ONGC-Japan's Mitsui tie-up, Cars24 buys CarInfo, and Crypto SIPs jump.

🗓️ Morning, folks! ☀️

Markets had a rough Tuesday, slipping into the red as heavyweight selling and weak consumer stocks took the wind out of the rally. The Sensex and Nifty closed up to 0.4% lower.

Reliance Industries did the most damage, sinking to its steepest one-day fall in nearly 10 months. Trent got hammered, sliding 8% after underwhelming revenue growth, while ITC fell another 2% to its lowest level in over two years.

💡 Spotlight: Metal stocks went full aura farming 🚀

Metal stocks had a blockbuster Tuesday, riding a global surge in copper, aluminium, and silver prices.

Tight supply and rising global tensions pushed copper to a record $13,253.50 per ton on the London Metal Exchange, sending the Nifty Metal index also up.

Silver joined the party too, jumping past $79/oz, now just 6% away from its all-time high, and up 9% since the US captured Venezuela’s President Maduro.

That boost also lifted Hindustan Zinc, India’s biggest silver producer, while Hindustan Copper, Hindalco, and NALCO climbed 2-4%.

Let’s hit it!

1 Big Thing: ONGC-Japan’s Mitsui seal an ethane deal 🚢

ONGC is partnering with Japan’s Mitsui OSK Lines (MOL) to set up two joint ventures in GIFT City, focused on shipping ethane to India.

What’s the deal: the two JV firms - Bharat Ethane One and Bharat Ethane Two will be 50:50 owned by ONGC and MOL.

Each JV will own and operate a very large ethane carrier (VLEC) under the Indian flag. These specialised ships will bring ethane from the US to fuel ONGC Petro Additions Ltd’s (OPaL) petrochemical plant in Dahej, Gujarat.

The ships will be built in Korean shipyards, costing about $370 million for both. Ethane imports are expected to begin by mid-2028.

Why it matters: ethane is a key raw material for making plastics and chemicals. By controlling transport, ONGC ensures a steady, long-term supply for OPaL and reduces reliance on changing LNG imports.

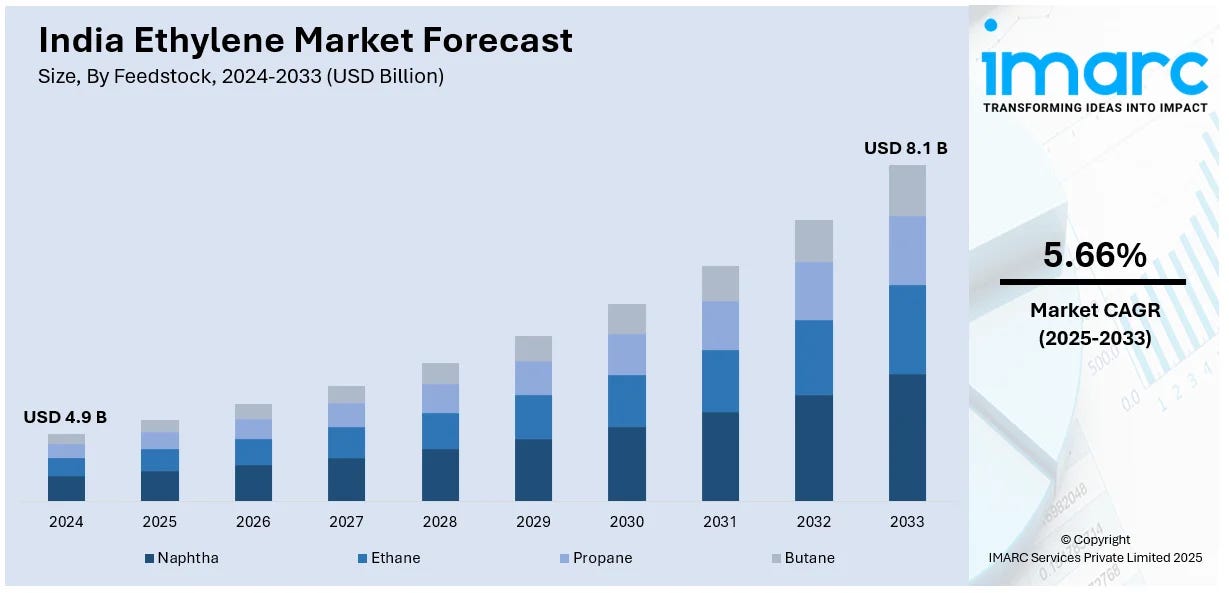

Big theme: India’s ethylene market is growing steadily from $4.9 billion in 2024 to $8.1 billion by 2033. This reflects rising demand for plastics and petrochemical products.

2. CARS24 adds CarInfo to its ecosystem 🚗

CARS24 is making a clear push to become more than just a used-car marketplace.

The scoop: the company has acquired CarInfo, a vehicle information platform, to expand its role beyond buying and selling cars. This is also CARS24’s second acquisition in under a year, after it took over the automotive community platform Team-BHP last year.

CarInfo and its sister app BikeInfo will now be part of the CARS24 ecosystem, but both will continue operating as standalone apps with their existing teams.

Why this makes sense: for many vehicle owners, checking basics like registration details, insurance validity, challans, FASTag updates, and other compliance information is still frustrating because the data is scattered. CarInfo built its value by making that information easier to access in one place.

Bottomline: CARS24 is betting that solving everyday ownership pain points, not just facilitating a sale, will keep users coming back long term.

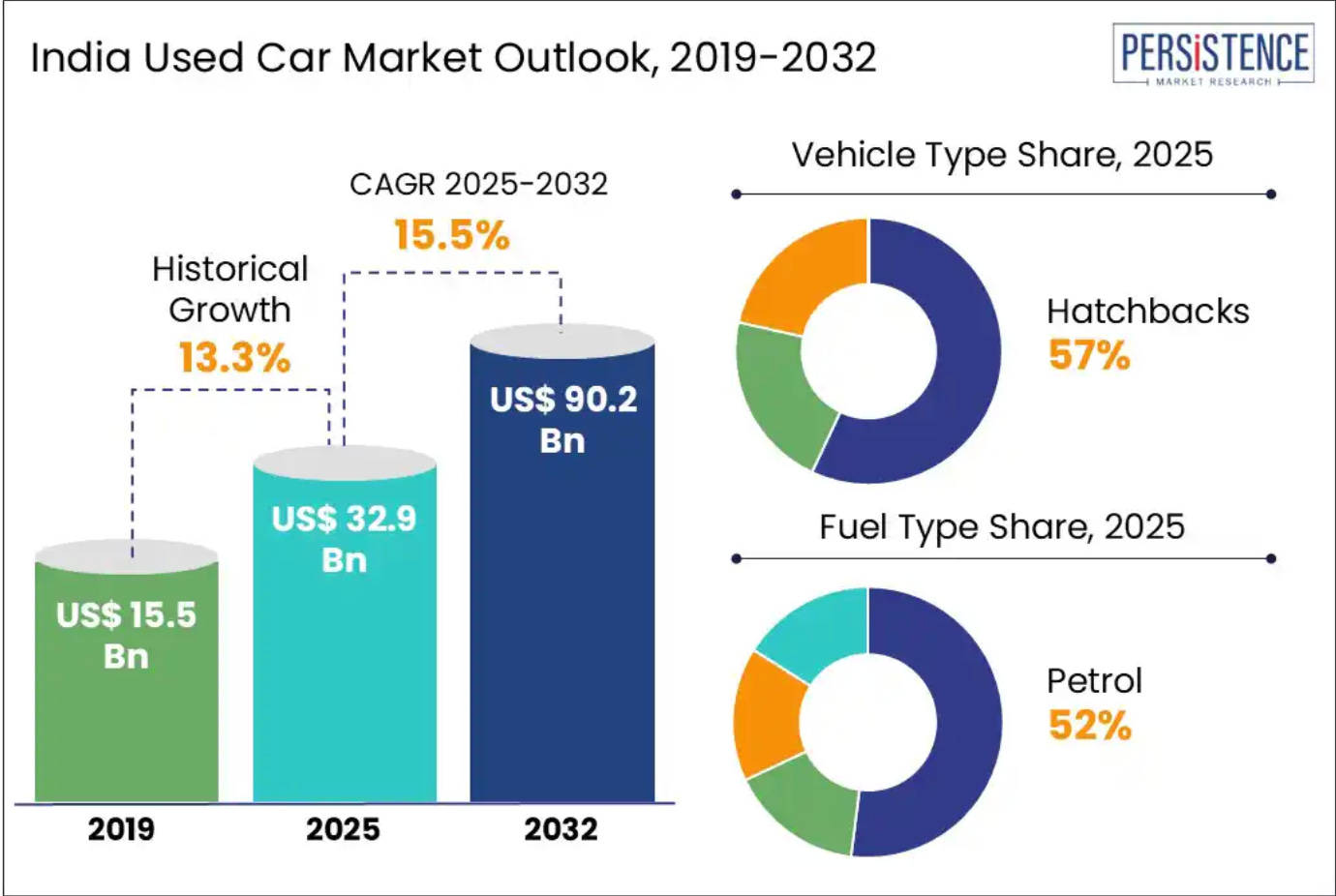

That loyalty could matter even more as India’s used car market is expected to jump from $32.9B in 2025 to $90.2B by 2032, growing at a rapid pace year after year.

3. Even Healthcare bags $20 million 🏥

Even Healthcare has raised $20 million led by existing investors Lachy Groom and Alpha Wave.

The Bengaluru-based company offers a subscription-based healthcare model with unlimited consultations, diagnostics, specialist access, and insurance, focusing on continuous care and recovery rather than hospital admissions.

The why: the proceeds will be used to expand Even Healthcare’s hospital footprint in Bengaluru and scale its existing model.

Background: the fresh funding comes within 15 months of its $30 million Series A in October 2024.

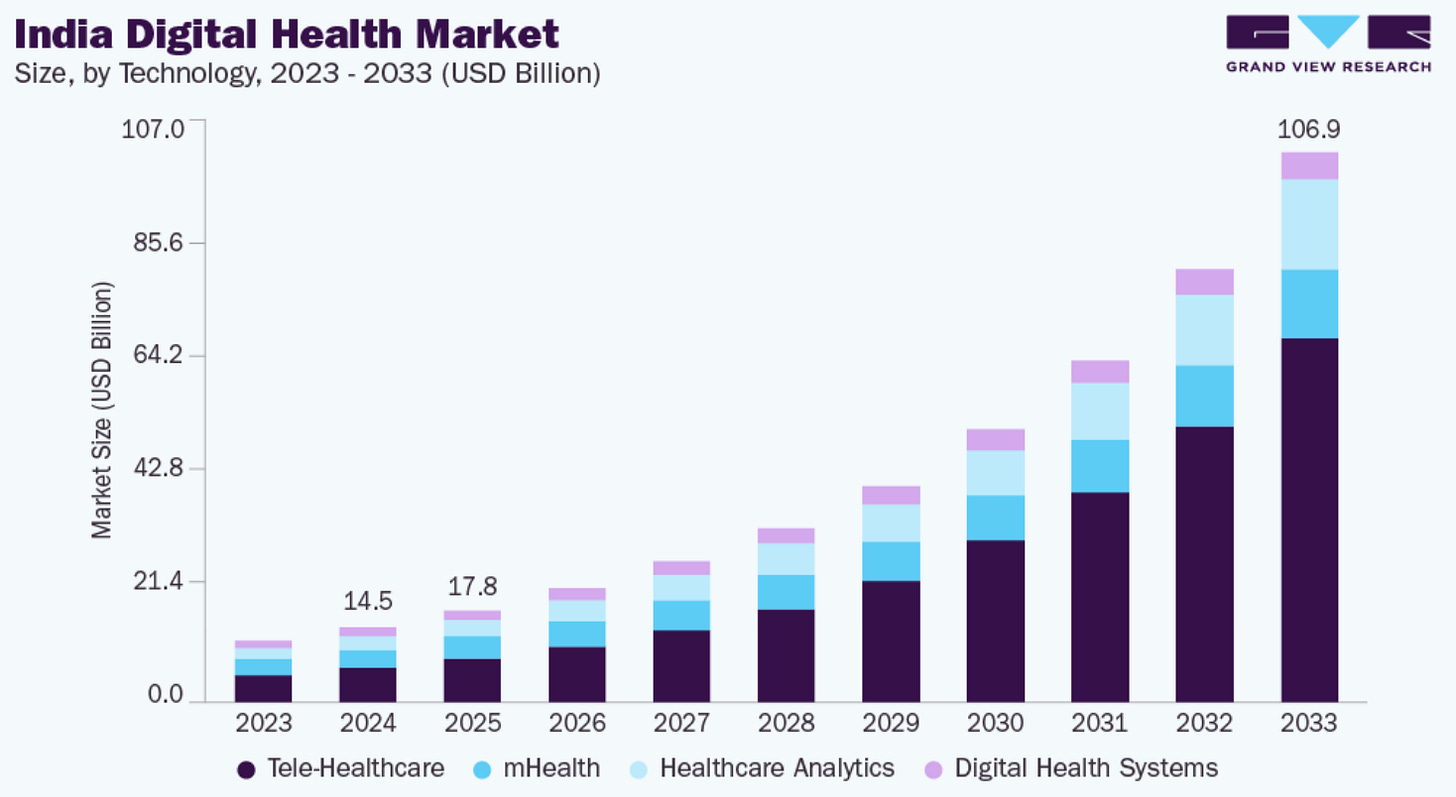

Big picture: rapid digital adoption, rising incomes, and an overstretched healthcare system are driving demand for digital health in India, where the doctor-to-patient ratio is nearly 30% below WHO norms.

The market is set to grow to $106.9 billion by 2033 at a rate of 25.1%, aided by government initiatives like the Ayushman Bharat Digital Mission.

While we are on fundraises 💰,

Hindustan Laboratories filed its draft papers with SEBI to raise funds through an IPO.

What they do: the pharmaceutical company mainly supplies generic medicines to government institutions. It also manufactures a wide range of formulations, including tablets, capsules, liquid orals, ointments, and powders.

The deets: the offer includes a fresh issue of 50 lakh shares and an offer-for-sale of 91 lakh shares by the promoter.

4. Stocks that kept us interested 🚀

1. IEX shares jump as it gets a breather from regulator ⚡

IEX shares ended more than 10% higher after a turn in its legal battle with the power regulator over market coupling.

The rally came after Central Electricity Regulatory Commission (CERC) told the Electricity Appellate Tribunal (APTEL) that it is willing to take instructions to withdraw its July 2025 order.

Context: in July 2025, CERC approved market coupling for India’s power markets. Till now, electricity prices were discovered separately on each exchange, with IEX dominating price discovery and controlling nearly 85% of the spot market.

Market coupling changes that. Under this system, all buy and sell orders from every power exchange are pooled together and matched centrally, leading to one uniform electricity price, regardless of the platform.

Why IEX opposed it: for the company, market coupling hits its biggest strength. If prices are discovered centrally, traders no longer need to come specifically to IEX. Volumes can shift to smaller exchanges, and IEX risks losing market share without any clear upside.

APTEL has set January 9 as the next hearing date and said the case can be closed immediately if CERC withdraws the order.

Now, the regulator stepping back has given IEX some much-needed breathing room.

What else are we snackin’ 🍿

🚀 Nvidia advances: Nvidia is moving beyond AI chips, unveiling its new Vera Rubin architecture while targeting a robotaxi launch by 2027 to enter autonomous mobility and software-led fleets.

📉 Growth cools: Services activity slowed to an 11-month low of 58 in December, signalling a return to more normal growth after a long expansion run.

🎶 Music bet: Universal Music India acquired a 30% stake in Excel Entertainment at a ₹2,400 crore valuation, securing global distribution rights for future original soundtracks.

₿ Crypto SIP boom: Crypto SIPs in India jumped over 60% as retail investors bet on long-term gains, with Bitcoin, Ethereum, Solana and Ripple leading choices despite small monthly investments.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.