India-US talks picks up, wholesale inflation rises, and Defence Ministry eyes 114 Rafale jets.

🗓️ Morning, folks and Happy Fridayyyy! ☀️

💡 Spotlight: Inflation makes a soft return 📈

Inflation is back but in a very “don’t panic yet” kind of way.

India’s wholesale inflation (WPI) slipped into positive territory in December, clocking in at 0.83%, after being in the red at -0.32% in November.

What’s nudging prices up: the pressure came mainly from factory-side costs. Manufactured goods, machinery, and minerals all turned costlier in December.

A quick look at the movers:

- electricity: +4.46%

- non-food articles: +2.76%

- minerals: +1.62%

- food articles: +0.88%

WPI doesn’t hit your wallet directly, but it does whisper early warnings to companies. With 13 of 22 manufacturing segments seeing price hikes, firms may soon face a margin squeeze or start passing costs down the chain.

Let’s hit it!

1 Big Thing: Infosys’ Q3 profit takes a hit ❌

Infosys has joined the Q3 earnings party with numbers that were largely in-line, and it also sounded a bit more upbeat about the year ahead.

The company has raised its FY26 revenue growth forecast to 3-3.5% in constant currency terms, signalling that demand is holding up and the pipeline looks steady.

The financials:

- $ revenue: up 0.5% at $5,099M vs $5,076M (QoQ)

- Net profit: down 9.6% at ₹6,654 cr vs ₹7,364 cr (QoQ)

- Margin: 20.8% vs 21% (QoQ)

Breaking it down: the company’s net profit was hit as it incurred ₹1,289 crore on account of labour codes.

The real good news in Infosys’ Q3 report was deal action. The company signed large contracts worth $4.8 billion, and more than half of that, 57%, came from fresh new business.

There was another upbeat cue too: hiring is back. Infosys added 5,043 employees in Q3, its biggest net hiring in 11 quarters, taking the total workforce to 337,034. It also aims to add 20,000 freshers this fiscal year.

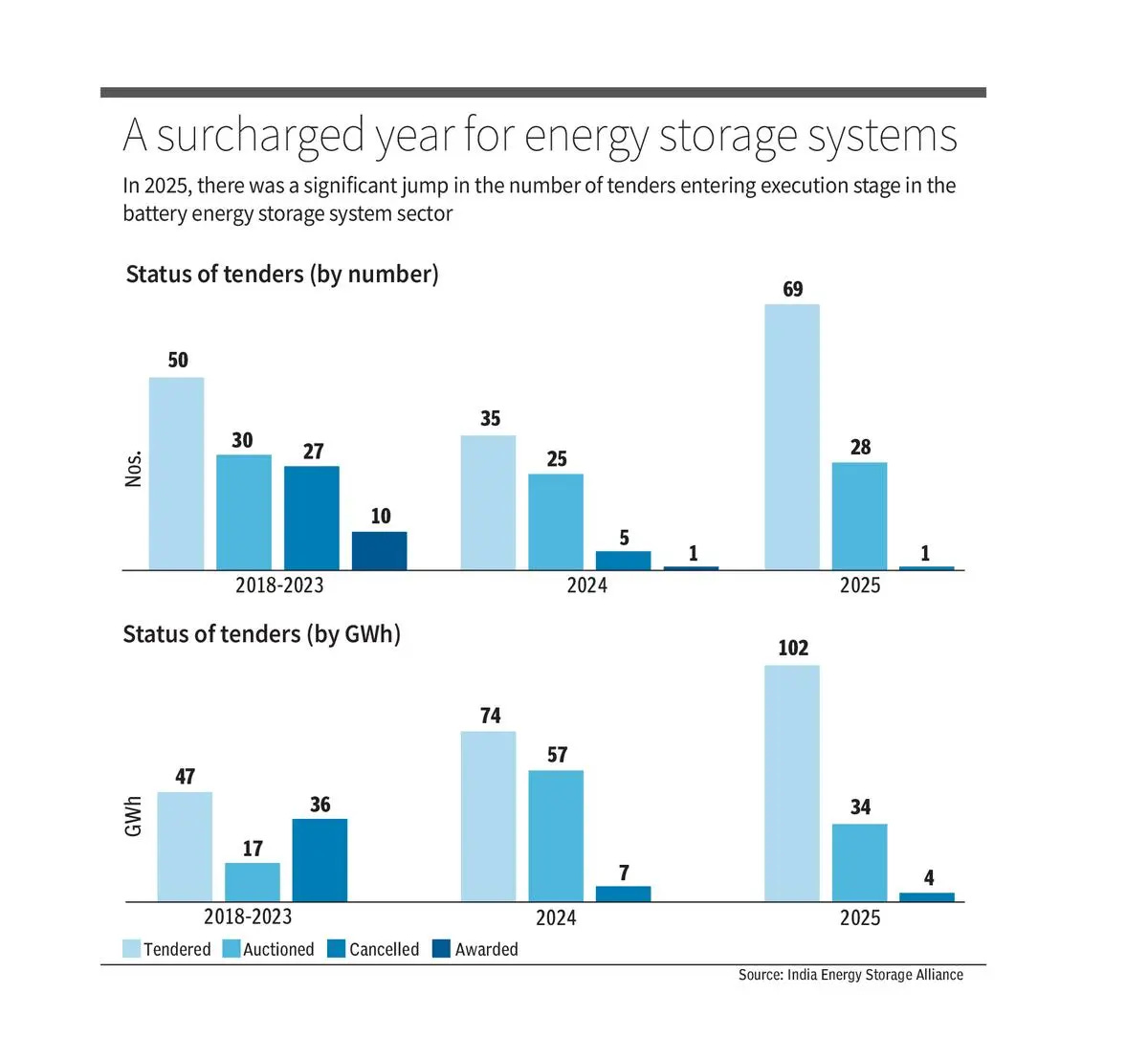

2. Make-in-India push for batteries 🔋

India is considering mandatory localisation norms for Battery Energy Storage Systems (BESS) used in wind, solar, and standalone grid-connected storage projects.

In plain terms, the government wants a larger share of the batteries that store renewable power to be built in India, instead of being fully imported.

What’s on the table: a rule that would require at least 50% local content in non-cell components such as battery management systems, inverters, containers, and energy management software. Battery cells would be kept out of the requirement for now.

Why it matters: the move aims to reduce import dependence, especially on China, and limit security risks in critical power infrastructure.

The backdrop: India is targeting 47 GW of BESS capacity by 2032, which could attract investments of nearly ₹3.5 trillion. Storage is becoming essential as solar and wind power don’t generate electricity around the clock.

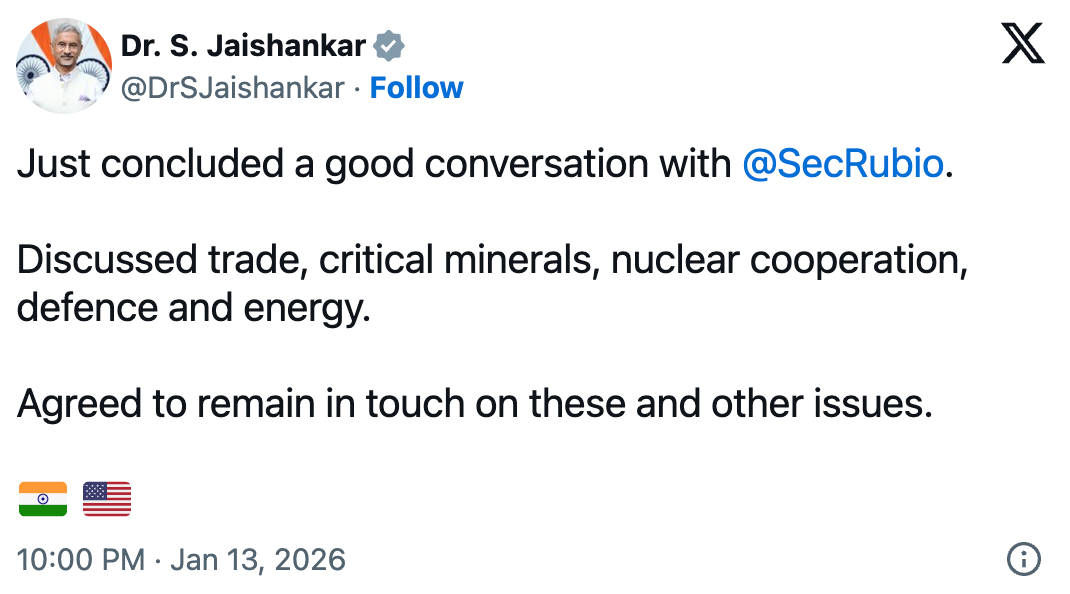

3. India-US trade talks continue…🇺🇸

External Affairs Minister S. Jaishankar said his call with U.S. Secretary of State Marco Rubio ended on a positive note.

The discussion focused on cooperation in trade, critical minerals, nuclear energy, and defence, as both sides aim to more than double bilateral trade to $500 billion by 2030.

Why the timing matters: the call comes while India and the US are deep in trade negotiations, even as Indian exports face tariffs of up to 50% in the US market.

To help narrow the gap, New Delhi has signalled it’s ready to step up purchases of American energy and defence equipment.

It also follows a fresh signal from Washington. Just days earlier, US Ambassador Sergio Gor said India would be invited to join Pax Silica, a US-led initiative focused on securing supply chains for silicon, advanced manufacturing, and AI—three areas both sides see as strategically critical.

4. TCS & US chipmaker AMD join hands 🤝

TCS has teamed up with US chipmaker Advanced Micro Devices (AMD) to help enterprises scale AI from small pilots to full deployment. The partnership will also focus on modernising legacy IT systems.

Breaking it down: the timing is notable. This comes soon after TCS said AI-related services are generating over $1.5 billion in annualised revenue, nearly 5% of its Q3 revenue.

Under the partnership, the two firms will co-develop industry-specific AI and generative AI solutions, combining TCS’s domain and integration expertise with AMD’s high-performance computing and AI hardware.

The focus will be on upgrading hybrid cloud and edge systems while accelerating AI-led innovation.

TCS will also upskill and certify its teams on AMD’s latest platforms, with both companies investing in building a specialised AI talent pool.

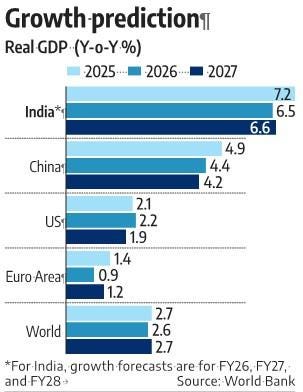

5. World Bank sees FY27 growth at 6.5% 📈

The World Bank is staying steady on India’s growth story, even if the pace cools a bit.

It’s holding on to a 6.5% GDP growth forecast for FY27, down from 7.2% expected this year, as global headwinds start to show up more clearly.

By the numbers:

- FY26: 7.2% growth (World Bank) vs 7.4% (govt estimate)

- FY27: 6.5%, assuming US 50% tariffs stay in place

- FY28: 6.6%, slightly lower than the earlier 6.7% call

Exports may take a hit from US tariffs, but strong services and local demand are expected to soften the blow.

Zoom out: global agencies broadly agree on India’s path. The UN recently nudged its 2026 growth forecast up to 6.6%, with a further pickup to 6.7% in 2027.

One wildcard: the upcoming GDP base year revision. With India shifting its base year to 2022-23, fresh growth numbers due on February 27 could force economists to redraw their forecasts all over again.

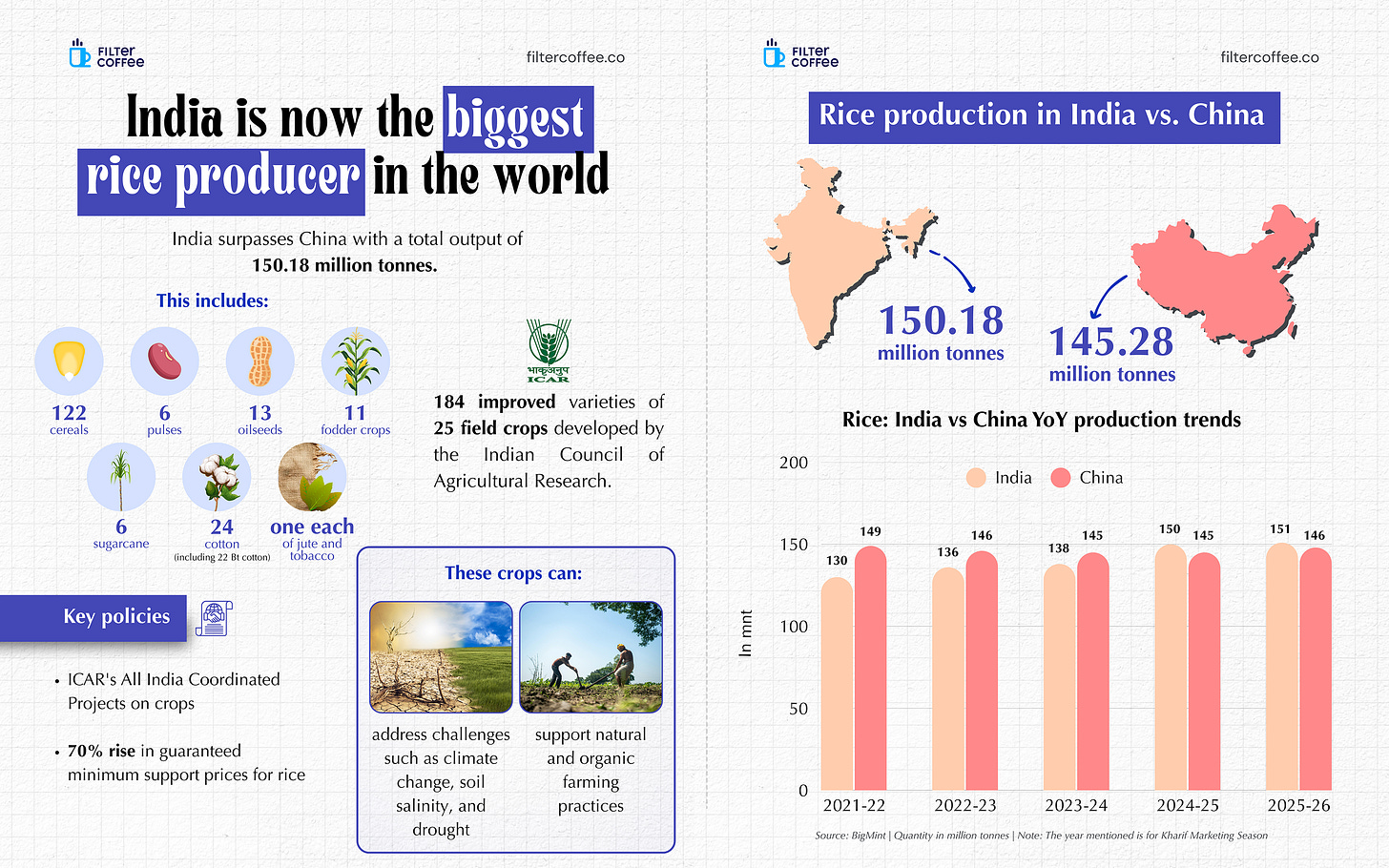

6. India tops global rice chart 🌾

India became the world’s largest rice producer, overtaking China with an output of 150.18 million tonnes, compared to China’s 145.28 million tonnes. The lift hasn’t come from farm alone.

India’s gains are backed by better seed varieties, higher yields across cereals, pulses, oilseeds, and fibre crops, and steady policy support.

Programmes led by ICAR, along with assured Minimum Support Prices (MSP) for rice, have helped farmers manage risks like climate stress, soil salinity, and drought while keeping production resilient.

What else are we snackin’ 🍿

🌍 Global backing: Piramal Finance raised $350 million from IFC and ADB post re-listing, and is in talks to add another $150 million, taking total DFI funding to $500 million by FY26 end.

📦 IPO alert: Shadowfax Technologies is set to hit the markets on January 20.

✈️ Rafale push: the Defence Ministry is evaluating a ₹3.25 lakh crore proposal to acquire 114 Rafale fighter jets for the Indian Air Force.

🚀 Space win: PTC Industries’ arm Aerolloy Technologies bagged an order from Blue Origin to supply critical castings for New Glenn’s BE-4 engines.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.