Blood bath on Dalal Street, Chhattisgarh gets infra boost, and ChatGPT Health debut.

🗓️ Morning, folks and Happy Fridayyyy! ☀️

Indian markets took a hard knock on Thursday, with the Nifty 50 cracking below 26,000.

The damage was steep, with BSE-listed companies losing over ₹8 lakh crore in market value as selling spread across the board.

The trigger came from global jitters. Markets turned edgy after US President Donald Trump approved a sanctions bill that could slap 500% tariffs on countries buying Russian oil, putting major buyers like India and China in the spotlight.

Almost every sector dropped, and metals were hit the hardest, falling 3.4%.

💡 Spotlight: Capital Goods face heat 🔻

Capital goods stocks had a rough Thursday, with ABB India, Siemens India, and L&T falling as much as 3-5%.

The slide came after a Reuters report said the Finance Ministry may ease rules that have kept Chinese firms from bidding for government contracts since 2020, after the Galwan clash.

In simple terms, easing curbs could bring Chinese companies back into tenders, increasing competition and squeezing Indian firms’ pricing power.

Investors worry that if Chinese players return, competition in big government tenders will heat up and Indian companies may find it harder to win orders at strong prices.

Let’s hit it!

1 Big Thing: Infosys’ next big bet on AI 🤖

Infosys has partnered with US-based Cognition to roll out Devin, an AI software engineer, across global enterprises to speed up software development.

What’s the deal: the company will deploy Devin across its own engineering teams and embed it into client delivery models worldwide. The AI agent will be integrated with Infosys Topaz Fabric, its in-house AI platform.

Together, they will make easy-to-use AI tools that help big companies build and fix software faster.

Why it matters: Devin can act like a virtual engineer, handling coding, testing, maintenance, and modernisation tasks.

An interesting shift is that AI tools are no longer just helping humans write code, they are starting to act like junior engineers & handling tasks such as fixing bugs. This is changing how software teams work, with AI doing the repetitive work while humans focus on ideas and design.

While we are on partnerships,

Adani Group has reportedly tied up with Brazilian aircraft maker Embraer to manufacture regional passenger jets in India.

Background: Embraer makes small and mid-sized jets that carry 70–146 passengers, mainly used on short and medium routes. These aircraft are widely used by regional airlines across the world.

Earlier, Adani Aerospace signed an MoU with Embraer to set up a Final Assembly Line (FAL) in India.

What’s going on: combining the earlier partnership & current one, aircraft will be assembled end-to-end in the country.

Zoom out: the government hopes Embraer’s move will help build a full aircraft manufacturing ecosystem in India. If successful, it could even push Airbus and Boeing to consider assembling planes in India, not just sourcing parts.

2. ₹1 lakh crore infra push for Chhattisgarh 🏡

HUDCO has signed a five-year deal with the Chhattisgarh government to lend up to ₹1 lakh crore to fund the state’s development projects.

Housing and Urban Development Corporation (HUDCO) is a government-owned company that provides financing and technical services for housing and urban infrastructure projects.

Breaking it down: the company will lend money to Chhattisgarh government-run agencies to carry out infrastructure, power and renewable energy projects, up to FY 2030. As per the deal, these agencies plan to borrow up to ₹20,000 crore every year, taking the total funding to ₹1 lakh crore over five years.

The why: Chhattisgarh is at an important stage in its growth story. Despite being rich in minerals and having surplus power, it still needs stronger infrastructure.

Under the Chhattisgarh Anjor Vision 2047, the state plans to speed up inclusive growth, and this project will help power that infrastructure and long-term development goals.

4. IPO fever on Dalal Street 💰

The IPO wave on Dalal Street is picking up pace, and Amagi Media Labs is the latest name to join the queue.

The SaaS company has filed its Red Herring Prospectus (RHP) for an IPO worth ₹1,789 crore, targeting a valuation of over ₹7,800 crore.

Worth noting: Amagi is among the first companies in its niche to tap public markets, and is being positioned as the first Media and Entertainment SaaS unicorn, or cloud-native video platform, to list.

Amagi powers the backend of modern video streaming. It helps broadcasters, OTT platforms, and content owners create, manage, distribute, and monetise video channels, largely using cloud infrastructure powered by Amazon Web Services India (AWS).

More on IPOs 💸,

India’s first online gas trading platform, Indian Gas Exchange (IGX), is lining up for a market debut and could launch its IPO by December.

What’s brewing: think of IGX as a digital marketplace for natural gas, where trades happen online and delivery follows. It operates under Petroleum and Natural Gas Regulatory Board (PNGRB) regulations and is backed by Indian Energy Exchange (IEX).

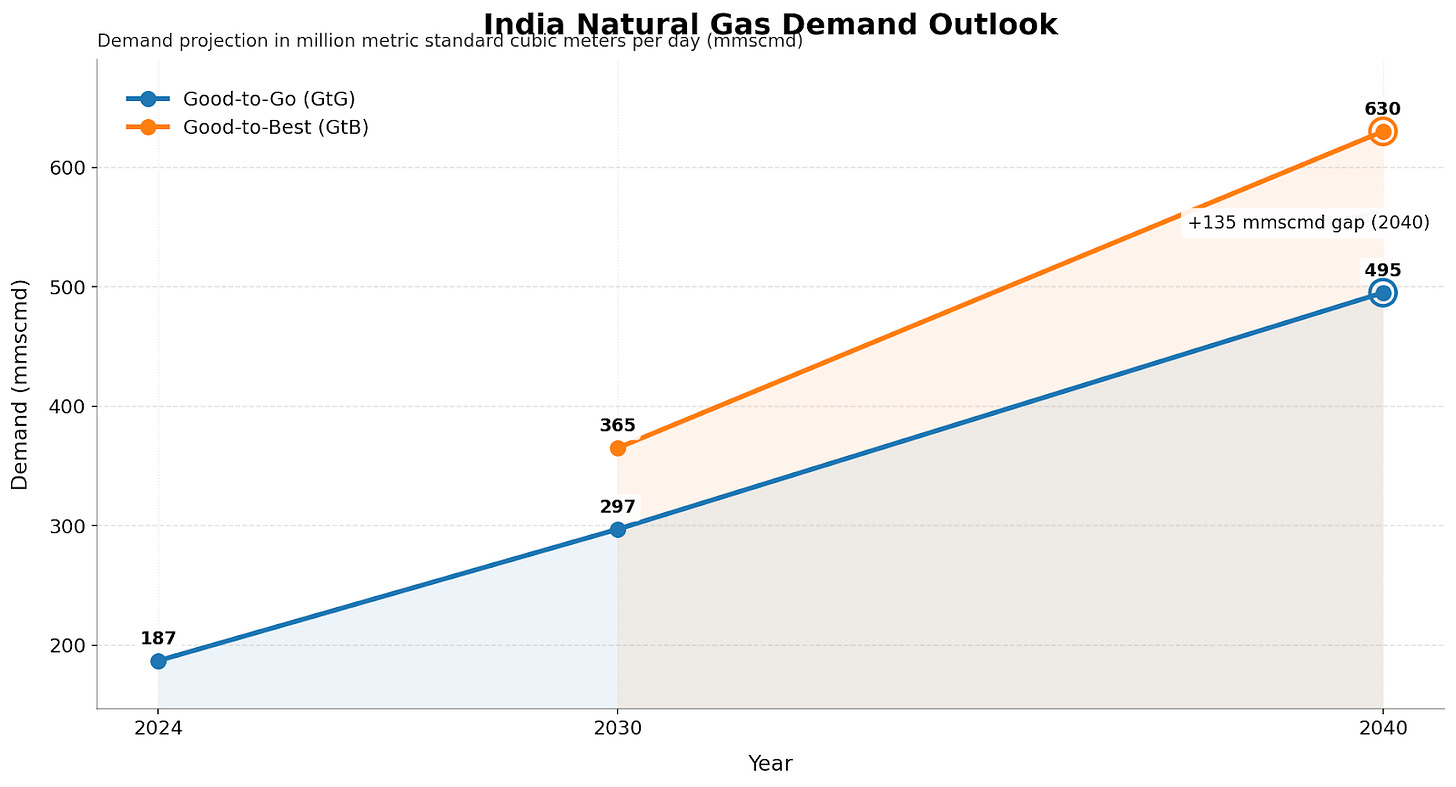

Why now: the timing is no accident. India’s gas demand is expected to climb sharply, reaching 297 mmscmd by 2030 and 495 mmscmd by 2040.

The biggest fuel behind that rise is City Gas Distribution, like piped gas for homes and CNG for vehicles, which could make up 29% of demand by 2030 and 44% by 2040.

5. More drama in the Warner Bros saga 🎞️

Warner Bros Discovery’s board has unanimously rejected Paramount Skydance’s $108.4 billion takeover bid, calling it a risky, debt-heavy deal that could burden the company and hurt investors.

Some background: on December 5, 2025, Netflix and Warner Bros Discovery announced a final deal under which Netflix would buy Warner Bros, including its film and TV studios, HBO, and HBO Max.

After this, Paramount launched its hostile take-over bid worth $108 billion, compared with Netflix’s $82.7 billion bid, sending shockwaves across the industry and raising antitrust alarms.

The hype: Paramount and Netflix were competing to buy Warner Bros, which owns top film and TV studios and a vast content library, including major franchises like Harry Potter, Game of Thrones, Friends, the DC universe, and classic films such as Casablanca and Citizen Kane.

5. Stock that kept us interested 🚀

1. Big defence win for L&T 💪

L&T has just scored a major defence win, and it’s all about keeping India’s powerful Pinaka rocket launcher system battle-ready.

For context, Pinaka is a truck-mounted launcher that fires multiple rockets in seconds, hitting targets far away across large areas.

What’s happening: the Indian Army’s Corps of Electronics and Mechanical Engineers (EME) has awarded L&T an order to overhaul, upgrade, and manage outdated parts of the Pinaka systems currently in service.

In simple terms, L&T will help the Army repair and modernise Pinaka so it stays reliable for years.

The project will focus on replacing obsolete components, upgrading key sub-systems, and providing ongoing technical support to Army Base Workshops. Since L&T is the original manufacturer (OEM), it will also supply critical spares.

What else are we snackin’ 🍿

🩺 HealthGPT: OpenAI unveiled ChatGPT Health, a space for health conversations, as over 230 million users already ask medical and wellness questions on the platform each week.

💊 ADHD nod: Granules India’s U.S. unit has got early approval from the USFDA to sell a generic ADHD medicine, and it may get a 180-day head start before competitors.

🔄 Market flip: Alphabet’s market cap overtook Apple’s for the first time since 2019, highlighting how Google’s AI-led push is outpacing Apple’s strategy.

💰 Fresh investment: Global private equity firm Apax Funds has bought a large minority stake in iD Fresh Food to help it grow faster in India and abroad.

📱 AI bet: Aditya Birla Ventures joined a $70 million funding round in AI startup Articul8, valued over $500 million, focused on safer private AI.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.