Pharma takes a hit, Paytm's earnings, and Ather makes a cold listing.

Good morning indeed!

India has retaliated against the Pahalgam terror attack with overnight strikes on targeted terrorist camps in Pakistan and POK.

The situation is escalating quickly. Tensions are high, and we pray for the safety and strength of our armed forces.

Markets will attempt to digest the developments. So far, India’s measured yet decisive response may be seen in a positive light. This also marks a critical test for India’s growing defense capabilities, many of which are now indigenously developed.

💡 Spotlight: Trump just hit Indian pharma where it hurts.

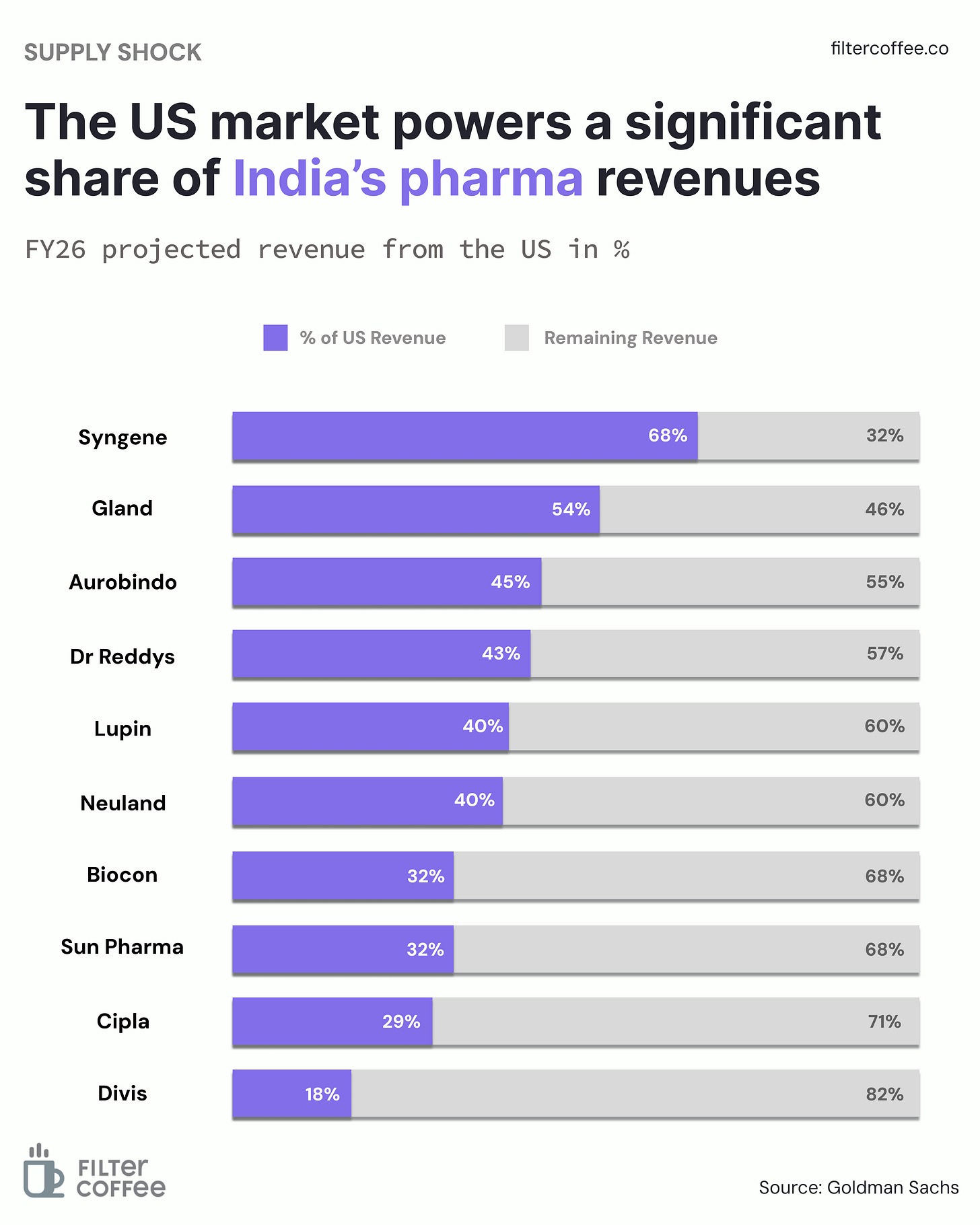

Indian drug majors like Aurobindo, Sun Pharma, Cipla, and Dr. Reddy’s saw their stocks tumble up to 4% after Trump signed an executive order to boost local drug manufacturing in the US.

The order slashes the usual 5-year setup time for new US plants, giving domestic players a boost and turning up the heat on Indian exporters, who depend heavily on the US market.

On a different note,

1 Big Thing: Sumitomo might buy YES Bank 🇯🇵

Japanese financial conglomerate Sumitomo Mitsui Banking Corporation (SMBC) is in talks to acquire a controlling stake in YES Bank.

The deets: India’s largest bank, SBI, currently owns 23.9% of YES Bank. Back in 2020, SBI along with other Indian banks had stepped in when YES Bank was in a liquidity crisis. Now that the bank is a bit steadier, SBI wants to slowly step away.

The banks including HDFC, ICICI, Axis, Kotak Mahindra are also looking to sell off their stake to SMBC.

If that goes through, SMBC could end up buying 51% of YES Bank, making it the majority owner. And because of Indian takeover rules, it would then have to make an open offer to buy another 26%, potentially turning this into India’s biggest-ever banking M&A deal.

But all discussions are still at a preliminary stage and nothing has been finalized yet.

Zoom out: the total foreign ownership can go up to 74%, but any single foreign investor can own only up to 15%. Even if they hold more shares, their voting rights are capped at 26%, meaning they can’t fully control decisions.

This makes big deals complicated. That’s why SMBC’s potential takeover of YES Bank could be a test case to see how much regulatory flexibility the Indian government might allow in the banking sector.

Above all, it is yet another piece of evidence showing global conglomerates vying for a piece of that India growth story.

2. Paytm’s Q4 was a mixed bag 📉

Paytm’s latest earnings paint two pictures: one of resilience over the last full year, and one of tougher times for the last quarter.

In the March quarter, revenue dipped 16% YoY to ₹1,912 crore, hit hard by the RBI clampdown on its payments bank. Wallets, FASTags, and other services took a hit. Net loss narrowed just slightly to ₹540 crore from ₹550 crore last year.

But step back, and the full-year story is more hopeful.

Paytm cut its annual loss by over half — from ₹1,417 crore in FY24 to ₹659 crore in FY25, even as full-year revenue fell 31% to ₹6,900 crore.

The how: cost cuts helped. The company reduced its workforce, dialed back marketing spends, and leaned more on partner banks to run payments infrastructure. A lot of non-cash charges like stock options were absorbed earlier in the year, so the year-end hit was smaller.

Zoom out: FY25 was Paytm's year of survival mode. Even with regulators coming down hard, services disrupted, and revenue taking a hit, the company still managed to slash losses. It’s not back in the green — but it’s no longer bleeding as badly either.

The big question investors ask though is what could drive the next lap of growth, especially when competition remains feisty and total market opportunity in fintech appears played out.

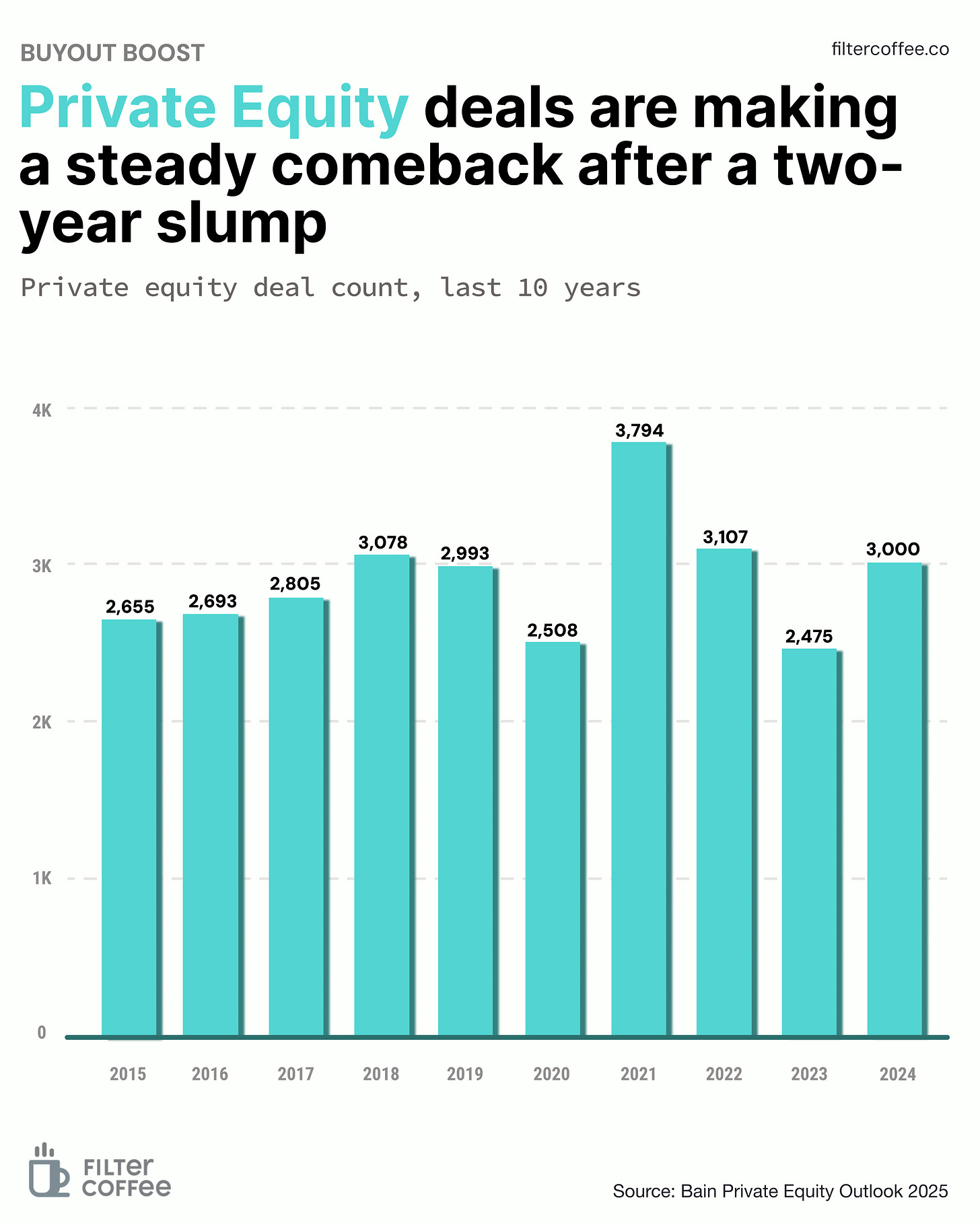

3. Private equity comes after Skechers 💸

3G Capital is acquiring Skechers for $9.4 billion, marking its return to the M&A scene after a four-year break.

Skechers is a U.S.-based footwear company that designs, develops, and sells casual and performance shoes for men, women, and children.

The footwear company is going from public to private post the buy. The move lets it step away from market pressure and focus on long-term strategy. Such flexibility, away from Wall Street’s prying eyes, could especially be a blessing when the company tries to navigate Trump’s tariffs.

While we are on acquisitions,

KPIT Technologies will acquire Caresoft's Global Engineering Solutions for $191 million.

The deets: Csresoft focuses on automotive benchmarking and cost reduction. and KPIT Technologies provides software and engineering solutions for the automotive and mobility sectors, focusing on electric, autonomous, and connected vehicles.

Why it matters: KPIT is looking to strengthen its position in automotive digital engineering. The deal gives it better tools to take apart vehicles and understand how they’re built and priced.

4. India tightens rules for satellite internet players 🔒

The telecom ministry has laid down fresh ground rules for satellite internet providers entering India.

The deets: the move comes as Starlink’s licence is still on hold and waiting for government approval. The government is saying that the company hasn’t yet met India's security protocols.

The updated rules are:

- Critical functions like the Network Control & Monitoring Centre must be set up within India.

- Operators must also give the government the ability to intercept, monitor, and block network activity when needed. Geo-fencing tech must prevent accidental signal spillover into neighbouring countries, and banned websites must stay blocked.

- Companies will also have to share user terminal info with security agencies, ensure devices are registered and authenticated locally, support NavIC, India’s own GPS, and make sure no Indian data is copied or decrypted outside the country.

Why it matters: India is making sure it stays in control of what happens on its digital turf.

This also creates a level playing field for Indian telecom giants like Jio and Airtel, who are trying to build their own satellite internet systems. Without these rules, global players with deep pockets and global infra could dominate quickly.

What else are we snackin’ 🍿

🧊 Cold listing: Ather Energy made a muted debut on the NSE, listing at just a 2% premium at ₹328 per share.

📈 Service surge: India’s Services PMI in April grew up to 58.7 from 58.5 in March, hinting at steady growth in the sector.

🌏 India rises: India is set to overtake Japan in 2025 to become the world’s fourth-largest economy, crossing the $4 trillion mark, says the IMF.

🤝 Trade win: India has successfully finished talks of a Free Trade Agreement (FTA) with the UK. This will allow on easy movement of certain goods between UK and India with minimum trade and tariff barrier.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.