Precious metal prices fall, a day of earnings, and Marico's bet on plant protein.

🗓️ Morning, folks and Happy Fridayyyy! ☀️

Indian markets hit the brakes on Thursday.

The Sensex and Nifty fell more than 0.5%, ending a three-day winning streak as global cues and a sell-off in metal stocks dragged sentiment down.

The big hitters were in a bad mood, and IT stocks joined the slide.

Smaller stocks managed to hold up a little better, but the main indices still looked heavy, with sellers popping up across most sectors.

💡 Spotlight: Gold & silver on a roller coaster ↘️

Precious metal prices fell again after two days of gains.

Silver led the slide, dragging down futures and ETFs. After hitting record highs over the past year, prices fell hard on Friday and Monday, then inched up on Tuesday but stayed well below their peaks.

Why it dropped: analysts point to several reasons. Trump’s pick of Kevin Warsh as Fed chief reassured markets, easing fears of aggressive rate cuts. Investors grew more confident about inflation control, reducing demand for safe-haven assets like gold and silver.

Besides, Trump’s comments on a possible Iran deal also lowered geopolitical tensions, further weakening safe-haven demand. A stronger US dollar added pressure.

Let’s hit it!

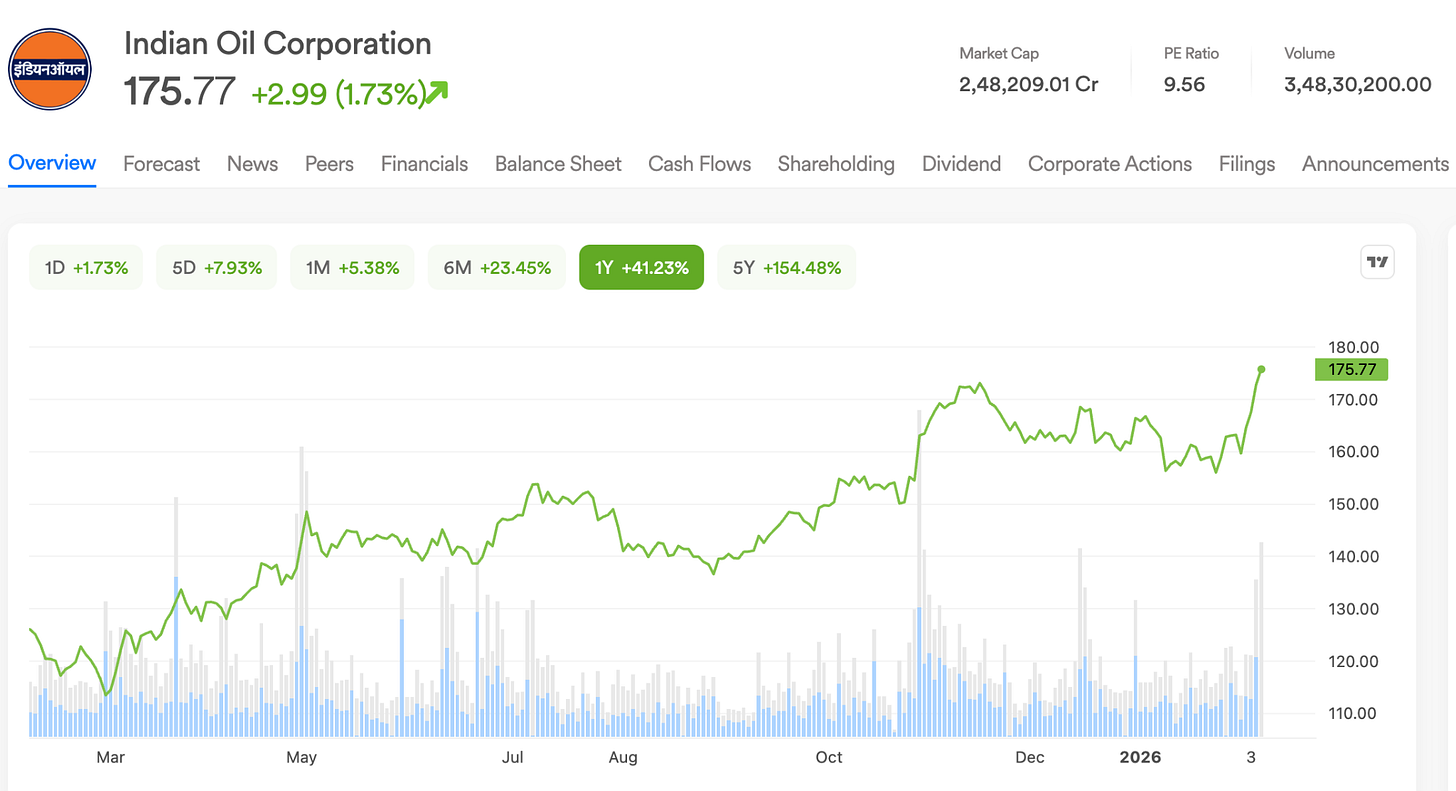

1 Big thing: IOC delivers in Q3 🛢️

Indian Oil Corporation (IOC) delivered a comeback quarter, its shares climbed after Q3 profits and revenue jumped from the previous quarter.

By the numbers:

- Net profit: up 59.3% QoQ at ₹12,126 cr vs ₹7,610.5 cr

- Revenue: up 14.3% QoQ at ₹2.04 lk cr vs ₹1.78 lk cr

- What helped: oil got cheaper, and people used more fuel.

Crude oil is the main raw material for refiners like IOC, and Brent crude prices fell over 9% in the October-December quarter.

When crude becomes cheaper, companies like IOC often make better profits on every litre they sell. At the same time, demand stayed strong. India’s fuel use hit a record high in December after already rising in November.

Government data from Petroleum Planning and Analysis Cell (PPAC) showed fuel consumption grew 5.5% in November and 5.3% in December compared to last year, after a small dip in October.

So basically, cheaper crude and stronger fuel demand powered a strong quarter for IOC, and the stock cheered.

2. PVR INOX Q3 profit surges 166% 🥵

PVR INOX reported a blockbuster quarter, and the numbers back it up.

The key numbers:

- Net profit: at ₹95.7 cr vs ₹36 cr YoY

- Revenue: up 9.4% YoY at ₹1,879 cr vs ₹1,717 cr

What drove it: more people showed up because the movie line-up was stronger and more consistent, with a few big releases drawing large crowds.

One of the biggest drivers was Dhurandhar, which the company says has become the highest-earning Hindi film ever after crossing ₹1,000 crore at the box office.

And this is not just a one-quarter spike. PVR INOX said 2025 was its best year yet, with total box office collections of ₹13,395 crore, about 32% higher than before the pandemic.

More on earnings 💰,

FSN E-Commerce Ventures, the parent company of Nykaa, reported a sharp jump in profit for the quarter.

Net profit surged 157% to ₹68 crore, up from ₹26.41 crore in the same period last year.

Sales also picked up nicely. Revenue from core operations also rose 27% YoY to ₹2,873 crore.

What’s driving the momentum: Nykaa says demand stayed strong, especially for skincare and makeup, which helped power the quarter’s growth.

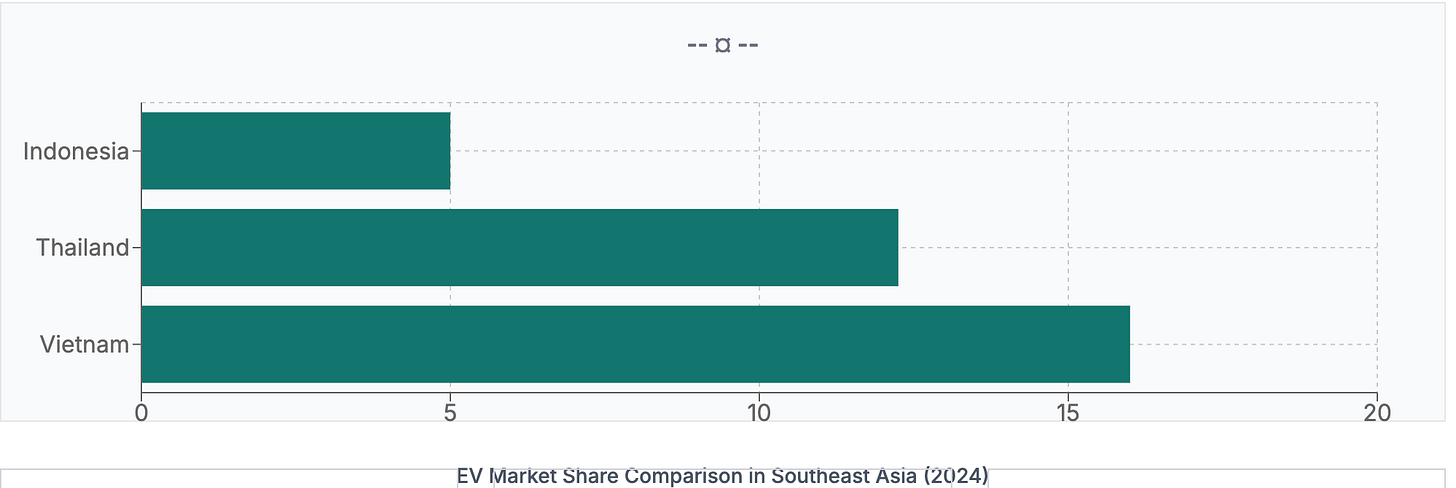

3. Ashok Leyland takes EVs to Indonesia 🇮🇩

Indonesia wants cleaner buses and stronger defence vehicles, and Ashok Leyland is stepping in to help build both.

What’s going on: the company has signed a pact with PT Pindad, Indonesia’s state-owned defence and industrial equipment maker, to jointly develop electric buses and defence vehicles.

PT Pindad is known for making military vehicles, weapons, ammunition, and heavy-duty industrial equipment, and it plays a key role in Indonesia’s defence ecosystem.

The idea: Ashok Leyland brings its global experience in electric commercial vehicles and defence mobility platforms. PT Pindad brings strong engineering skills, local manufacturing capability, and a deep understanding of what Indonesia needs on the ground.

Why now: Indonesia is pushing for energy-efficient transport, faster EV adoption, and modern defence upgrades.

This partnership supports that push by helping build cleaner tech locally. The target is to electrify 90% of urban mass transport by 2030 and go fully electric by 2040.

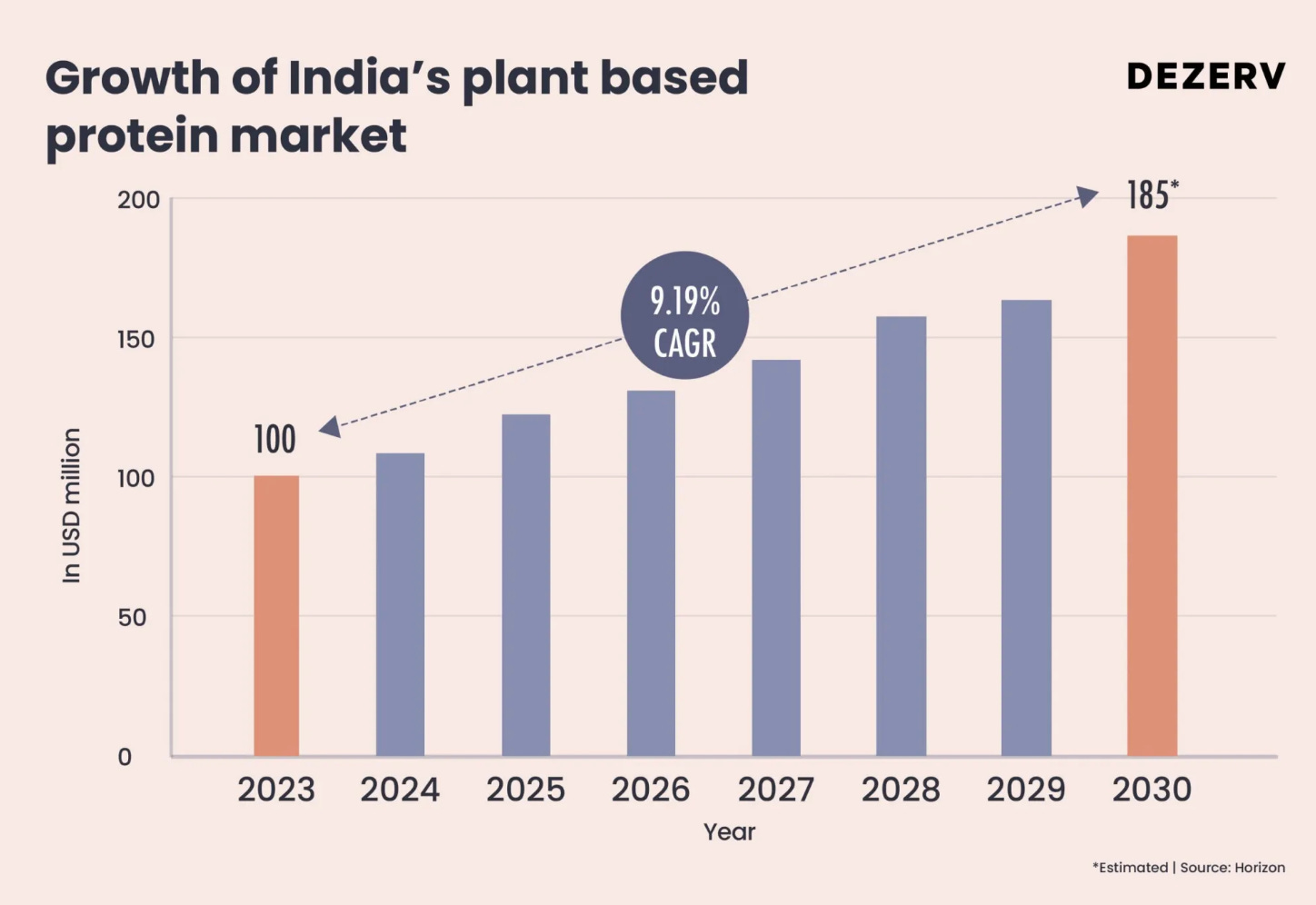

4. Marico bets big on plant protein 🍀

Marico is acquiring a 60% majority stake in Cosmix Wellness for ₹375 crore.

Founded in 2019, Cosmix is a wellness brand best known for its plant-based protein and nutrition products, sold mainly through its own website and popular online marketplaces.

Big theme: Marico has been actively acquiring and scaling D2C brands over the past few years. It bought men’s grooming brand Beardo in 2017 and has since built a D2C portfolio that includes Plix, True Elements and Just Herbs.

The Cosmix deal gives Marico a strong foothold in the fast-growing plant-based protein segment.

Why this niche: plant-based protein is emerging as a high-growth, high-potential category as consumers increasingly look beyond whey. The segment is projected to reach $184.9 million by 2030, growing at a robust 9.3% annually.

The segment is also getting strong support from the government as clearer regulations are making it easier for brands to scale.

While we are on clean-eating, 🥗

Clean-label health food brand The Whole Truth has raised $51 million in a Series D finding round.

Per an ET report, this funding marks the start of the company’s IPO journey, with profitability set as the next major milestone.

Why this matters: demand for clean-label and healthy eating options in India is booming, driven by rising lifestyle diseases, greater influence of fitness creators, and the rapid surge in quick-commerce platforms.

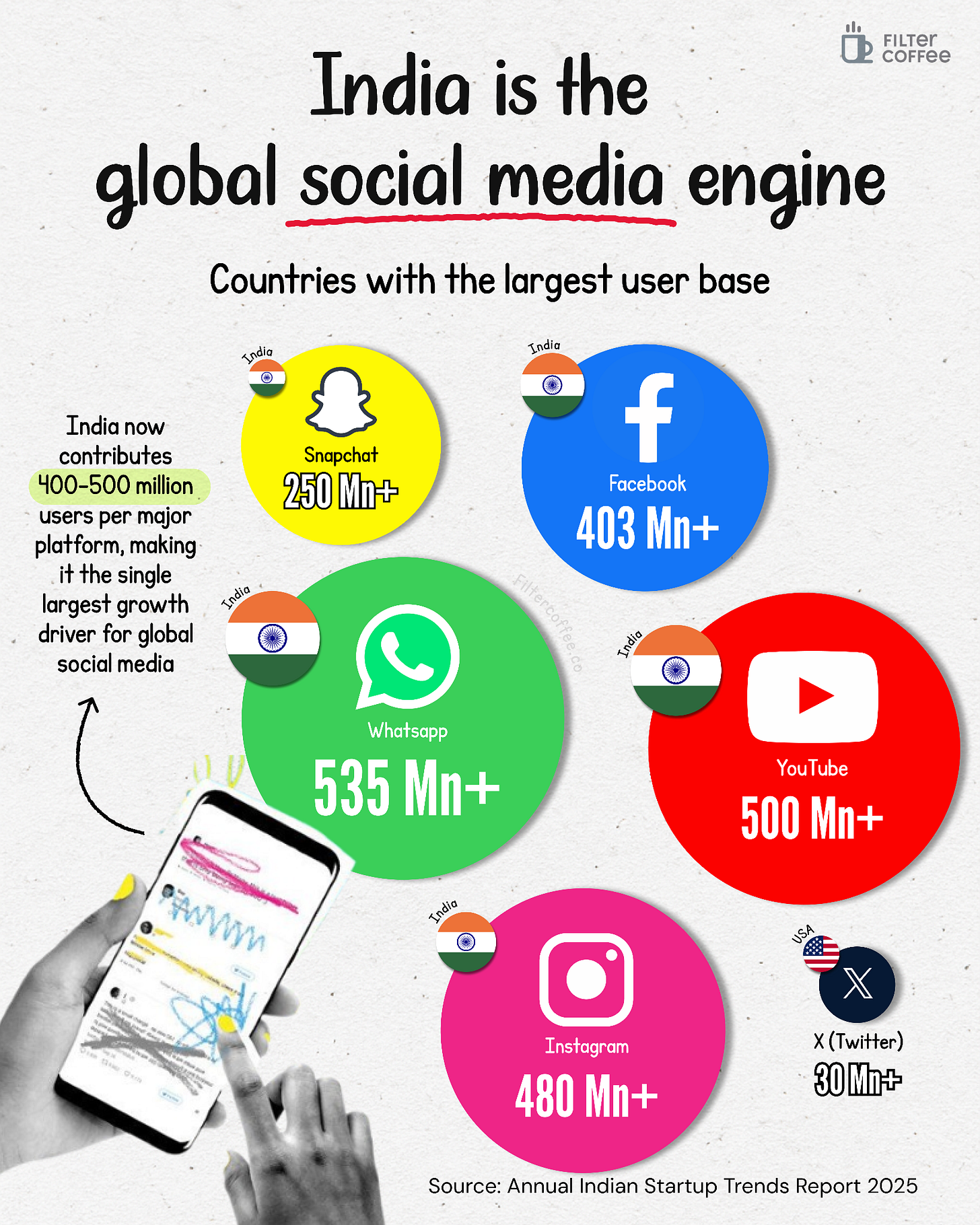

5. India is obsessed with social media 🧐

WhatsApp, YouTube, Instagram, Facebook, and Snapchat all have their biggest user bases here, which means what Indians watch, share, and scroll through can shape features, trends, and growth plans worldwide.

India isn’t just online, it’s where social media really comes alive. When you have 400 to 500 million people using each major app, platforms stop treating India like ‘one of the markets’ and start building around it.

6. Stock that kept us interested 🚀

1. Swan Defence scores big Oman export order 📈

Swan Defence and Heavy Industries landed a defence export order from Oman to build them a next-gen naval training ship.

Stock action: the stock has surged over 3,000% over the past year, driven by a steady stream of order wins and updates.

Think of it like a floating training campus, classrooms, training offices, accommodation, and even an auditorium for up to 70 officer cadets. It’ll also have advanced navigation and communication systems, plus the ability to support helicopter operations.

Big win for India too, it backs our homegrown shipbuilding and adds more weight to India-Oman defence ties.

What else are we snackin’ 🍿

🚕 New ride: the Bharat Taxi app has been launched as a zero-commission, driver-led alternative to big ride-hailing platforms, promising fair pricing through a cooperative model.

⚙️ Electronics push: the government is likely to clear 5-7 proposals worth about ₹11,000 crore under the Electronics Component Manufacturing Scheme.

📰 Pink slips: the Washington Post laid off around 300 employees, with deep cuts hitting foreign bureaus, local reporting, sports, and business teams.

📄 IPO filed: MSME-focused NBFC Aye Finance filed its ₹1,010 crore IPO with a ₹710 crore fresh issue and ₹300 crore OFS.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.