Deals galore, Urban Company to hit D-street & platform fee hike buzz.

🗓 Morning, folks!

Markets bounced back strong on Wednesday, with Nifty and Sensex closing in the green.

A late-session charge led by banking, metal, and pharma stocks lit up the rally, driven by rising hopes that the upcoming GST reforms could spark a powerful economic boost.

💡 Spotlight: India’s services sector just posted its sharpest growth in over 15 years.

The HSBC India Services PMI jumped to 62.9 in August from 60.5 in July, the highest since mid-2010. A reading above 50 signals growth, and this one reflects the fastest rise in new orders and activity in a decade and a half.

International demand also played a big role, with stronger inflows from Asia, Europe, the Middle East, and the US. Firms responded by stepping up hiring, marking an 11-month streak of job creation.

But the surge wasn’t without costs as higher wages and expenses pushed inflation in service prices to a 13-year high, lifting overall inflation to a nine-month peak.

1 Big Thing: Govt bets on consumption with pre-festive GST cuts 📈

At the 56th GST Council meeting, Finance Minister Nirmala Sitharaman announced a long-awaited simplification of India’s tax maze. The old four-slab structure will dissolve into a two-rate system including 5% for essentials, 18% for the rest with a few luxury sinners pushed into a new 40% tax bracket.

The changes, aimed at boosting consumption and correcting anomalies, will take effect from September 22, the first day of Navratri.

What’s cheaper now:

- Personal care basics (toothpaste, shampoo, soaps, hair oil): down from 18% → 5%

- Pantry staples (ghee, butter, cornflakes, biscuits, jam): 18% → 5%

- Indian breads, paneer, UHT milk: 5% → 0%

- Spectacles and vision aids: 28% → 5%

- Farm inputs and biopesticides: 12% → 5%

- Small cars, ACs, and bikes up to 350cc: 28% → 18%

Insurance for all, Tax for none

All individual life and health insurance policies are now GST-exempt. That means your premiums won’t be padded with 18% tax anymore.

What is expensive — a new 40% slab now applies to:

- High-end cars (above 1200cc petrol / 1500cc diesel)

- Motorcycles >350cc

- Personal-use aircraft, yachts, racing cars

- And, of course, pan masala, gutkha, and cigarettes

Tobacco products will continue to attract 28% + compensation cess till loans to states are paid off.

The fine print:

- Non-economy air travel: 12% → 18%

- EVs: Stay at 5%

- Commercial vehicles (trucks, ambulances): 28% → 18%

- Farm and composting machines: 12% → 5%

- Handicrafts, marble, granite, leather goods: 12% → 5%

Why now: with global slowdowns and domestic consumption cooling, the government is betting big on spending. And nothing says “please shop more” like lower taxes on what fills your fridge, bathroom cabinet, and garage.

So yes, this festive season shopping list might come with a lighter receipt.

2. Waaree secures 64% Kotson’s stake for ₹192 cr ⚙️

Waaree Energies is acquiring a 64% stake in transformer maker Kotson’s for ₹192 crore, turning it into a subsidiary.

Kotson designs and supplies transformer solutions with a plant capacity of 4,000 MVA. Kotson’s plant can make transformers powerful enough to handle electricity for lakhs of homes and factories, with a total capacity of 4,000 MVA.

Alongside, Waaree will also take over 100% of Impactgrid Renewables, a non-operational step-down subsidiary, from its unit Waaree Forever Energies.

Why Kotson’s: Waaree builds solar panels and large solar projects, and having transformers in-house means smoother integration from generation to transmission.

Why it matters: transformers are critical for moving electricity from solar plants to the grid, and owning this capability means Waaree can control more of its supply chain, cut costs, and ensure quality. The move expands Waaree’s footprint beyond just solar panels into the wider power transmission and distribution industry, positioning it as a more integrated clean energy player.

While we are on acquisitions,

TBO Tek will acquire US-based Classic Vacations from Najafi Companies for up to $125 million. Investors loved the update as the stock soared 15%.

Classic Vacations connects luxury advisors and suppliers to offer high-end vacation packages worldwide. Meanwhile, TBO Tek is an Indian travel-tech platform that provides a global B2B marketplace for travel agents, offering flights, hotels, tours, and other travel services.

The deets: the deal combines TBO’s global tech platform with Classic’s network of 10,000+ luxury travel advisors and suppliers. Classic will keep running as an independent brand but will now tap TBO’s tech and distribution muscle to scale.

3. Indus Towers forays into African markets 🤝

Indus Towers came into focus after its board approved its foray into African markets, beginning with Nigeria, Uganda, and Zambia. Despite the significance of this move, the stock slipped around 2% in Wednesday’s trading session.

Indus Towers Limited was formed by the merger of Bharti Infratel Limited and Indus Towers. This combined strength makes Indus one of the largest telecom tower companies in the world.

The deets: the company’s entry into Africa marks its first-ever overseas expansion and is being viewed as a strategic attempt to widen its international footprint. Management believes these markets present strong opportunities for revenue diversification, operational scalability, and long-term value creation.

The catch: shares of the company slipped as investors worried that cash could be funneled into operations instead of dividends.

For context, Indus Towers hasn’t paid a dividend since May 2022, largely due to delayed payments from its key customer, Vodafone Idea. Earlier this year, the board was expected to announce a bonus, a buyback, or both in its May meeting, but the plan was postponed, which only added to investor disappointment and dragged the stock lower.

4. Urban Company files for ₹1,900 crore IPO 🎯

Urban Company, India’s largest home and beauty services platform, is hitting the public markets with its ₹1,900-crore IPO.

The deets: the issue includes ₹472 crore worth of fresh shares from the company itself, while existing investors will cash out ₹1,428 crore via offer-for-sale.

Why it matters: proceeds from the fresh issue will go into tech and cloud development, office leases, marketing, and general corporate purposes. Urban Company has carved a niche with services like home cleaning, plumbing, pest control, grooming, and recently expanded into home solutions.

While we are on fundraises,

AI startup Anthropic has closed a jaw-dropping $13 billion funding round, valuing the company at $183 billion.

The deets: Anthropic, best known for its AI assistant Claude, has seen its revenue explode, from a $1 billion run rate at the start of 2025 to $5 billion by August. The company claims more than 300,000 business customers now rely on its products. This fresh capital will fuel global expansion, safety research, and rising enterprise demand.

The funding is also one of the largest single rounds ever in AI, underlining the market’s appetite.

5. DCM Shriram partners with Aarti Industries for steady chlorine-supply ⚗️

DCM Shriram and Aarti Industries entered into a long-term strategic partnership for steady supply of chlorine.

What they do: DCM Shriram is India’s second largest chlor-alkali producer which is a key ingredient in making caustic soda which is then used to make paper, textiles, yarn etc. While Aarti Industries also produce specialty chemicals used in polymers, pharmaceuticals, and pigments.

The deets: the two companies have entered an agreement where DCM Shriram will become the sole supplier of chlor-alkali for AIL’s new facility in Zone IV in Jhagadia, Gujarat. The companies will also establish an exclusive chorine pipeline to streamline the production process.

Worth noting: shares of DCM Shriram jumped over 1.16% while AIL’s stock also inched up by over one percent after the announcement.

6. Stocks that kept us interested 🚀

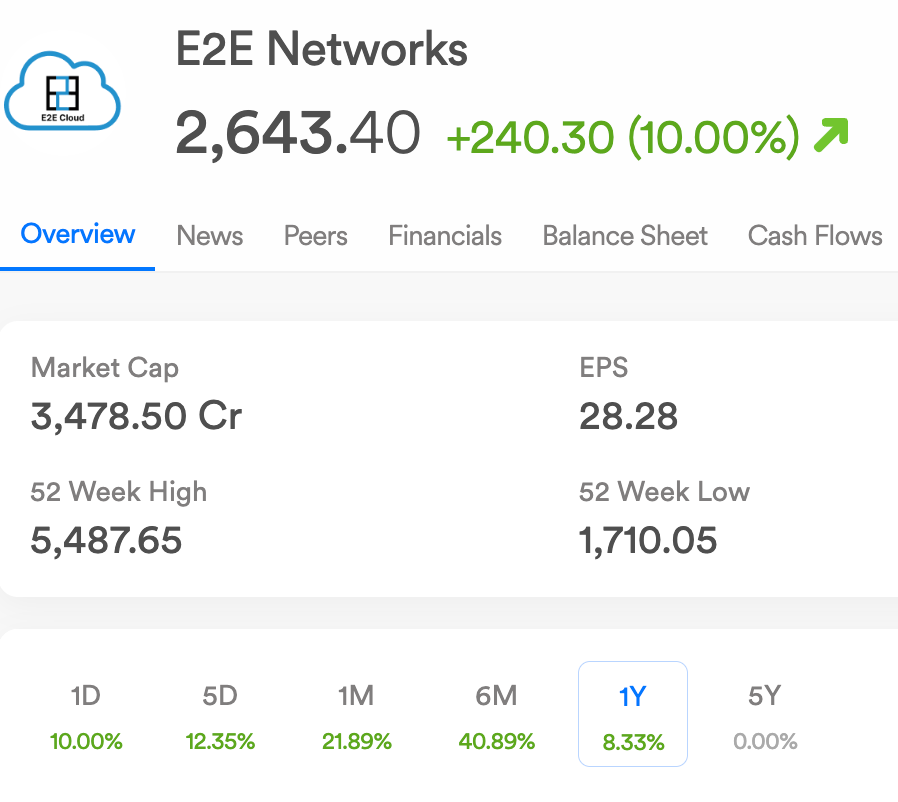

1. E2E hits upper circuit on ₹177cr IndiaAI deal 🚀

E2E Networks hit the 10% upper circuit after bagging a ₹177 crore contract from the IndiaAI Mission under MeitY.

The deets: the deal is for immediate allocation of GPU resources including Nvidia’s H100 SXM and H200 SXM chips.

These GPUs are cutting-edge processors built to handle heavy AI workloads, enabling faster training of large language models. The resources will go to GNANI AI to build India’s foundational AI model.

Gnani.ai is a voice-first AI startup building advanced speech technology that understands and processes multiple Indian languages.

Zoom out: India’s Cabinet approved the IndiaAI Mission in March 2024 with a massive commitment of ₹10,372 crore over five years to power AI innovation across the country.

Since then, the government has rolled out its IndiaAI Compute pillar, aiming to deploy over 10,000 GPUs for AI workloads, and by mid-2025, has added nearly 16,000 GPUs, including TPUs through successive tenders.

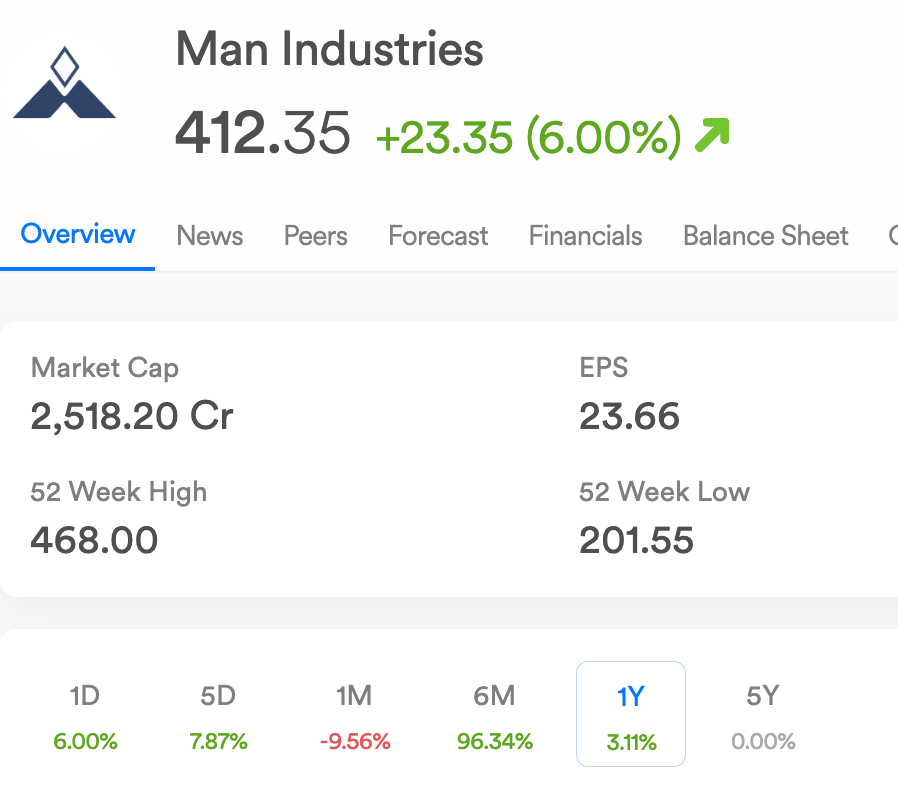

2. Man Industries stock jumps on fresh export win 📈

Man Industries soared nearly 7% after the company received a new export order worth ₹1,700 crore.

MAN Industries is one of the largest makers and exporters of large diameter carbon steel line pipes in India.

The deets: the order is for the supply of various coated pipes. It is expected to be delivered during the next 6-12 months. With this, the company’s total orderbook now stands at an all-time high of ₹4,700 crore, with exports making up nearly 80% of the share. The order is also likely to contribute 50% to the company’s annual revenue.

By the numbers: Man Industries had announced its first-quarter results last month, reporting a 45.2% rise in net profit to ₹27.6 crore compared to ₹19 crore in the same period last year. However, revenue from operations slipped 0.9% to ₹742.1 crore.

What else are we snackin’ 🍿

⚖️ Ruling relief: Google dodged a breakup as court spared Chrome and Android, but must share search data with rivals.

💰Fee hike: Eternal Ltd, owner of Zomato and Blinkit, raised platform fees on food delivery orders to ₹12 from ₹10, a 20% hike.

⚡Fee feast: Swiggy raised its platform fee to ₹15 per order, just after Zomato, marking the steepest hike amid festive demand.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.