Markets on fire, Satellites zoom, and PVR’s muted Q4.

🗓 Morning!

The PM addressed the nation last night with a stark message: no more tolerance for terrorism or nuclear blackmail.

Just minutes after the speech though, Pakistan resumed drone strikes across Jammu & Kashmir and Punjab—violating the weekend ceasefire that, per Trump, was brokered by the US to prevent “a bad nuclear war.”

Meanwhile, markets are cheering both the resolution and India’s newfound mojo in defence capabilities and execution.

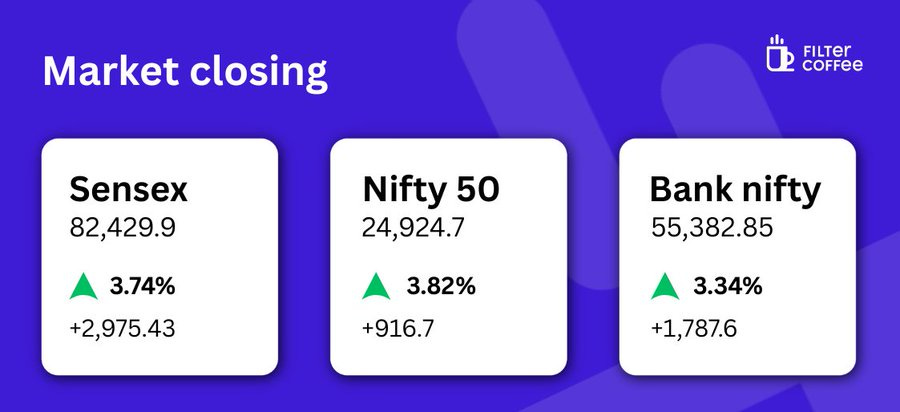

- Tuesday’s market rally was one for the books—Sensex and Nifty jumped nearly 4% each, marking their best single-day gains in over four years.

💡 Spotlight: The U.S. and China have decided to hit the brakes on their long-running tariff battle. Both countries have agreed to reduce most tariffs to 10% for the next 90 days, while the two negotiate a long-term deal.

One exception: the U.S. will continue to levy a 30% duty on specific Chinese imports tied to illegal fentanyl ingredients—keeping some pressure in place.

Both S&P and the Nasdaq shot up over 4% yesterday.

Let’s hit it!

1 Big Thing: PVR Inox’s soft Q4 🎬

PVR Inox’s Q4 was more slow burn than blockbuster, steady in parts, but far from a big comeback, as the movie industry continues to struggle.

By the numbers: the company reported a consolidated net loss of ₹125 crore in Q4 FY25, slightly narrowing from ₹129.5 crore in the same quarter last year. Revenue dipped marginally to ₹1,250 crore, marking a 0.5% YoY contraction.

What’s up: Despite a packed release calendar, the company’s losses persist because box office hits alone aren’t enough anymore. Audiences are more selective, and OTT has permanently reshaped consumer behavior. Fewer people are going to the movies, even when blockbusters succeed.

Moreover, running a cinema isn’t cheap and comes with high-overhead costs (think rent, salaries, etc.). Even if footfalls go up slightly, the costs remain constant and eat into profits.

- Worth noting: PVR Inox added 77 new screens in Q4 great for growth, but it comes with big setup costs and takes time to turn profitable.

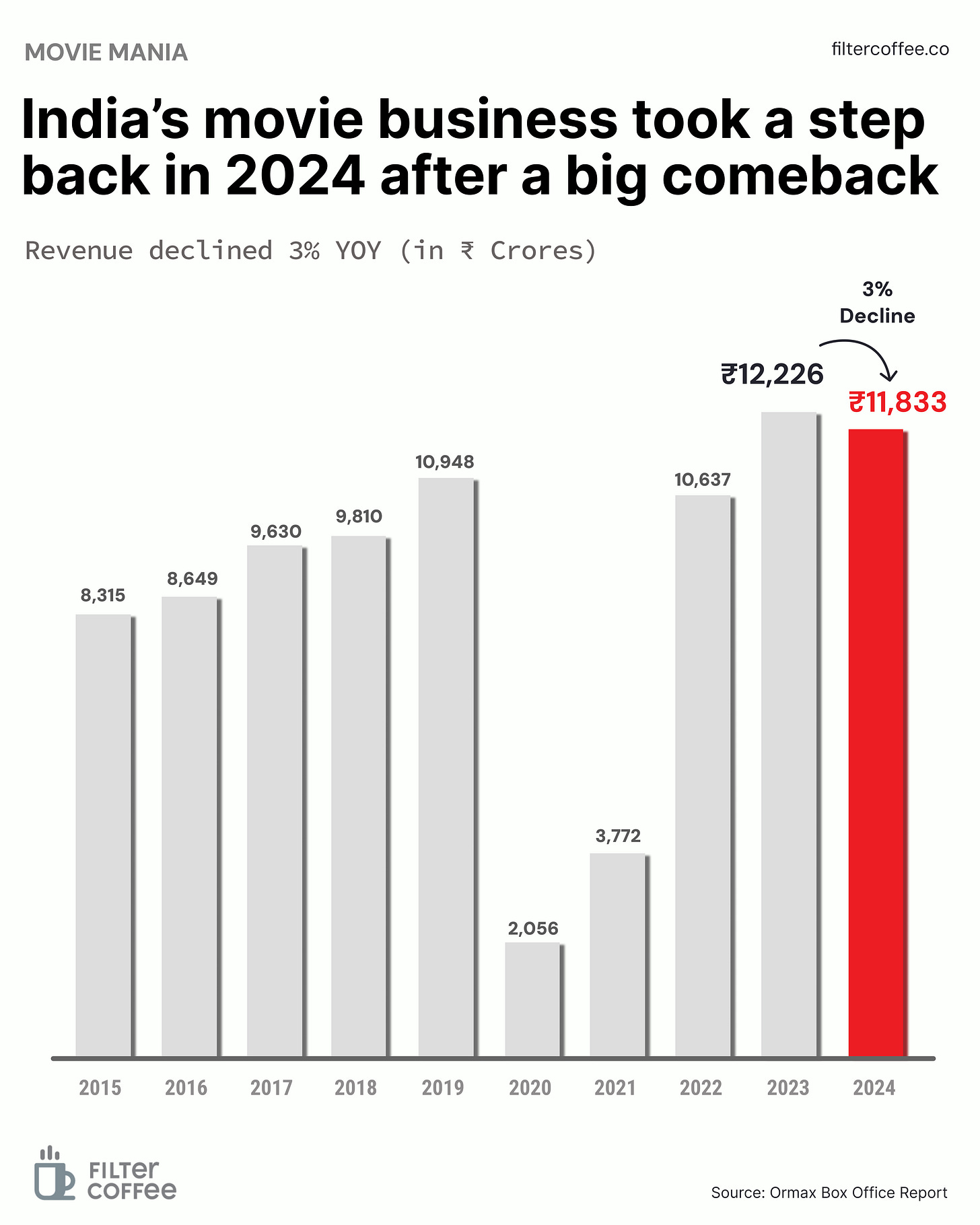

Big picture: movie business continues to remain volatile post pandemic. After peaking in 2023, box office revenues dipped 3% in 2024—but they’re still well above pre-COVID levels.

2. India fast-tracks spy satellites 🛰️

India’s space plans just got a major speed boost. In response to rising geopolitical tensions, the government is fast-tracking its $3 billion satellite surveillance mission, SBS-3, aiming for a 2026 launch.

The deets: GOI has directed three private players (Ananth Technologies, Centum Electronics, and Alpha Design Technologies) to compress their satellite development timelines from four years to just 12–18 months.

One of the satellites, built by Ananth Technologies, is already in advanced stages and is expected to launch later this year via ISRO’s LVM3 or SpaceX, depending on mission slots.

The who’s who: these aren't newcomers. All three companies have been long-time partners of ISRO, having worked on missions like Chandrayaan-3, IRNSS, and more.

- Notably, Alpha Design Technologies, now owned by Adani Defence and Aerospace, played a key role in building NavIC, India’s homegrown GPS alternative.

The SBS-3 mission is India’s signal to the world that it’s no longer waiting for data from anyone, it’s building its own eyes in the sky.

3. ReNew Power is going big on renewables ☀️

ReNew Power, one of India’s largest clean power players, has launched a ₹22,000 crore renewable energy project in Andhra Pradesh’s Anantapur, which is India’s largest green power complex at a single location.

The deets: this mega facility will generate 2.5 GW of clean energy and pack in a 1 GWh battery storage system.

- That’s enough electricity to run about 20 lakh homes, and it also has a huge battery to store that power and use it later when needed.

The project will roll out in two phases:

- Phase 1: ₹14,000 crore for 500 MW each of solar and wind, plus 1 GWh of storage.

- Phase 2: ₹8,000 crore for another 500 MW each of solar and wind.

Zoom out: South India has 86 GW of renewable potential, and Andhra Pradesh alone holds over 51 GW, with Anantapur alone leading at 20 GW. This project puts the state firmly on the green energy map.

FYI, Renew had gone public on the Nasdaq during the 2021 SPAC euphoria.

4. Stocks that kept us interested 🚀

1. Adani’s power move worth $2 billion ⚡

Adani Power surged 7% after winning a contract to supply 1,500 MW of electricity to Uttar Pradesh. The deal is backed by a $2 billion investment in a brand-new thermal power plant.

The deets: Adani Power will set up a 2x800 MW ultra-supercritical thermal plant in UP, of which 1,500 MW is already locked in through a long-term agreement with the state government.

- An ultra-supercritical thermal plant is a next-gen coal power plant that uses very high pressure and temperature to produce electricity more efficiently and with less pollution.

Zoom out: as per estimates, UP’s power demand is expected to rise by 11,000 MW over the next decade, thanks to more cities, factories, and everything electric. This project is a key part of the state's long-term energy plan.

2. LTIMindtree’s AI Jackpot 🤖

LTIMindtree jumped over 7% after bagging its biggest deal ever of $450 million AI-powered partnership with a global agribusiness giant.

The deets: over the next seven years, LTIMindtree will revamp the client’s IT systems using AI across app management, infrastructure, and cybersecurity.

Zoom out: a key theme across India’s IT giants is the push to rewire legacy operations to deliver AI-specific products and services. Not all will succeed, but markets are rewarding those that have moved early and decisively.

What else are we snackin’ 🍿

🖥️ Tech cover: TCS has partnered with Oman’s largest insurer, Dhofar Insurance, to upgrade its core systems using the TCS BaNCS platform.

⚡ Gensol shake-up: Anmol Singh Jaggi quit as MD and Puneet Jaggi stepped down as Whole-Time Director of Gensol Engineering.

💸 Ant exits: China’s Ant Group is selling a 4% stake in Paytm for $242 million.

💰 Plex it: AI giant Perplexity is in talks to raise $500 million at a staggering $14 billion valuation.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.