IHCL acquires hotels, Digital payment boom, and knockout deals.

🗓 Morning, folks!

Dalal Street hit the brakes hard on Tuesday, closing at the day’s low as the Nifty and Sensex slipped into the red. Early optimism fizzled out, with a sharp selloff in the last hour wiping out gains.

Banking and financial stocks bore the brunt of the selling, dragging the market lower, even as pharma, auto, and IT managed to stay in the green.

In domestic data,

India’s retail inflation, measured by the consumer price index (CPI), cooled to an eight-year low of 1.55% in July, just shy of the all-time low of 1.46% recorded in June 2017 under the current CPI series.

CPI inflation tracks how much prices for everyday goods and services change over time, reflecting shifts in the cost of living.

What’s behind the drop? A favourable base effect and sustained moderation in key food and service categories have driven prices lower, offering welcome relief to households across both rural and urban India.

💡 Spotlight: India’s digital payment boom

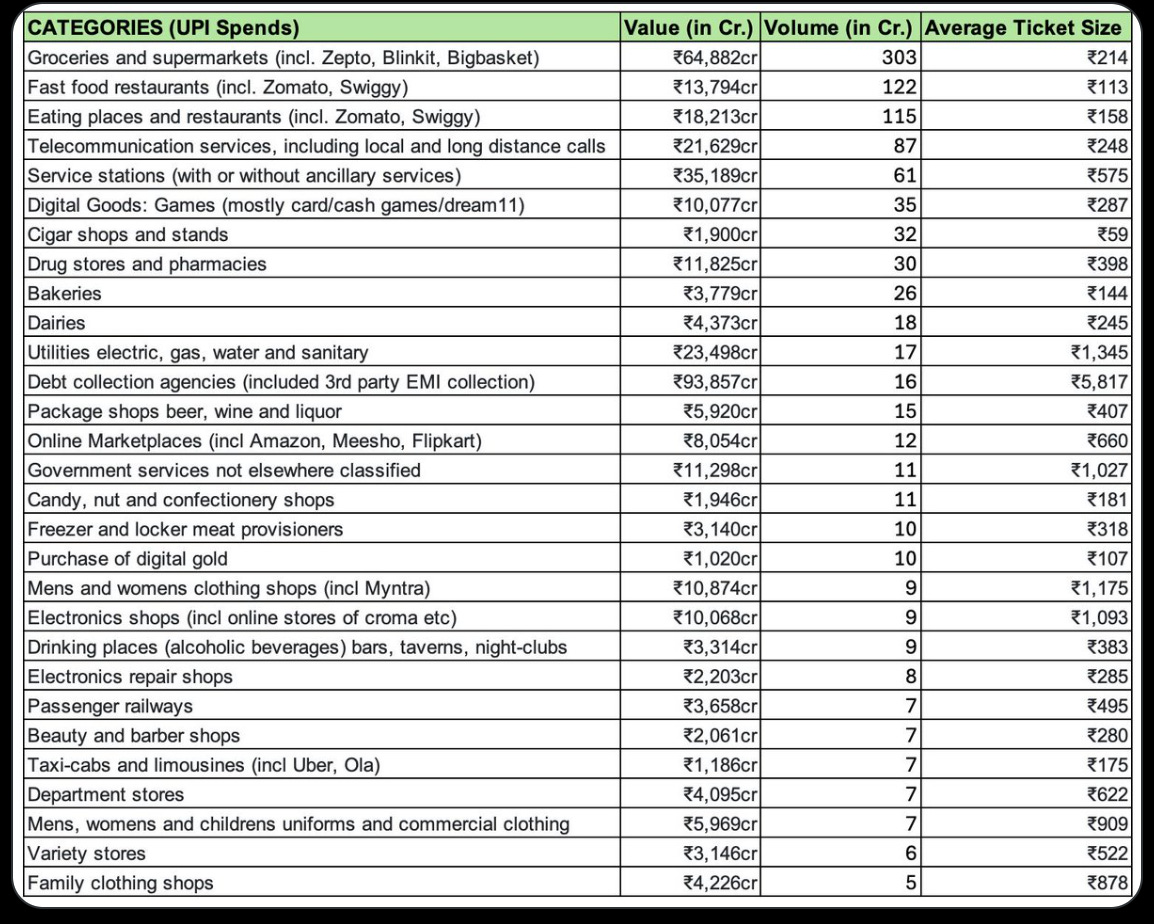

Digital transactions in India have exploded, surging over 10x in the past seven years to reach 22,831 crore in FY25, up from just 2,071 crore in FY18. UPI has been the star performer, skyrocketing from 92 crore transactions to 18,587 crore in the same period, a jaw-dropping 114% CAGR.

Meanwhile, Indians spent a whopping ₹65,000 crore stocking kitchen shelves in July, with UPI powering 3 billion+ grocery checkouts, a quarter of all merchant payments.

1. Big Thing: India greenlights four new semiconductor projects 🔌

The Union Cabinet chaired by PM Modi has approved four new semiconductor projects under the India Semiconductor Mission (ISM).

The deets: the four new semiconductor projects are approved with a total investment of ₹4,594 crore. The projects include two in Odisha and one each in Punjab and Andhra Pradesh. The production is expected to begin within the next 2-3 years.

The four newly approved companies are SiCSem Private Limited, Continental Device India Private Limited (CDIL), 3D Glass Solutions Inc. (3DGS), and Advanced System in Package (ASIP) Technologies.

The why: these projects zero in on compound semiconductors and advanced packaging, critical pieces in powering India’s electronics manufacturing push. They’re designed to elevate India’s standing in the global chip supply chain and advance its ambition for tech self-reliance.

Why it matters: with execution expected to move at full throttle, India could see its first made-in-India semiconductor chip roll out this very year, a milestone that could redefine the country’s role in global tech.

While, we are on big investments,

Oil and Natural Gas Corporation (ONGC) will invest ₹4,600 crore in newly discovered reserves in KG Basin of Konaseema district, Andhra Pradesh.

The deets: the state-owned enterprise plans to drill 10 development wells, set up two unmanned platforms, lay an offshore pipeline, and establish an onshore gas processing facility in the southern state.

A development well is drilled when there are proven and viable reserves of oil found in a region. The unmanned platform and offshore pipelines would also be used for drilling the reserves while the gas processing facility will help purify raw natural gas.

2. HAL flies high with strong Q1 performance ✈️

Hindustan Aeronautics flew past street estimates in Q1, delivering solid numbers across most metrics despite a dip in profit.

By the numbers:

Revenue: up 10.8% YoY at ₹4,819 cr

Net profit: down 4.11% YoY ₹1,377 cr

The deets: HAL’s revenue growth was fuelled by the execution of orders worth ₹1.89 lakh crore and a stronger contribution from repairs and overhauls. Looking ahead, the company is eyeing an ambitious order book target of ₹2.5-2.6 lakh crore for FY26.

Outlook for FY26: the company expects revenue growth of around 8–10% this year, with potential to hit double digits sooner. It also plans to deliver 12 LCA Mk1A fighter jets in FY26, furthering India’s indigenous defence manufacturing ambitions.

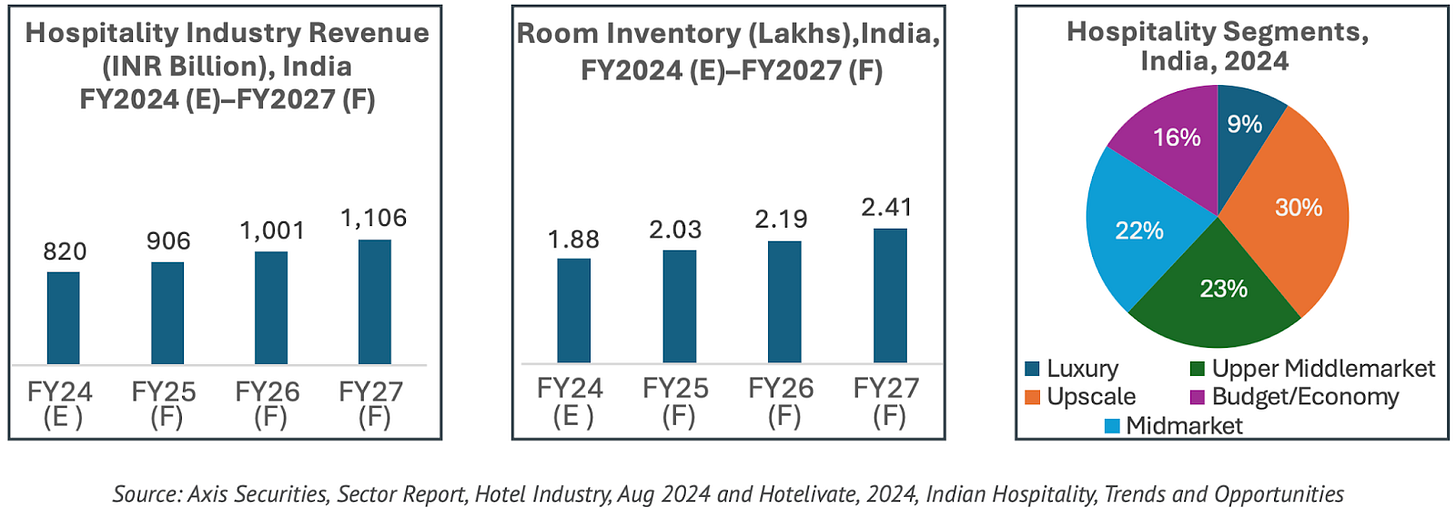

3. IHCL expands footprint with twin acquisitions 🏨

Indian Hotels Company Limited (IHCL) is acquiring controlling stakes in two hospitality firms for up to ₹204 crore.

The deets: the two hospitality firms are ANK Hotels Private Limited and Pride Hospitality Private Limited. IHCL will acquire majority shareholding in ANK Hotels for ₹110 crore and in Pride Hospitality for ₹94 crore. The transactions are expected to be completed by November 15 this year.

ANK Hotels Pvt. Ltd., with a portfolio of 111 midscale properties, operates and manages hotels under The Clarks brand. Pride Hospitality Pvt. Ltd. runs 24 hotels across India.

The why: both transactions aim to strengthen IHCL’s presence in India’s midscale segment while reinforcing its asset-light growth strategy. The acquisitions will substantially expand IHCL’s portfolio, as The Clarks Hotels & Resorts operates 135 properties nationwide and Pride Hospitality adds further reach in the midscale market.

4. Pronto speeds up home help 🏠

Pronto has raised $11 million in Series A funding to expand its 10-minute home services platform to more Indian metros.

What they do: Pronto controls the entire supply chain, from recruiting and training to scheduling and performance tracking, to ensure predictable incomes for workers and consistent quality for customers.

The deets: the round was co-led by US-based General Catalyst and Glade Brook Capital, with Bain Capital Ventures also participating.

Zoom out: quick commerce is moving beyond groceries into services. Startups like Snabbit and Pync, along with incumbents like Urban Company, are racing to offer instant home help. With fewer than 15,000 Indians using organised domestic services daily, the market is still largely untapped, and ripe for growth.

While we are on fundraises,

Luxury villa and apartment rental platform Elivaas has raised $10.4 million in a Series B round.

What they do: Elivaas links travellers with luxury villas and apartments, offering more space, privacy, and personalised stays than hotels, targeting leisure and corporate groups.

The deets: the funds will be used to expand Elivaas’ property portfolio in India and abroad, enhance its tech platform, and hire more talent. It’s also eyeing markets like UAE, Sri Lanka, Thailand, and Indonesia.

Zoom out: India’s luxury villa and apartment rental market, currently worth $4 billion, is projected to touch $20 billion by 2035. Post-pandemic, demand for luxury holiday rentals has surged, growing up to 10x faster than hotels.

5. Paramount locks in UFC knockout deal 🥊

Days after merging with Skydance, Paramount has secured U.S. rights to TKO Group’s Ultimate Fighting Championship - UFC for seven years starting in 2026.

TKO Group is a U.S. company created when WWE joined forces with UFC’s parent company, Zuffa, under the sports giant Endeavor.

What’s brewing: the deal, worth about $7.7 billion, covers UFC’s full lineup of 13 numbered events and 30 “fight nights” for Paramount’s streaming service, with select events also airing on CBS. Paramount may also bid for UFC rights in other markets. In a major shift from pay-per-view, all matches will be available to viewers at no extra cost.

The why: live sports rights, especially for major events, have become a core part of media strategies as cord-cutting gains pace. Netflix and Disney have also signed similar deals to strengthen their content portfolios with high-profile properties like WWE.

6. Stocks that kept us interested 🚀

1. Inox Green locks in mega O&M deal ⚡

Inox Green shares surged nearly 2% after it entered an agreement for operations and maintenance of 182 MW of operational wind projects.

The deets: the wind projects are spread across several locations in Western India and are connected to the company’s existing shared infrastructure. The deal upgrades 82 MW of wind projects from basic maintenance to full-service care.

Why it matters: this deal marks Inox Green’s debut in the fast-growing solar O&M sector, a market expected to expand several-fold over the next decade, unlocking significant long-term growth potential for the company.

2. HBL Engineering wins contract for Railway KAVACH Installation 🚂

HBL Engineering shares jumped in Tuesday’s trading session after the company received an order worth ₹54 cr.

The deets: the order comes from West Central Railway and is expected to be completed within 700 days. HBL Engineering will set up KAVACH, an anti-collision safety system, along 166 km of railway tracks in the Kota division.

The total number of stations included is 18 and 166 kms of station will be covered under this contract.

In other news, the company also reported strong Q1FY26 numbers, driven by higher revenues and lower expenses. The company’s net profit surged 79% YoY to ₹143.27 crore & revenue from operations climbed 15.7% YoY to ₹601.7 crore.

What else are we snackin’ 🍿

☀️ Solar surge: Havells eyes ₹1,500 crore solar push after ₹600 crore Goldi Solar investment, despite Q1 revenue and profit dips.

🇺🇸 Tariff timeout: Trump has extended the US-China tariff truce for 90 more days, averting a potential tax hike on Chinese imports just hours before the deadline.

💉 Going global: Lupin launched Glucagon injection in the US, matching Eli Lilly’s product, to treat severe hypoglycaemia in children and adults with diabetes.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.