AI spending rises, IPO pipeline builds, and Infra momentum holds.

🗓️ Morning, folks! ☀️

Markets kicked off the new year on a cautious note, ending largely flat as gains in financials and midcaps balanced pressure.

Sensex ended in the Red while Nifty stayed positive, comfortably holding above the 26,100 mark amid mixed cues.

Sector-wise, banks supported the indices. On the brighter side, Bajaj Auto gained 3% ahead of sales data, and auto names like M&M and Ashok Leyland moved higher on strong December volumes.

💡 Spotlight: Sin tax strikes back

Cigarette stocks went up in smoke on January 1, with ITC and Godfrey Phillips sliding as much as 17% after the government announced a fresh excise duty hike on cigarettes. The move will come into effect from February 1.

The new excise duty ranges from ₹2,050 to ₹8,500 per 1,000 sticks, depending on cigarette length. The change that is expected to push up retail prices.

Why it matters: cigarettes are a core profit driver for ITC and other tobacco players, and higher prices risk denting volumes.

For the government, it’s a familiar sin-tax play to boost revenue and discourage consumption. Read more here.

Let’s hit it!

1. Zaggle’s payment play gets a Visa stamp 💳

Zaggle Prepaid Ocean Services signed a seven-year agreement with Visa to roll out co-branded domestic prepaid cards in India.

What’s happening: under the deal, Visa will actively support and incentivise Zaggle to launch and promote these cards on its network.

While Visa is a global player, the agreement itself is focused entirely on domestic transactions, making it a long-term growth play rather than a one-off tie-up.

Just last month Zaggle announced a partnership with Mastercard Asia Pacific, which allows it to offer Mastercard credit cards and related solutions to both existing and potential customers.

The expansion play: Zaggle has been pushing growth through strategic partnerships and acquisitions, including Rivpe Technology acquisition and a roadmap to issue one million credit cards over the next five years.

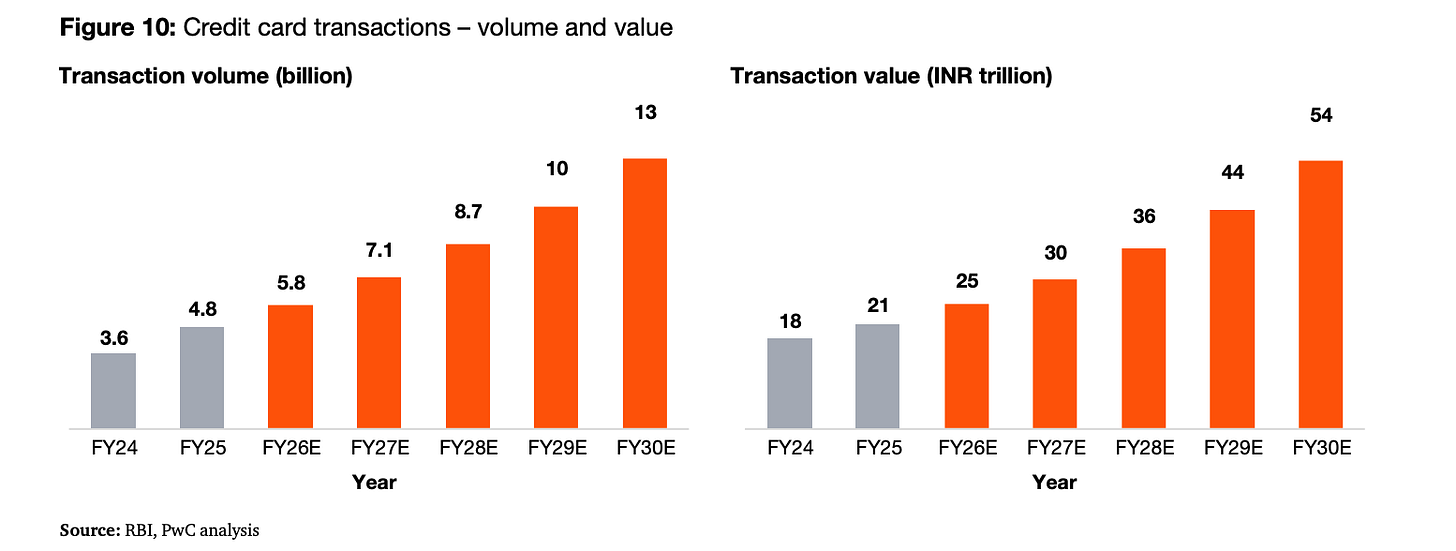

Quick bite: over the next five years, credit card usage in India is set to surge. Both the number of transactions and the money spent on cards are expected to grow at a little over 20% annually.

2. CapitaLand invests in three AI-ready data centres 🤖

CapitaLand’s India Data Centre Fund (CIDCF) will buy a 20.2% stake in three data centres from CapitaLand India Trust for about ₹702 crore.

What do they do: CapitaLand is one of Asia’s largest diversified real estate groups, headquartered in Singapore, focusing on development, and management of properties.

CIDCF is a dedicated investment fund set up by CapitaLand Investment to own and invest in data centres in India.

The deets: these data centres are being built in Mumbai, Hyderabad, and Chennai. They are AI-ready, designed to be energy-efficient, and built to serve large tech companies and cloud players. Together, they will have a total capacity of 200 MW.

A 200 MW data centre runs non-stop, year after year, using enough electricity to power 15-20 lakh homes annually, but for the internet.

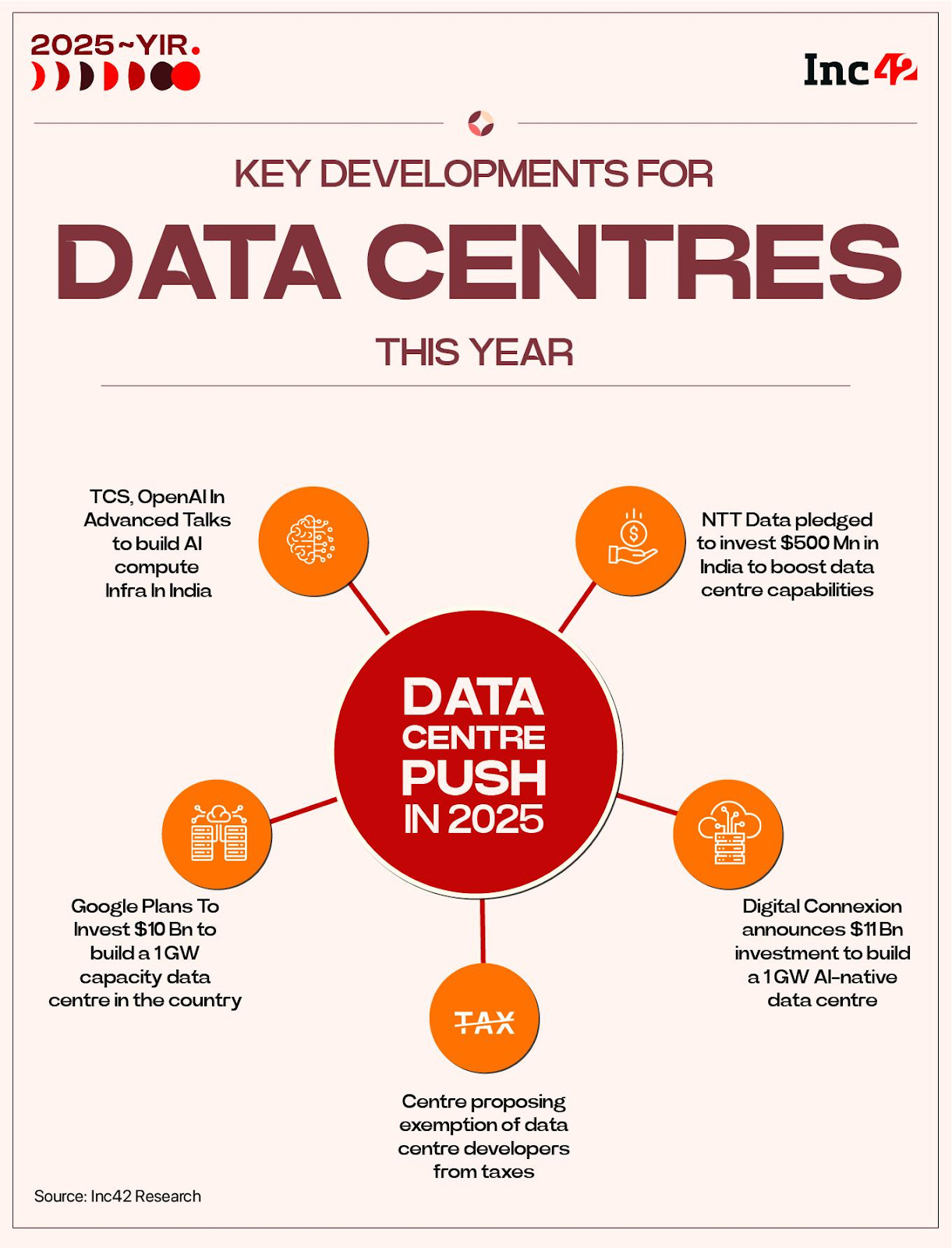

Why it matters: as India becomes a global hotspot for data centre investments, funds like CapitaLand’s are tapping into this surge. Capacity is estimated at 2,070 MW by 2025 and could exceed 4,500 MW by 2030, creating $20–25 billion in investment opportunities.

3. Deepa Jewellers’ ₹250 cr IPO bets on India’s gold demand 💍

Deepa Jewellers has filed draft papers with SEBI to raise ₹250 crore through a fresh issue of shares.

Deepa Jewellers operates in the 22-carat gold jewellery space, offering designing, processing, job-work services and trading. It has a strong footprint across Telangana, Karnataka, Andhra Pradesh, Tamil Nadu and Kerala.

The deets: the IPO includes fresh issue, while promoters Ashish Agarwal and his wife will offload up to 1.18 crore shares via an offer-for-sale.

Why it matters: Gold prices have risen over 12-15% year-to-date, supported by central-bank buying, geopolitical uncertainty and expectations of global rate cuts.

Against this backdrop of strong cash flows and favourable valuations, jewellery companies are choosing to tap equity markets to fund inventory-heavy growth.

While we are on IPOs,

Tonbo Imaging India, a global defence electronics OEM, has filed its draft papers with SEBI for a proposed IPO that will be entirely an offer for sale of over 1.8 crore equity shares.

What’s going on: the company emerged as India’s largest exporter of thermal imaging systems in FY25 and has built a presence across 24 international markets, catering to defence and security needs worldwide.

Tonbo Imaging follows an asset-light model, owning its core design and intellectual property while partnering certified EMS players for manufacturing.

4. Stocks that kept us interested 🚀

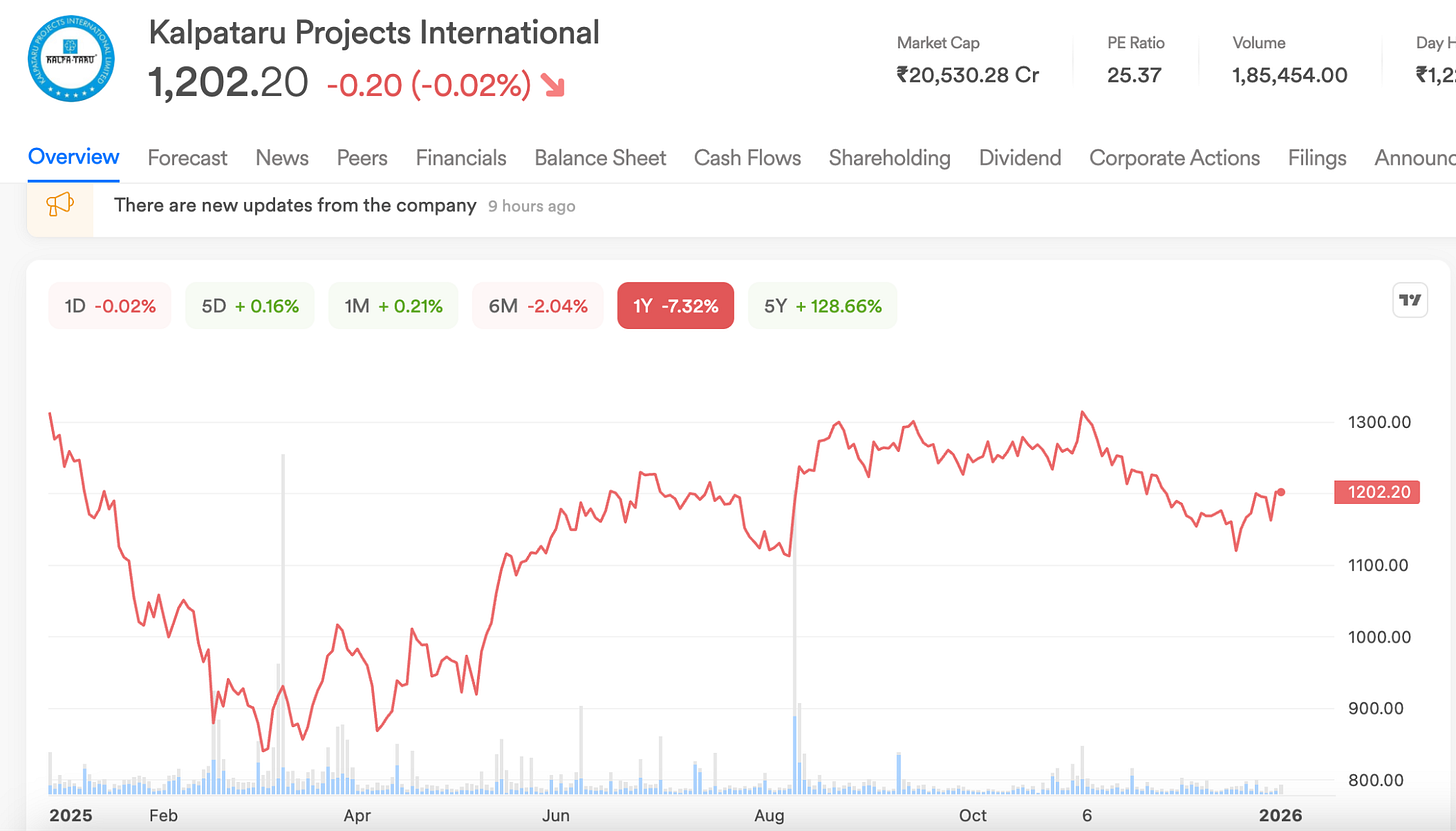

1. Kalpataru Projects wins Thane Metro order worth ₹719 cr 🚆

Kalpataru Projects, along with its joint venture, bagged a ₹719 crore order for an elevated metro rail project in Thane, Maharashtra.

The deets: the project falls under KPIL’s urban mobility EPC portfolio, covering construction work for elevated metro infrastructure. The order deepens company’s footprint beyond power transmission into high-value civil EPC projects.

Why it matters: Thane is one of the busiest commuter corridors, with lakhs of people travelling daily towards Mumbai and Navi Mumbai. An elevated metro offers a faster, predictable alternative to overcrowded local trains and traffic-choked roads.

The project will ease pressure on some of the city’s busiest corridors like the Eastern Express Highway, Ghodbunder Road and the Thane–Mulund belt, where daily traffic snarls are routine.

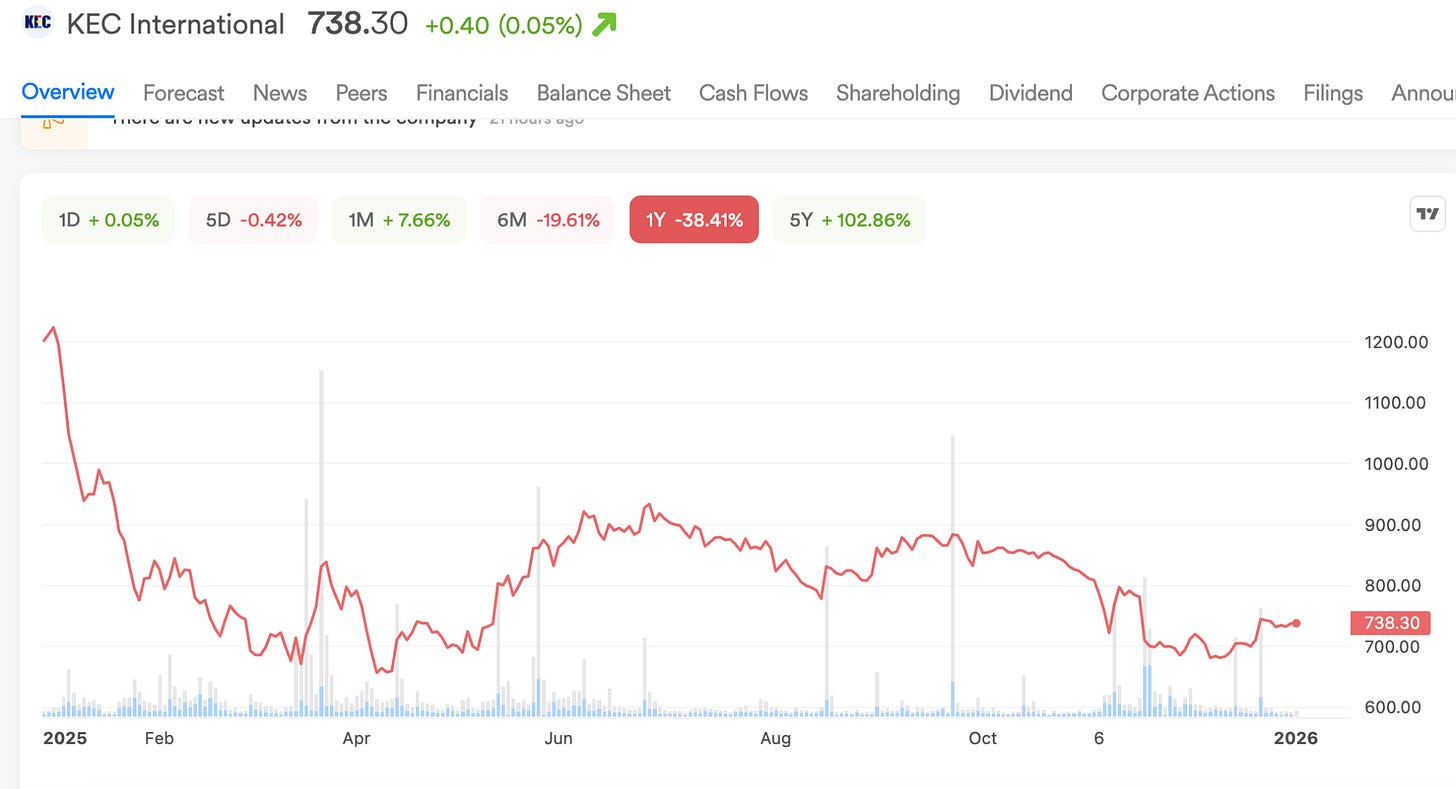

2. KEC International bags multi-sector orders worth ₹1,050 cr ⚡

KEC International bagged fresh orders worth ₹1,050 crore, spanning renewables, civil, transmission & distribution (T&D) and cables and conductors.

The deets: the highlight is KEC’s maiden entry into wind energy, with a 100+ MW wind power project in South India from a private developer. The civil arm also secured a Buildings & Factories order for a downstream project for a leading steel company in western India.

A 100+ MW wind power project can generate enough electricity to supply around 75,000–1,00,000 homes every year.

Big theme: India has nearly 44 GW of installed wind capacity as of 2025, making it the 4th-largest wind power market globally, after China, the US and Germany.

The nation targets 140 GW of wind capacity by 2030, positioning wind as a key pillar alongside solar in meeting clean energy and net-zero goals.

What else are we snackin’ 🍿

💳 UPI milestone: UPI transactions in December hit fresh highs in both value and volume.

🚆 Sleeper express: India’s first Vande Bharat sleeper train will run between Guwahati and Kolkata.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.