VC funding isn’t flowing like it used to.

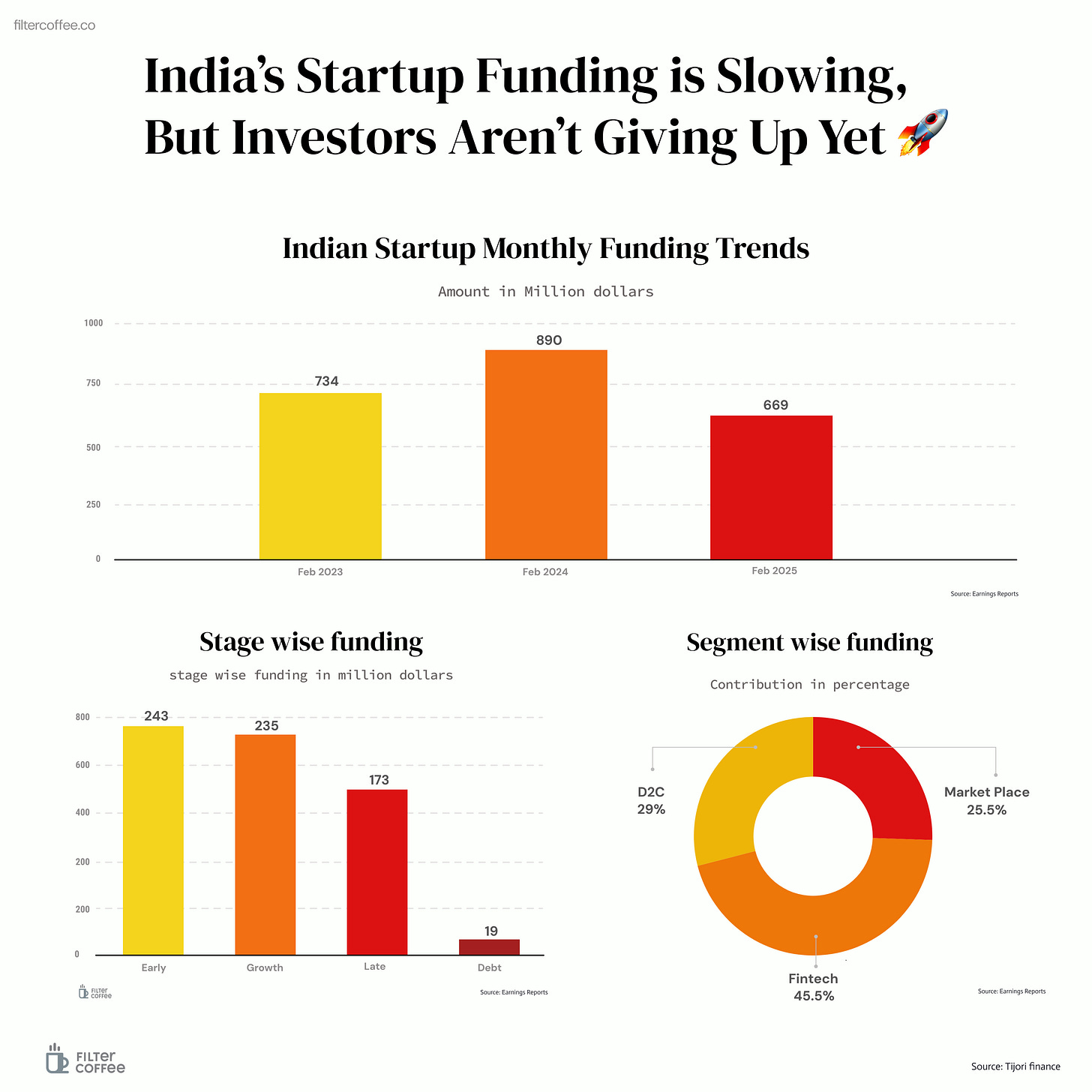

In February, Indian startups raised $669 million across 100 deals, down 25% from last year and 6% lower than January’s $712 million.

The real reason: no big-ticket deals. Investors seem to be on a digital detox from writing big cheques.

Not a single startup pulled in a $100 million+ round, and only six startups—Cashfree, Zeta, ToneTag, SpotDraft, Udaan, and Geniemode—managed to raise more than $50 million.

The one outlier was Zeta which hit unicorn status, now valued at $2 billion. But beyond that, it’s been a slow month.

Whats causing this: the Indian stock market has been shaky, and global trade tensions (Thanks to Orange Man) aren’t helping.

Investors wanna stay at arms length, and its showing.

Fintech was the only sector to cross $100 million in funding, pulling in $143 million, while most others struggled to break into the eight-figure range.

Zoom out: funding continues to be heavily concentrated in Bengaluru, Delhi-NCR, and Mumbai, while cities like Chennai, Hyderabad, and Pune are still waiting for their VC moment.

The first two months of the year are usually slow for VC funding, but the big question is: Will 2025 bounce back, or are is the funding winter already here?

Worth noting: the number of IPOs also took a hit, with only five companies going public in January and four in February—way down from 16 listings in December 2024.