Starlink buys Echostar, Glenmark's AbbVie deal, and Solar gets a bump.

🗓 Morning, folks!

Markets closed higher on Tuesday, with Sensex and Nifty touching two-week highs thanks to a strong tech rally.

Infosys jumped 5% after announcing its board will weigh a share buyback on September 11, a move investors see as a vote of confidence. Wipro, Tech Mahindra, HCLTech, and TCS rode the wave too, adding 2–3% each and giving the Nifty IT index its best day in nearly two months.

Auto stocks kept the momentum going, with Maruti Suzuki and Eicher Motors up another 1% a piece.

Let’s hit it!

1. Big thing: Glenmark signs $700m deal with US-based AbbVie 💊

Glenmark Pharma’s subsidiary, Ichnos Glenmark Innovation (IGI), has bagged a massive $700 million upfront payment from US-listed AbbVie for its lead cancer molecule ISB 2001. The update sent Glenmark shares up over 3%.

The deets: ISB 2001 is a trispecific antibody being developed for multiple myeloma, a form of blood cancer.

Under the exclusive global licensing deal, AbbVie gets rights to develop, manufacture, and commercialise the molecule across North America, Europe, Japan, and Greater China. The agreement includes $1.225 billion in potential milestone payments plus tiered, double-digit royalties on net sales.

Why it matters: this is one of the biggest licensing deals by an Indian biotech player. It gives Glenmark validation on its R&D and a strong global partner to take ISB 2001 through the costly and risky late-stage clinical trials.

Big theme: cancer therapies are among the most lucrative areas in global pharma, with the oncology market projected to cross $375 billion by 2030. For Glenmark, ISB 2001 could be its ticket into the big leagues.

While we are on deals,

Elon Musk’s SpaceX, which operates the Starlink satellite internet network, is acquiring wireless spectrum from EchoStar Corp. in a deal worth about $17 billion.

The deets: for EchoStar, the sale helps resolve a regulatory probe tied to its spectrum holdings and provides much-needed cash to pay down debt. The deal also effectively ends EchoStar’s ambition of becoming the U.S.’s fourth major wireless carrier, a possibility once floated when regulators approved its earlier merger.

Shares of EchoStar jumped as much as 64% in premarket trading, while its bonds led gains in the junk-bond market, according to TRACE data.

2. Nebius’ $19b Microsoft deal 💻

Nebius Group shares soared over 60% in extended trade after the company inked a deal with Microsoft worth up to $19.4 billion over five years.

Nebius Group runs data centers that provide powerful Nvidia graphics chips, giving companies the computing power they need to train and run AI models.

The deets: Nebius, headquartered in Amsterdam, provides cloud infrastructure powered by Nvidia GPUs, which are the core chips used for training large AI models like ChatGPT.

Under the deal, it will supply Microsoft with this high-performance computing power from its New Jersey data center.

This partnership directly helps Microsoft meet the exploding demand for AI compute capacity across Azure and OpenAI workloads.

The why: demand for AI infrastructure is outstripping supply, with OpenAI and other cloud clients scrambling for GPU capacity. Microsoft has already tapped CoreWeave and Google to plug the gaps. For Nebius, the deal means faster growth and financing options to scale GPU services in multiple tranches this year and next.

Big theme: the global AI compute infrastructure market is exploding. Demand for GPUs and cloud computing resources far outstrips supply, pushing companies like Microsoft, Google, and Amazon to partner with specialized players such as CoreWeave and Nebius.

3. Prime Focus gains as Mauritius fund invests ₹188 Cr 📈

Mauritius-based Craft Emerging Market Fund picked up a 3.87% stake in Prime Focus for ₹187.9 crore through open market deals, sending the stock into a 10% upper circuit.

Craft Emerging Market Fund PCC is a Mauritius-based institutional investor that backs fast-growing small to mid-cap companies often through SME IPOs and open market deals.

The deets: Prime Focus, a key player in movie and video production, is seeing heavy churn in its shareholder base. But with marquee investors buying in, the market seems to be betting on a big screen comeback.

Prime Focus was buzzing last week too as investors like Ramesh Damani, Utpal Sheth, and Madhusudan Kela’s Singularity AMC scooped up a 3.3% stake for ₹146.2 crore.

Why it matters: Craft EMF likely sees value in Prime Focus’s digital content infrastructure and global clientele. By accumulating a 3.87% stake, they're positioning for potential upside from a media revival, leveraging their experience backing high-growth, undervalued firms.

4. Gautam Solar to invest ₹4,000 crore to power India’s solar ambitions ☀️

Gautam Solar is investing ₹4,000 crore to develop a state-of-the-art solar cell manufacturing facility in Madhya Pradesh.

The Delhi-based company specialises in production of high-capacity solar modules. They also provide Engineering, Procurement, and Construction (EPC) services for solar power plants to a diverse clientele. Currently they have a production capacity of 3.2 GW.

The deets: the company plans to build a solar plant of 5 GW in Gwalior. It will span 54 acres and will be used to produce advanced TOPCon solar cells. Phase 1 of the project is already underway and the entire facility will be operational by 2029.

Zoom out: the move aligns with India’s larger aim of achieving 500 GW of renewable energy capacity by 2030 and cut down import dependence.

6. Stocks that kept us interested 🚀

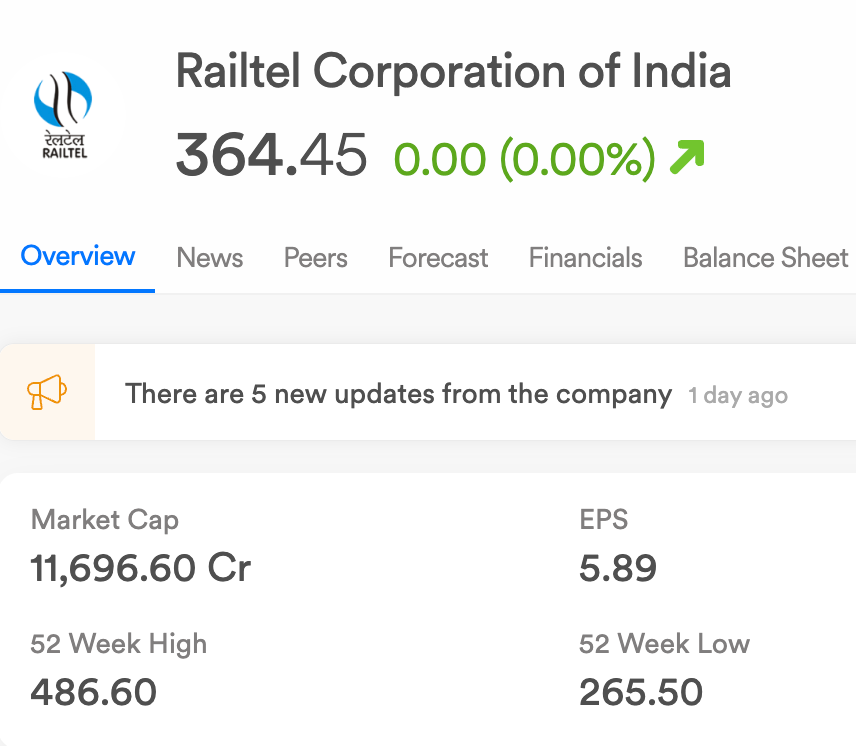

1. RailTel secures ₹700 crore Bihar digital education deals

RailTel shares surged more than 4% after the company announced fresh project wins worth around ₹700 crore from the Bihar Education Project Council.

The deets:

- an order worth ₹262 crore for procurement, supply, and installation of smart classrooms in government secondary and senior secondary schools.

- a ₹44 crore contract for supply, installation, testing, and commissioning of ICT/ISM labs.

- a ₹90 crore order to provide teaching-learning material for Classes I–V in government schools.

- a separate ₹257 crore LOA for another round of smart classroom installations in Bihar.

- an additional supply project valued at ₹59 crore.

Why it matters: RailTel is quietly becoming a backbone for India’s digital classrooms. For the company, it means a steady, long-term revenue stream beyond railways.

Earlier, RailTel has been actively involved in the government’s ICT in Schools and Digital India initiatives, executing projects like smart classrooms, digital labs, and broadband connectivity for schools across states including Gujarat, Rajasthan, and Assam.

The company has leveraged its pan-India fibre network and IT expertise to deliver digital infrastructure for education, healthcare, and governance.

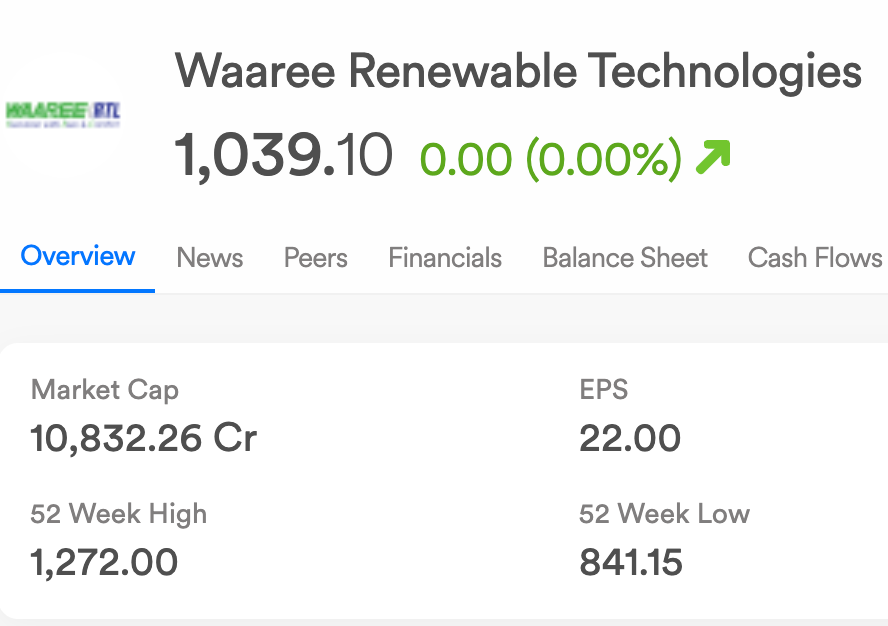

2. Waaree’s ₹1,252 cr solar win ☀️

Waaree Renewables bagged a ₹1,252 crore order from Waaree Forever Energies for building a large solar power project. The stock gained nearly 3% following the update.

The deets: the turnkey EPC order covers an 870 MWac/1,218 MWp ground-mounted solar plant. It also includes a 33kV/400kV substation, transmission line, and two years of O&M services.

What it means: an 870 MWac / 1,218 MWp solar plant can generate enough clean electricity to power 10–12 lakh homes, replacing coal-fired power with renewable energy.

Zoom out: India’s solar power has exploded over the past decade, from 2.8 GW in 2014 to over 100 GW by early 2025. As of July 2025, cumulative solar capacity climbed to 119 GW, making up roughly 24% of India’s total power capacity and nearly 50% of all renewable energy capacity.

States like Rajasthan, Gujarat, and Maharashtra led the charge. Driven by this momentum, the Central Electricity Authority projects that solar capacity (292.6 GW) will surpass thermal by 2030, pushing toward the country’s broader 500 GW non-fossil power target.

What else are we snackin’ 🍿

🤝 India-Israel pact: the two nations inked a bilateral investment deal to boost investor protections and expand trade and investment ties.

🏗️ Infra win: HUDCO inked an MoU with the Nagpur Metropolitan Region Development Authority (NMRDA) for a ₹11,300 crore project.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.