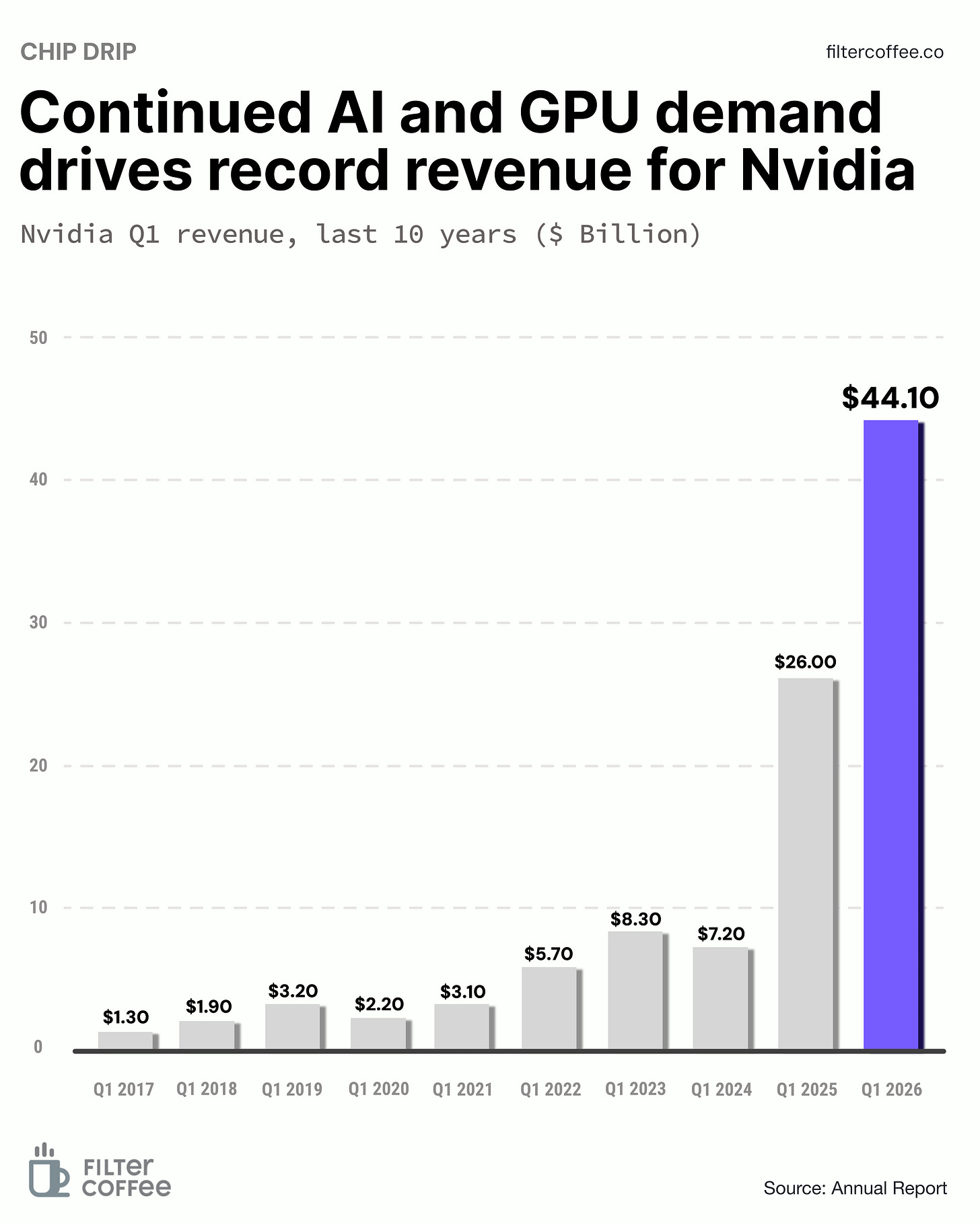

Nvidia reported yet another blowout quarter on Wednesday, sending the stock up 6% in after-hours trading. AI chip demand is still off the charts, and Wall Street is here for it.

By the numbers:

- Revenue: $44.06 billion, up 69% YoY

- Data Center Sales: $39.1 billion, up 73% YoY

- Gaming Sales: $3.8 billion, up 42% YoY

- Profit: $18.8 billion, up 26% YoY

The secret sauce: Nvidia’s data center biz now makes up the lion’s share of revenue, thanks to hyperscalers like Microsoft hoarding its Blackwell GPUs to power tools like ChatGPT.

Even the plumbing is booming: its networking division, which connects all those GPUs together, pulled in $5B.

What went wrong: the U.S. government’s export restrictions on high-end AI chips to China led to a $2.5 billion hit in lost sales and another $4.5 billion in inventory write-offs. The company had to slash prices and book charges for unsold chips, dragging down its gross margin to 61% from what would’ve been 71.3%.

The $50 billion Chinese AI chip market is now “effectively closed” to American companies, and Nvidia’s China playbook needs a rethink, said CEO Jensen Huang.

Zoom out: Nvidia’s chips power nearly every major generative AI model in the world today. Whether it's OpenAI’s GPT models or cloud providers racing to build supercomputers, Nvidia is the go-to name.

As long as the demand for AI compute keeps growing, so will Nvidia’s grip on the market.