India-Malaysia ink 11 MoUs, M&M's largest manufacturing hub, and NSE to hit D-street.

🗓️ Morning, folks and Happy Mondayyy! ☀️

We’ve been hearing a lot about semiconductors lately. Supply chains. Geopolitics. AI.

So we decided to step away from the headlines and actually go see how this stuff is built.

For our fourth episode of This Is Business, we went to IISc Bengaluru to spend time with Agnit Semiconductors, a startup working on gallium nitride (GaN) chips. These are the chips that end up inside telecom networks, defence systems, and high-power infrastructure.

What surprised us wasn’t just the technology, but how long this journey has been in the making. Years of research inside IISc labs. A slow move from experiments to real manufacturing. And a growing push to build these capabilities inside India, after decades of depending on global supply chains.

We spoke to Agnit’s founders about what it actually takes to make advanced chips here, why GaN matters, and why this moment feels like a turning point.

Full story here 👇

💡 Spotlight: PM Modi’s Malaysia visit packed 11 MoUs 🤝

PM Modi’s two-day visit to Kuala Lumpur may have been short, but it packed a punch.

India and Malaysia signed 11 MoUs and exchanged several bilateral documents across a wide range of sectors.

This was Modi’s first Malaysia visit since the relationship was upgraded to a Comprehensive Strategic Partnership in August 2024.

A key focus was security too, with both countries doubling down on counter-terrorism, intelligence sharing, and maritime security as regional challenges keep evolving.

Let’s hit it! 💪🏻

1 Big thing: RBI holds repo rate steady at 5.25% ✅

The RBI has hit pause again. The Monetary Policy Committee (MPC) kept the repo rate unchanged at 5.25%, and the decision was unanimous.

Breaking it down: it also stuck with a ‘neutral’ stance, which is basically the RBI saying it will stay flexible and react to how the economy behaves next.

This is the third time in the last four policy meetings that rates have been left untouched, after the RBI cut rates by a total of 1% across February, April, and June 2025.

What does this mean for you: loan EMIs are unlikely to move much right now. So if you are paying a home loan, car loan, or personal loan, this is a no fresh shock kind of update.

On inflation, the RBI slightly raised its forecast from 2% to 2.1%, but stressed that price pressures are still under control and within the tolerance band.

RBI Governor Sanjay Malhotra said high-frequency indicators show the momentum remains strong, and the central bank raised its FY26 growth forecast slightly to 7.4% from 7.3%.

He added that India’s growth outlook looks steady, helped by improving trade tailwinds, even as global risks like geopolitical woes and nervous bond markets continue to hover in the background.

2. Nagpur to host Mahindra’s largest facility 🚗

Mahindra and Mahindra plans to build its largest integrated manufacturing facility for automobiles and tractors in Nagpur, Maharashtra.

The deets: the facility will span 1,500 acres, backed by a 150-acre supplier park in Sambhajinagar (Aurangabad).

To fund this long-term push, M&M has announced a capex plan of ₹15,000 crore over the next 10 years to expand manufacturing capacity. Overall, the company will acquire 2,000 acres across three locations for these mega projects.

Why build something this big: once the Nagpur facility becomes operational in 2028, it’s expected to have the capacity to produce over 5 lakh vehicles and 1 lakh tractors.

Mahindra also plans to manufacture both internal combustion engine (ICE) and electric vehicles (EVs), while keeping flexibility for evolving auto technologies.

3. Blackstone goes shopping 🏦

The RBI has cleared an approval for Blackstone to acquire up to 9.99% stake in Federal Bank, through its arm Asia II Topco XIII Pte.

Big theme: the deal adds to a string of big-ticket transactions in India’s private banking space.

Over the past year, Emirates NBD agreed to buy a 60% stake in RBL Bank, while Japan’s SMBC acquired a 20% stake in Yes Bank and later raised it by 4.2%.

The opportunity: a key draw is India’s massive population. Large sections of it are still outside the formal financial system. That gap presents a long-term opportunity for banks to expand credit, deposits, and financial inclusion.

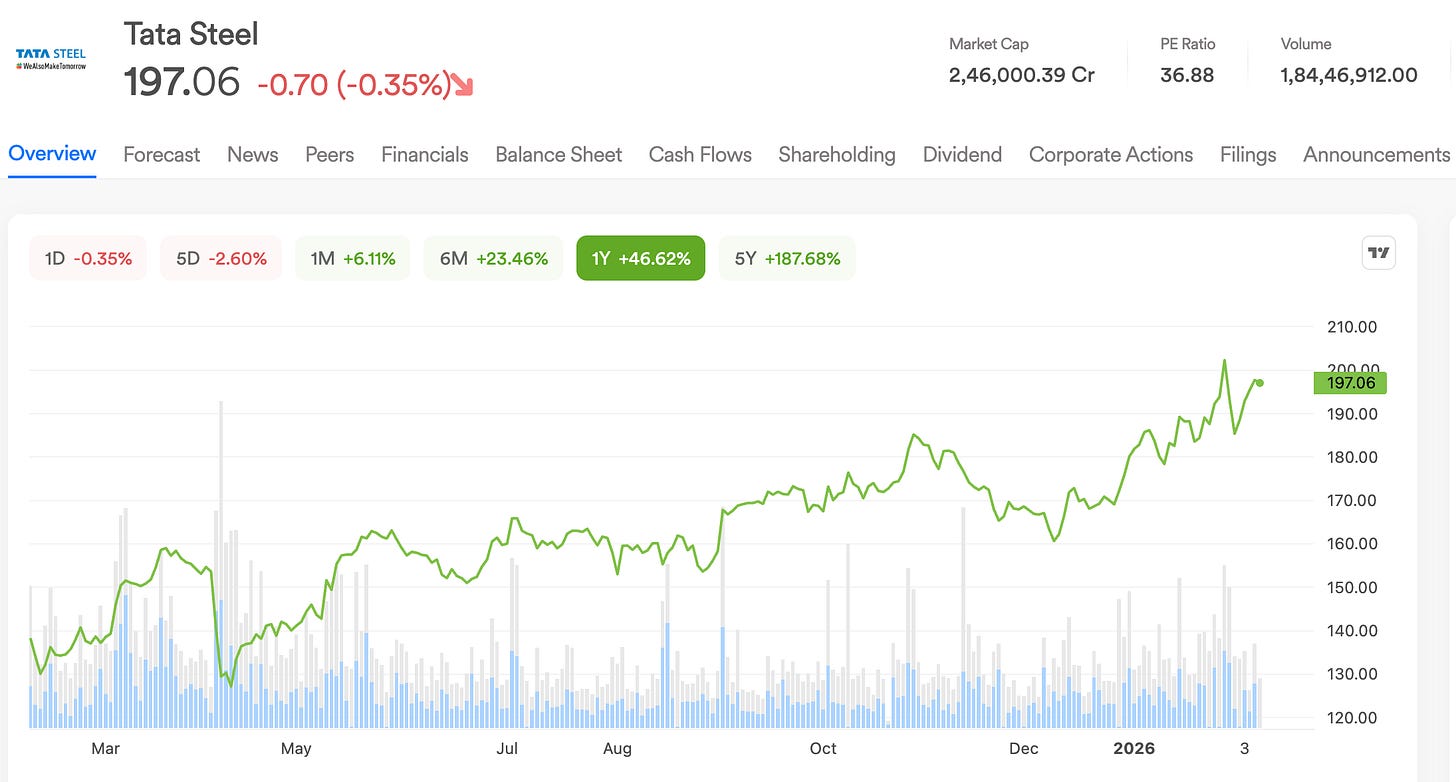

4. Tata Steel Q3 profit up over 700% YoY 💪🏻

Tata Steel had a standout Q3FY26.

The key numbers: the company posted a net profit of ₹2,689.7 crore, a massive jump of 723%.

Revenue also moved up by over 6%, with consolidated operations bringing in ₹57,002 crore versus ₹53,648 crore a year ago.

So, what helped: the big lift came from a sharp improvement in profitability at its Netherlands unit, while steady performance in India helped keep things on track.

This strength also helped cushion the impact of continued operating losses in the UK.

More on earnings,

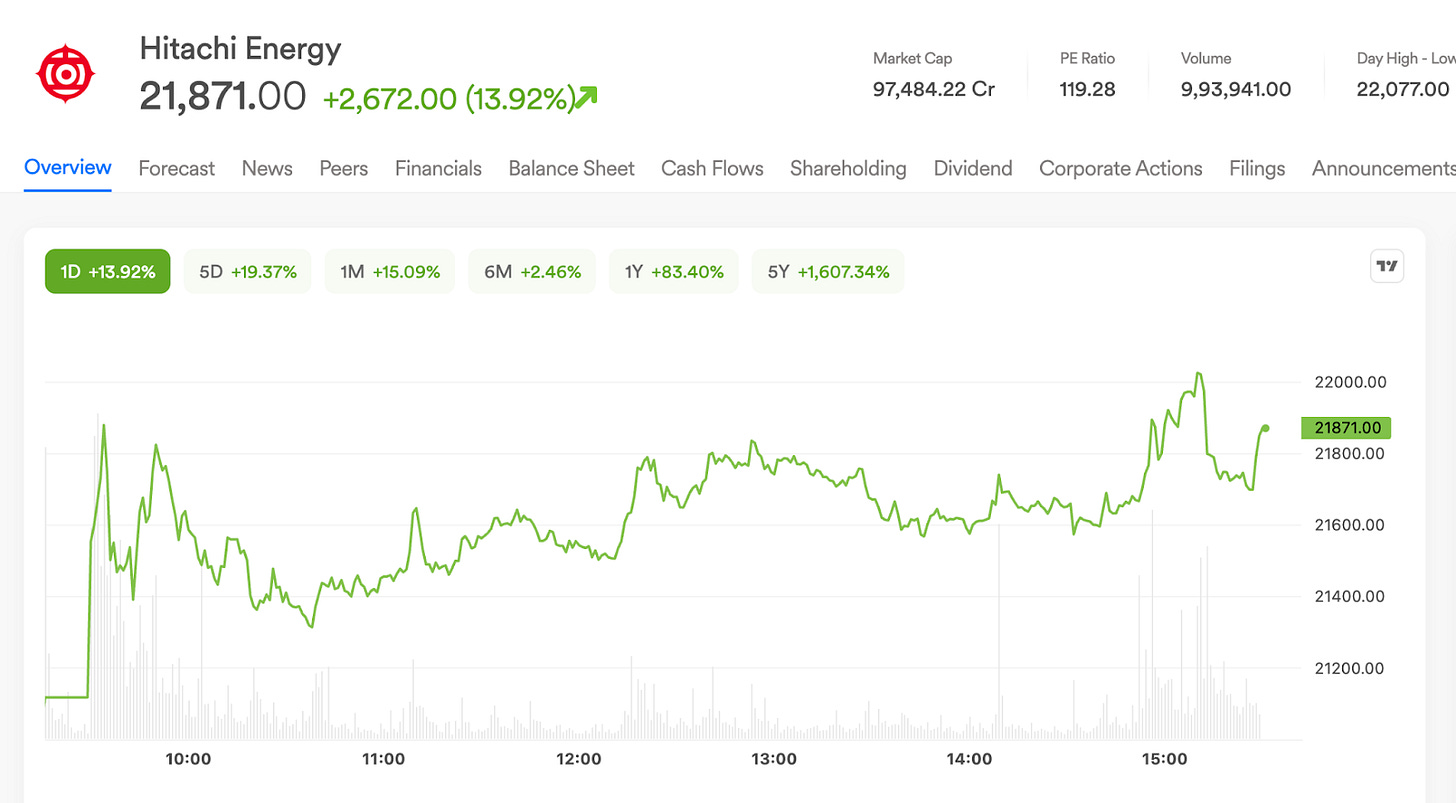

Hitachi Energy put up a strong Q3, with profit surging over 90% YoY on the back of solid execution and a strong order pipeline.

Stock action: shares jumped nearly 14% on Friday after the management said it expects to maintain its double-digit operational EBITDA guidance for next financial year.

In simple terms, it means the company expects its core business profits to grow strongly next year too.

Here’s the snapshot:

- Net profit: up 90.3% YoY at ₹261.4 vs ₹137.4 cr

- Revenue: up 28.5% YoY at ₹2,082.2 cr vs ₹1,620.3 cr

What’s driving it: transformers, reactors, and gas insulated and air insulated switchgear led demand, with data centres and renewables emerging as key growth engines.

5. Why does Indian IT top global brand value? 🧐

2026 has been a bit of a whiplash year for India’s IT sector.

New AI tools from the US spooked markets and pushed Indian IT stocks into the spotlight for the wrong reasons, bringing back the old fear: if AI can do more, will services shrink?

But zoom out and the picture looks far healthier. Indian IT giants still dominate global brand value rankings, with TCS, Infosys, HCLTech, and Wipro holding strong positions.

6. Stocks that kept us interested 🚀

1. BEL wins ₹581 crore defence orders 🚀

Bharat Electronics (BEL) has landed another set of orders, worth ₹581 crore. However, the stock slipped in Friday’s session.

So, what did BEL win: the new orders span a wide mix of defence work, including communication equipment, radar warning receivers, tank sub-systems, radar systems, and software solutions. It also covers upgrades, spares, and related support services.

And this comes right after a solid Q3.

In Q3FY26, BEL reported a profit of ₹1,590 crore, up 20.8% YoY from ₹1,316 crore last year. It also had a strong order book of ₹73,015 crore as of January 1, 2026.

2. Talbros revs up on ₹1,000 crore order win 🚘

Talbros Automotive Components and its joint ventures have won multi-year orders worth over ₹1,000 crore from major automakers in India and overseas.

Talbros Automotive Components supplies key components like gaskets and heat shields to major vehicle manufacturers.

What’s happening: the company has secured a strong multi-year order book across its core businesses. This includes:

- ₹500 crore of export orders in forgings, largely from a new European auto component major

- ₹250 crore from its sealing business for gaskets and heat shields, including ₹110 crore in exports

- ₹170 crore in domestic orders for hoses and anti-vibration parts

- and ₹90 crore in EV-focused export orders for chassis components through its joint venture.

The new orders will boost Talbros Automotive’s presence in the European market, with a large share coming from a newly added global auto component supplier.

What else are we snackin’ 🍿

✅ Green signal: NSE approved its long-awaited IPO, clearing the path for India’s largest stock exchange to list through a shareholder stake sale.

🤝 Trade talks: India and the GCC signed the basic plan to restart free trade talks. The GCC includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE.

💊 Cheap pills: US President Trump launched a new website TrumpRx.gov in his own name to sell medicines to Americans at cheaper prices.

⚡️Deeptech push: Government expanded Startup India, recognising deeptech firms and raising startup turnover eligibility to ₹200 crore from ₹100 crore.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.