Textile stocks up, Adani Energy gets funding from Japan, and Moody's bet on India.

🗓️ Morning, folks! ☀️

Markets kicked off Monday with a solid comeback, staying in the green through the session thanks to upbeat global cues and fresh optimism around an interim India-US trade framework.

The benchmark indices opened higher and held on to their gains till the close.

Buying wasn’t limited to just a few pockets either, realty, metal, and pharma led the charge, while midcaps and smallcaps also climbed nicely.

💡 Spotlight: textiles catch a tariff break 🥵

Textile stocks had a strong Monday after India and the US agreed on an interim free trade deal framework, easing months of trade tension.

India’s textile exports to the US were worth $8.3 billion in FY25, making up 9.6% of total shipments. With tariffs slashed from as high as 50% to 18%, margins improve, order flows could pick up, and India gains an edge just as global buyers look to diversify away from China.

Gokaldas Exports jumped up to 8%, while Raymond and Welspun Living also rallied as investors priced in better export economics.

Let’s hit it! 💪🏻

1 Big thing: Adani Energy gets backing from Japan for green power ⚡

Adani Energy Solutions has raised long-term funding from a group of Japanese banks for its flagship HVDC transmission project. The project is aimed at moving renewable power across northern India.

Importance: this project will help carry solar power from Rajasthan to high-demand regions, ensuring green electricity doesn’t get stuck where it’s produced.

Breaking it down: the project is a ±800 kV HVDC transmission corridor with a capacity of 6,000 MW.

In simple terms, this means the project is a very high-power electricity highway that can carry a huge amount of power (enough for millions of homes) over long distances efficiently, with minimal loss.

The project will use advanced power transmission technology from Hitachi, developed together with BHEL.

Big theme: the funding is led by MUFG Bank and SMBC, underlining deepening India-Japan collaboration in clean infrastructure.

Japan brings capital and cutting-edge transmission technology to the project. India, in return, gains a stronger power grid, more local manufacturing under Make in India, and faster integration of renewable energy.

2. Reliance Consumer buys its way into Australia 🇦🇺

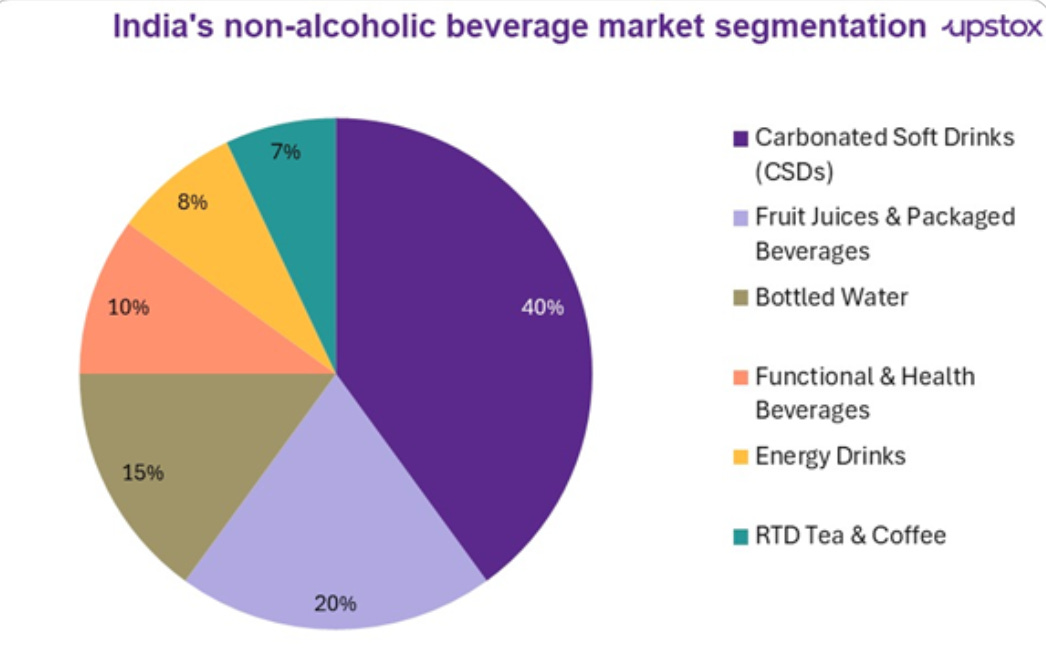

Reliance Consumer Products (RCPL) has acquired a majority stake in Australia-based ‘better-for-you’ beverage company Goodness Group Global (GGG).

Sydney-based Goodness Group Global develops and sells healthier drinks with lower sugar and fewer artificial ingredients across Australia and 21 global markets.

The deets: under the agreement, RCPL will promote Goodness Group’s healthy drink brands, including Nexba and Pat Cummins-backed PACE, across new markets including India.

What will they gain: adding Goodness Group Global’s brands strengthens RCPL’s healthy beverages portfolio.

While GGG gets a strong platform to expand globally, targeting up to 50 western markets over five years.

Zoom out: this follows Reliance’s earlier acquisition of a majority stake in its joint venture with zero-sugar beverage maker Naturedge Beverages.

The strategy aligns with rising consumer demand for healthier drinks. With India’s health beverages market expected to grow by $4.55 billion at a 10.6% rate between 2024 and 2029, the acquisitions further strengthen Reliance’s competitive positioning.

3. BEML’s ₹1,500 cr rail bet near Bhopal 🚃

BEML is planning a brand-new rail manufacturing plant near Bhopal. The company wants to set up a greenfield facility called BRAHMA at Umariya in Madhya Pradesh, with an investment of around ₹1,500 crore.

Stock action: its shares jumped over 8% on the back of this development.

So, what’s the game plan: this new unit is expected to boost BEML’s muscle in the rail and mobility space, giving it more capacity to build trains and rail-related equipment at scale.

The timing is also important. With India doubling down on homegrown manufacturing and ramping up infrastructure, BEML is gearing up to ride the wave and meet the growing demand in rail.

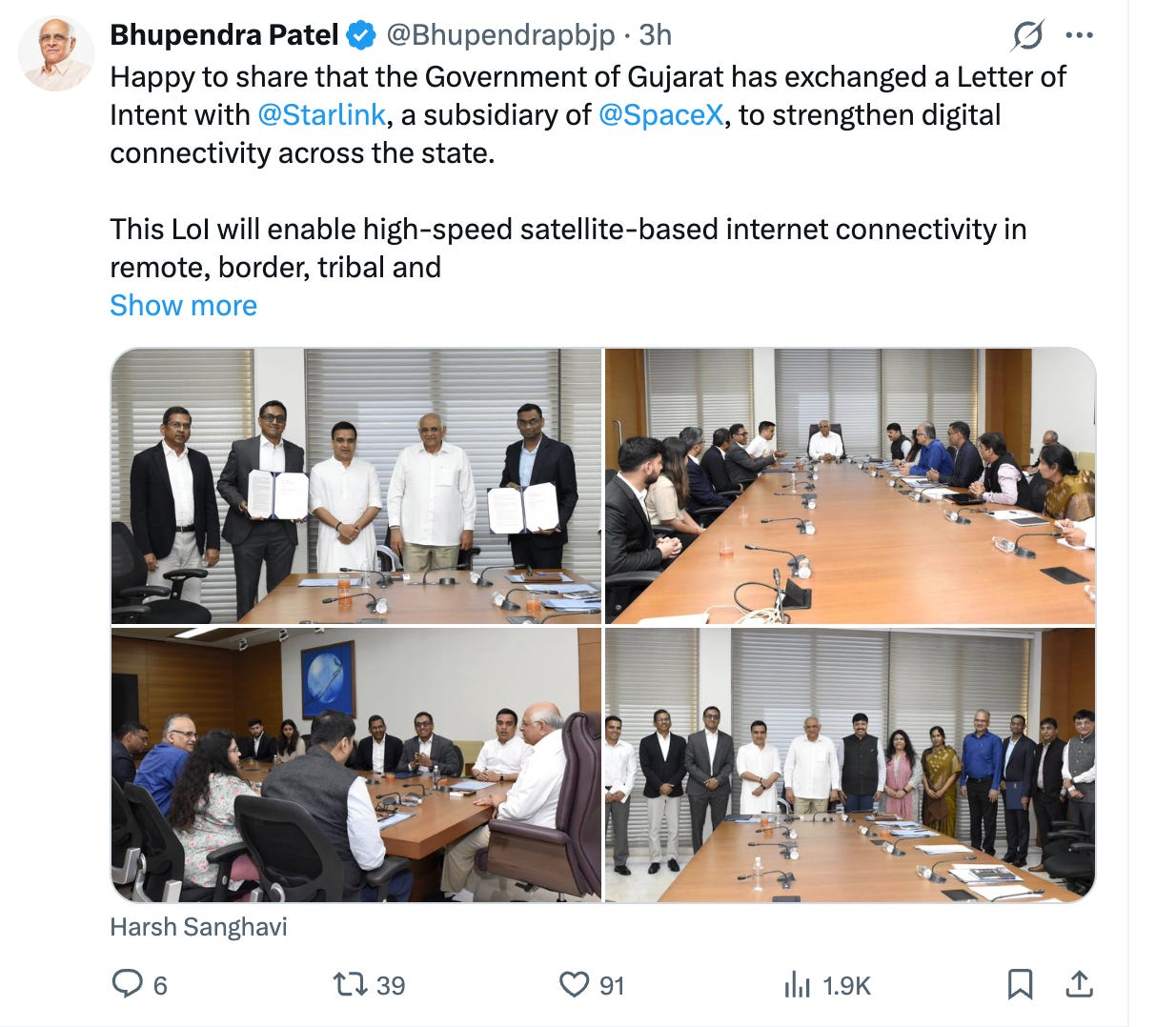

4. Gujarat taps Starlink for last-mile internet 🚀

Gujarat has signed an agreement with Elon Musk’s Starlink to roll out satellite-based high-speed internet.

The deal, announced by Chief Minister Bhupendra Patel, aims to plug connectivity gaps in remote, border, tribal, and aspirational districts, using Starlink’s satellite broadband tech.

What changes on the ground:

According to the state government, better connectivity will help:

- Improve education and healthcare outreach

- Strengthen disaster response and security systems

- Make government services more accessible in low-connectivity areas

A joint working group with officials from Gujarat and Starlink will oversee execution.

Zoom out: last month, Goa signed a similar MoU with Starlink, exploring satellite broadband for schools, healthcare centres, and disaster management.

The government recently allowed Starlink to move forward with initial approvals and state-level tie-ups, clearing the path for satellite broadband services.

5. Where the Budget put the money 📊

Budget 2025 makes its priorities pretty clear, big money is going into security, rural India, and core public services.

Defence tops the chart with ₹6,81,210 crore, reflecting continued focus on national security and military modernisation. Close behind is rural development at ₹2.66 lakh crore, signalling the government’s push to support villages, jobs, and consumption beyond cities.

The rest of the spending shows a balance between growth and welfare.

Home affairs (₹2.33 lakh crore) and agriculture & allied activities (₹1.71 lakh crore) get solid allocations, while education (₹1.28 lakh crore) and health (₹98,311 crore) underline long-term human capital bets. Add steady spends on urban development, IT & telecom, energy, and social welfare.

6. Stock that kept us interested 🚀

1. Axiscades wins ₹80 cr fighter jet order 🛩️

Axiscades Technologies shares hit a 5% upper circuit after its defence arm Mistral Solutions won an ₹80 crore order under HAL’s Tejas fighter jet programme.

The deets: Mistral will supply electronic hardware for critical avionics, including the Mission Computer and Smart Multifunction Display.

Zoom out: the Indian Air Force currently operates around 31 fighter squadrons, well below the sanctioned strength of 42 squadrons.

To bridge this gap, India has placed an order for 83 Tejas Mk1A fighter jets, worth roughly ₹48,000 crore, with deliveries expected to ramp up over the next few years.

What else are we snackin’ 🍿

💸 Growth leader: Moody’s expects India’s GDP to grow 6.4% next fiscal, the fastest among G-20 economies, supported by strong consumption, policy support and a stable banking system.

🤝 Merger cleared: Ambuja Cements said the NCLT has approved its merger with subsidiary Sanghi Industries.

☘️ Green funding: Radiance Renewables has raised $100 million in equity from Impact Fund Denmark and Dutch development bank FMO.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚if you liked this issue.