Copper bet, space intel, and a cancer drug lands in India.

🗓️ Morning, folks! ☀️

Indian stocks kept the good vibes going, ending higher for the third session in a row on Tuesday.

The Sensex and Nifty both finished in the green, helped by upbeat global cues. On the sector front, Metal and Auto stocks led the charge, while healthcare and pharma dragged.

Among Nifty 50 movers, Eternal and Tata Steel were the star performers, while HCLTech and Bajaj Finance ended lower.

💡Spotlight: India’s AI model goes global 🌍

Sarvam AI is reportedly making waves globally with Sarvam Vision and Bulbul V3, claiming strong results against big names like ChatGPT and Google Gemini in select tests.

Sarvam Vision focuses on OCR, meaning it ‘reads’ text from images and documents like scanned PDFs, forms, and invoices.

It reportedly beat several rivals and scored 93%+ on another benchmark.

What’s unique: it’s trained on 22 Indian languages, boosting accuracy for regional scripts.

Let’s hit it! 💪🏻

1 Big thing: Why is Gravita betting ₹565 crore on copper? 🔶

Gravita India has signed a deal to acquire up to 100% of Rashtriya Metal Industries for ₹565 crore.

The players: Gravita India is a global recycling company, with growing businesses in aluminium, plastic, and rubber. Rashtriya Metal Industries (RMIL) is a legacy copper and copper alloy manufacturer.

The acquisition gives Gravita India RMIL’s 24,000-tonne capacity, strong export mix (~40%), and presence in markets like the US, UAE, Saudi Arabia, and Egypt.

Zoom out: copper is fast becoming the metal of the future. Demand is being supercharged by electric vehicles, renewable energy, charging infrastructure, and global decarbonisation.

According to the India Copper Report 2026, India’s copper demand alone could hit 3.24 million tonnes by FY30.

While we are on acquisitions 💰,

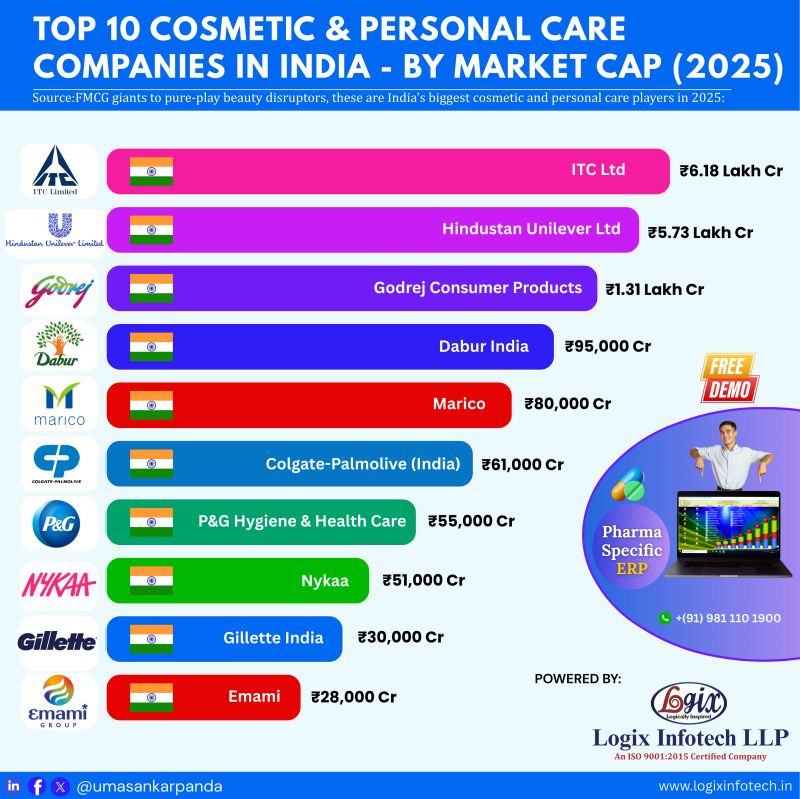

Marico acquired a 75% stake in Vietnam-based Skinetiq for ₹262 crore through its wholly owned arm, Marico South East Asia Corporation.

Skinetiq is a digital-first skincare company in Vietnam. It owns the science-backed brand Candid and also has exclusive distribution rights for luxury clinical skincare brand Murad in the country.

Why it matters: buying Skinetiq gives Marico a ready-made entry into Vietnam’s fast-growing, premium skincare market. Instead of building from scratch, Marico gets science-backed products, a strong D2C presence, and social commerce reach through brands like Candid and Murad.

2. US-based Carlyle knocks on Edelweiss’ housing door 🏠

Edelweiss Financial Services jumped 9% after the company’s profit more than doubled in Q3 and it announced that US-based asset manager Carlyle will buy a 45% stake in its housing finance arm Nido Home Finance for ₹2,100 crore.

Nido Home Finance provides home loans, mainly to affordable and mass-market customers, with a strong focus on rural and semi-urban India.

Breaking it down: for Edelweiss, this helps unlock value from its business while keeping a significant stake in a fast-growing housing platform.

Why this matters: India’s housing finance market is still under-penetrated. Home loan credit is only about 11–12% of GDP, compared to 40–60% in developed markets.

With demand shifting to Tier-2, Tier-3, and rural markets, well-funded housing finance companies are right at the centre of India’s next growth cycle.

3. Two PSU shipbuilders team up 🚢

Garden Reach Shipbuilders signed an agreement with Hindustan Shipyard to jointly take on a strategically important national shipbuilding project.

The deets: the partnership will focus on building advanced ships, strengthening India’s maritime infrastructure.

The tie-up aims to boost local manufacturing and reduce India’s dependence on foreign shipyards.

Big theme: this comes as the Centre has sharply raised spending on ports, shipping, and waterways to ₹5,164.8 crore, a 48% jump over FY26 signalling strong policy support for the sector.

The move also aligns with Maritime India Vision 2030 and Amrit Kaal Vision 2047, which aim to build world-class ports, boost waterways, and create a greener maritime sector.

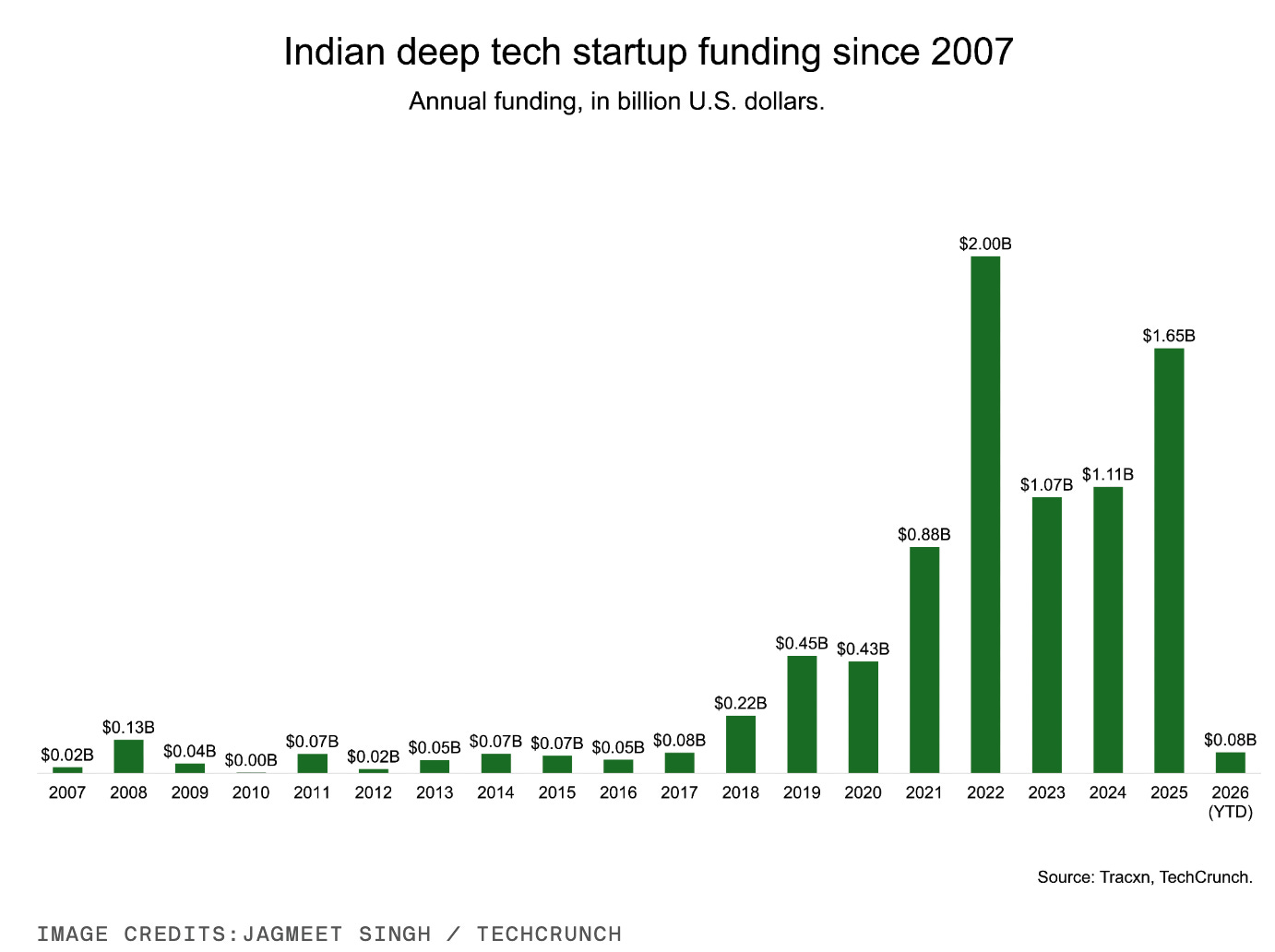

4. $1M in Satlabs Space Systems’ kitty 💰

Satlabs Space Systems has raised $1 million from Finvolve and India Accelerator (IA) and plans to tackle a very real problem.

What’s poppin’: Satlabs is building a data relay network that helps satellites send earth observation data faster, cutting delays from hours to minutes and eventually aiming for near real-time.

That kind of speed can be a game-changer for defence, farming, disaster response, offshore energy, and industrial IoT.

It is also moving closer to launching its proof-of-concept relay satellite, with a phased rollout planned over the next few years.

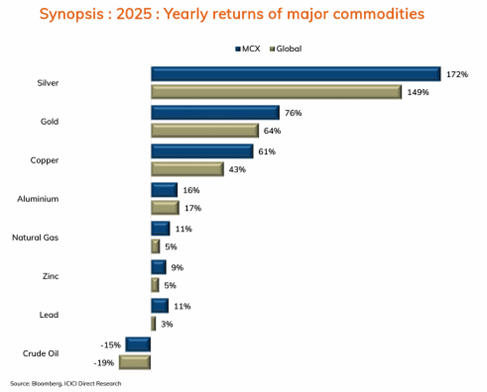

5. The hidden geography of silver supply 🌍

Silver is a global commodity, but its supply is actually highly concentrated. Mexico leads the world by a wide margin, producing over 200 million ounces annually. Add China and Peru, and a handful of countries end up controlling a large share of global silver output.

Why this matters: when production is dominated by a few heavy hitters, any disruption like strikes, policy changes, or geopolitical tensions can quickly move prices.

That ripple shows up everywhere, from jewellery and electronics to solar panels and industrial manufacturing, making silver far more sensitive to supply shocks than most people realise.

6. Stocks that kept us interested 🚀

1. Ceigall India wins ₹1,700 cr solar-storage project 🔋

Ceigall India bagged a ₹1,700 crore order from Rewa Ultra Mega Solar to develop Unit 1 of the Morena Solar Park in Madhya Pradesh, with a capacity of 220 MW. The stock gained more than 3% reacting to the news.

In simple terms, the company will build a large solar power project in Madhya Pradesh that can generate enough electricity for millions of homes.

The deets: Ceigall will generate solar power and store it in batteries, and get paid at a fixed electricity rate.

Why it matters: solar power doesn’t always generate electricity all the time, like at night or on cloudy days. Adding batteries helps store extra power and use it when needed, making renewable energy more stable and dependable for the grid.

2. AstraZeneca gets approval for uterine cancer treatment 🩺

AstraZeneca gained more than 3% after it received approval from India’s drug regulator to bring a new cancer medicine called Imfinzi. The medicine is to treat endometrial cancer, a cancer that affects the lining of the uterus in women.

Why it matters: Endometrial cancer is one of the most common cancers in women, especially after menopause. It can come back even after treatment and is harder to treat once it spreads.

The medicine, Imfinzi (durvalumab), helps the body’s own immune system fight cancer cells. It is given along with chemotherapy first, and then continued on its own to keep the cancer from returning or growing.

What else are we snackin’ 🍿

✈️ Defence boom: India may approve a plan to buy 114 Rafale jets this week during Macron’s Delhi visit, making it a ₹3.25 lakh crore deal.

📈 Investor surge: data from depositories NSDL and CDSL shows 3.62 million new demat accounts were opened, the highest since September 2024 and the second straight month above 3 million.

🪨 Mineral push: India is in talks with Brazil, Canada, France and the Netherlands to partner on exploring, processing and recycling critical minerals.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.