Deals with Uncle Sam, IPO galore, and US government shutdown.

🗓 Morning, folks! It’s a new week.

💡 Spotlight: GST collections scale new high

India’s GST collections grew 9.1% in September, reaching ₹1.89 lakh crore, compared to ₹1.73 lakh crore in the same month last year.

From April to September 2025, GST collections touched ₹12.1 lakh crore, up 9.8% from a year earlier, already about 55% of the full-year FY24 total.

In simple terms, monthly GST collections reflect how much money the government is earning from taxes on consumption.

Higher GST collections show stronger consumer demand and business activity, giving the government more money to spend on infrastructure, welfare, and growth schemes. It’s also seen as a key health check of the economy.

Let’s hit it!

1 Big thing: RBI keeps rates steady, future cut on horizon 🔒

In an expected move, the RBI monetary policy committee has decided to keep the repo rates steady at 5.5%.

FYI: Market watchers still expect the RBI to deliver one more rate cut before the end of FY26.

Breaking it down: the central bank also raised India’s FY26 growth forecast to 6.8% from 6.5%, signaling stronger economic momentum and better business sentiment.

At the same time, it reduced the inflation forecast to 2.6% from 3.1%, suggesting more stable prices and some relief for households.

Governor Sanjay Malhotra added that recent tariff changes could slow growth in the second half of this year, though easing food prices and GST cuts are expected to keep inflation in check.

To strengthen the rupee’s global role, the RBI announced steps such as introducing reference rates for major currencies. It also allowed Indian banks to lend in rupees to neighbouring countries and offered foreign partners more options to invest their rupee balances.

To support exporters facing US tariffs, the RBI cut paperwork and extended the deadline to bring back foreign earnings from one month to three months.

2. Infra.Market eyes ₹5,000 crore d-street debut 🧱

Infra.Market has filed its DRHP with SEBI for a ₹5,000 crore IPO via a confidential route.

The Bengaluru-based company has a digital platform for easy procurement of building and construction materials. They offer a wide range of products like tiles, sanitaryware, pipes, and cement to both manufacturers and retail customers.

The deets: the company will reportedly have an equal split of equity shares and offer-for-sale.

This IPO adds one more to the list of companies who are choosing the confidential route to enter the public market.

With India’s construction market set to grow at 6.87%, Infra.Market can leverage its strengths to ensure sustained growth post debut.

Another player heads to Dalal Street,

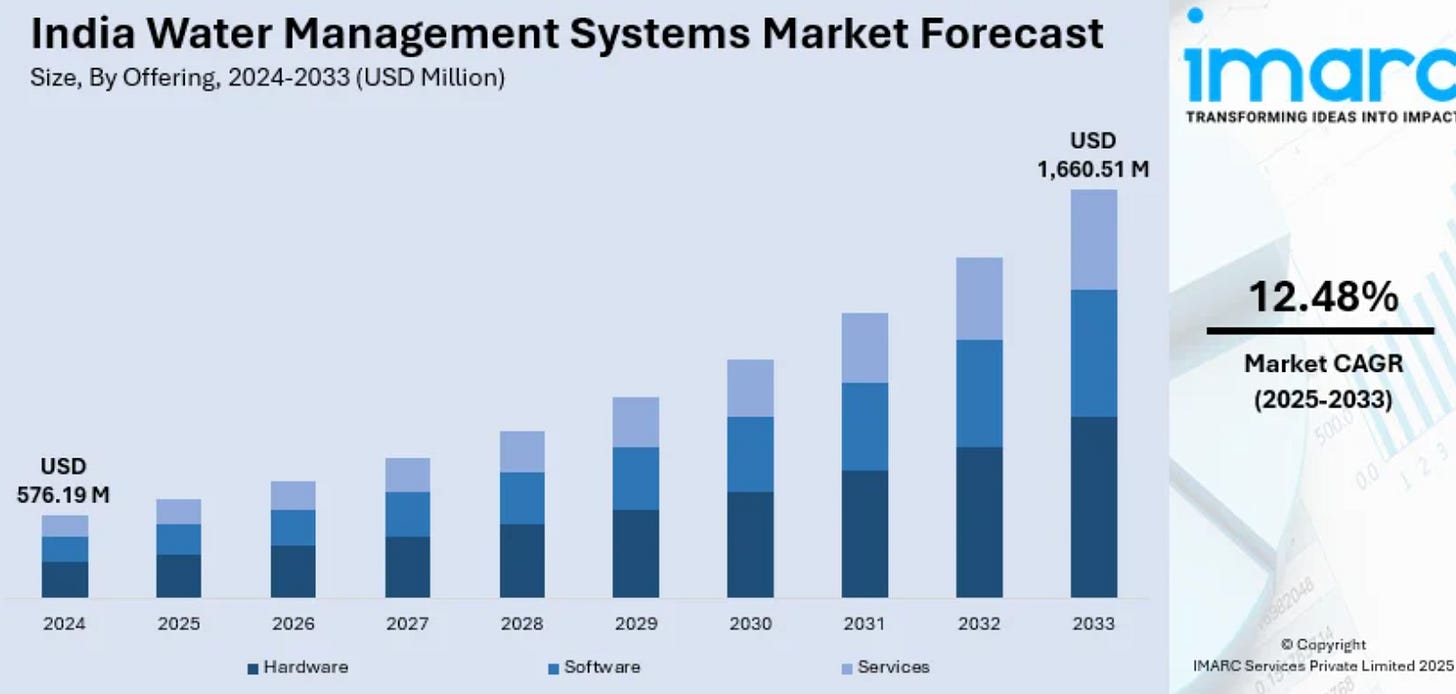

Vishwaraj Environment has filed its draft papers for IPO with SEBI and aims to raise ₹2,250 crore.

The company is a developer of water utilities and wastewater management projects in India with a strong focus on treating sewage water for industrial use.

The deets: the IPO consists of fresh issue worth ₹1,250 crore and offer-for-sale of ₹1,000 crore.

Zoom out: India’s wastewater management market is growing at a steady rate of 12.48% and is expected to reach a valuation of $1,660.5 million by 2033. Combining its two-decade long industry experience and extensive portfolio, the company can earn a major market share post-IPO.

3. RateGain strengthens U.S. footprint with Sojern deal ✈️

RateGain Travel Tech has announced plans to acquire US-based Sojern Inc and its subsidiaries for $250 million. The stock gained 7% in Wednesday’s trading session on the back of this news.

Sojern Inc is a provider of digital marketing and guest engagement solutions for the travel and hospitality industry.

What’s happening: the deal will be paid fully in cash and carried out through RateGain Technologies, the company’s own unit. RateGain also said it will provide a guarantee of up to $150 million to banks and financial institutions for loans that its UK arm may take. RateGain has been expanding its scale through acquisitions, and this marks its biggest deal yet.

The why: the main goal of this move is to build a new, AI-powered platform that helps hotels, airlines, car rental services, attractions, and travel organisations.

Why it matters: once completed, the acquisition is expected to bring several benefits by combining the strengths of both companies. It will also provide better access to a large number of hotel customers in the U.S.

While, we are on acquisitions,

Zaggle is set to acquire 100% stake in Greenedge Enterprises in a deal worth up to ₹25 crore.

Founded in 2009, Greenedge provides golf travel, experiences, and rewards via RuPay, offering corporate unique loyalty and engagement solutions.

The deets: Zaggle is buying all the shares of Greenedge, about 1.3 lakh shares in total for up to ₹25 crore, once the final share purchase agreement is signed.

The why: the acquisition will help Zaggle add more services in loyalty, rewards, and travel, making its main platform bigger. By bringing in Greenedge’s specialised services, Zaggle can offer unique benefits to corporate clients and become even stronger in the loyalty and rewards market.

Big theme: loyalty is moving beyond simple cashback to unique experiences like golf and travel. India’s loyalty market is booming, and is expected to grow by 18.3% YoY to reach $3.58 billion in 2025.

4. India’s shipbuilding gets a lift from Samsung Heavy Industries 🚢

Swan Defence & Heavy Industries has signed a deal with Samsung Group’s arm Samsung Heavy Industries to boost shipbuilding & maritime projects in India.

Swan Defence and Heavy Industries Limited (SDHI) is India’s largest shipbuilding and heavy fabrication company, while Samsung Heavy Industries is a leading ship making company in South Korea.

FYI: this deal makes it the second top South Korean shipbuilder to forge a tie-up with an Indian shipyard in the last few days.

Breaking it down: under this partnership, the two companies will work on shipbuilding and heavy engineering projects in India and abroad, including tankers, gas carriers, container ships, and specialised vessels.

The deal comes amid India’s accelerating maritime growth, just weeks after the government announced nearly ₹70,000 crore schemes to position the country as a global shipbuilding hub.

Big theme: globally, shipbuilding is moving toward green technologies and digitalisation, and this partnership ensures India isn’t left behind.

While we are on deals,

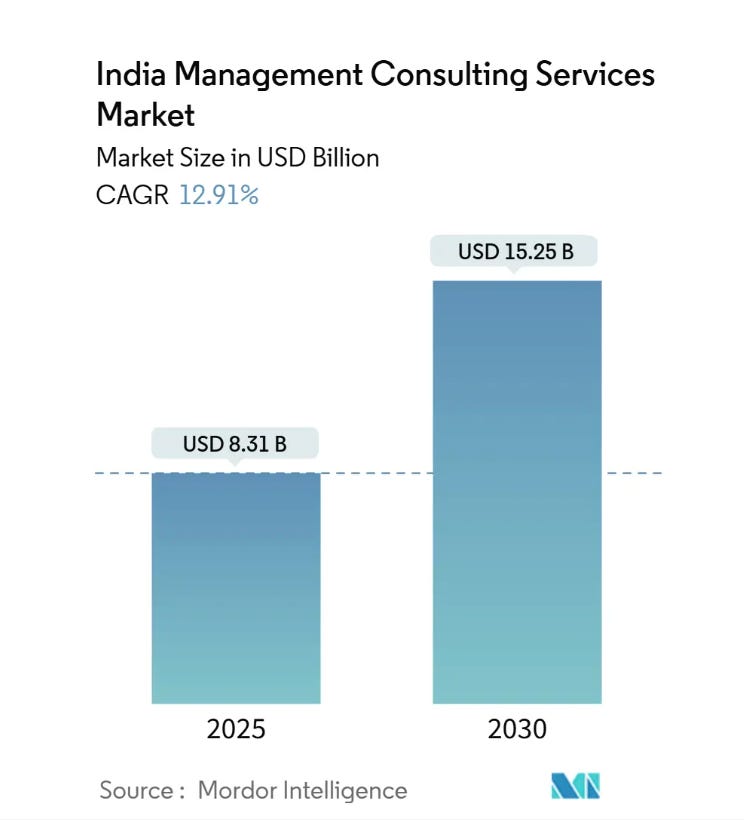

L&T Technology Services has secured a $100 million multi-year agreement with a US-based industrial manufacturer in the semiconductor segment.

The deets: under the partnership LTTS will establish a Centre of Excellence (CoE) dedicated to support innovation, simplify platforms, and help clients shift towards digital and AI-powered operations.

India’s management consultancy services is also rapidly growing at 12.9% and is expected to reach a valuation of $15.25 billion by 2025.

Amid stiff competition from China, Taiwan and USA, this move will also help gain international trust in developing a robust and sustainable semiconductor ecosystem.

5. America enters shutdown mode 🚫

For the first time in over six years, the US government has officially shut down as political battles over funding reach boiling point.

A late-night vote collapsed on Tuesday after Democrats blocked repeated Republican attempts to pass a stopgap bill to keep the government running.

The shutdown, previewed by President Donald Trump in recent days, now means federal departments will go dark and thousands of workers will be sidelined without pay until a deal is struck.

Full story here

6. Stock that kept us interested 🚀

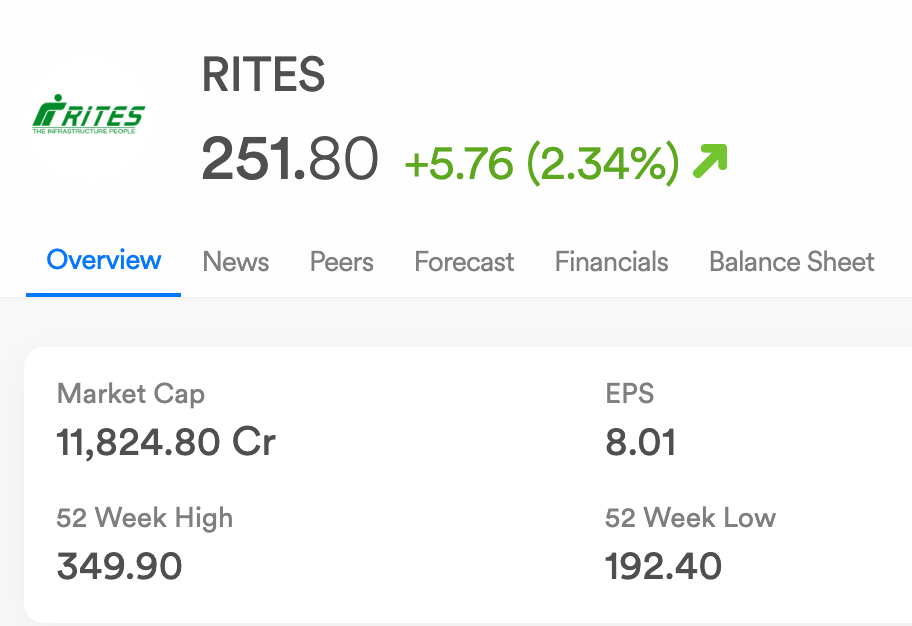

1. RITES expands global reach with UAE tie-up 🚆

RITES has signed a Memorandum of Understanding with Etihad Rail and its subsidiary, National Infrastructure Construction Company (NICC). The stock ended 2% in Wednesday’s trading session.

What’s happening: this deal is to enhance business collaboration in the mobility sector across the UAE and beyond.

The partnership aims to combine RITES’ five decades of expertise in consultancy, transport infrastructure, and engineering solutions with the execution capabilities of NICC. Together, they plan to create synergies for infrastructure projects in the region.

Big theme: the UAE logistics market is projected to reach $95.2 billion by 2033, growing at an annual rate of 5.7% from 2025-2033. This provides huge opportunities for infrastructure players.

What else are we snackin’ 🍿

🚀 D-street debut: Bengaluru-based Capillary Technologies got SEBI approval for IPO, to raise ₹430 crore fresh issue plus 1.83 crore shares OFS.

📉 Manufacturing slows: India’s HSBC India Manufacturing PMI slipped to 57.7 in September, a four-month low, with weak jobs and record-high inflation.

📈 Digital boom: UPI processed 19.6 billion transactions worth ₹24.9 lakh crore in September 2025, slightly fewer than August, though transaction value increased.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.