BEL shines in Q4, Coal India lines up IPOs & Waaree’s ₹293 Cr deal.

🗓 Morning, folks!

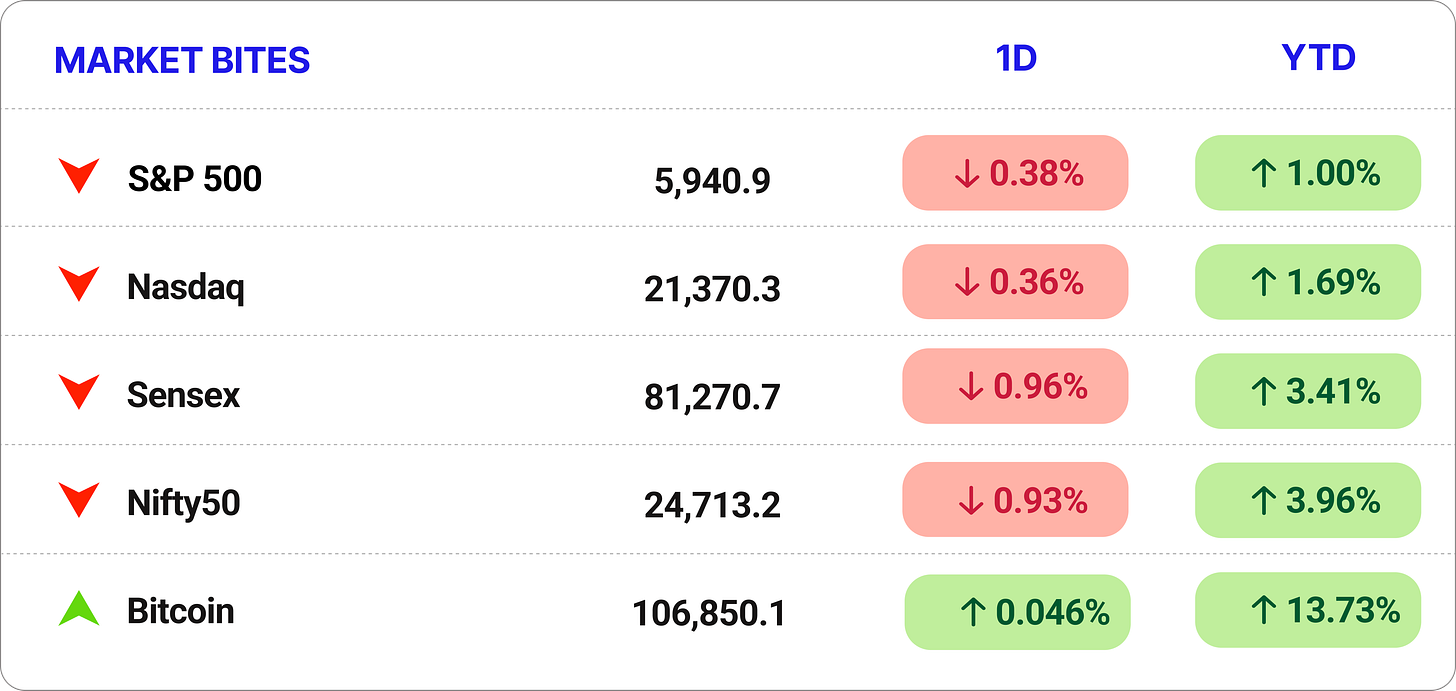

Markets hit the brakes on Tuesday, with the Nifty and Sensex both slipping nearly 1% as investors booked profits across the board.

Autos, financials, and defence stocks led the drop, with three of the top four Nifty losers coming from the auto pack. After flashing signs of a recovery, valuation jitters and patchy demand seem to be stalling the sector’s momentum.

💡 Spotlight: you know the economy’s moving when people are spending more on hospitals and hangovers.

In FY24, Indian households shelled out 17.4% more on healthcare and 15.7% more on alcohol and tobacco, the biggest jump in over a decade. Call it balanced living.

Anyway, easy news day today. Let’s get through it and leave you to better things. ☕

Let’s hit it!

1 Big Thing: Waaree’s power move Buys Kamath for ₹293 Cr⚡

Waaree Energies is acquiring Kamath Transformers for ₹293 crore to power up its manufacturing muscle.

Waaree Energies is India’s largest solar panel maker, while Kamath Transformers has been building industrial-grade transformers since 1996.

This gives Waaree access to in-house transformer manufacturing, a key piece in solar energy infrastructure.

The why: as Waaree expands rapidly across solar parks and utility projects, having its own transformer capabilities gives it tighter control over supply chains and costs. The two companies serve adjacent parts of the energy value chain including solar and power transmission, so this acquisition is a natural fit.

Why it matters: Waaree won’t just make panels, it will now also control what helps move that power around. That means better margins, faster delivery, and an edge over competitors still relying on third-party equipment.

Big theme: India is targeting for 500 GW of non-fossil energy by 2030, and solar is the big bet. As solar scales up, integrated players like Waaree who can do everything from modules to transmission will be best positioned to dominate.

Shares of Waaree gained as much as 3% on Tuesday.

2. India, US race to lock trade deal before tariffs land ⚖️

India and the US are working on a phased trade pact, with the first leg expected to be signed before July—a move that could help both sides dodge Trump’s upcoming tariff blitz.

The deets: the deal is being split into three stages

- Phase 1: Market access for industrial goods, select farm products, and removal of non-tariff barriers like quality restrictions.

- Phase 2: Expected around Sep–Nov, may coincide with Trump’s India visit for the Quad Summit.

- Phase 3: A comprehensive agreement—but it could need US Congress approval, likely pushing it into 2026.

Where things stand: Commerce Minister Piyush Goyal is in Washington, already meeting US Commerce Secretary Howard Lutnick, and expected to meet US Trade Rep Jamieson Greer next.

Why it matters: with Trump’s tariffs looming and India prepping counter-duties, the clock is ticking. Both sides want a deal—but it’s a delicate balancing act between diplomacy and domestic politics.

3. BEL hits bullseye in Q4 earnings 🎯

Bharat Electronics Ltd (BEL) posted a steady Q4, with profit and revenue both climbing as defence demand stays hot.

By the numbers:

- Net profit rose 18.4% YoY to ₹2,127 crore

- Revenue grew 6.8% YoY to ₹9,149.6 crore

- Expenses rose just 1.6%, despite a 20% bump in employee costs, helping margins hold firm

Why it matters: BEL’s strength lies in visibility. It closed the quarter with a massive ₹71,650 crore order book, and it's front and center in the government’s Make in India and emergency procurement push.

Zoom out: India’s defence sector is in a high-growth cycle. Capex hit ₹1.72 lakh crore in FY25, and with rising geopolitical tensions, everything from drones to radar systems is in high demand.

BEL’s solid footing makes it a key player in India’s modern military buildout.

4. Quick IPOs in focus 📈

1. Coal India’s subsidiaries set for IPO move 💸

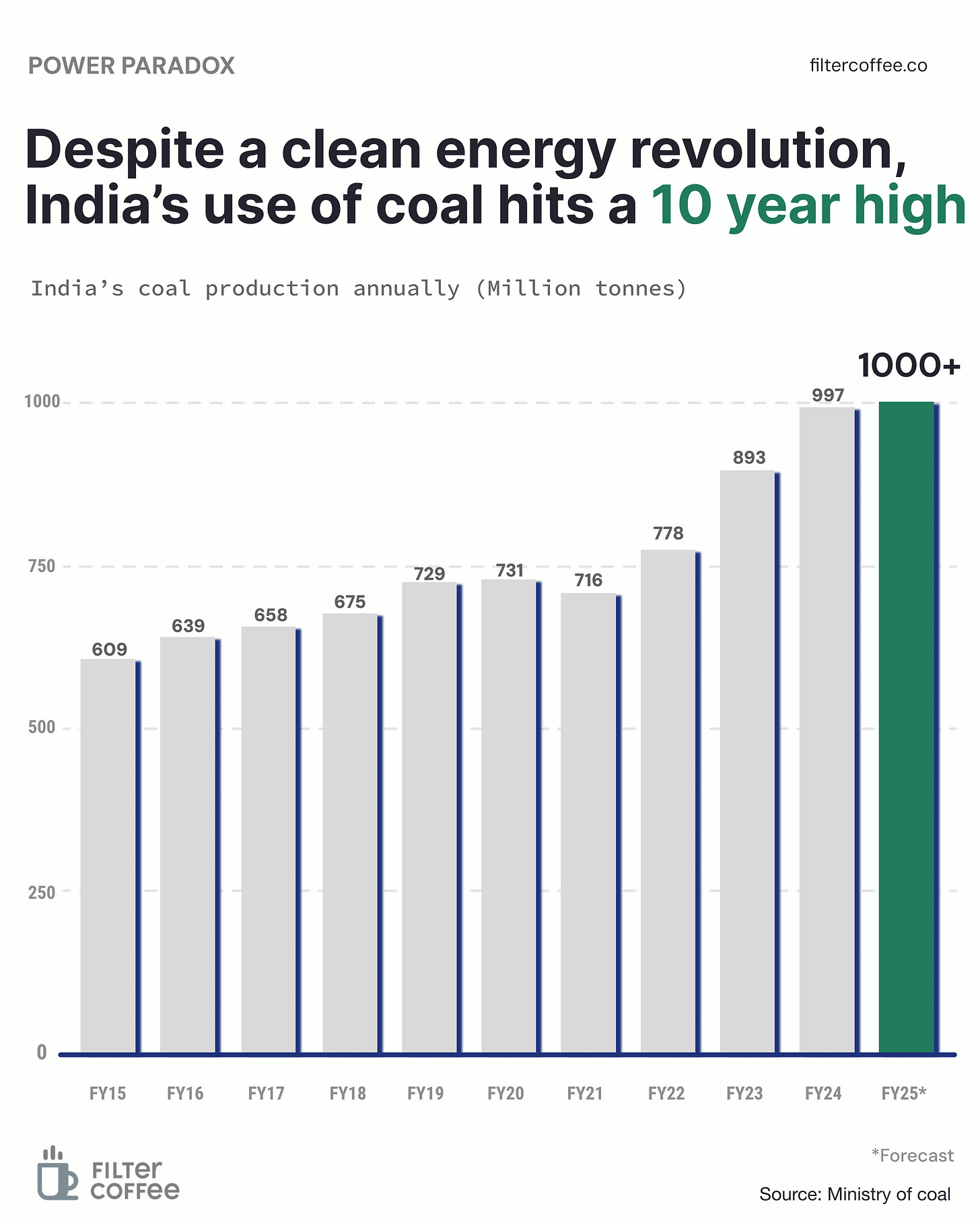

Coal India Ltd has kicked off the listing process for two of its subsidiaries - Bharat Coking Coal Ltd (BCCL) and Central Mine Planning and Design Institute (CMPDI). Draft papers for their IPOs will be filed with SEBI soon.

BCCL is a key producer of coking coal used in steelmaking while CMPDI is CIL’s technical and consultancy arm. Together, the two firms represent a strategic slice of India’s coal value chain.

Why now: Coal India reported a healthy 12% YoY jump in consolidated Q4 profit at ₹9,604 crore and is looking to build on that momentum.

Zoom out: CIL, which controls over 80% of India’s coal production, saw coal output hit 781 MT in FY25 slightly below target. But it’s eyeing 875 MT for FY26, with offtake set at 900 MT.

2. Loan Giant ARCIL Plans ₹1,500 Cr IPO 💰

India’s oldest bad loan buyer, Asset Reconstruction Company (India) Ltd (ARCIL), is preparing to go public. The company has started work on its draft red herring prospectus for an IPO that could raise anywhere between ₹1,000 and ₹1,500 crore.

ARCIL specialises in acquiring non-performing assets basically, bad loans from Indian banks and financial institutions. It helps clean up lenders’ books by taking over stressed assets and trying to recover value from them.

It is currently backed by US-based Avenue Capital Group and is also sponsored by SBI.

3. Sri Lotus gets green light for ₹792 Cr IPO 🏗️

Sri Lotus Developers and Realty, the Mumbai-based luxury real estate player has secured SEBI approval for its ₹792 crore IPO.

Sri Lotus operates across Greenfield, Redevelopment, and Joint Development models. It’s targeting the ultra-luxury segment, tapping into Mumbai’s growing appetite for high-end homes.

The deets: the IPO is a pure fresh issue—no offer for sale. Proceeds will be used to fund ongoing premium redevelopment projects in Mumbai’s western suburbs.

Zoom out: luxury real estate is heating up again, and Sri Lotus is betting big on Mumbai’s top-end market. With celeb money, buzzy projects, and strong growth, it’s hoping to turn its IPO into blockbuster real estate.

What else are we snackin’ 🍿

🚨 Layoff alert: Microsoft has laid off around 6,000 employees across multiple divisions, including AI director Gabriela de Queiroz, a prominent voice for ethical AI.

📵 Network freeze: A massive network outage has knocked out telecom services across Spain, hitting major providers and even disrupting emergency helplines in parts of the country.

💰 Funding boost: SBI’s board has greenlit a $3 billion long-term fundraising plan for FY26 to boost its funding base and fuel growth at home and abroad.

🛢️ Crude strategy: India is planning a $10B push to build 112 oil tankers by 2040, aiming to secure energy supply and cut reliance on foreign shipping.

🏥 Bajaj buys back: the CCI has cleared Bajaj Group’s ₹24,180 crore deal to buy Allianz’s 26% stake in their two insurance JVs.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.