Castrol bids, India’s chip push, and Waaree’s US win.

🗓 Morning, folks!

Markets shook off a wobbly start on Thursday to close slightly higher. After starting in the red, it bounced back thanks to good buying in IT and real estate stocks Sensex & Nifty closed 0.4% higher.

💡 Spotlight: Trump’s tariffs just hit a legal wall.

A US federal trade court has struck down key parts of President Trump’s global tariff orders, calling them an overreach of executive power.

The US Court of International Trade ruled that Trump misused emergency powers under the IEEPA (International Emergency Economic Powers Act) to justify sweeping trade levies—including the controversial “Liberation Day” tariffs announced last month.

The challenge was brought by a coalition of Democratic states and small businesses, who argued the tariffs bypassed Congress and hurt American commerce. The court agreed.

Let’s hit it!

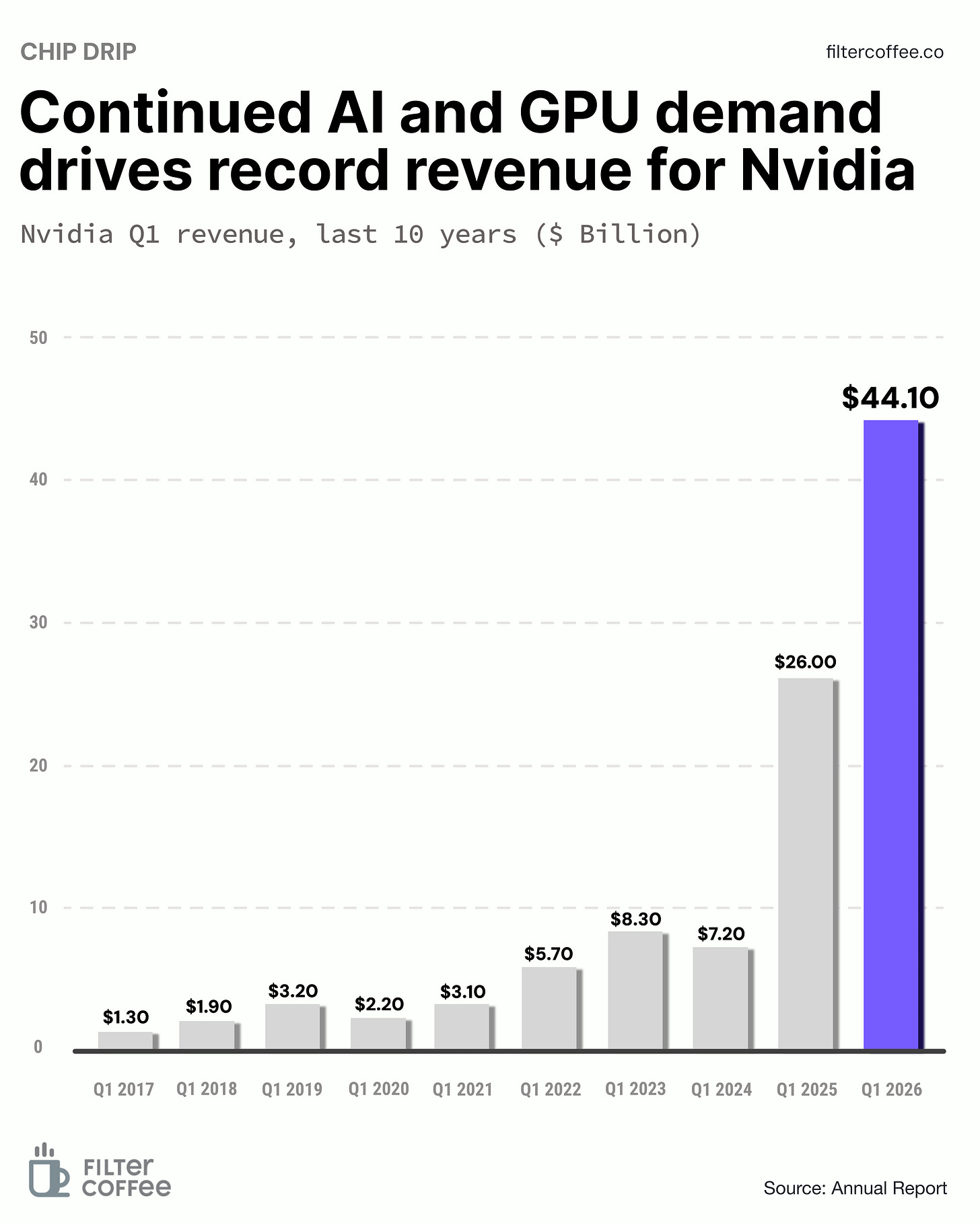

1 Big thing: Nvidia flexes AI muscles, the street cheers 📊

Nvidia reported yet another blowout quarter on Wednesday, sending the stock up 6% in after-hours trading. AI chip demand is still off the charts, and Wall Street is here for it.

By the Numbers:

- Revenue: $44.06 billion, up 69% YoY

- Data Center Sales: $39.1 billion, up 73% YoY

- Gaming Sales: $3.8 billion, up 42% YoY

- Profit: $18.8 billion, up 26% YoY

The secret sauce: AI, obviously. Nvidia’s data center biz now makes up the lion’s share of revenue, thanks to hyperscalers like Microsoft hoarding its Blackwell GPUs to power tools like ChatGPT.

Even the plumbing is booming: its networking division, which connects all those GPUs together, pulled in $5B.

What went wrong: the U.S. government’s export restrictions on high-end AI chips to China led to a $2.5 billion hit in lost sales and another $4.5 billion in inventory write-offs. The company had to slash prices and book charges for unsold chips, dragging down its gross margin to 61% from what would’ve been 71.3%.

The $50 billion Chinese AI chip market is now “effectively closed” to American companies, and Nvidia’s China playbook needs a rethink, said CEO Jensen Huang.

Zoom out: Nvidia’s chips power nearly every major generative AI model in the world today. Whether it's OpenAI’s GPT models or cloud providers racing to build supercomputers, Nvidia is the go-to name.

As long as the demand for AI compute keeps growing, so will Nvidia’s grip on the market.

While we are on earnings,

Suzlon just clocked its strongest performance in a decade.In the March quarter, net sales surged 73.2% YoY to ₹3,773.5 crore.

FY25 revenue came in at ₹10,851 crore, up 67% over FY24.

Deliveries hit 1.55 GW for the year, a 118% jump from last year. With volume picking up and demand holding strong, Suzlon is clearly riding a second wind.

2. Castrol bidding war heats up 💰

Global energy giants and PE firms are lining up to buy BP’s Castrol unit, with a price tag of up to $10 billion.

The deets: BP is exploring a sale of its Castrol lubricants business, one of the biggest energy M&A moves in play right now. Bidders include Reliance Industries, Saudi Aramco, and PE heavyweights like Apollo, Brookfield, and Lone Star.

The unit could fetch between $8–10 billion, and bankers are already prepping a $4 billion debt package to finance the deal.

The why: Castrol has got deep market reach in India, strong brand equity, and a strategic foothold in emerging tech, thanks to its work on liquid cooling systems for AI data centres.

For Aramco and Reliance, it's a rare chance to expand their downstream footprint in a growing market.

While we are on acquisitions,

Imarticus Learning, an IPO-bound professional education platform, has acquired ed-tech startup MyCaptain in a ₹50 crore deal, its fourth strategic buy in four years.

This acquisition marks a push into non-tech career domains, expanding the platform’s reach beyond its core offerings.

MyCaptain, which currently boasts over 5,00,000 learners, recorded ₹27 crore in revenue in FY25.

3. Schaeffler’s ₹4,800 cr India play 🔧

German auto parts giant Schaeffler AG will invest €500 million in India over the next 5 years.

Schaeffler AG makes high-precision parts for cars, industrial machines, and clean energy systems like EVs and wind turbines.

The deets: the company plans to ramp up factory capacity, expand into EVs, railways, and clean energy, and localise even more production. It’s a push to get closer to Indian customers and tap into sectors growing faster than global auto demand.

Context: Schaeffler’s India unit clocks ~$1 billion in annual revenue. It’s now merging with Vitesco Technologies—a move expected to double its India size to ₹20,000 crore.

Zoom out: right now, 76% of what Schaeffler sells in India is made in India but they want to push that even higher. For example, they’ll start making wind turbine parts locally, which were earlier imported.

And while EV adoption in India won’t mirror China, Schaeffler sees long-term demand rising across EVs, hybrids, and even traditional engines.

4. Stocks that kept us interested 🚀

1. Waaree lands a $176M solar win in US ☀️

Shares of Waaree Energies jumped 8% after its US arm, Waaree Solar Americas, bagged a massive order worth $176 million.

The deets: the order is for supply of 586 MW solar modules to a major player in the US solar and energy storage space.

Think of solar modules as the building blocks of solar power plants, the actual panels that convert sunlight into electricity.

Now, 586 MW is enough solar power to light up over 4 lakh homes or offset over half a million tons of CO₂ every year.

Zoom out: Waaree is one of India’s biggest solar panel makers, with a strong presence in both domestic and international markets. Their modules are known for being efficient, durable, and trusted across utility, rooftop, and off-grid solar projects.

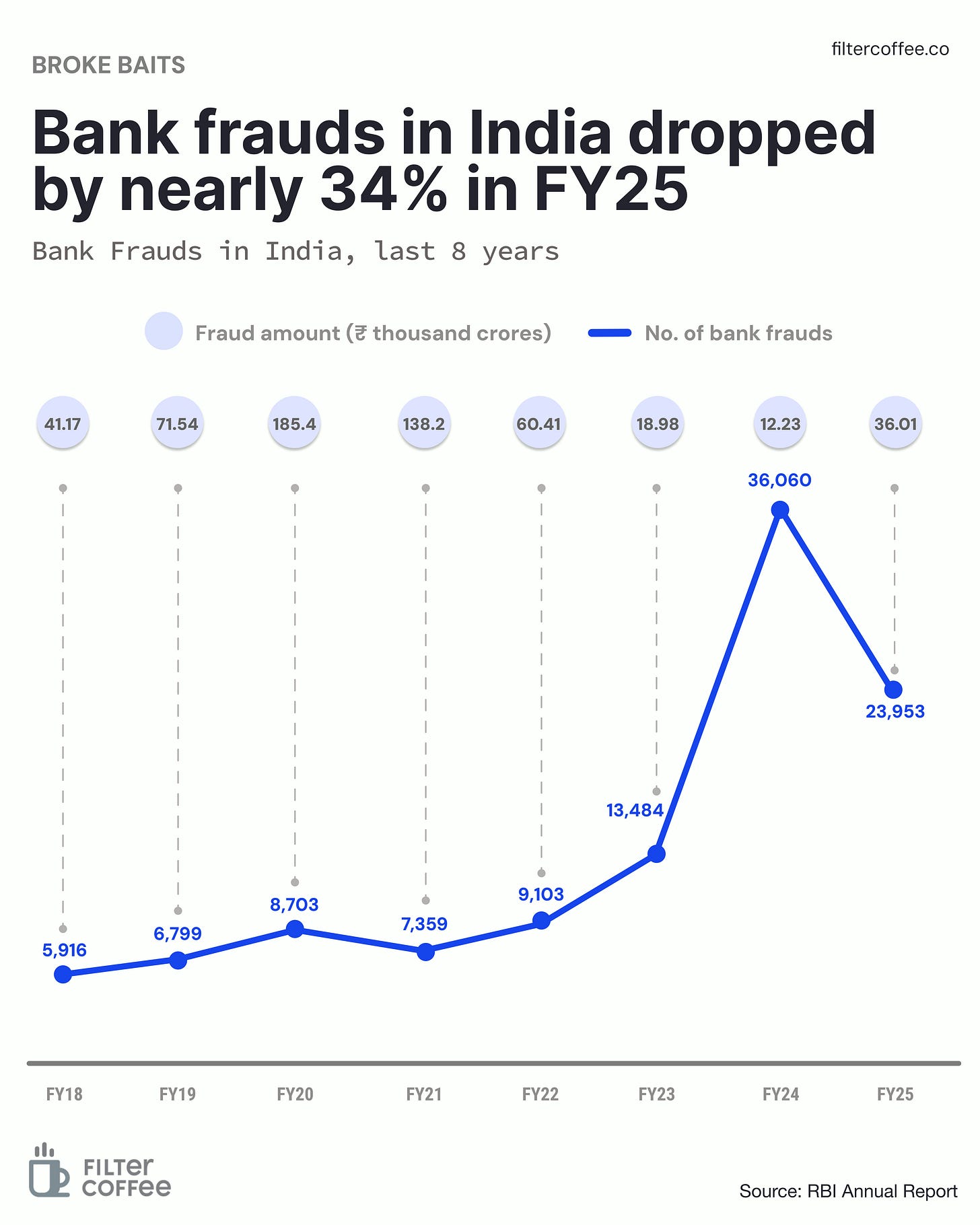

5. Story in data: The scam slump 📊

Bank frauds in India declined sharply in FY25, both in volume and number, according to the RBI’s latest annual report.

Reported cases fell to 23,953 from a record 36,060 in FY24—a 34% drop that suggests stronger oversight and tighter internal controls.

However, the total value involved in these frauds rose to ₹36,010 crore, triple that of FY24, indicating fewer but higher-stakes scams.

Public sector banks continue to account for the bulk of fraud cases, though private lenders are seeing rising instances too.

The data underscores a shift toward better detection and accountability, but also the growing sophistication of financial crime.

What else are we snackin’ 🍿

🧊 Gensol freeze: NCLT has allowed the govt to freeze bank accounts and lockers of Gensol Engineering, its 10 subsidiaries, and key individuals.

⚡ Rickshaw reloaded: Japan’s Terra Motors launched its new electric three-wheeler KYORO+ in India to boost its presence in the L5 segment.

🇮🇳 Chip breakthrough: India will roll out its first-ever ‘Made in India’ semiconductor chip (28-90 nm) this year.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.