QSR giants merge, Pharma buys scale, and Coal exports open.

🗓️ Morning, folks! ☀️

Markets closed at record highs on Friday, with both the Nifty and Bank Nifty ending the session at fresh lifetime peaks.

💡What went down this weekend:

The US carried out a surprise military operation in the early hours of January 3, capturing Venezuelan President Nicolás Maduro and flying him out of the country.

Venezuela is one of the world’s richest countries in oil, and the U.S. has been steadily increasing pressure on its leadership. What made this moment extraordinary was that a sitting president was removed overnight.

The White House said the U.S. would temporarily oversee Venezuela until a transition of power is put in place.

The memes had a field day.

Let’s hit it!

1. KFC–Pizza Hut get new home as Devyani, Sapphire merge 🍟

Sapphire Foods India plans to merge with Devyani International. The move will bring two of Yum! Brands’ largest franchise partners under one scaled Quick-Service Restaurant (QSR) platform.

Yum! Brands is a global fast-food giant behind KFC and Pizza Hut, with Devyani International and Sapphire Foods operating these brands as its key franchise partners in India and select markets.

Devyani runs 2,000+ outlets across 280+ cities in India, Thailand, Nigeria and Nepal. Sapphire, set up in 2015, operates KFC and Pizza Hut restaurants across India and Sri Lanka.

Why it matters: the deal comes at a tough time for fast-food players. Rising living costs have slowed eating-out demand, squeezing same-store sales and margins.

By coming together, the two companies aim to cut costs, improve efficiencies and protect profitability through scale.

The process: under the merger plan, Devyani will issue 177 shares for every 100 shares held in Sapphire.

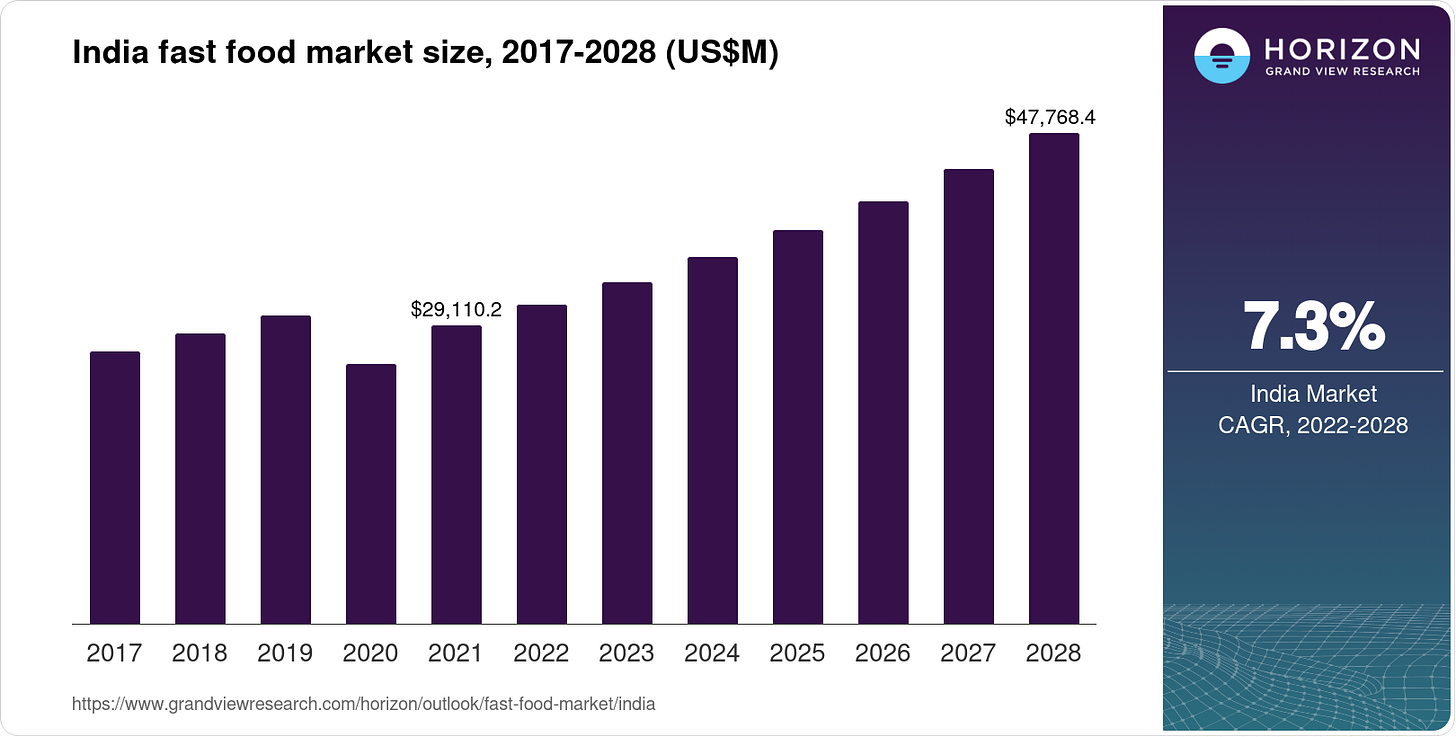

Zoom out: India’s fast-food market is on a strong growth path, projected to reach nearly $47.8 billion by 2028, growing at a 7.3% annual rate.

2. Aurobindo Pharma expands India business with ₹325 cr deal 💊

Aurobindo Pharma, via its wholly owned arm Auro Pharma, has acquired Khandelwal Labs’ non-oncology prescription formulations business for ₹325 crore. The stock reacted positively to the update as it ended nearly 2% higher.

Simply put, the company wants regular prescription medicines that are not used to treat cancer.

The acquisition gives Aurobindo a push in pain management and anti-infective therapies. These are two high-volume, sticky segments in India’s pharma market.

Why Khandelwal Labs: the buyout brings 23 brands across 67 SKUs, plus nine pipeline products, all aligned with Aurobindo’s existing portfolio.

It also includes inventory, IP, employees, contracts, and a ready-made distribution network, meaning faster scale.

Zoom out: in India, the non-oncology prescription formulations market is estimated at ₹1.6–1.8 lakh crore annually, accounting for over 85–90% of the domestic pharma market.

Within this, anti-infectives and pain management alone contribute ~25–30%, driven by high-volume, repeat prescriptions.

By contrast, oncology drugs make up just 8–10% of domestic pharma sales, despite being high-value per patient.

3. What’s happening in the VC lane?

Agritech firm Arya.ag has raised ₹725 crore in a Series D round led by GEF Capital Partners.

Arya.ag is a digital platform that helps farmers store, finance, and sell their crops by connecting warehousing, credit, and markets in one system.

What’s going on: the fresh capital will be used to deepen farmer engagement, scale climate-smart agriculture, and strengthen its tech-led post-harvest ecosystem.

The company has enabled over $1.5 billion in farm loans. The new funds will also target lower farm-gate losses, better market linkages, and wider credit access for small farmers and FPOs.

Why it matters: Arya.ag is building infrastructure + finance + data into one stack. That’s hard to replicate and critical in a sector plagued by inefficiencies.

Zoom out: the agri-infrastructure and farm-commerce sector in India sits at the intersection of storage, logistics, credit, and market access. It is seen as one of the most under-built parts of the economy.

India produces over 300 million tonnes of foodgrains annually, yet 10–20% is lost post-harvest due to poor storage and fragmented supply chains.

While we are on fundraises,

Mumbai-based Knight Fintech has raised ₹215 crore in a Series A round led by Accel, with participation from IIFL and Rocket Capital.

What’s the deal: unlike consumer-facing fintechs, Knight builds backend lending and treasury infrastructure used by banks and NBFCs to run credit, risk, and capital flows.

4. Stocks that kept us interested 🚀

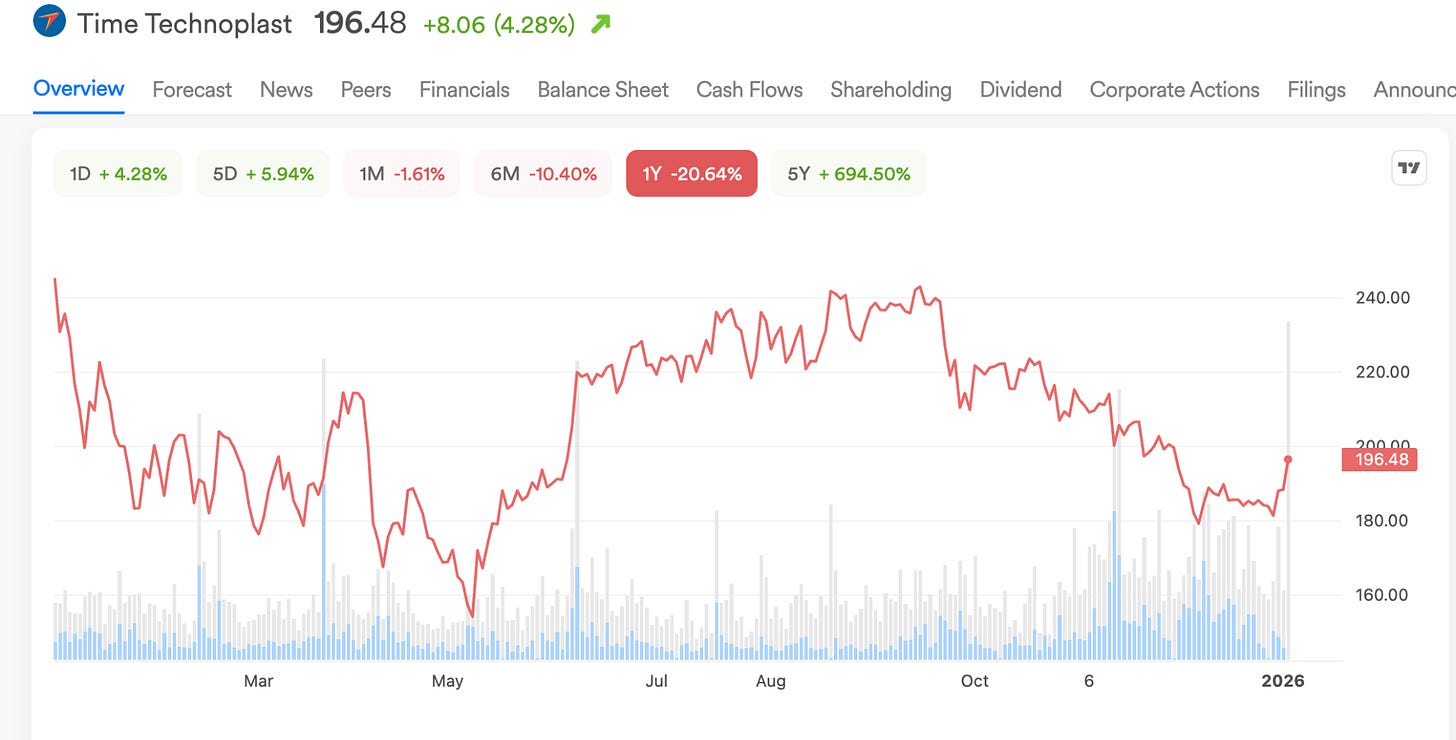

1. Time Techno gets clearance to make high-pressure cylinders 🛢️

Time Technoplast shares rose over 4% after the company got key safety approvals to make and sell small, high-pressure cylinders used to safely store and transport gases like oxygen and hydrogen.

Time Technoplast manufactures industrial plastic products, including composite cylinders, packaging solutions and infrastructure materials.

PESO is Petroleum and Explosives Safety Organisation & it is India’s regulator that approves and oversees safety standards for petroleum, gas and explosive products.

Note: this milestone makes Time Technoplast the first company in India to secure approval for a variety of high-pressure gas cylinders.

Breaking it down: with the latest PESO approval, these cylinders can be used almost everywhere, from medical oxygen in hospitals and emergency services, to industrial gases used in labs and metal factories.

This approval puts the company right in the middle of that shift and in line with the “Make in India, For the World” push.

2. L&T bags SAIL steel expansion orders worth ₹5,000–10,000 crore 🔩

L&T bagged a major order from Steel Authority of India (SAIL) and other domestic clients. The deal value is pegged between ₹5,000-10,000 crore.

The contracts sit within L&T’s minerals & metals vertical and focus squarely on India’s steel sector.

Breaking it down: the company will execute the complete end-to-end work of core steelmaking units at SAIL’s IISCO Steel Plant in West Bengal.

This includes coke oven batteries, by-product plants, basic oxygen furnaces, and specialised material handling systems. The project will support capacity expansion from 2.5 MTPA to 6.5 MTPA.

These are high-value, execution-heavy projects that lock in long-term revenue visibility.

Market Bites this week

India has a new way to tax tobacco. Will it work?

Last week, while the country was busy wrapping up the year and planning what 2026 might bring, the Finance Ministry quietly rewrote the rules for one of India’s most politically sensitive products.

On December 31, 2025, it notified a new taxation framework for tobacco and tobacco-related products, effective February 1, 2026.

This single notification marked the end of an eight-year stopgap and the start of a much harder conversation India has been postponing.

India has raised tobacco taxes many times before. But this time, it is different.

What else are we snackin’ 🍿

🚄 Bullet boost: India aims to quadruple rail exports by 2030, with its first bullet train set to start operations by August 2027.

🌍 Global boost: Coal India shares jumped 7% after the PSU opened its coal e-auctions to buyers from Bangladesh, Bhutan and Nepal.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.