Fortis grows Bengaluru footprint, Kuku FM tunes IPO, and India's core sector grows.

🗓 Morning, folks! ☀️

Markets kicked off the week on a strong footing, closing at the day’s high as buying stayed broad-based across sectors. Sensex & Nifty gained nearly 1% each.

On the sectoral front, IT stocks continued to shine for the fourth straight session. Persistent Systems, Wipro and Infosys rallied over 3% each.

Broader markets joined the party too, with mid- and small-cap names seeing healthy action.

💡 Spotlight: Railway stocks back on track 🚀

Railway stocks rallied sharply on Monday, with Jupiter Wagons jumping nearly 20% and RailTel, IRCTC, rising up to 3%.

The reaction was partly driven by Indian Railways’ fare rationalisation announcement, effective December 26, 2025, which nudges up non-AC fares by ₹10 for journeys up to 500 km, while leaving suburban services and shorter routes untouched.

Moreover, with the union budget around the corner, often a catalyst for rail capex and new projects.

Let’s hit it!

1 Big Thing: Apollo Micro scores big in defense tech race 🇮🇳

Apollo Micro Systems hit 5% upper circuit after securing two key technology transfer approvals from DRDO in the high-tech Directed Energy Weapons (DEW) space.

What’s brewing: the two critical DEW technologies includes a multi-channel 10kW laser system from DRDO’s Hyderabad lab, and an Electro-optical (EO) tracking system from its Dehradun facility.

These systems are like a powerful laser and super-smart eyes used by the army. The laser can shoot and damage enemy drones or targets, while the tracking system spots them, follows them, and helps aim the laser accurately.

Why it matters: Directed-energy weapons use powerful lasers to stop or destroy targets quickly and cheaply, unlike traditional weapons.

Zoom out: the timing is key. The company is already developing anti-drone systems for the Indian Armed Forces under the ‘Make’ category, covering both soft-kill and hard-kill solutions to counter swarm drone threats.

Big theme: India’s laser and directed energy weapons market is the tech behind high-power laser systems and precision tracking gear.

It is part of a fast-growing global defence segment that’s expected to balloon from around $8.6 billion in 2024 to over $32 billion by 2033 at a nearly 15.7% annual rate, showing how militaries are betting big on these systems.

2. Varun Beverages enters South Africa soft drink market🥤

Varun Beverages is acquiring a 100% stake in South Africa-based Twizza Proprietary for ₹1,118.7 crore. The stock gained more than 2% on the back of the news.

VBL is one of the world’s largest PepsiCo bottlers, with a growing footprint across India, Africa and the Middle East.

Twizza makes and sells its own branded non-alcoholic beverages, with a strong local presence in South Africa.

What’s going on: this gives Varun access to homegrown South African brands that already have local acceptance, reducing dependence on only multinational labels.

Zoom out: like India, South Africa has a price-sensitive consumer base and strong demand for affordable, flavoured soft drinks.

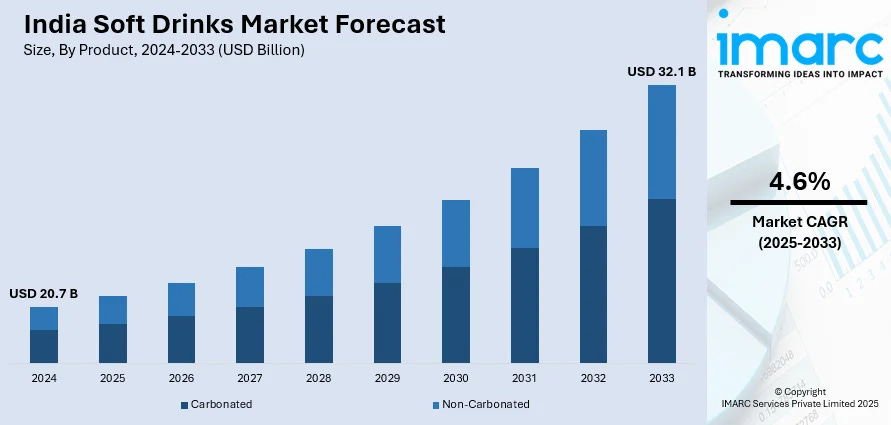

India’s soft drinks market is entering a steady growth phase, with industry estimates showing the market expanding from $20.7 billion in 2024 to around $32.1 billion by 2033, implying a 4.6% growth between 2025 and 2033.

While we are on acquisitions,

Tata Chemicals’ arm Tata Chemicals International Pte has agreed to acquire 100% ownership of Singapore-based Novabay, bringing a leading premium manufacturer into its global fold.

Novabay stands out as one of the largest producers of high-quality sodium bicarbonate in the Asia-Pacific region, catering to pharmaceutical, personal care, and food applications.

What’s brewing: this acquisition fits squarely with Tata Chemicals’ strategy to deepen its focus on premium-grade products and expand its footprint in high-value, non-cyclical segments.

The deal is also expected to sharpen TCL’s ability to meet demanding customer needs, strengthen its premium portfolio, and accelerate sustainable long-term growth.

More on acquisitions,

Fortis Healthcare has inked a pact to acquire Bengaluru-based People Tree Hospital for ₹430 crore.

People Tree Hospital in North-West Bengaluru, offers cardiac sciences, orthopaedics, neurosciences, renal sciences, gastroenterology, and enjoys strong connectivity in a growing area.

What’s happening: IHL will also buy the hospital building and land from TMI Healthcare’s promoters, plus a nearby 0.8-acre plot from another owner. This extra land lets them expand the hospital to over 300 beds.

3. Kuku FM lines up ₹3,000 cr IPO 💸

Kuku FM is eyeing a ₹3,000 crore IPO and has roped in Kotak, Jefferies, JM Financial, and Axis Capital to steer the fundraising.

Kuku FM is an audio app where people listen to podcasts, stories, and shows in Indian languages. It earns through subscription fees from both individuals and enterprises, and today boasts over 10 million subscribers.

The plan: the company aims to file its IPO papers in the January-March quarter and is aiming to list on the stock exchanges by mid-2026.

The timing: new-age companies like Groww, Meesho, Lenskart, and Urban Company have delivered strong stock-market debuts, boosting confidence in startup listings. Moreover, the IPO plan comes at a time when there is a strong traction as demand for bite-sized audio and video content rises.

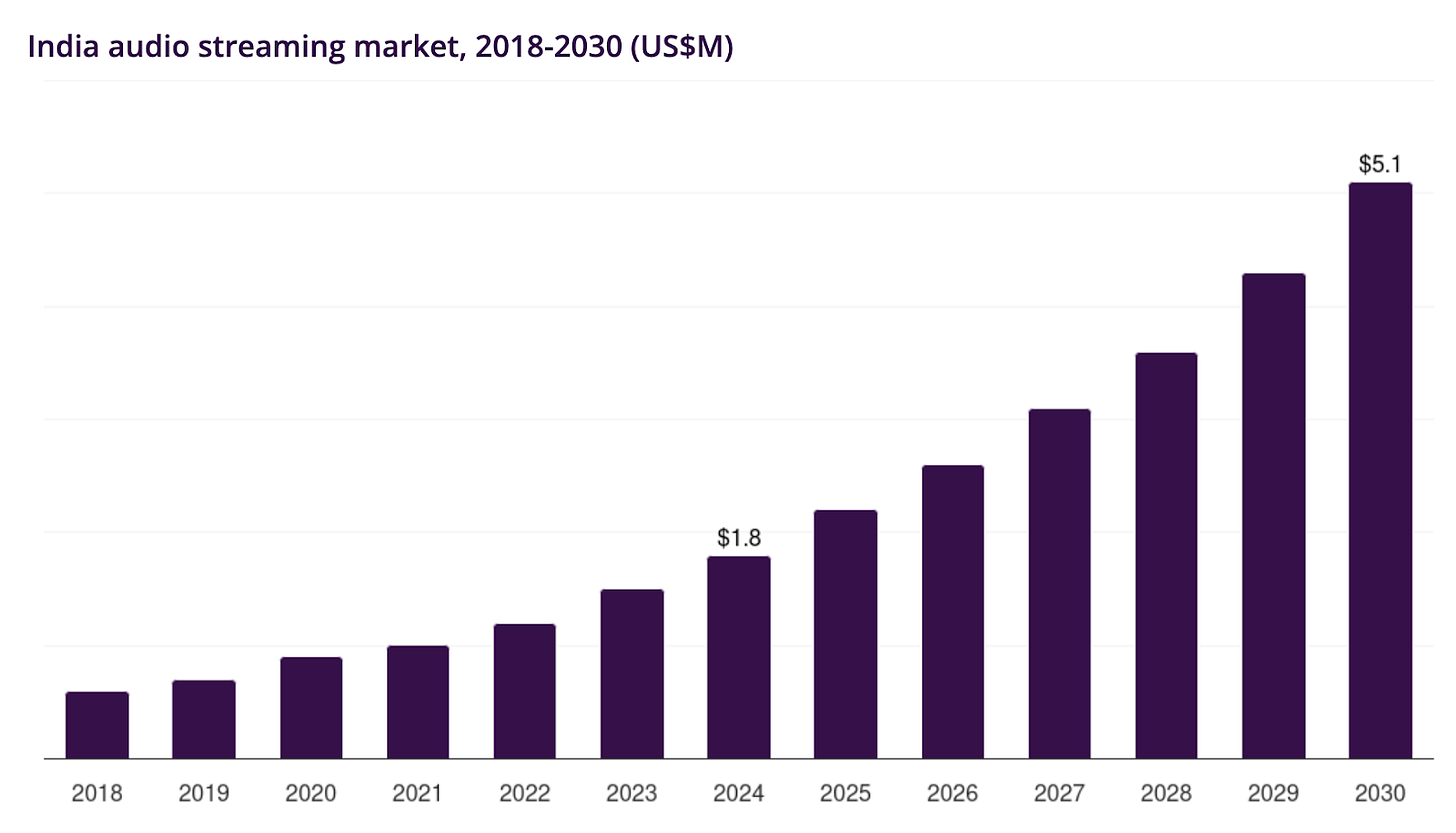

Zoom out: India’s audio streaming market is also on a growth spurt, rising 18.6%, driven by higher mobile adoption, rising demand for on-demand content, and growing interest in regional formats, placing Kuku FM in a strong position to benefit.

4. Stocks that kept us interested 🚀

1. Sunshine payday for Dilip Buildcon ☀️

Shares of Dilip Buildcon jumped 3.4% after the company scored a big win, it’s now the lowest bidder for a massive solar project awarded by the Madhya Pradesh Urja Vikas Nigam.

So, what’s the project all about: it’s set to install 1,363.5 MW (AC) of grid-connected solar power under the government’s PM KUSUM-C scheme.

To give you an idea of the scale, this is one of the largest renewable energy contracts ever in Madhya Pradesh, giving a huge boost to the state’s clean energy goals.

Why does this matter for people like us: the PM KUSUM-C feeder solarisation programme is designed to cut power losses and help electricity distribution companies stay financially healthy.

How? By replacing the old agricultural power supply with decentralised solar generation, basically, producing solar power closer to where it’s used instead of losing electricity along long transmission lines.

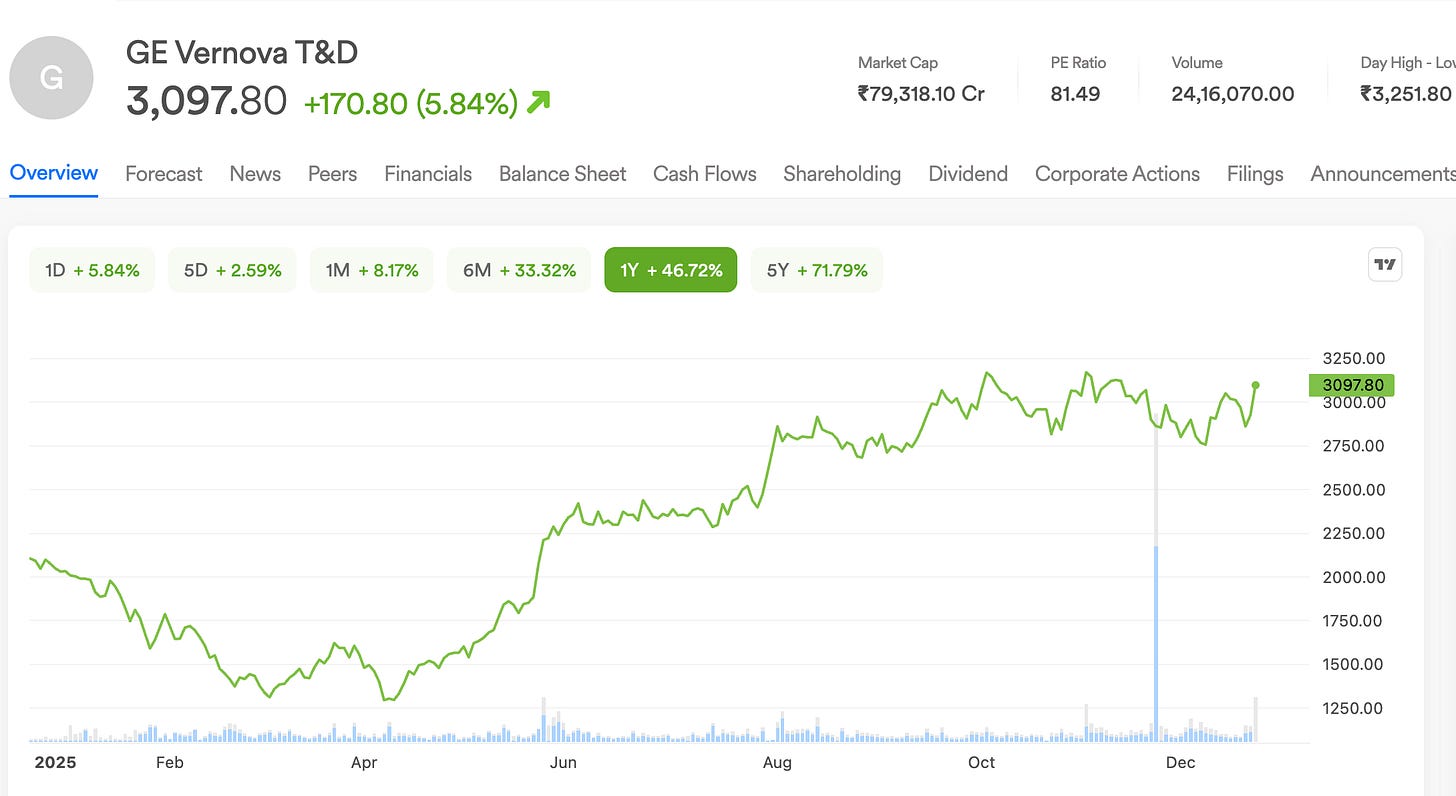

2. GE Vernova T&D jumps on power station order win 💡

GE Vernova’s shares gained 3% after the company secured a new contract from AESL Projects, a subsidiary of Adani Energy Solutions.

GE Vernova is a global energy technology company with capabilities across Power, Wind, and Electrification.

The deets: the company has won a contract to build a large power station that can move a huge amount of electricity. It will be able to handle 2,500 MW of power, split into two equal parts, using high-voltage direct current technology.

Once completed, this station will help carry renewable energy generated at Khavda to South Olpad, making it easier to supply clean power to that region.

The importance: Khavda in Gujarat is developing into one of the world’s largest solar and wind parks, capable of producing enough power for millions of homes.

Since it’s in a remote desert, the energy must be moved to high-demand areas. South Olpad acts as the key link, helping deliver this clean power to major cities and industrial hubs where it’s needed most.

What else are we snackin’ 🍿

⬆️ Growth rebound: India’s eight core sectors grew 1.8% in November 2025, driven by higher cement, steel, fertiliser, and coal production.

🤝 FTA finalised: India and New Zealand have concluded negotiations on a free trade agreement, strengthening economic ties after nine months of talks.

🥃 Whisky expansion: Triveni Engineering shares rose 3% after the company entered Delhi’s IMFL market with a premium whisky launch, boosting its presence in the high-end segment.

📊 Waffle stake: Vixar has acquired 45% of Belgian Waffle Co, valuing the dessert chain at ₹1,700 crore, alongside investors Vallabh Bhansali and HDFC AMC.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.