Acquisitions fire up, Jio-Kinetic join hands for EVs, and Paytm eyes global expansion.

🗓 Morning, folks! ☀️

Indian markets seesawed on Tuesday and ended almost flat. Sensex slipped, while the Nifty barely stayed in green.

IT, healthcare, PSU banks and realty dragged, falling up to 1%. Media led the gainers list with a 0.8% rise, while metals, PSU stocks and energy posted modest gains.

Selling pressure stayed broad, with financials and FMCG offering limited support. Investors now turn to earnings and Fed rate-cut expectations.

💡 Spotlight: Gold & Silver hit fresh records 🔥

Gold and silver prices jumped over 1% on Tuesday morning, smashing past record levels on MCX. With fresh geopolitical tensions and a softer dollar, investors rushed back to precious metals.

Rising US-Venezuela tensions have added a new layer of uncertainty, boosting demand for safe assets.

- Gold (MCX Feb) hit an all-time high of ₹1,38,381 per 10g

- Silver (MCX) touched a record ₹2,16,596 per kg

- The dollar index slipped 0.20%, making gold cheaper for global buyers

Let’s hit it!

1 Big Thing: Acquisition fever grips the market 🚀

HCLTech’s software business division, HCLSoftware, is all set to acquire Wobby, an early-stage AI startup based in Belgium.

What’s driving this move: demand is rising for data and AI solutions at the company’s AI division, Actian.

Adding agentic AI data analyst capabilities would take this a step further, allowing customers to interact directly with raw data and generate fast, accurate business insights on demand.

Worth noting: HCLTech has announced nearly $400 million in acquisitions over the past week, its biggest deal spree in three years.

Why Wobby fits: unlike traditional business intelligence tools, Wobby is being built to spot patterns and share useful insights on its own, helping teams make decisions faster.

By combining Wobby’s AI with Actian’s platform, HCLTech can help customers manage data more easily and make faster, better decisions.

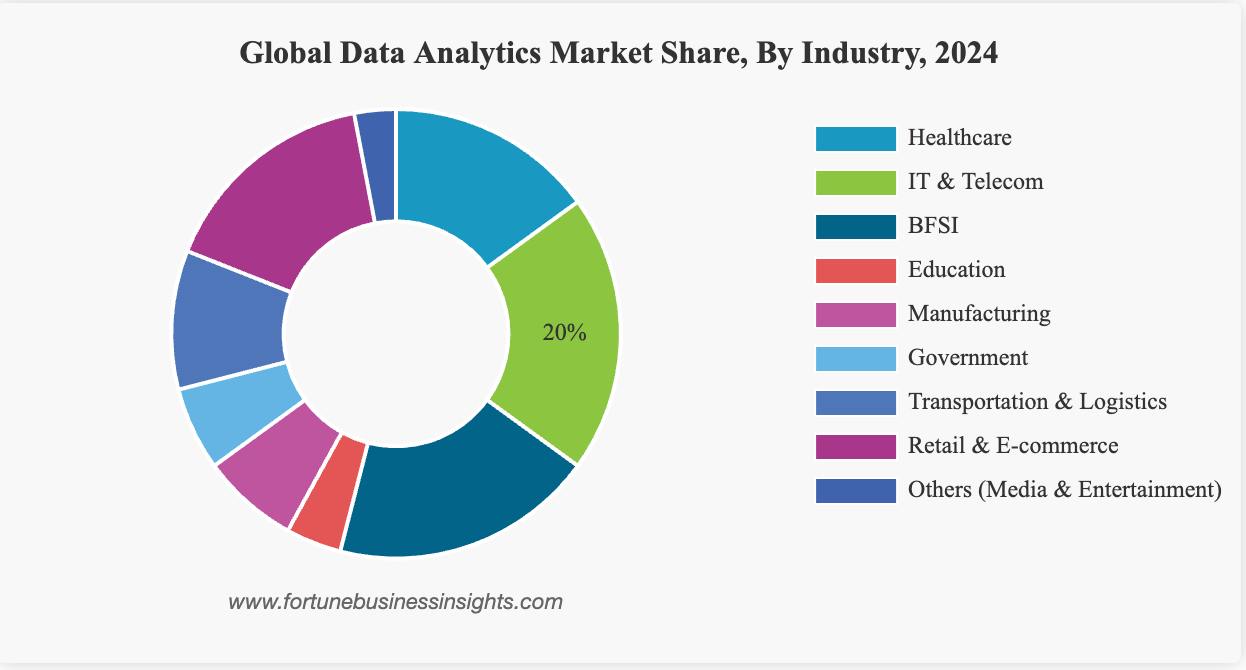

Zoom out: enterprises are racing to turn data into faster, everyday decisions. The global data analytics market is expected to grow from about $82 billion in 2025 to over $400 billion by 2032.

Staying with acquisitions 💰,

Samvardhana Motherson International has approved the acquisition of the automotive wiring business of Nexans autoelectric GmbH and Elektrokontact GmbH in a deal worth approximately $242.2 million.

FYI: the acquisition will be carried out through Motherson’s indirect wholly owned subsidiary.

Nexans autoelectric and Elektrokontact design and manufacture wiring systems, electrical parts, and connectivity solutions that are used by global vehicle makers.

The why: this acquisition will strengthen Motherson’s global wiring harness business across both PVs & CVs.

More on deals and acquisitions 💸,

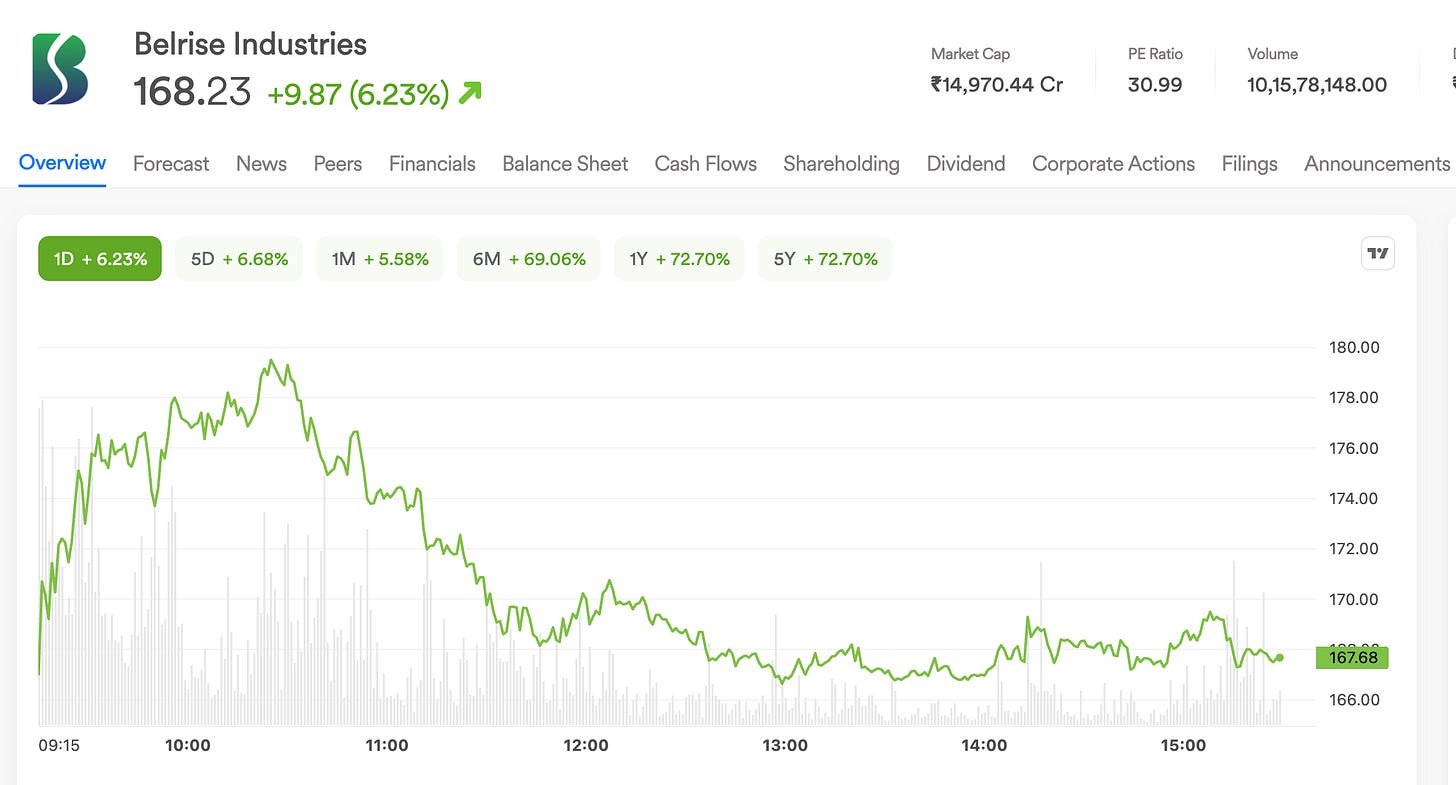

Belrise Industries signed a three-year partnership with Israel’s Plasan Sasa to tap into India’s defence market. Shares of the company hit over 6% in Tuesday’s trade.

Plasan Sasa is known globally for its armour and protection systems used in military vehicles and by soldiers in active combat zones.

Now, the two companies will work together to adapt Plasan’s All-Terrain Electric Mission Module (ATEMM) for Indian defence forces. Think of ATEMM as a rugged, electric, go-anywhere platform designed to carry heavy loads more efficiently on tough terrain.

Plasan will bring its defence and vehicle-protection expertise, while Belrise will handle manufacturing and local execution

2. Aurobindo Pharma expands China play 🇨🇳

Aurobindo Pharma’s wholly-owned subsidiary, Helix Healthcare B.V., has signed an agreement to buy an additional 20% stake in Luoxin Aurovitas Pharma for $5.12 million.

What’s driving the move: Aurobindo is looking to deepen its presence in the Chinese pharmaceutical market while scaling up manufacturing.

Luoxin Aurovitas, incorporated in March 2019, focuses on making inhalation products specifically for China, a segment seeing steady demand growth.

Quick background: Aurobindo already operates in China through Luoxin Aurovitas, a joint venture with Luoxin Pharmaceuticals. The JV manufactures and sells generic medicines in China, one of the world’s largest, and toughest, pharma markets to crack.

Once the acquisition is complete, Aurobindo plans to expand capacity by adding two high-speed production lines, positioning the business to meet rising demand.

3. Kinetic, Jio team up to make smart EV scooters ⚡

Kinetic Watts & Volts has entered into a tech partnership with Jio Things, subsidiary of Jio Platforms for next-generation connected electric two-wheelers.

In simple words, the two companies are working together to make electric scooters smarter and easier to use.

Kinetic Watts & Volts, part of Kinetic Engineering, is building India-focused EV scooters. Jio Things brings IoT ecosystem spanning devices, connectivity, cloud, and remote management.

The deets: Jio’s technology will be built into all new Kinetic electric scooters. This will give them voice commands, smart displays, and real-time connected features.

This makes Kinetic one of the first Indian EV companies to add voice controls to affordable electric scooters. Until now, such smart features were mostly seen only in expensive models.

Why it matters: the partnership matters because it shows where electric scooters are headed next, not just cheaper batteries, but smarter, connected rides for everyday people.

Big theme: globally, the connected EV segment is estimated at around $15-20 billion in 2024 and is expected to cross $50-60 billion by 2030, growing at a 15–18% annual rate.

4. ArcelorMittal’s $900 million clean energy bet ☀️

ArcelorMittal is planning to invest around $900 million to develop three renewable energy projects in India, with a combined capacity of 1 gigawatt (GW).

What they do: ArcelorMittal is a global leader in steel and mining, producing steel from iron ore and coal for various industries like automotive, construction, and appliances.

The deets: the investment spans three renewable energy projects across India. This includes:

- a 36 MW solar power plant in Amravati

- a 400 MW solar plant with 500 MWh of battery storage in Bikaner, and

- a wind-solar project in Bachau, Gujarat combining 250 MW of wind, 300 MW of solar, and 300 MWh of battery storage.

The why: the clean electricity from these projects will be used by ArcelorMittal Nippon Steel India, ArcelorMittal’s steelmaking joint venture with Nippon Steel, which operates a major steel plant in Hazira, Gujarat.

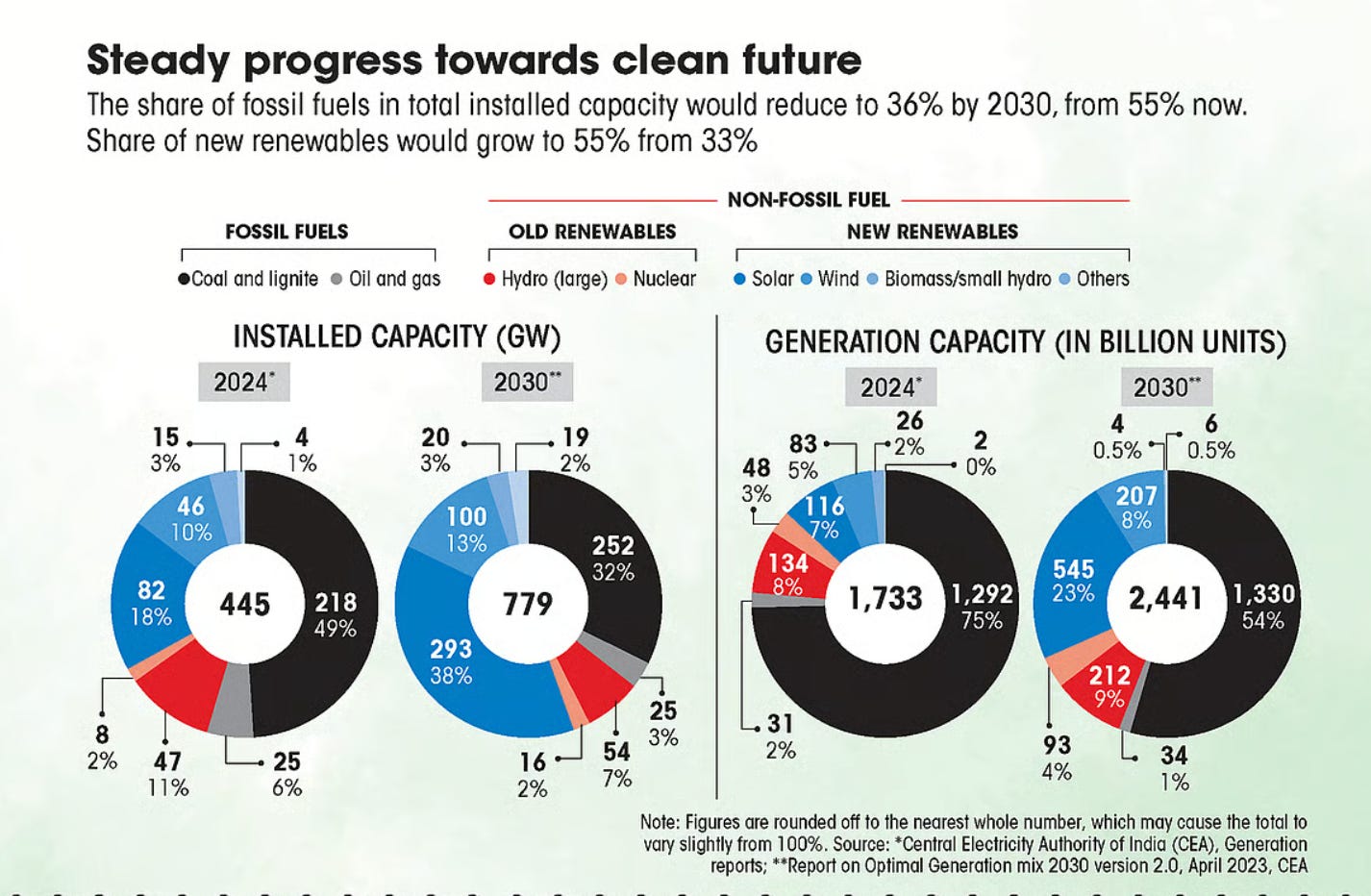

In the long-term: India’s power mix is steadily shifting cleaner, with fossil fuels falling from 55% today to 36% by 2030, while new renewables rise from 33% to 55% of installed capacity.

5. Stock that kept us interested 🚀

1. RITES wins South Africa loco order worth $35.2 million 🚆

RITES shares jumped up to 4% after the company bagged an international order from South Africa for $35.2 million.

The deets: RITES will provide new diesel-electric trains and make sure they are ready to run. It will also handle the cost, insurance, and shipping of the trains until they reach South Africa.

What’s going on: this order strengthens South Africa’s freight rail sector. Reliable locomotives ensure goods like food, fuel, minerals and construction material move on time, keeping factories running and shop shelves stocked.

For citizens, that efficiency shows up in lower transport costs, less pressure on roads, and fewer truck-related delays and accidents.

What else are we snackin’ 🍿

🌍 Paytm expansion: Paytm will set up overseas subsidiaries in Indonesia and Luxembourg, while Abbar Global SPV acquires a 49% stake in its UAE unit, as part of its global push.

⚡AI power deal: Alphabet will acquire Intersect Power for $4.75 billion, expanding clean energy capacity to support its AI-driven data centers.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.