GDP looks upbeat, insurtech eyes IPO, and Elon Musk's xAI bags fresh cash.

🗓️ Morning, folks! ☀️

Markets stayed on the back foot for a third straight session on Wednesday, with both the Sensex and Nifty closing slightly lower.

The mood remained shaky as investors reacted to rising geopolitical tensions, continued foreign investor selling, and weak cues from Asian markets.

Sector-wise, it was a mixed bag. IT, consumer durables, and pharma managed to hold up well and ended among the top gainers. But auto, oil and gas, and realty stocks stayed under pressure, finishing as the biggest laggards for the day.

💡 Spotlight: India GDP outlook turns brighter ⚡️

India’s first official GDP estimates, which are an early step before the Union Budget, suggest the economy will grow 7.4% in FY26, faster than the 6.5% growth seen in FY25.

A big reason for the stronger number is the services sector like IT, banking, and retail, which continues to perform well. This helped overall production growth rise to 7.3%, up from 6.4% last year.

Sector-wise, manufacturing is expected to pick up, growing 7% compared with 4.5% earlier. Agriculture is likely to grow slower at 3.1%, down from 4.6%. Mining may shrink slightly, and electricity growth is also expected to cool down.

Let’s hit it!

1 Big Thing: Infosys teams up with AWS for genAI push 🤝

Infosys is partnering with Amazon Web Services (AWS) to help enterprises adopt generative AI faster. Infosys gained nearly 2% following the update.

Context: Infosys is one of India’s largest IT services firms, while AWS is the world’s biggest cloud provider. Both are betting big on AI as the next growth engine for enterprise tech.

Breaking it down: Infosys will integrate Infosys Topaz, its AI-first platform, with Amazon Q Developer, AWS’s genAI-powered coding and productivity assistant.

Together, they will give businesses AI tools that can write code, analyse data, answer questions, and automate daily work, so employees can do things faster and with less effort.

Zoom out: traditional AI works on fixed rules and pre-defined tasks, such as flagging fraud, sorting emails, or predicting demand based on past data.

Generative AI goes a step further by understanding natural language and context, allowing it to write text, generate code, analyse data, and respond like a human assistant.

Unlike older AI systems that needed constant manual training, generative AI can learn from large datasets and adapt across different use cases. That’s why companies like Infosys and AWS are betting on it to transform how employees and enterprises operate.

2. Tata Power’s ₹6,675 cr solar play 🌞

Tata Power is building a 10 GW ingot and wafer manufacturing facility in Andhra Pradesh, marking a big step in India’s solar manufacturing push.

Note: the plant is expected to be the largest ingot and wafer manufacturing facility in India once completed.

What’s going on: the project will be developed at Nellore in Andhra Pradesh.

Why it matters: it will help reduce India’s dependence on imported solar components, especially from overseas suppliers. Ingots and wafers are important for the country because they are the starting materials used to make solar cells and solar panels.

Today, India imports most of its ingots and wafers, which makes solar projects expensive and dependent on foreign supply chains. Building these components locally helps cut imports, lower costs, and secure energy supply.

Big theme: India today has 80+ GW of solar module capacity and around 25-30 GW of solar cell capacity, but ingot and wafer capacity is negligible.

Right now, China controls over 95% of global wafer manufacturing, which makes India heavily dependent on imports for the most critical solar input.

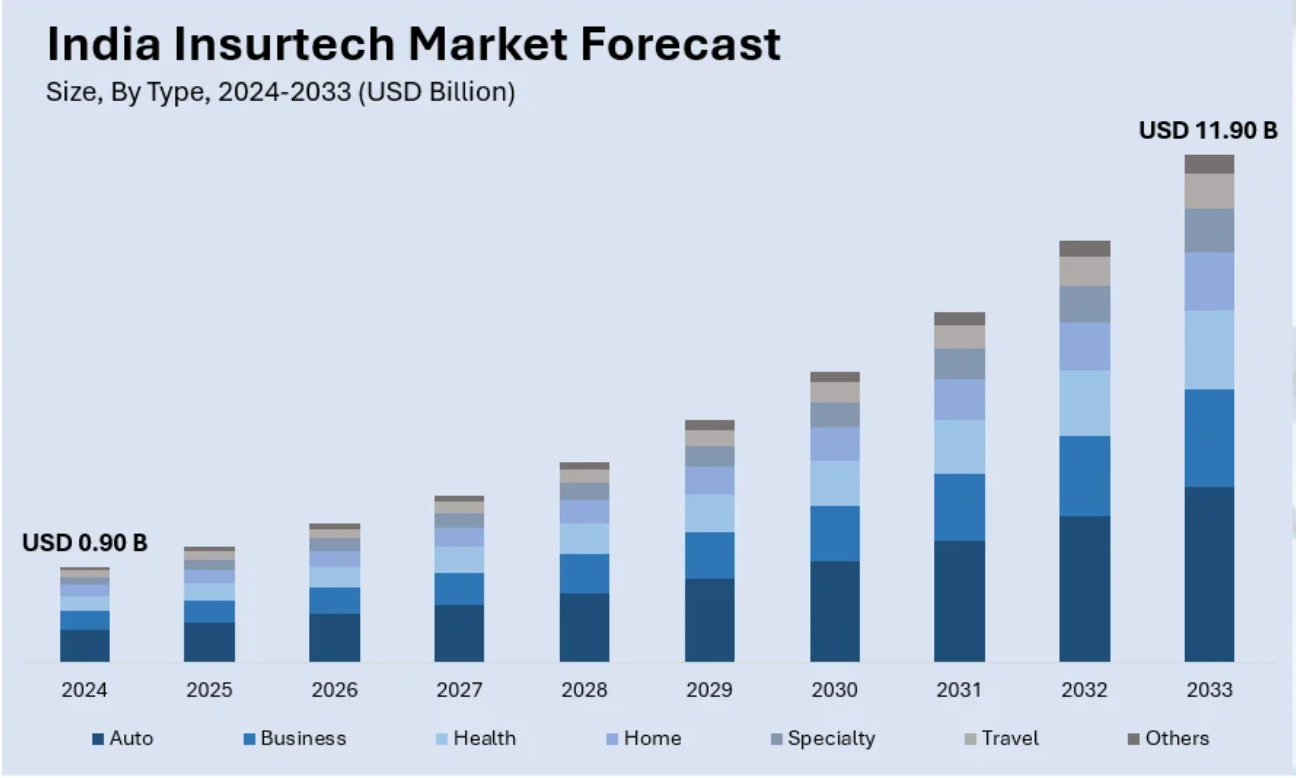

3. Turtlemint Fintech eyes D-street 💰

Turtlemint Fintech Solutions is set to file its updated draft papers with SEBI for a ₹2,000 crore IPO.

What’s poppin’: the company had confidentially filed its initial IPO papers in September and received approval from the market regulator in December.

Founded in 2015, Turtlemint focuses on making insurance easier to buy and manage, especially for everyday consumers. It has reportedly sold around 1.6 crore policies, supported by a wide network of over 5 lakh advisors.

Why now: the timing also shows how quickly investor interest is heating up in India’s insurtech space, as more digital-first platforms try to make insurance less paperwork-heavy and far easier to navigate.

The latest came in November 2024, when Niva Bupa Health Insurance Company raised ₹2,200 crore in its public issue. Before that, in May 2024, Go Digit General Insurance raised ₹2,614.6 crore.

And on the insurtech side, the big moment came in 2021, when PB Fintech hit the markets with a ₹5,709 crore IPO, putting digital insurance platforms in the spotlight.

While we are on fundraises 💸,

FutureCure Health has raised ₹104 crore led by Carnelian Asset Management LLP, with participation from other investors.

Founded in 2015, FutureCure runs NeuroEquilibrium clinics that diagnose vertigo’s real cause and offer targeted rehabilitation.

What’s hot: the fresh funding will be used to expand access to vertigo diagnosis and treatment, making it easier for more patients to get the right care sooner.

4. Stocks that kept us interested 🚀

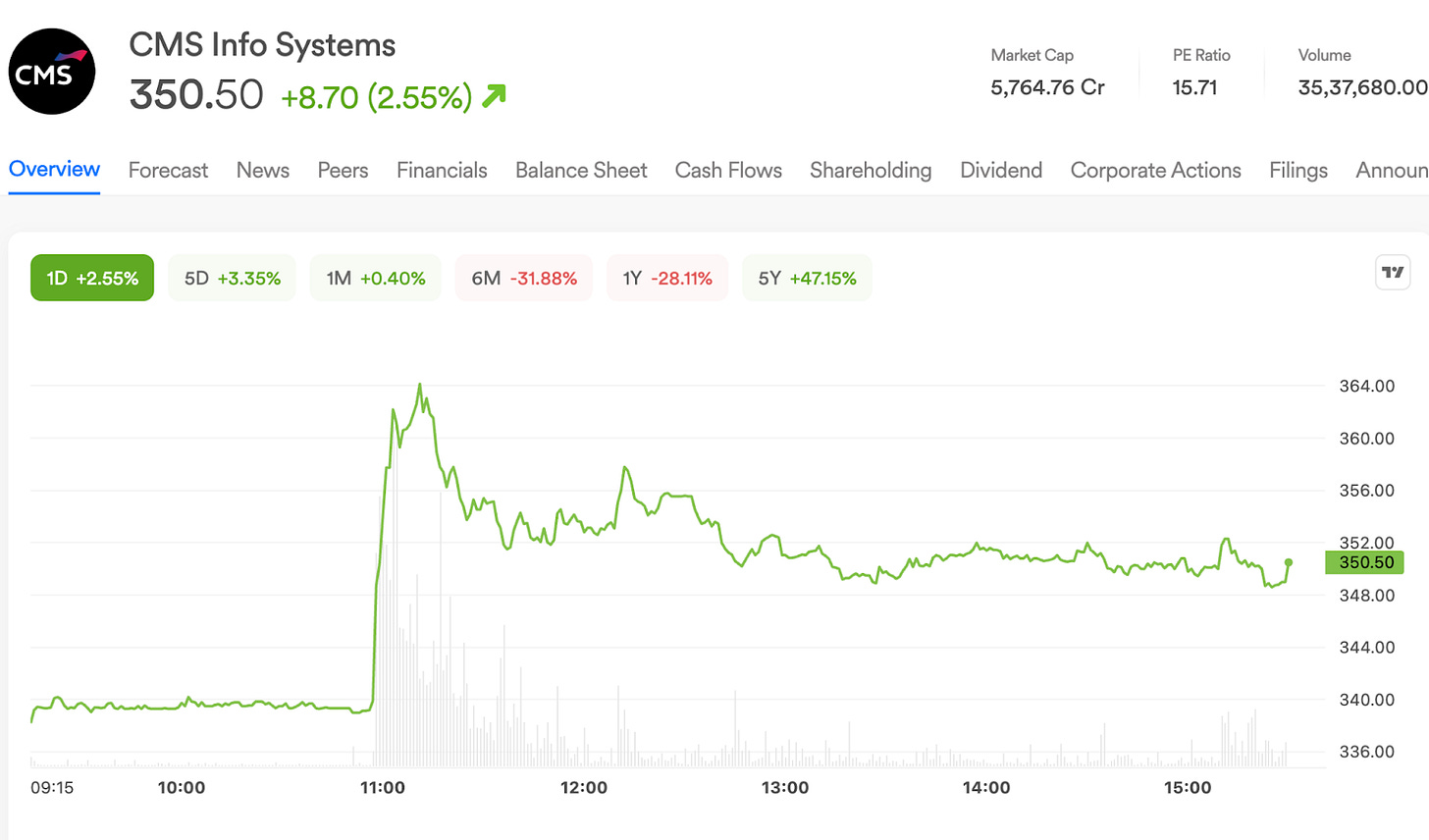

1. CMS soars on winning ₹1,000 crore SBI contract 💪🏻

Shares of CMS Info Systems jumped as much as 2.5%, as the company won a ₹1,000 crore integrated cash solutions contract from State Bank of India.

The company offers logistics, technology solutions and services to banking and financial technology players.

The deets: the 10-year contract will manage about 5,000 SBI-owned ATMs across India and will start this month. The goal is to ensure ATMs have enough cash and work smoothly, so customers face fewer outages and delays.

Worth noting: this is the first time a PSU bank has handed out a direct cash management deal of this scale. It’s also a clear sign that banks are shifting gears, preferring one end-to-end outsourcing partner over juggling a patchwork of multiple vendors.

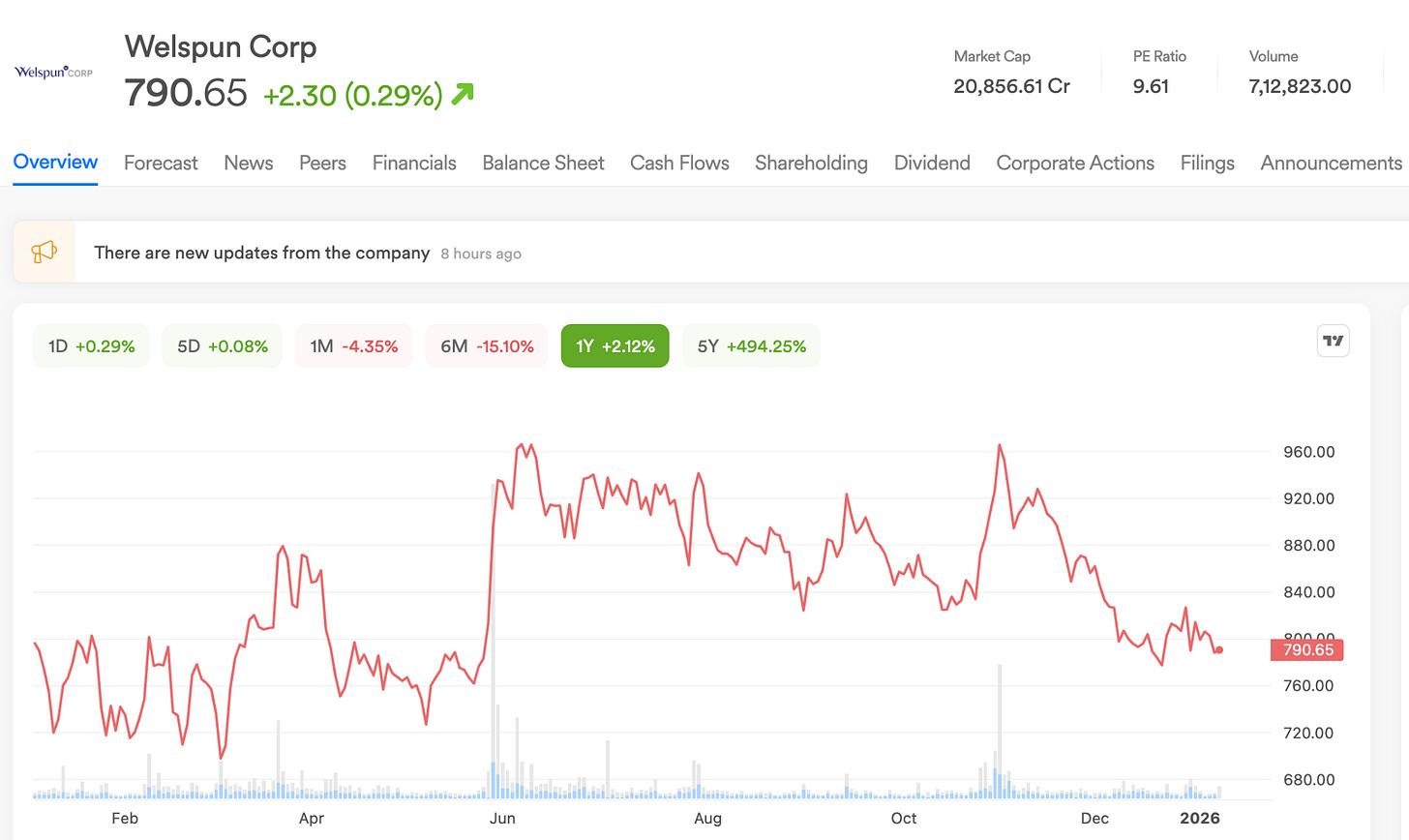

2. Welspun Corp bags ₹23,460 cr global orders 🏗️

Welspun Corp has secured a fresh export order for large-diameter coated line pipes for the Americas, pushing its total global order book to ₹23,460 crore.

The deets: the company will make and supply big steel pipes that are used to carry oil, gas, or water over long distances in countries across the Americas.

These pipes are large in size and specially coated so they don’t rust or get damaged underground or underwater. This makes them suitable for major energy and infrastructure pipeline projects.

Zoom out: since its last update in September 2025, Welspun has bagged ₹3,100 crore of additional domestic orders. With the new export win, the consolidated order book now stands at about $2.6 billion.

What else are we snackin’ 🍿

💸 UPI in-house: Zepto rolled out in-app UPI payments as delivery platforms move to own the checkout, cut failures, and rely less on external payment apps.

🤖 xAI Fundraise: Elon Musk’s xAI closed a $20 billion funding round with backing from Nvidia and investors including Fidelity, StepStone, MGX and Baron Capital.

🪑 Pepperfry exit: Pidilite Ventures exited Pepperfry by transferring its entire stake to TCC Concept in a 100% share-swap deal, picking up a 2.2% holding in the company.

💊 Onco launch: Biocon’s arm announced plans to launch three new oncology biosimilars at a US healthcare conference.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.