India's aerospace push, legaltech startup gets funding, and banana boom at home.

🗓️ Morning, folks! ☀️

Markets pulled off a neat comeback after a choppy start on Tuesday.

Sensex and Nifty gained up to 0.5% higher, shaking off intraday volatility as buying returned to banks, metals, and a few heavyweight names.

💡 Spotlight: Gold goes full safe-haven mode 🪙

Global gold is on a tear, racing past $5,100 an ounce, and India is feeling the heat too, with local rates hovering near record highs.

The move comes as investors worldwide rush to safe assets amid rising geopolitical and trade tensions. The latest trigger came from fresh trade tensions, after Donald Trump threatened a 100% tariff on Canada over a potential China trade deal.

Let’s hit it!

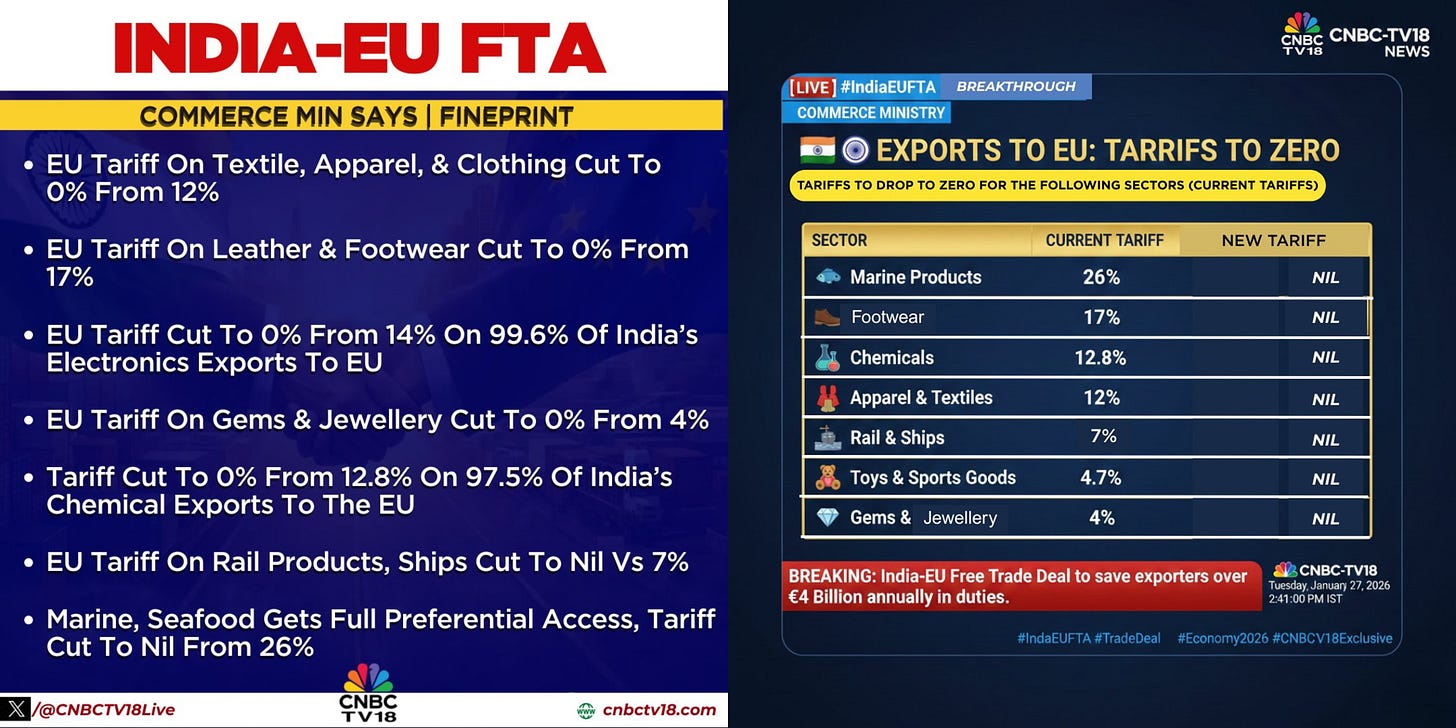

1 Big thing: India-EU delivers ‘Mother of all deals’ 💪🏻

India and the European Union have finally shaken hands on a free trade agreement, ending an 18-year negotiation marathon that began in 2007.

Why it matters: with global trade getting messy and the US turning more protectionist, India is looking to widen its export lanes. A pact with the EU links two heavyweight economies and can open a much bigger runway for Indian businesses.

What changes for you: some European imports could get cheaper.

The EU says tariffs on 96.6% of its goods exports to India will be cut or removed, translating into up to €4 billion a year in duty savings.

That covers everything from processed foods and fruit juices to olive oil, machinery, medical equipment, chemicals, pharmaceuticals, and even aircraft.

Duties on spirits are expected to drop to 40%, while cars and wines get concessional access.

What India gets: easier entry into the EU’s 27-country market. Most Indian goods are expected to get zero-duty access, with a few exceptions like autos and steel. Labour-heavy sectors like apparel, footwear, and chemicals could be the big winners.

Plus, this isn’t just about trade, both sides also signed a strategic defence partnership pact and a mobility agreement, signalling a broader India-EU reset.

2. Waaree’s power transmission bet 🔌

Waaree Renewable Technologies is set to acquire a 55% stake in power transmission EPC firm Associated Power Structures for ₹1,225 crore.

Associated Power, based in Vadodara, designs and builds power transmission towers and substations.

The deets: the deal includes a mix of primary and secondary capital. Around 25% of the money will go directly into Associated Power, while the rest buys out existing shareholders.

The company operates two plants in Vadodara with 108,000 mtpa manufacturing capacity.

Why it matters: Waaree is moving beyond just solar plants and into the power transmission side of the energy business. Making solar power is one thing. Moving that power to the grid is another. This deal helps Waaree control both.

3. India’s aerospace MRO gets a boost ✈️

Axiscades Technologies has partnered with Portugal’s OGMA, which is part of Embraer.

Quick context: OGMA is a well-known name in aircraft maintenance and engineering within the Embraer ecosystem.

Embraer is a Brazilian aircraft manufacturing company.

Breaking it down: the tie-up will help expand aircraft manufacturing and maintenance work in India and other global markets. A key focus is supporting Embraer and other OEM aircraft fleets in India.

OGMA will bring its expertise in aircraft maintenance, certifications, and experience with Embraer aircraft, while Axiscades Technologies will handle engineering work and on-ground execution in India and nearby regions.

Why it matters: the partnership brings advanced aircraft maintenance and repair work into the country instead of sending planes abroad. That means lower costs & faster turnaround.

While we are on partnerships, 🤝

Adani Group and Brazilian aircraft maker Embraer have announced a partnership to set up a regional aircraft manufacturing facility in India.

India is one of the world’s fastest-growing aviation markets, with rising demand for flights to Tier 2 and Tier 3 cities. Embraer specialises in regional jets with up to 150 seats.

The deets: the regional transport aircraft will include setting up a Final Assembly Line (FAL) in India.

Why it matters: India is now just not flying planes, it’s actually building them. This helps in cutting imports and strengthening the local aviation ecosystem. It also supports better regional connectivity and creates high-skilled manufacturing jobs.

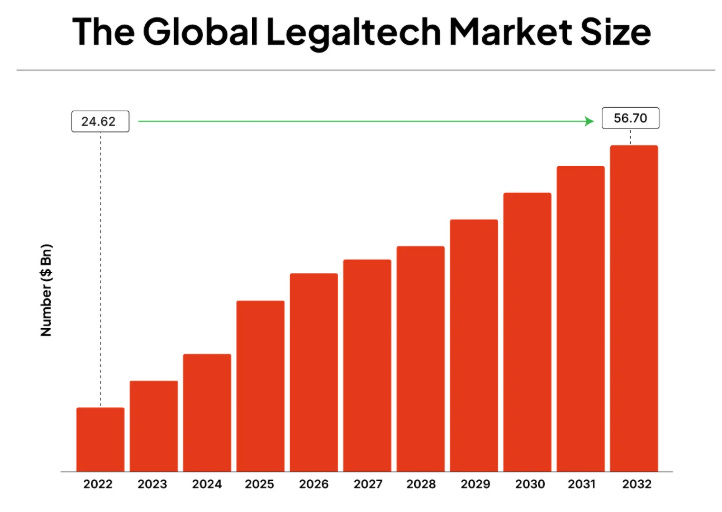

4. Legal-tech SpotDraft grabs fresh cash 💰

SpotDraft has bagged $8 million from Qualcomm Ventures, topping up its war chest nearly a year after its $54 million Series B raise in February 2025.

SpotDraft is a legal-tech startup that uses AI to help companies create, review, and manage contracts securely, keeping sensitive legal data private.

SpotDraft’s pitch is straightforward: it uses AI to help companies handle contracts faster, while keeping sensitive documents safer. Instead of sending legal files to outside cloud AI systems, it’s built to process them on the user’s device, reducing the risk of leaks.

That matters because while businesses are eager to use GenAI, legal teams are often cautious. Contracts are packed with confidential details like pricing, deal terms, and proprietary business information.

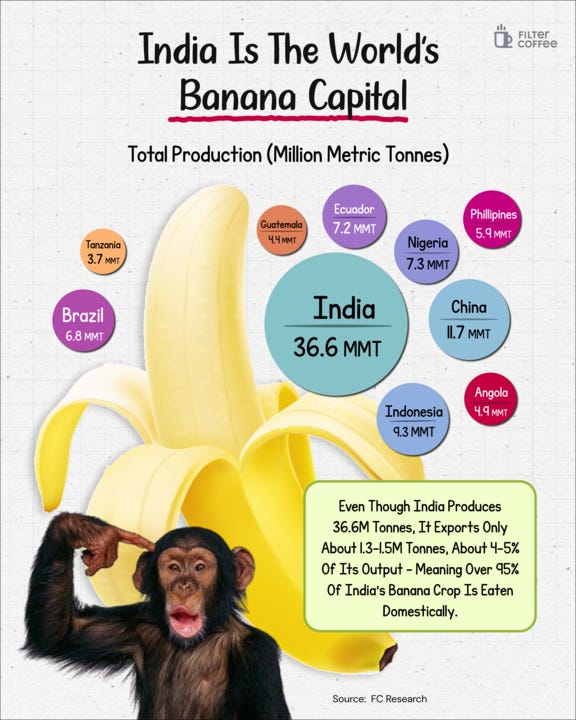

5. India’s bananas don’t leave home 🍌

India is the world’s largest producer of bananas, with an annual output of 36.6 million metric tonnes, giving it a clear lead over every other country globally.

This places India far ahead of producers like China, Indonesia, and Brazil in overall banana production.

But here’s the twist: despite this massive output, India exports only about 1.3-1.5 million tonnes, roughly 4-5% of its production.

That means over 95% of India’s bananas are consumed domestically, making it a story of scale driven almost entirely by local demand rather than exports.

6. Stock that kept us interested 🚀

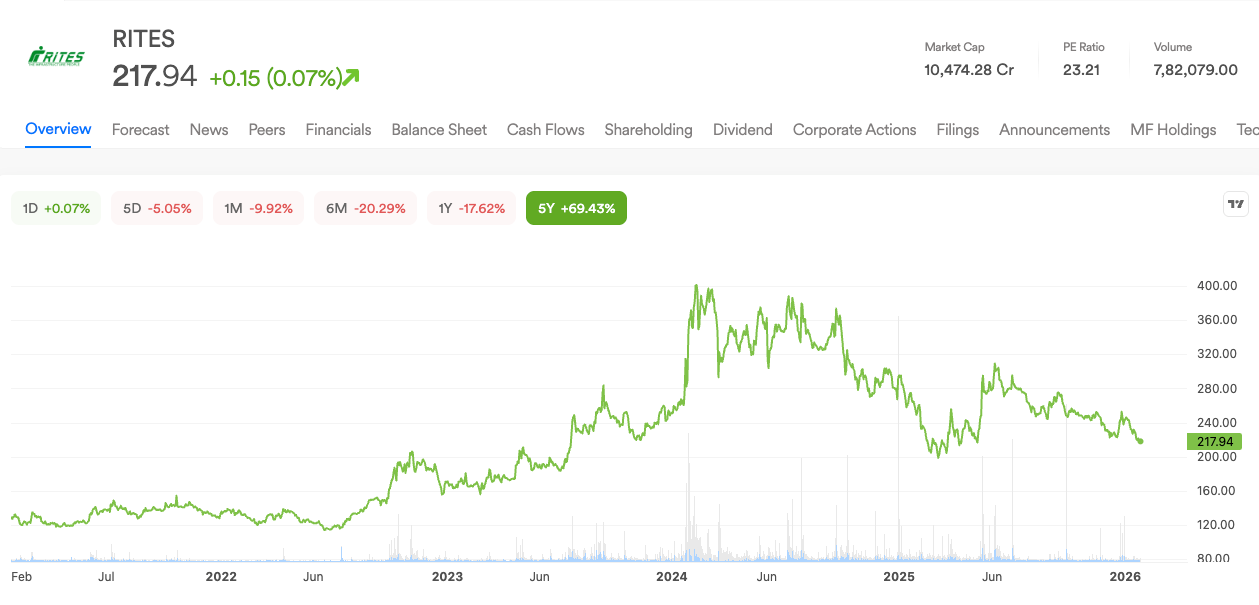

1. RITES bags ₹171 crore locomotive order in Mozambique 🚆

RITES bagged a major overseas order from International Coal Ventures Limited (ICVL) Mozambique for supplying and maintaining diesel electric locomotives. The deal is valued at $20.6 million, or about ₹171 crore.

What’s the deal: supply new diesel trains and keep them running smoothly with regular servicing and spare parts.

RITES will design and source the locomotives through its network of Indian rail manufacturers and suppliers. The trains will be built to suit Mozambique’s rail tracks and operating conditions.

What else are we snackin’ 🍿

💳 Infra tie-up: Pine Labs partnered with UAE-based Wio Bank to power its tech infrastructure, strengthening its presence across the Middle East and other global markets.

⚡ IPO filed: transformer maker Kanohar Electricals filed IPO papers with a ₹300 crore fresh issue, while promoter K Sons Family Trust plans to sell up to 1.45 crore shares via OFS.

🛢️ Green oils: HPCL and Castrol India teamed up to build a re-refined base oil ecosystem, exploring used-oil collection, re-refining capacity, and cleaner lubricant solutions.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.