India holds its ground, clean energy tie-up with Taiwan & Tata's international boost

🗓️ Morning, folks! ☀️

Markets ended almost flat after a choppy session, with the Nifty holding on to gains despite pressure from IT stocks. It was a classic tug-of-war day, every dip got bought, but upside stayed capped.

IT heavyweights TCS, Infosys and HCLTech dragged the Sensex, while autos stepped in to cushion the fall.

💡Spotlight: India-US trade deal gets softer edits 🇮🇳🇺🇸

Just a day after unveiling a fact sheet on their interim trade deal, the White House quietly revised key language by removing mentions of tariff cuts on “certain pulses” and walking back claims that India would scrap its digital services tax.

It also softened the $500 billion purchase language to say India “intends” to buy US products rather than having “committed,” aligning the document closer to the joint statement both sides actually signed.

Why it matters: pulses are politically sensitive for India’s farmers, and tariff could hurt farmers.

The tweaks also avoid overselling commitments on big US buys and digital tax reform, keeping expectations realistic.

Let’s hit it!

1 Big thing: Reliance cooking up a health bet 🥣

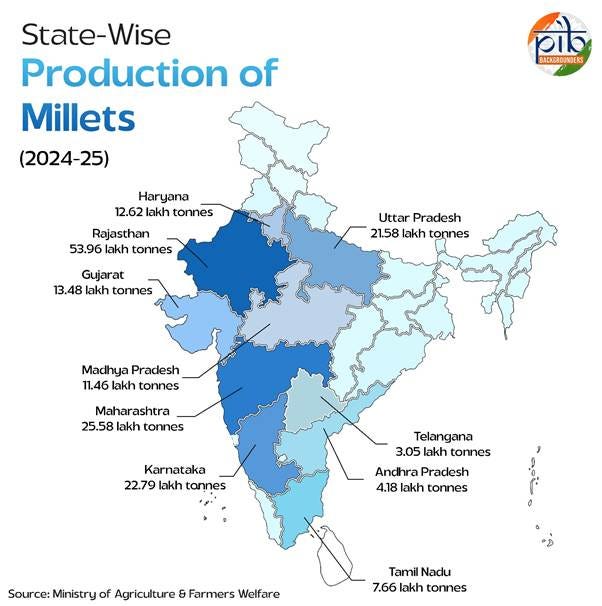

Reliance Consumer Products (RCPL) acquired Southern Health Foods, the parent of Tamil Nadu’s well-known brand Manna.

Southern Health Foods makes millet-based and multigrain health food products under the Manna brand.

What’s brewing: Manna has a strong foothold in Tamil Nadu and neighbouring states so Reliance gets access to ready demand and existing shelf-space.

Why it matters: India’s health and nutrition foods market is estimated at over ₹70,000–80,000 crore, with millet-based products growing at double-digit rates (12–15% annually), faster than traditional staples.

Health-focused packaged foods typically earn 2–4% higher margins than basic commodity staples.

By plugging Manna into Reliance Retail’s 18,000+ store network and JioMart ecosystem, RCPL can scale volumes quickly without heavy new distribution costs.

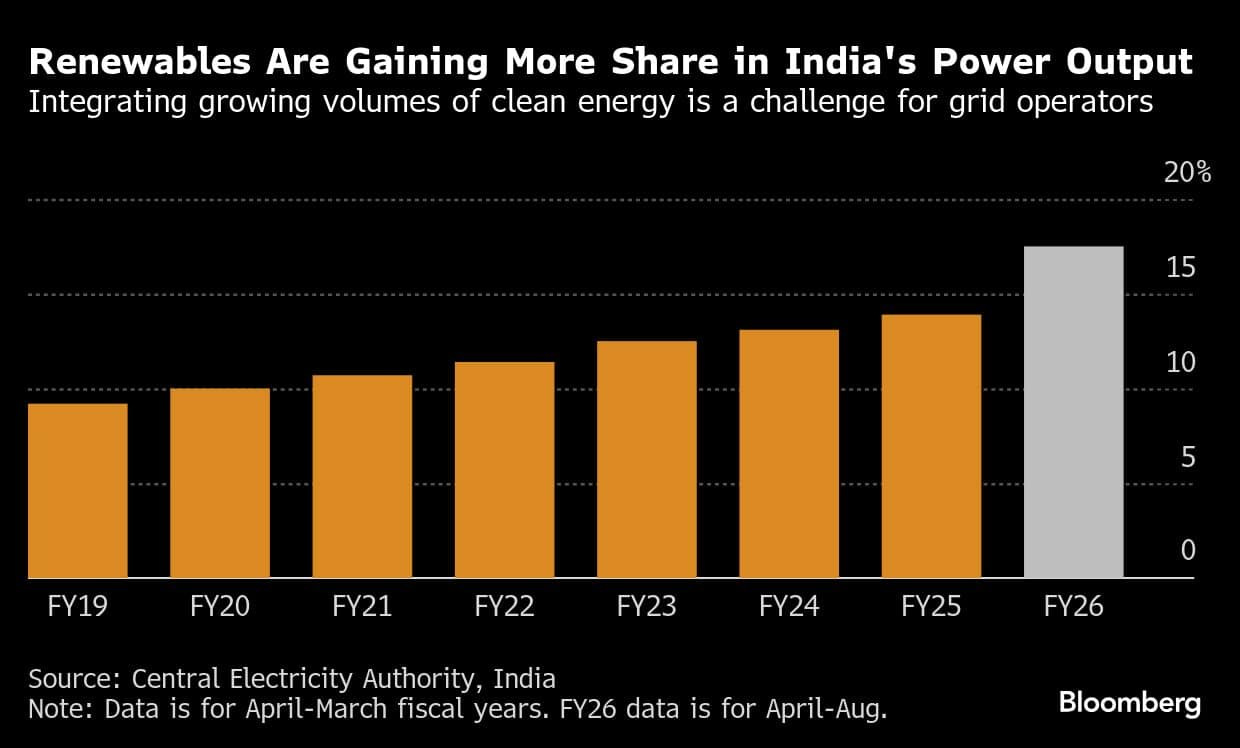

2. This smallcap stock signs mega Taiwan solar pact ⚡

PVV Infra has signed an agreement with ITC Services Company, Taiwan to step deeper into renewable energy manufacturing. The partnership covers solar cells, BESS, micro-inverters and smart power electronics.

In simple terms, PVV Infra will set up an integrated solar and battery manufacturing complex in India using Taiwan-based ITC’s technology and process support.

What’s the deal: this partnership will power PVV’s planned integrated clean energy manufacturing complex, where it aims to produce solar cells, solar panels, battery storage systems, and inverters under one roof.

With the Taiwan technology tie-up and expanded scope, the total proposed investment has now nearly doubled to around ₹1,250 crore, subject to phased execution and funding closure.

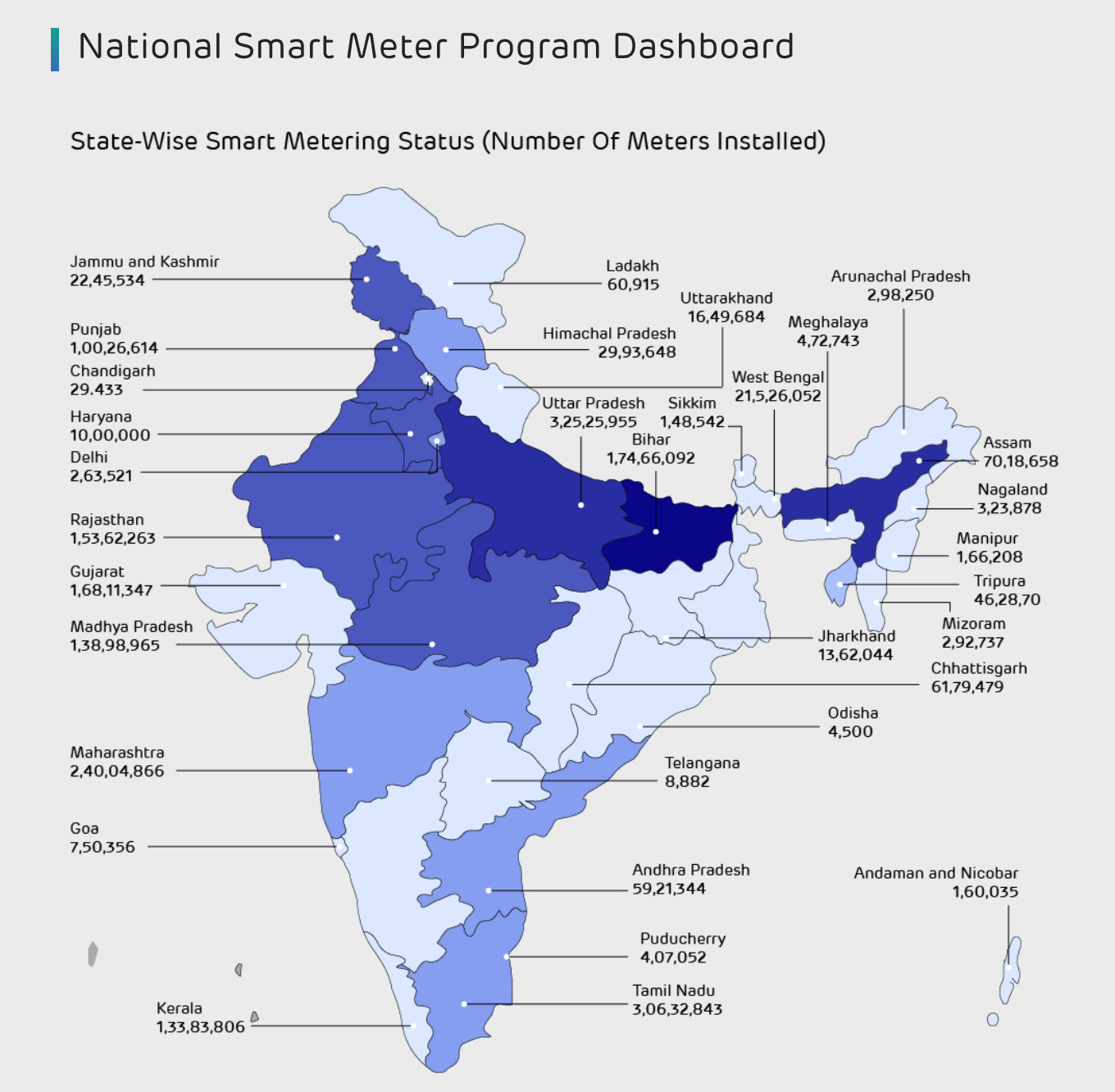

3. Polaris powers up India’s metering and battery play 🔌

Polaris Smart Metering will invest nearly ₹4,500 crore by 2027 to expand manufacturing, projects, and enter battery energy storage. The move also sets the stage for a potential IPO.

What it does: Polaris Smart Metering is an Indian energy tech company that helps power companies reduce electricity losses and track power usage in real time using smart meter technology.

The deets: the company will commission a new 250,000 square feet manufacturing facility called Polaris Nova in Rajasthan by December 2026.

This will double its annual smart meter production capacity from 5 million units to 10 million units, making it the largest single smart metering plant in India.

4. How much do major economies owe? 💰

If you line up major economies by debt-to-GDP, the picture is far from uniform.

- Japan sits at the top with a staggering 227%, meaning its government debt is more than twice its annual economic output.

- Singapore follows at around 176%

- United States stands near 129%. These numbers suggest that high debt is not confined to one region, it’s widespread across advanced economies.

Then there are the relative outliers.

India’s debt-to-GDP ratio stands at about 81%, noticeably lower than many of its global peers. Germany sits even lower at 66%, and Israel is around 70%.

Debt-to-GDP essentially measures how much a country owes compared to what it produces in a year. A ratio of 100% means the debt equals one year’s national income. While higher numbers don’t automatically signal crisis, they do limit fiscal flexibility.

5. Stocks that kept us interested 🚀

1. Is this Tata’s biggest overseas truck win yet? 🚛

Tata Motors has secured an order to supply 70,000 commercial vehicles in Indonesia through its subsidiary PT Tata Motors Distribusi Indonesia.

The stock gained more than 3% on the back of this news.

Breaking it down: the company will deliver 35,000 Yodha pick-ups and 35,000 Ultra T.7 trucks to Indonesian state-owned firm PT Agrinas Pangan Nusantara.

The vehicles will power farm-to-market transport and rural goods movement across the country, with deliveries rolled out in phases.

2. Ion Exchange jumps on ₹1,730 cr Oman water deal 💧

Ion Exchange’s arm, Ion Exchange and Company, has won a contract to develop a water treatment facility worth ₹1,730 crore in Oman.

The 60-year-old Indian company provides water and environmental solutions, helping industries and cities treat, recycle, and desalinate water while managing wastewater.

What is happening: the project involves design, operation and maintenance of a potable water facility and sewage treatment facility in the South PDO Concession Area.

The importance: according to the World Population Review, Oman is the third most water-stressed country in the world. It faces severe water shortages due to climate challenges, population growth and rising industrial demand

What else are we snackin’ 🍿

☁️ Cloud expansion: Oracle will launch multi-cloud services in India through three new data centres by April, tied up with AWS and Google Cloud.

💳 UPI leaderboard: in January, PhonePe led the charts, followed by Google Pay and Paytm, as total UPI payments touched ₹28.3 lakh crore.

🤖 AI shock: US wealth management stocks fell after a new AI-powered advisory tool sparked fears that traditional advisors could be the next disruption target.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.