to launch an IPO.

The deets: the offer includes a fresh issue of ₹250 crore and an offer-for-sale (OFS) of 46 lakh shares by promoters.

What they do: Oswal Energies is an integrated EPC player that also makes specialised process equipment. It serves oil & gas, power, and petrochemical clients. The company operates out of Gandhinagar, Gujarat, with a 2,000 MT annual capacity.

Zoom out: India’s energy infra needs are rising, and EPC players are seeing stronger demand. Oswal is looking to ride that wave, and this IPO could give it the fuel to scale.

6. Stocks that kept us interested 🚀

1. IRCON expands footprint with Metro & Railway projects 🚇

IRCON International shares gained after the company secured multiple infrastructure contracts.

In Mumbai, IRCON bagged two major contracts from the Mumbai Metropolitan Region Development Authority - MMRDA for Metro Lines 5 and 6.

- Line 5 (₹471.3 Cr): IRCON to handle power systems, cabling, overhead wires, lifts, escalators, and 5-year maintenance.

- Line 6 (₹642.4 Cr + €2.78M): Similar scope with extended maintenance included.

In Madhya Pradesh, IRCON won a contract from Rail Vikas Nigam to build a 69 km railway line between Pipaliya Nankar and Budni. The project covers roadbeds, bridges, stations, and electrical works, part of the larger Indore–Budni rail corridor.

Big picture: with metro and rail projects piling up, IRCON is cementing its place in India’s growing transport infrastructure play.

2. PCBL unit secures US Patent for energy tech 🇺🇸

Nanovace Technologies, a subsidiary of PCBL Chemicals, has been granted a U.S. patent for its breakthrough method to produce high-performance nanomaterials, tiny particles that could supercharge future energy storage systems.

Nanovace’s silicon-based nanomaterials help batteries last longer, charge faster, and store more power, making them ideal for EVs and next-gen power grids.

Why it matters: the patent is a major R&D milestone for PCBL. It strengthens the company’s IP in energy tech and opens doors for global partnerships, licensing deals, and commercialisation.

It also pushes PCBL closer to its long-term vision of becoming a key player in sustainable energy innovation.

What else are we snackin’ 🍿

🟢 Hydrogen start: L&T Energy GreenTech will set up India’s first green hydrogen plant at IOCL’s Panipat refinery under a build-own-operate model.

👨💻 Back in the game: SEBI has allowed Jane Street to resume trading after the firm deposited ₹4,840 crore. However, it might not trade in options.

👶 Grok Junior: Elon Musk has unveiled Baby Grok, a kid-friendly version of his chatbot, designed as a safer, age-appropriate alternative to Grok’s adult personas.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.