Steel stocks rally, logistics parks' maker IPO and ₹4,531 cr boost for exporters.

🗓️ Morning, folks! Happy New Year! ☀️

25 either been a kick-ass year, or a lame farce, depending on who you ask. Lets just hope the year end break was relaxing for all!

Business in India has kicked off on a high already.

Markets ended 2025 on a happier note. After a rough patch, stocks bounced back on Wednesday, snapping their recent losing streak on the very last trading day of the year.

The Nifty and Sensex both moved higher, with metal stocks leading the charge after the government announced a three-year safeguard duty on select steel imports, giving domestic producers a boost.

Here’s a quick look at the most important headlines going in.

Let’s hit it!

1 Big Thing: Govt signs ₹4,666 cr defence weapons deals 🚀

The Ministry of Defence (MoD) signed contracts worth ₹4,666 crore for battle carbines and heavyweight torpedoes. Shares of Bharat Dynamics, BEML, BEL, HAL climbed 1-2%, lifting the Nifty India Defence index up 1.3% and snapping a three-day losing streak.

Battle carbines are short guns for close combat, while heavyweight torpedoes are powerful underwater weapons used by submarines.

The deets: the contracts are to procure over 4.25 lakh battle carbines and 48 heavyweight torpedoes.

- ₹2,770 crore worth of carbines were ordered for the Indian Army and Navy from Bharat Forge and PLR Systems

- ₹1,896 crore was allocated to torpedoes for the Indian Navy’s Kalvari-class submarines, sourced from WASS Submarine Systems (Italy)

Why it matters: this gives the Army modern, lighter weapons that improve firepower and safety in close combat.

For the Navy, new heavyweight torpedoes significantly boost underwater attack and defence capabilities, helping submarines detect and destroy enemy threats more effectively.

Big picture: ahead of the Union Budget, the government has accelerated India’s defence push with a series of big-ticket orders and approvals.

Earlier this week, Defence Acquisition Council approved ₹1,600 crore lease for two more Predator drones, and the clearance of a massive ₹79,000 crore military modernisation project.

2. Vodafone Idea gets time on dues, not closure ⏰

Vodafone Idea stock crashed more than 10% after reports said the government has approved a relief package on its massive AGR dues but investors remain unsure about the fine print.

Adjusted Gross Revenue (AGR) dues are money telecom companies owe the government based on their total earnings, including fees and penalties.

What’s going on: the telecom company has been struggling for years under a huge pile of AGR dues. This was a long-running dispute between telecom companies and the government over how revenues are calculated.

Now, the Union Cabinet has reportedly approved an AGR relief package. Under this, the company’s total AGR liability has been frozen at ₹87,695 crore, meaning the number won’t keep rising.

The government has also reportedly given a five-year moratorium, allowing Vodafone Idea to pause AGR payments for now. These dues are expected to be repaid over a long stretch from FY32 to FY41.

However, there’s still no clarity on whether interest and penalties will be waived, or continue to apply. That uncertainty spooked investors, sending the stock into a 15% lower circuit, despite the relief.

3. Blackstone’s logistics bet eyes IPO 💰

Horizon Industrial Parks has filed its Draft Red Herring Prospectus with SEBI, kicking off plans for a ₹4,250 crore IPO.

Owned by Blackstone, the company builds and runs industrial and logistics parks, the massive warehouses and infrastructure that keep factories running and supply chains moving.

The deets: the IPO will be a primary issue and is part of a larger $500 million fundraise. Horizon had already secured about $200 million or ₹1,650 crore through a pre-IPO placement, signalling strong investor appetite even before the public offering.

Quick bite: logistics is one of Blackstone’s biggest global bets, with over 1.2 billion square feet of warehousing space worldwide. Though it entered India’s logistics market only six years ago, this IPO marks a clear push to scale in a big way.

While we are on IPOs,

OYO’s parent company, PRISM, just filed confidential papers for an IPO, aiming to raise a massive Rs 6,650 crore.

They’re eyeing a company valuation between $7 billion and $8 billion for this fresh share sale.

The move is officially a go after getting the green light from shareholders during a meeting just a few weeks ago.

4. Stocks that kept us interested 🚀

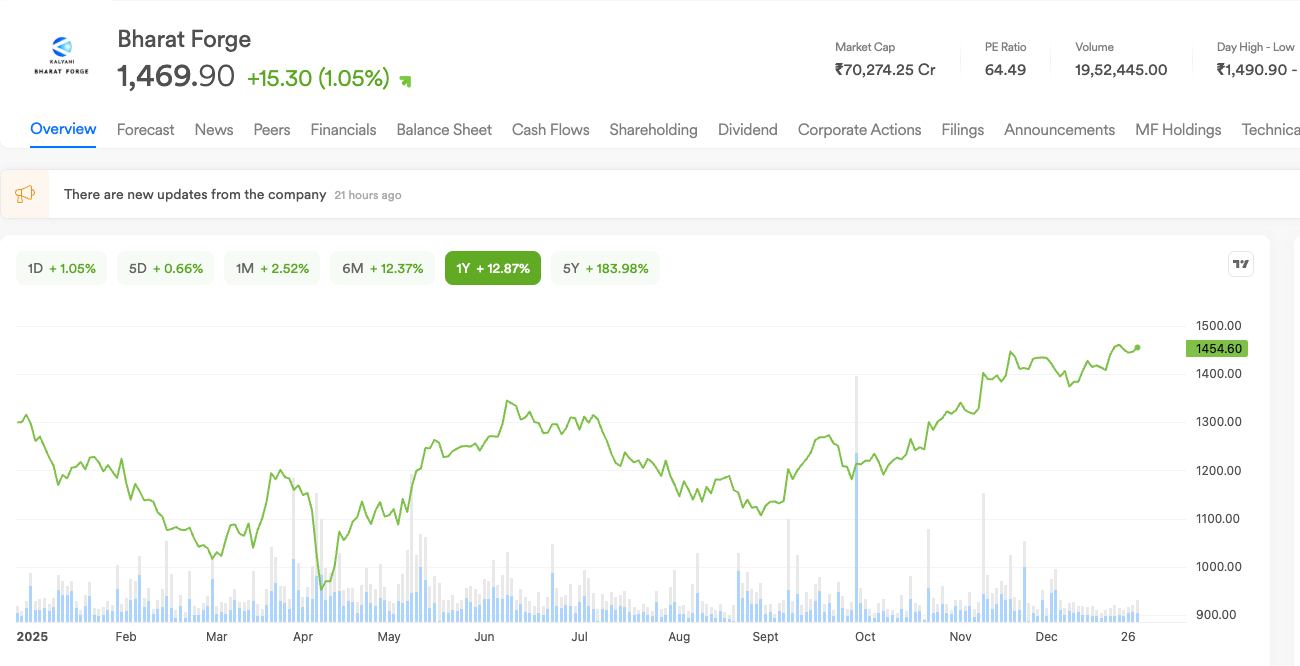

1. Bharat Forge powers India’s urban combat edge 💪🏻

Bharat Forge’s stock moved higher after the company signed its largest-ever small arms contract with the Ministry of Defence, worth ₹1,661.9 crore, for the supply of Close Quarter Battle (CQB) carbines.

So what’s the big deal: CQB, or Close Quarter Battle, carbines are firearms built specifically for fighting in tight spaces.

The 5.56 x 45 mm CQB Carbine being supplied under this contract is fully indigenous. It has been designed, developed, and manufactured in India through a joint effort between DRDO’s Armament Research and Development Establishment (ARDE) and Bharat Forge.

Why it matters: the carbine is meant to fill a critical gap in modern warfare. The CQB Carbine’s compact design improves mobility, allows faster reactions, and makes it easier for forces to operate in confined environments.

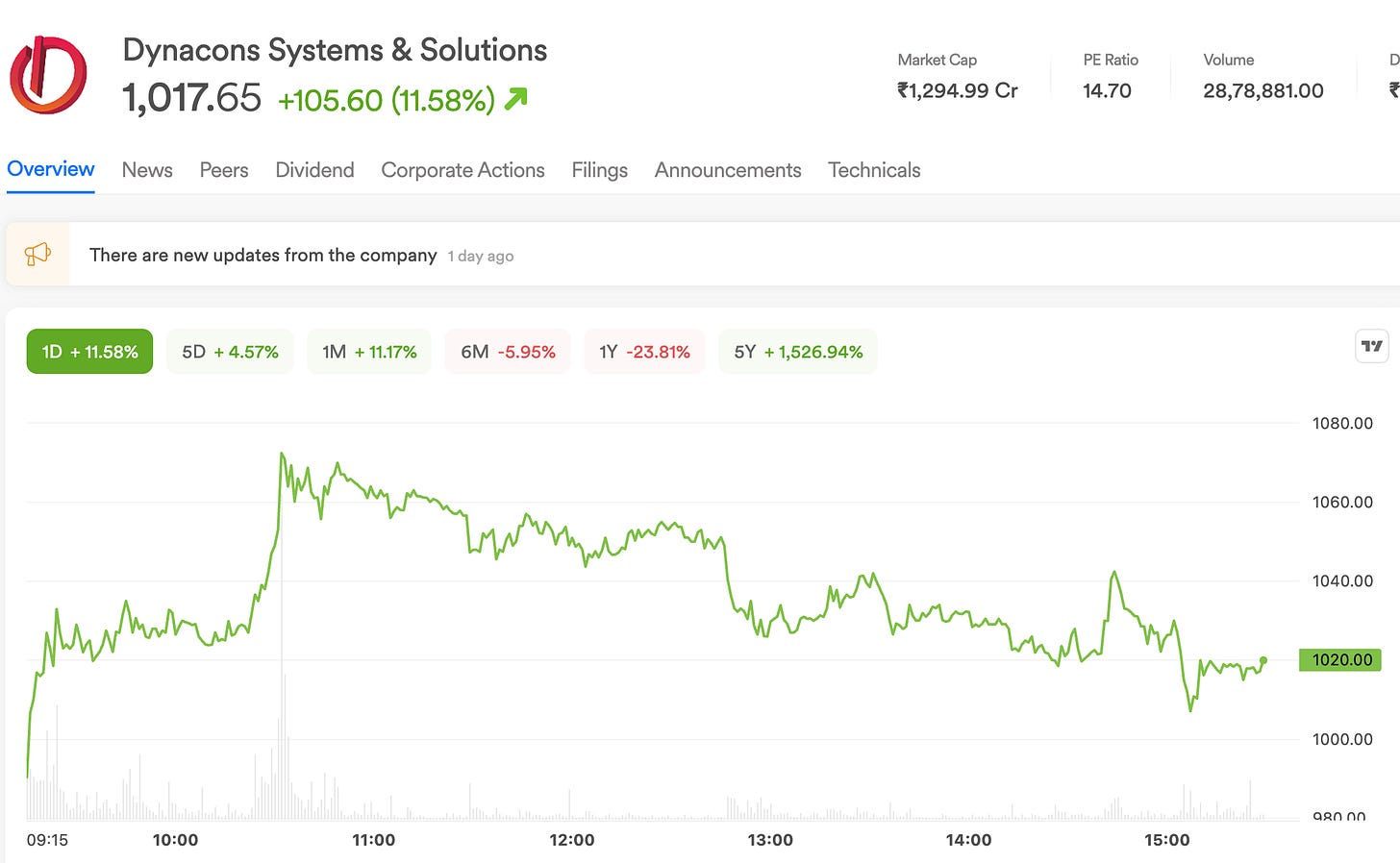

2. Dynacons jumps after landing big RBI tech order 💰

Shares of Dynacons Systems and Solutions jumped nearly 12% after the company won a ₹249 crore contract from the Reserve Bank of India for enhancing its software systems.

Dynacons provides end-to-end technology services like cloud solutions, digital transformation, and security for various industries like banking, government, and enterprises.

The deets: the five-year contract covers setting up, running, and supporting the RBI’s Enterprise Application Platform (EAP). The EAP works as the RBI’s digital backbone, helping it manage and connect its critical software systems securely and efficiently, while allowing them to scale as needed.

The RBI’s EAP order aims to simplify and secure the complex, multi-cloud software systems that banks rely on for daily transactions.

By centralizing and streamlining these critical apps, the mandate makes the entire financial system safer and more efficient.

What else are we snackin’ 🍿

📊 Export boost: Government launched ₹4,531 cr export support to boost global market access.

💰 Pay hike: Swiggy and Zomato raised peak-hour pay for delivery partners as gig worker unions threatened a nationwide strike.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.