Tata Motors clocked in a stronger-than-expected Q4, powered by its luxury play. Net profit came in at ₹8,470 crore, beating analyst estimates of ₹7,458 crore.

What’s driving it: Jaguar Land Rover (JLR), which makes up two-thirds of Tata Motors’ revenue, delivered the goods. SUV demand stayed strong in North America and Europe, helping offset weaker sales in China and slowing growth back home.

JLR’s margins held up too—10.7% for the quarter, helping it meet its full-year target of 8.5%.

Overall revenue was up just 0.4% YoY to ₹1.2 trillion, but that’s with expenses dropping 2%, thanks to easing raw material costs.

The stock closed down 1.8% ahead of results.

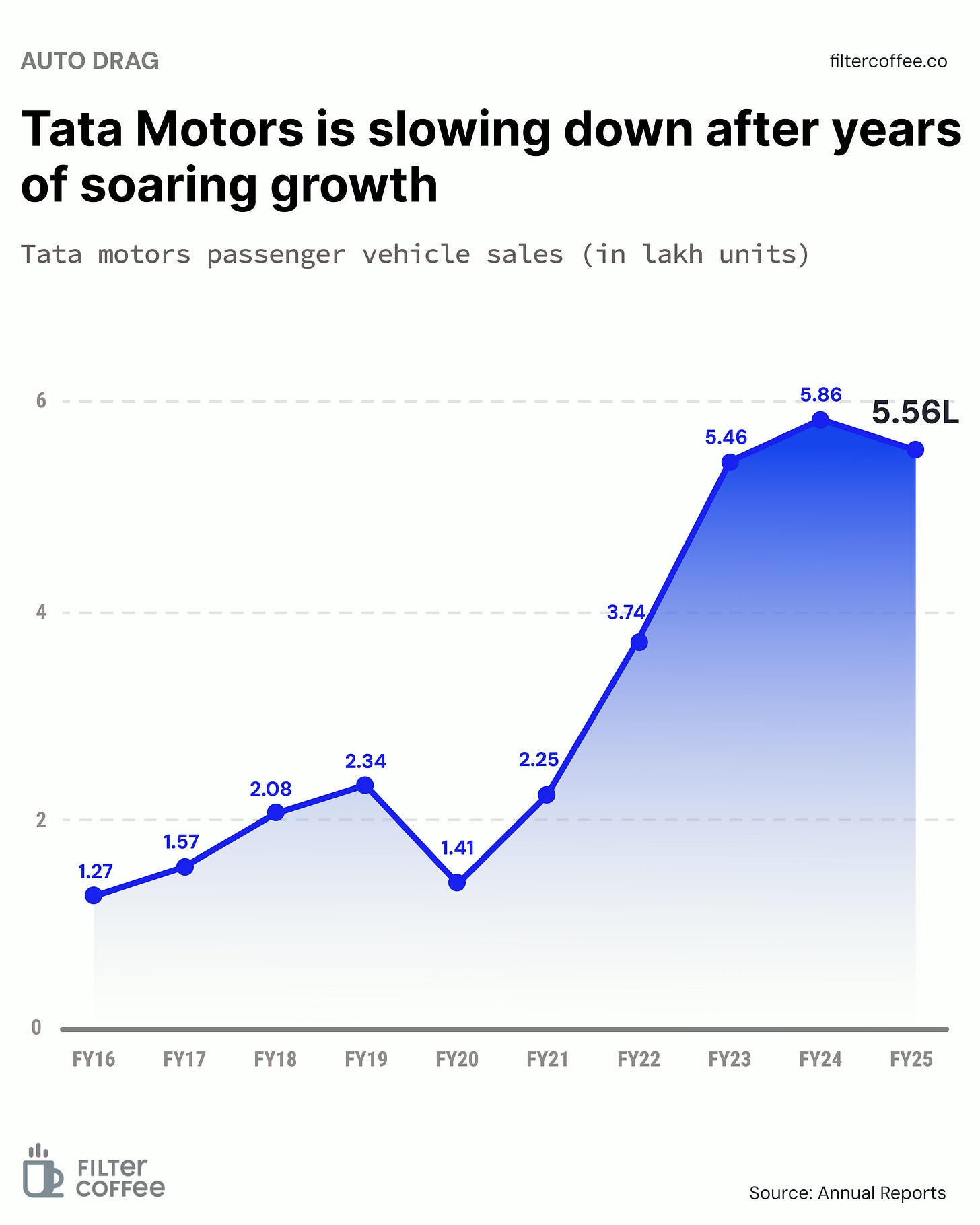

While JLR is holding up, domestic passenger vehicle sales are starting to lose steam after years of strong growth.

Tata Motors sold fewer units in FY25 than in FY24, hinting at a potential plateau in the home market.