Tata–Intel semiconductor push, Paramount bids big, and Delhivery expands abroad.

🗓 Morning, folks! ☀️

Markets ended lower on Tuesday but made a good comeback after falling sharply earlier in the day. A late rebound in financial stocks and strength in the broader market helped steady sentiment, even though more than half of the Nifty 50 names still ended in the red.

On the winners’ side, Kaynes Technology stole the show, jumping 16% after a bullish brokerage note snapped its four-day losing streak.

💡 Spotlight: Rice exporters feel the pinch of tariff threat 🍚

US President Donald Trump swung the tariff hammer again and the business world felt the jolt.

Addressing American farmers, he announced a $12 billion farm-aid package and warned of fresh curbs on agricultural imports, accusing countries like India and Thailand of “dumping” cheap produce.

Export-focused stocks initially slipped on the news, though most bounced back. LT Foods, however, closed in the red.

Now, all eyes are on upcoming trade talks as U.S. official Allison Hooker lands in India for bilateral consultations.

Let’s hit it!

1 Big Thing: Microsoft makes $17.5B leap to build India’s AI future 🤖

Microsoft has committed $17.5 billion investment in India between 2026–2029.

FYI, this is its largest bet in Asia to supercharge cloud infrastructure, AI capabilities, and skilling initiatives.

What’s happening: this builds on its earlier $3B commitment, which it expects to fully deploy by 2026.

“Together, Microsoft and India are poised to set new benchmarks and drive the country’s leap from digital public infrastructure to AI public infrastructure in the coming decade,” the company said in the blog.

What is Microsoft bringing with this investment?

- New hyperscale region in Hyderabad going live in mid-2026

- Expansion of existing data centers in Chennai, Hyderabad, and Pune

- Focus on sovereign, secure, India-controlled cloud systems

- AI upgrades for e-Shram & National Career Service

- Multilingual access, job matching, predictive analytics, auto-resumé tools

- Goal doubled to train 20 million Indians by 2030

- Launch of Sovereign Public & Private Cloud offerings

- Microsoft 365 Local and Copilot to process data within India by end-2025

Why it matters: with Microsoft 365 and Copilot shifting to in-country data processing by 2025, India reduces its reliance on foreign data jurisdictions. This is a major priority as the country rolls out the Digital Personal Data Protection Act.

India today is the world’s fastest-growing cloud market, expected to touch $17.8 billion by 2027 (IDC), but capacity is still concentrated in a few cities and demand regularly outpaces supply.

By upgrading e-Shram and NCS using Azure OpenAI, Microsoft will bring AI tools to 310 million informal workers, one of the largest employment ecosystems in the world.

2. Tata, Intel team up to shape India’s semiconductor future 🔧

Tata Electronics has brought Intel on board as the first major potential customer for its upcoming semiconductor plants in India. The two companies have also agreed to explore a collaboration in advanced chip packaging.

Context: the Tata Group is currently building two semiconductor facilities in India worth around $14 billion, a fabrication plant in Gujarat and an assembly-and-testing (OSAT) unit in Assam.

The joint statement read, “Intel and Tata intend to explore manufacturing and packaging of Intel products for local markets at Tata Electronics’ upcoming Fab and OSAT facilities, as well as a collaboration for advanced packaging in India.”

The deets: this partnership framework means Tata and Intel will jointly explore chip manufacturing, packaging, and scaling AI PCs for India. The country is expected to be among the top five markets globally by 2030.

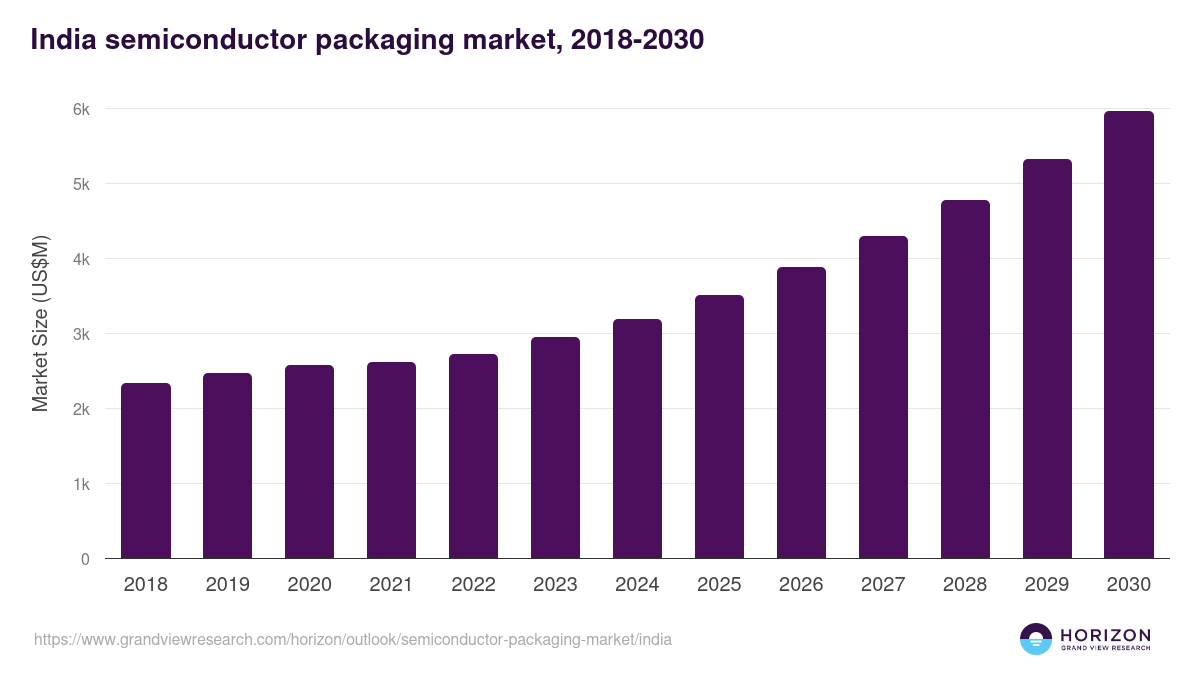

Zoom out: India’s semiconductor demand is rising sharply, with data showing the market growing from $24 billion in 2020 to a projected $63–64 billion by 2026.

The government’s official forecast highlights how quickly India is becoming one of the world’s largest chip-consuming economies driven by smartphones, autos, data centres, and electronics manufacturing.

While we are on deals,

Vietnam’s Vingroup is committing $3 billion to Telangana across smart cities, EVs, healthcare, education, tourism, and green energy.

What’s going on: the group plans to roll out a large electric taxi fleet in the state using VinFast EVs, backed by a full mobility-as-a-service platform through Green Smart Mobility (GSM).

Moreover, through VinEnergo, the company aims to build a 500 MW solar farm spread across 500 hectares, powering industrial zones, EV charging networks, and the broader urban ecosystem.

3. Paramount challenges Netflix with $108B Warner Bros bid 🎬

Paramount is trying to outbid Netflix by offering $108.4B directly to Warner Bros’ shareholders to take over the company.

What’s happening: Paramount has skipped Warner Bros’ board and made a $30-per-share cash offer directly to the shareholders. The company said that the sale process unfairly favoured Netflix.

It claims it submitted six proposals in 12 weeks which were all rejected. Paramount says it’s doing this to restore a fair bidding process.

Paramount CEO David Ellison added, “We’re fighting for our shareholders, and we’re also fighting for the shareholders of Warner Bros Discovery.”

Background: Netflix swooped in last week with a $72 billion equity deal for Warner Bros Discovery’s film, TV and streaming assets.

The deal includes HBO and DC Comics, comes with a $5.8 billion breakup fee, and is expected to face antitrust scrutiny. Even US President Donald Trump has raised concerns about Netflix’s takeover attempt.

What can happen: the deal is now wide open. If Warner’s shareholders believe Paramount’s higher all-cash offer is better, the Netflix agreement could unravel but regulatory pushback and doubts over Paramount’s financing may complicate things.

Warner Bros’ board has already questioned Paramount’s ability to fund the bid, but if pressure builds from investors, the company may have to re-evaluate its “Netflix-first” stance.

4. Centre Court Capital raises ₹410 crore for sports-tech fund 🎾

Centre Court Capital, a sports tech and gaming-focused VC fund backed by Parth Jindal, has closed its first-ever fund at ₹410 crore.

The fund has drawn an impressive lineup of backers from Premji Invest, SanRaj Group, GMR Sports to athletes like Neeraj Chopra, Rishabh Pant, PV Sindhu.

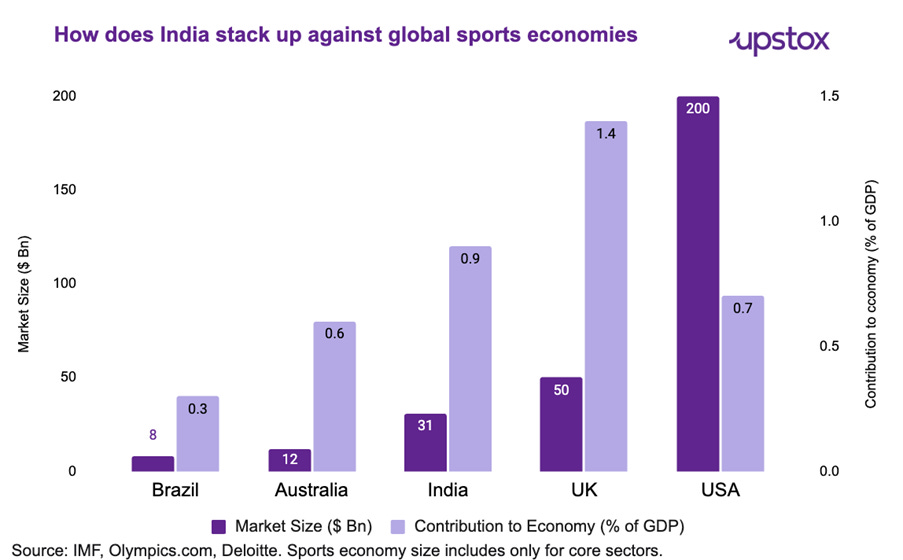

Why it matters: India’s sports economy is booming, estimated at $19 billion today and expected to hit $40 billion by 2030.

With tech reshaping everything from fan engagement to athlete performance, this fund gives startups the capital to turn India’s sporting potential into global-scale businesses.

5. Stocks that kept us interested 🚀

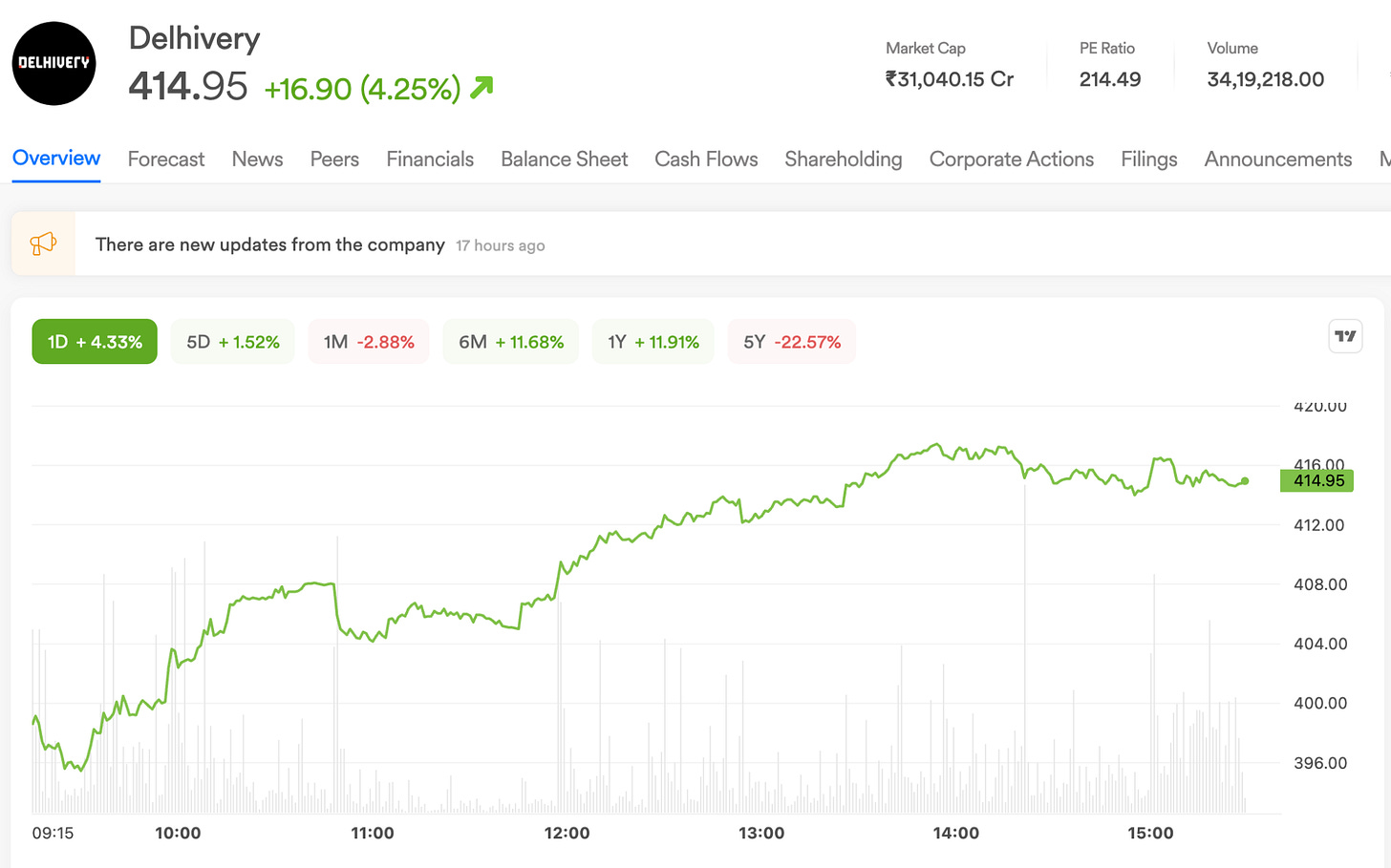

1. Delhivery rallies on launch of new international logistics arm 🚍

Delhivery’s stock jumped 4% after the company unveiled Delhivery International, a new venture aimed at helping India’s Micro, Small, and Medium Enterprises (MSMEs).

Delhivery is India’s largest fully-integrated logistics provider, offering solutions for express parcel delivery, freight, warehousing, and cross-border shipping.

What’s brewing: Delhivery International is an economy air parcel service built to make exports cheaper and more dependable for Indian businesses.

What is it solving: the service tackles the key pain points SMEs face in cross-border shipping like high costs, complicated country-specific paperwork, unpredictable delivery timelines, and poor shipment visibility.

Big theme: India is pushing hard to become an export-driven economy, shifting from being a heavy importer to a global supplier across multiple sectors.

2. Welspun bags ₹1,165 crore steel pipe order in Saudi Arabia 💸

Welspun Corp’s associate company in Saudi Arabia has secured orders worth ₹1,165 crore from the Saudi Water Authority to manufacture and supply steel pipes for water projects.

The deets: the order will be executed by its Saudi associate, East Pipes Integrated Company for Industry (EPIC), over a six-month period.

What they do: EPIC is one of Saudi Arabia’s top makers of Helical Submerged Arc Welded (HSAW) pipes used in major infrastructure projects and is known for delivering quality turnarounds.

These are large, strong steel pipes made by rolling a steel sheet into a spiral shape and welding the edges together and are suitable for long-distance transport of water, oil, or gas.

The significance: this order will help EPIC deliver vital pipelines that support Saudi Arabia’s core industries, while reinforcing its role in advancing the country’s Vision 2030 goals.

What else are we snackin’ 🍿

📲 UPI crowned: the IMF has recognised UPI as the world’s largest real-time payments system, contributing 49% of global instant transactions.

✈️ Winter cut: IndiGo is set to face a 10% reduction in its winter flight schedule to restore normal operations.

⚠️ Bubble warning: Blinkit’s CEO cautioned that India’s quick commerce boom may be nearing a breaking point, even as global investors like SoftBank, Temasek and Gulf funds continue to pour in billions.

🏢 RMZ IPO: RMZ Corp is exploring a $1 billion IPO, potentially the biggest real estate listing since DLF’s 2007 debut.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.