Mexico slaps 50% tariffs on India, smart farming push, and a ₹710 crore IPO.

🗓 Morning, folks! ☀️

Dalal Street finally saw some relief. After three days of falling, the market bounced back as investors picked up auto and metal stocks at lower prices.

Both Sensex and Nifty rose about 0.5%, helped by positive global cues after the US Fed cut interest rates by 0.25%.

Most sectors joined the uptrend. Auto, IT, pharma, PSU banks, metal and real estate all gained between 0.5-1%.

The only weak spot was the rupee. It slipped further and closed near a record low at 90.36 against the US dollar, compared to 89.97 earlier, as a stronger dollar and continued foreign outflows kept it under pressure.

💡 Spotlight: Mexico puts steep tariffs on Asian imports 🇲🇽

Mexico just approved a sweeping plan to hike import tariffs up to 50% on goods coming from China, India, South Korea, Thailand, and Indonesia.

The move, which kicks in next year and expands through 2026, is meant to shield local manufacturers even as global businesses and impacted governments push back.

The tariff spike covers a huge basket of goods including autos and parts, textiles, plastics, steel, metals, apparel, and footwear.

Why it matters: these hikes apply only to countries without a free trade agreement with Mexico which includes India and could reshape supply chains for companies relying on Mexican assembly and US-bound exports.

Let’s hit it!

1 Big Thing: TCS buys Coastal Cloud for $700M to boost Salesforce & AI play 🤖☁️

TCS is acquiring Coastal Cloud in a $700 million all-cash deal, bringing the AI and Salesforce specialist into its fold through US subsidiary ListEngage.

The deal marks TCS’ second major Salesforce-led acquisition in just three months amid acceleration of its cloud and AI strategy.

Coastal Cloud is a Salesforce Summit Partner backed by Salesforce Ventures. It’s a Florida-based consulting firm.

The deets: TCS bought ListEngage for $72.8M in October. With the addition of Coastal Cloud, the company says it will now rank among the top 5 Salesforce advisory and consulting firms globally.

Why it matters: the deal strengthens TCS’ capabilities in AI, multi-cloud, digital engineering, and Salesforce-led transformations. It also helps the company expand local US hiring at a time when visa rules remain uncertain.

It also fits TCS’ broader plan to scale AI services and build 1 GW of data center capacity, as outlined during its Q2 roadmap.

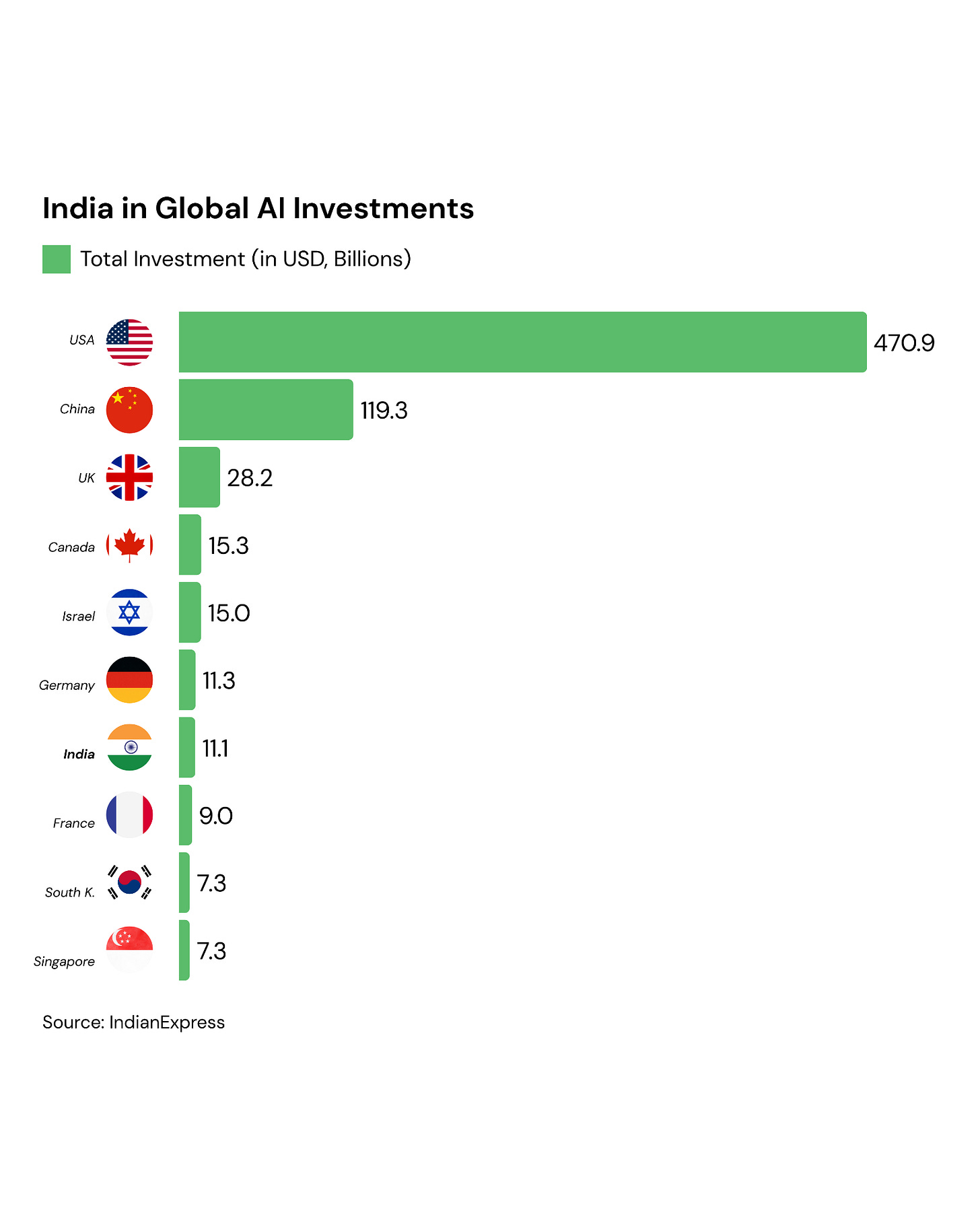

Big theme: last week, Microsoft announced a $17.5 billion India investment for 2026–2029, its biggest in Asia to build sovereign data centers, expand cloud infrastructure, train 20 million people, and for AI tools.

Amazon followed with an even bigger push, taking its India commitment to $35 billion by 2030, focused on AI-driven digitisation and expansion.

While we are on acquisitions,

Lloyds Metals & Energy has approved a plan for its subsidiary, Lloyds Global Resources FZCO (LGRF), to acquire up to 50% equity in Nexus Holdco FZCO.

This gives the group a direct entry into one of Africa’s most resource-rich regions.

2. DCM Shriram & Germany’s Bayer CropScience join hands 💪🏻

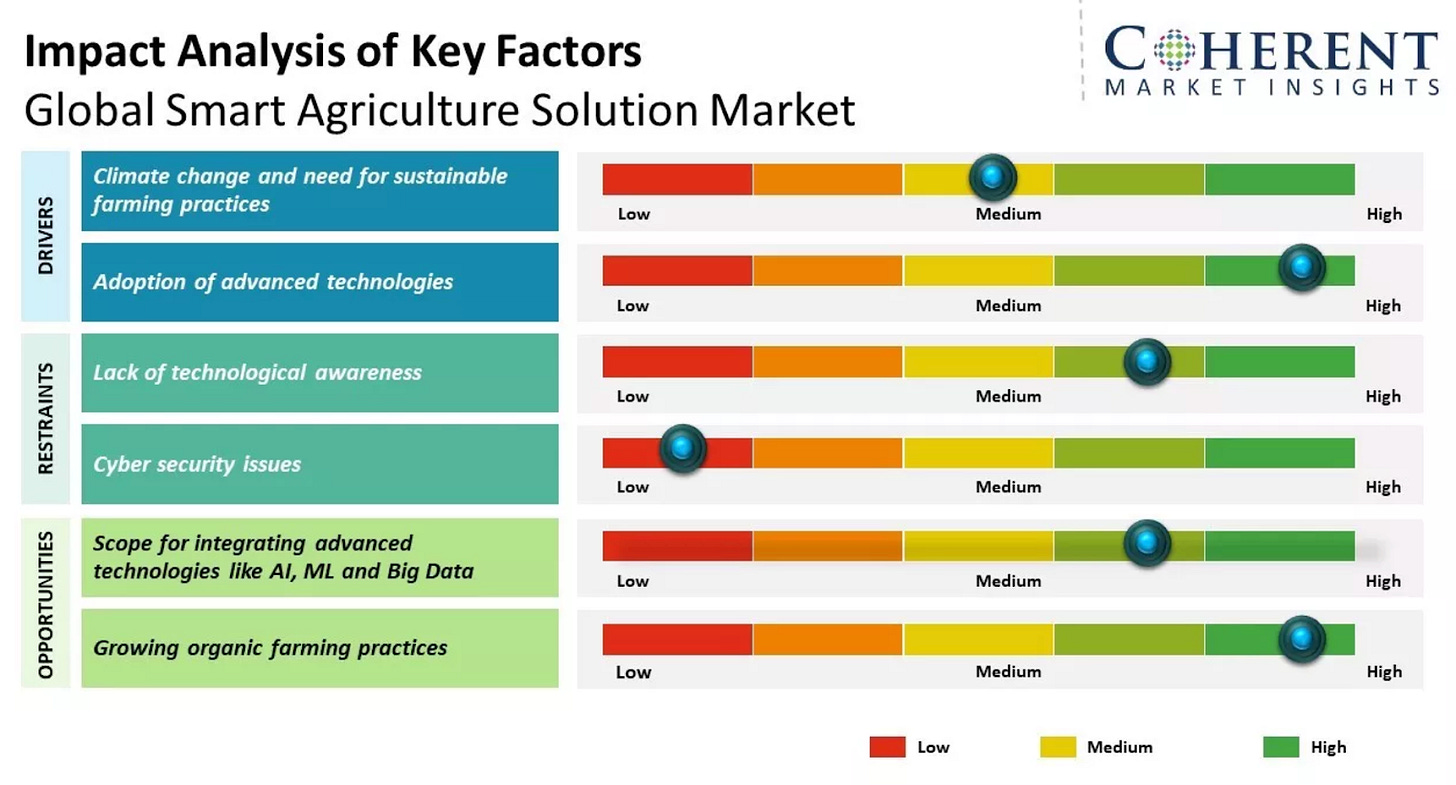

DCM Shriram signed a Memorandum Of Understanding (MoU) with Bayer CropScience to jointly explore ways to improve India’s agriculture system using new ideas, sustainable practices, and solutions that benefit farmers.

DCM Shriram operates in farming, chemicals, and vinyl products, while Germany’s Bayer Crop Science focuses on crop protection, advanced seeds, and digital farming tools.

What’s happening: the two organisations will work together in areas like seed improvement, plant nutrition, eco-friendly crop solutions, and digital tools that help farmers.

How will the companies benefit: under the partnership, Bayer gains access to a wider rural market through DCM’s strong on-ground reach, while DCM benefits from Bayer’s global expertise and advanced agricultural technologies.

Why it matters: India’s smart agriculture market is growing at 20.5% and is projected to reach $3,837.6 million by 2033. However, the industry still faces major hurdles, including low technical awareness among farmers, which slows adoption, and the growing impact of climate change.

While we are on partnerships,

Mazagon Dock Shipbuilders, in association with the Indian Navy inked a partnership with the Brazilian Navy to boost cooperation on maintenance of Scorpene-class submarines and other military vessels.

A Scorpene-class submarine is like a high-tech underwater ninja ship which is silent, hard to detect.

What’s going on: the agreement lets both sides work together to find new defence deals, share their manufacturing know-how, and jointly develop new technologies.

This order comes just a month after Mazagon Dock signed an MoU with Swan Defence to design and build landing platform docks (LPDs) for the Indian Navy.

3. KSH International readies ₹710 crore IPO 🚀

KSH International is all set to open its ₹710 crore IPO on December 16.

KSH International makes magnet winding wires that are used in motors and other electrical equipment, and it is already one of the leading manufacturers in India.

FYI: a CARE report says the company is likely to become the country’s biggest exporter in this segment by export revenue in FY25.

What’s happening: the company itself will bring in ₹420 crore by creating and selling new shares, and the main existing owners, called promoters, will sell some of their own shares worth ₹290 crore through an offer-for-sale, as mentioned in its Red Herring Prospectus filed on December 10.

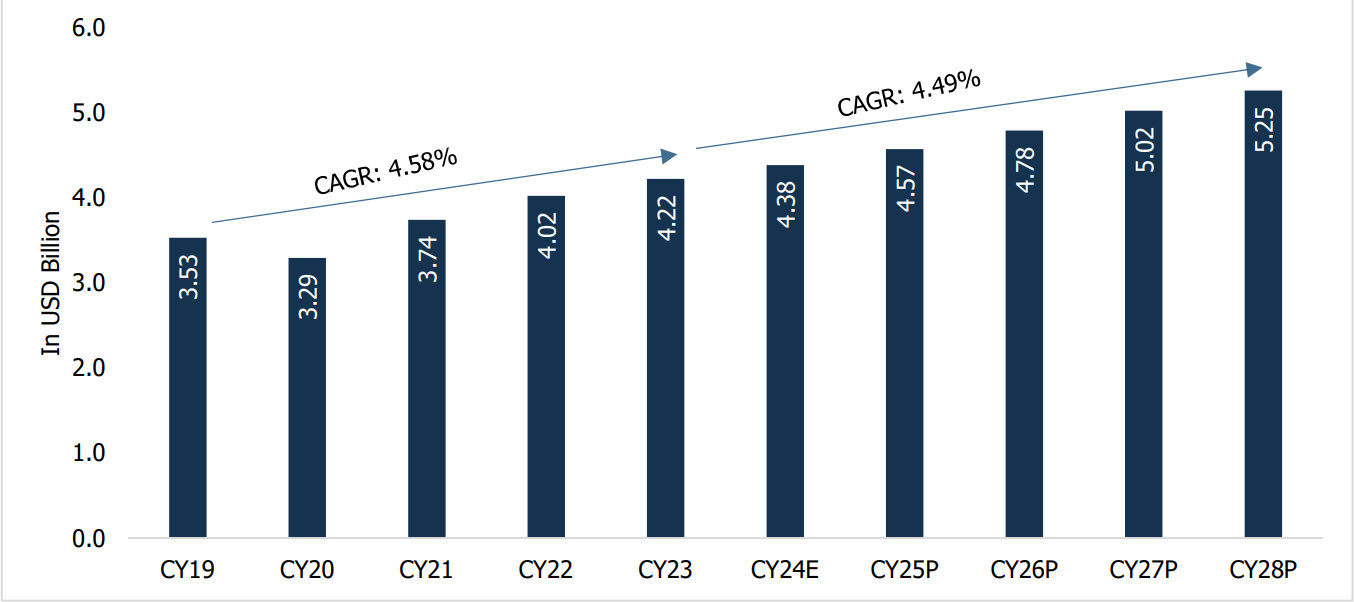

Zoom out: looking ahead, India’s magnet winding wire market is expected to become a $5.2 billion business by 2028. In terms of quantity, the market is expected to reach about 6.7 lakh tonnes by 2028, growing at roughly 4% a year.

This growth is mainly because India is upgrading its power system, investing in better electricity grids, more EVs on the road, and people are using more energy-efficient appliances at home and in offices.

4. Stocks that kept us interested 🚀

1. Shakti Pumps bags ₹444 crore solar pump order 🚰

Shakti Pumps surged 14% after winning a ₹444 crore order from Maharashtra State Electricity Distribution Company (MSEDCL).

The deal covers the supply and installation of 16,025 off-grid solar water pumping systems across the state.

The deets: the company will be responsible for end-to-end execution of DC solar pumping systems. These solar pumps will help farmers access reliable water supply without depending on grid power or diesel, a key priority for Maharashtra’s rural irrigation push.

Why it matters: for the state, it accelerates the rollout of clean-energy irrigation systems while cutting dependence on subsidised electricity. It also reduces the burden of supplying subsidised electricity to agriculture, one of the biggest expenses for power utilities.

2. Ashoka Buildcon JV lands long-term BMC project 🤝

Ashoka Buildcon’s shares went up 2% after its JV with Adani Road Transport & Akshaya Infra received a work order worth ₹1,815.7 crore from the BMC.

What’s the deal: this order is for the Mithi River Development and Pollution Control Project (Package III). It includes work like stopping dirty water from flowing into the river at tidal points, laying big pipes called transfer sewers, shaping and strengthening the river’s path.

Why it matters: the Mithi River project is central to Mumbai’s efforts to cut flooding, clean polluted water and protect nearby communities.

For Ashoka Buildcon, it delivers a sizeable contract plus 10 years of maintenance income, strengthening revenue visibility and its credentials in complex urban and environmental infrastructure projects over the coming years.

What else are we snackin’ 🍿

🌫️ Clean air push: the World Bank has approved funding to help Uttar Pradesh and Haryana to improve air quality through clean mobility and broader green transition programs.

🪙 Silver soars: Silver prices hit a record ₹1.92 lakh per kg on MCX as gold rallied, raising the question of whether the metal could touch ₹2 lakh in December.

📈 Equity rush: in November 2025, Indian mutual funds saw net equity inflows of ₹29,894 crore, up 21% from October’s ₹24,671 crore levels.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.