Reliance shops FMCG, Flipkart glows up, and Adani aims for the sky.

🗓 Morning, folks! ☀️

💡 Spotlight: Pharma rallies on US Biosecure Act

Indian pharma stocks rallied after the US Senate passed the Biosecure Act, which blocks some Chinese biotech firms from accessing federal funding. Markets read this as a tailwind for Indian drugmakers, with Wockhardt, Laurus Labs ending 3% higher, Divi’s, Biocon and Ajanta also rose more than 1% each.

The move, part of the nearly $1 trillion FY26 National Defense Authorization Act, signals a push to shift US biotech supply chains away from China. It is expected to open up longer-term manufacturing and research opportunities for Indian pharma players.

Let’s hit it!

1 Big Thing: Ather expands EV ecosystem with insurance 🚗

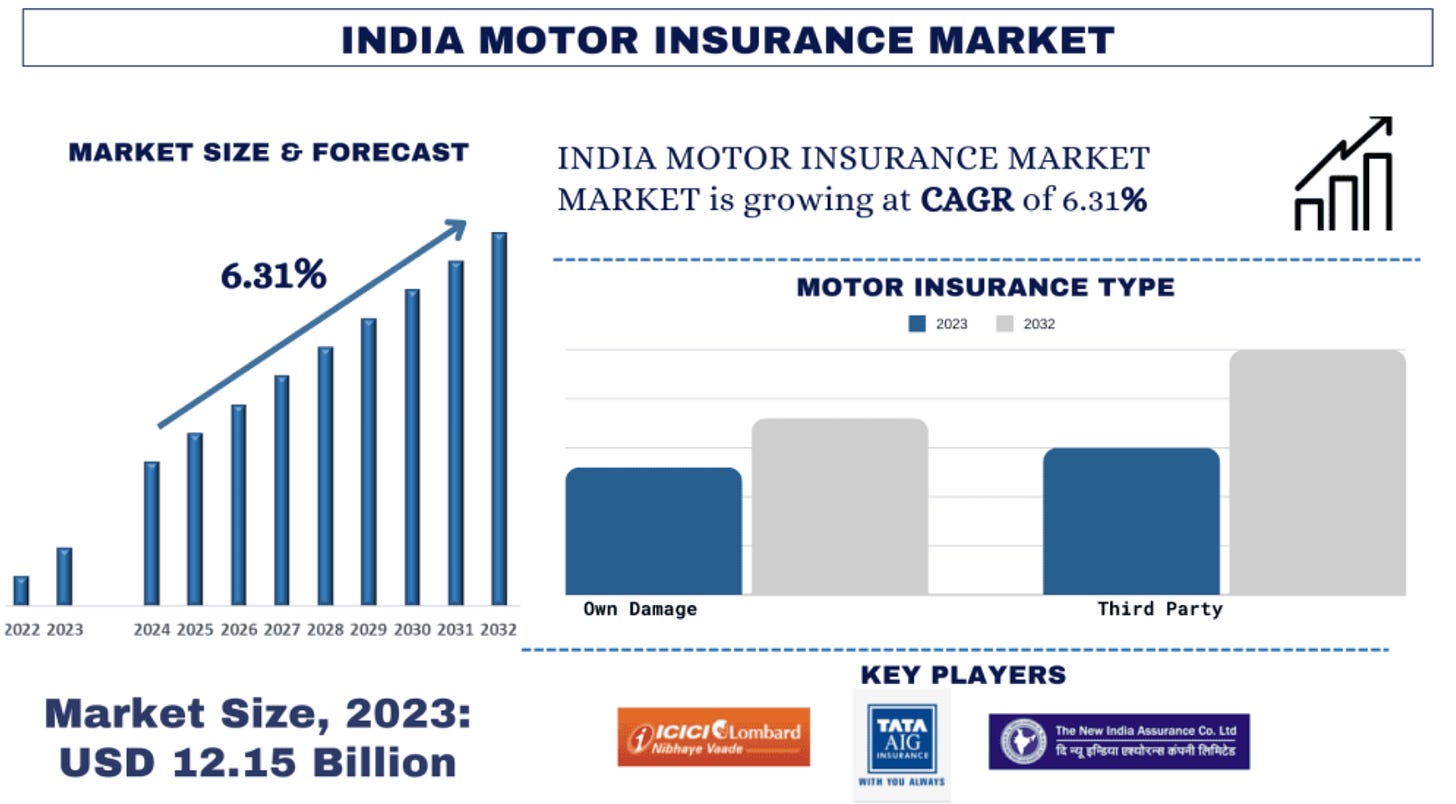

EV maker Ather Energy is entering auto insurance through a subsidiary to offer EV-focused policies and simplify the ownership experience for its customers.

The company’s board has approved the creation of a wholly owned subsidiary that will operate as a corporate insurance agent.

This means that the company will not underwrite insurance or take balance-sheet risk. Instead, it will partner with multiple insurers to distribute motor insurance products directly to its customers.

The why: the move addresses a key pain point for EV owners. Insurance for electric vehicles is often priced inconsistently, offers limited EV-specific coverage, and can be cumbersome to renew.

By bringing insurance distribution in-house, Ather plans to offer EV-tailored policies, simplify renewals, and integrate insurance more seamlessly into the ownership journey.

Big theme: strategically, insurance also deepens customer engagement beyond the point of sale. As India’s motor insurance market grows alongside rising vehicle penetration and stricter compliance norms, manufacturers are increasingly looking to control more touchpoints.

2. Reliance fills pantry with ₹380 cr Udhaiyam deal 🛒

Reliance Consumer Products acquired a 76% stake in Udhaiyams Agro Foods via a joint venture, investing ₹380 crore.

Context: RCPL is the FMCG arm of Reliance Industries, having a portfolio across staples and daily essentials while Udhaiyams Agro Foods sells rice, spices, snacks and idli batter.

Why it matters: this acquisition gives Reliance a strong entry point into South India, particularly Tamil Nadu, where Udhaiyam enjoys deep household trust and a dense distributor network.

It also strengthens Reliance’s push into branded staples and fresh-to-packaged foods like rice, spices and idli batter, high-frequency categories with steady demand and repeat consumption.

Zoom out: Reliance has been on an FMCG shopping spree, snapping up brands like Campbell Retail (Campa), Ravalgaon, Sosyo, and Lotus Chocolate, while also building in-house labels across staples, beverages, and packaged foods.

The strategy is to buy trusted regional brands, plug them into Reliance’s massive retail and distribution engine, and scale fast.

3. Flipkart buys majority stake in Minivet AI 🤖

Flipkart has acquired a majority stake in Minivet AI, a generative AI startup focused on visual and video content for ecommerce.

The deets: Minivet’s tools will be used to power product discovery and content creation on Flipkart, enabling visual assets to be created at scale across sellers. In simple terms, Flipkart will use Minivet AI to make product listings look better and more helpful.

Today, many sellers upload just a few photos or plain images. Minivet’s AI can turn those static images into high-quality visuals and short videos, showing products from multiple angles or in real-life use.

Why this matters: this helps Flipkart maintain consistent quality across millions of listings, even from small sellers who don’t have the budget or skills to create professional content. In short, Flipkart is using AI to make online shopping feel closer to an in-store experience.

Better visuals mean higher engagement, lower returns, and a more consistent shopping experience. Owning the tech also gives Flipkart tighter control over content quality across its massive catalogue.

4. Adani bets big on India’s airport boom ✈️

The Adani Group plans to pour over $11 billion into airports by 2030.

It is building new terminals, upgrading runways, and expanding into aircraft maintenance and services. And yes, an airport’s IPO is firmly on the runway.

What’s cooking: Adani Airport Holdings is eyeing bids for 11 more airports under the government’s privatisation push. Think Varanasi, Bhubaneswar, Amritsar bundled assets where profitable airports subsidise weaker ones.

Why it matters: airports are long-term, cash-generating assets. The business is already EBITDA-positive, and cash-flow positivity is targeted within three years, key milestones before any IPO.

The group is eyeing a slice of aviation services as it bids on services from AI Engineering Services to bring heavy aircraft maintenance back to India.

5. Stocks that kept us interested 🚀

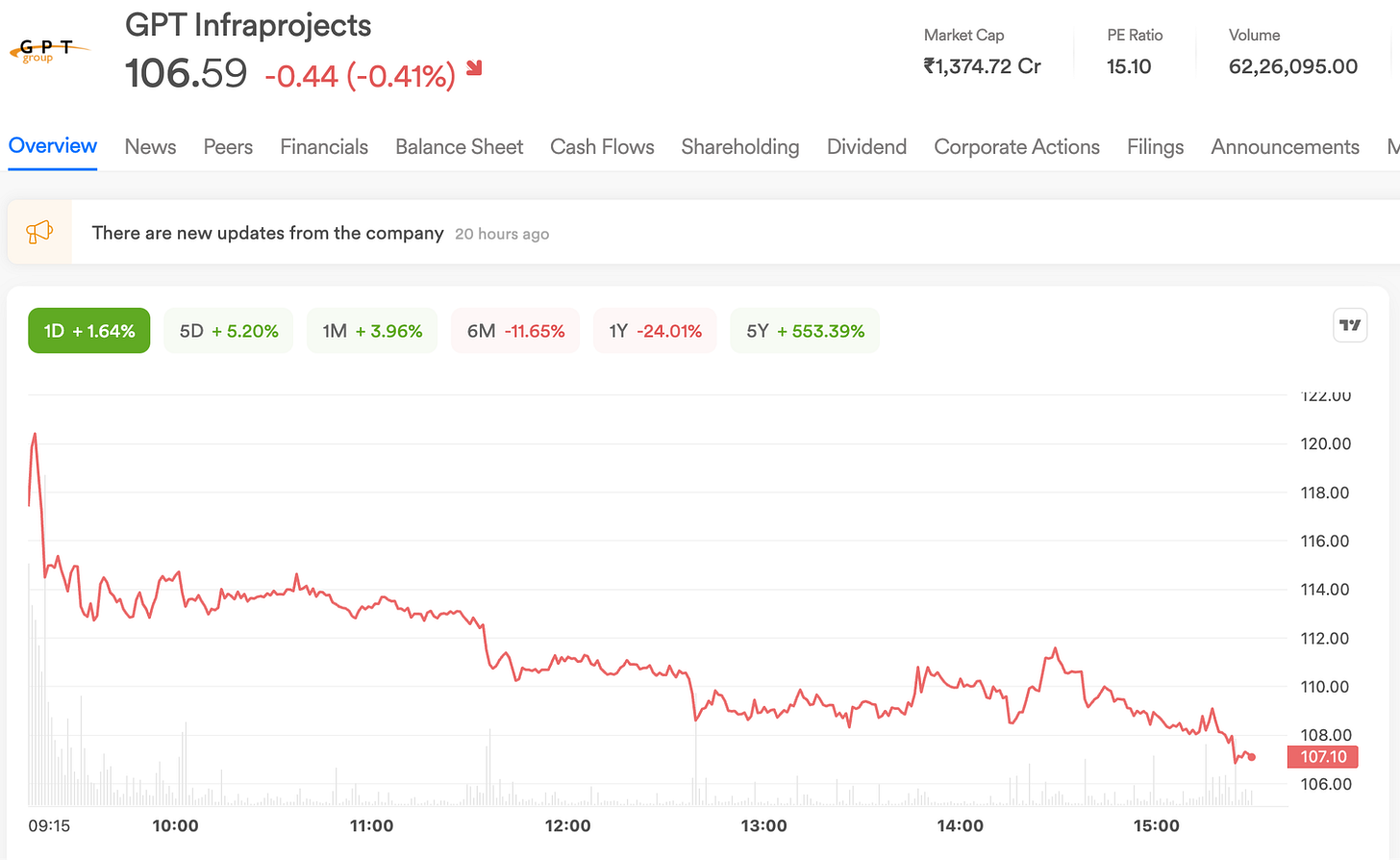

1. GPT Infra soars after JV bags ₹1,804 crore Mumbai flyover order 🚧

GPT Infraprojects JV won a ₹1,804.5 crore contract to build key flyovers from the Municipal Corporation of Greater Mumbai. The stock surged 1% on the back of this news.

The Kolkata-based infrastructure firm focuses on major infrastructure projects like railway bridges, roads, and manufacturing concrete sleepers for railways, with operations in India and internationally.

What’s brewing: under the order, the company will help build a new flyover on LBS Marg, linking Kurla to Ghatkopar in Mumbai’s eastern suburbs.

The significance: for Mumbai commuters, this flyover means shorter travel times and fewer traffic snarls on the busy Kurla–Ghatkopar stretch, one of the most congested parts of the eastern suburbs.

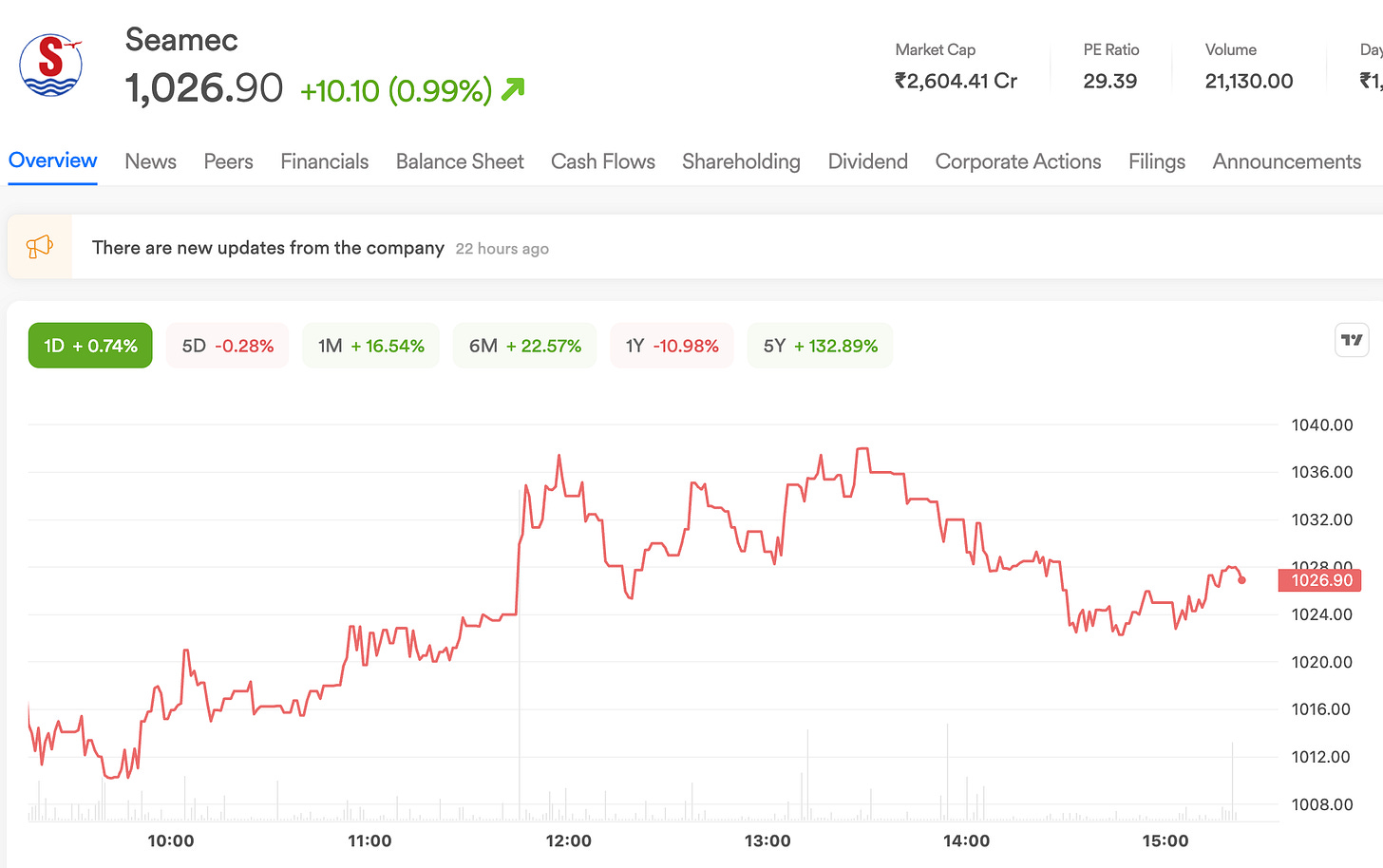

2. Adsun Offshore bags $3.2M Seamec deal for subsea upgrades 🚢

Seamec has awarded a $3.2 million contract to Adsun Offshore Diving Contractors for providing diving services on the vessel Seamec III. The stock gained around 1% on the back of this news.

SEAMEC is a company that uses specialised ships with trained divers and equipment to carry out underwater jobs like inspecting pipelines & helping build new facilities at sea. Whereas, Adsun Offshore provides underwater and marine services for the oil & gas, ports, and energy sectors.

Why this matters: the deal is about keeping India’s energy system running smoothly. The work supports ONGC’s offshore pipelines, which carry oil and gas that power homes, industries and transport across the country. When these pipelines are maintained well, it reduces the risk of leaks, disruptions and costly shutdowns.

What else are we snackin’ 🍿

💣 Defence Boost: Apollo Micro Systems shares climbed after its subsidiary received an industrial licence to manufacture defence explosives.

📄 Nuclear Opening: parliament approved a new nuclear energy bill that will allow private companies to take part in India’s civil nuclear sector, which was earlier tightly controlled by the government.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.