BP banks on Castrol, Pharma firms plot expansion, and India to get 2 new airlines.

🗓 Morning, folks and Happy Friday! ☀️

💡 Spotlight: IT stocks bear the brunt to H1-B woes 📉

The U.S. government announced changes to the H-1B work visa selection process, scrapping the random lottery system in favour of a model that prioritises higher-skilled and higher-paid applicants.

H-1B visas are a key route for U.S. companies to hire foreign talent, with Indian professionals forming one of the largest groups of visa holders. The change raises onsite staffing costs and limits talent flexibility for Indian IT firms, pressuring margins and near-term growth expectations.

IT stocks reacted negatively to the news. Tech Mahindra led the decline followed by Coforge, Wipro, and Persistent Systems which also ended in the red.

Let’s hit it!

1 Big Thing: BP spun the Castrol wheel & Dalal Street noticed 👀

Global oil major BP has agreed to sell a 65% stake in Castrol to investment firm Stonepeak for about $6 billion. The stock ended nearly 2% higher following the update.

Breaking it down: the deal values the lubricants business at $10.1 billion including debt.

The India impact was immediate. Castrol India shares jumped nearly 8%, as investors cheered the prospect of sharper focus, capital backing and operational clarity.

Why is BP selling: BP said the entire proceeds will go towards cutting net debt, and the deal forms a big part of its plan to divest $20 billion of assets by 2027. The urgency comes after years of underperformance and mounting pressure from activist investor Elliott Investment Management, which has been pushing BP to move faster and harder.

Zoom out: and this is also a strategy reset. BP kicked off the Castrol sale earlier this year as part of a broader pivot back to its core which is oil and gas, lower costs, and a leaner balance sheet.

For India, the question now is whether a new majority owner brings sharper execution and growth ambitions to Castrol India or simply treats it as a steady cash machine.

More on acquisitions💰,

Bharti Enterprises and private equity heavyweight Warburg Pincus are stepping into India’s fast-growing appliances space with a 49% stake acquisition in Haier India.

Breaking it down: the remaining 49% will stay with Haier Group, keeping the global parent firmly in the driver’s seat.

Haier India is already a familiar name in Indian homes, making everything from air conditioners and refrigerators to washing machines, TVs, and kitchen appliances.

What’s the ambition: scale up manufacturing in India. More local production means faster growth, better supply chains, and a stronger grip on a market that’s heating up quickly.

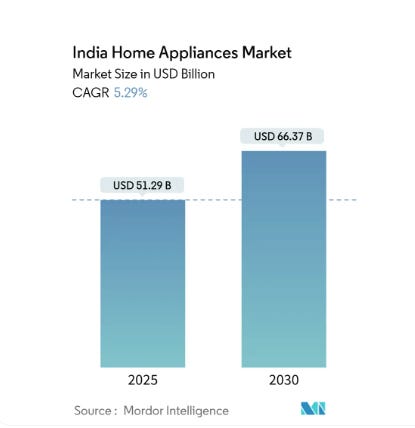

Zoom out: India’s consumer appliance market is on a strong upward curve, powered by rising incomes, evolving lifestyles, and first-time buyers across the country.

2. Zydus sharpens its US biosimilar play 💪🏻

Zydus Lifesciences’ arm Zydus Lifesciences Global FZE, has entered into a partnership with Swiss biopharma firm Bioeq AG to license, supply, and commercialise NUFYMCO.

What’s poppin’: NUFYMCO is a lower-cost, FDA-approved alternative to Lucentis, used to treat serious eye conditions.

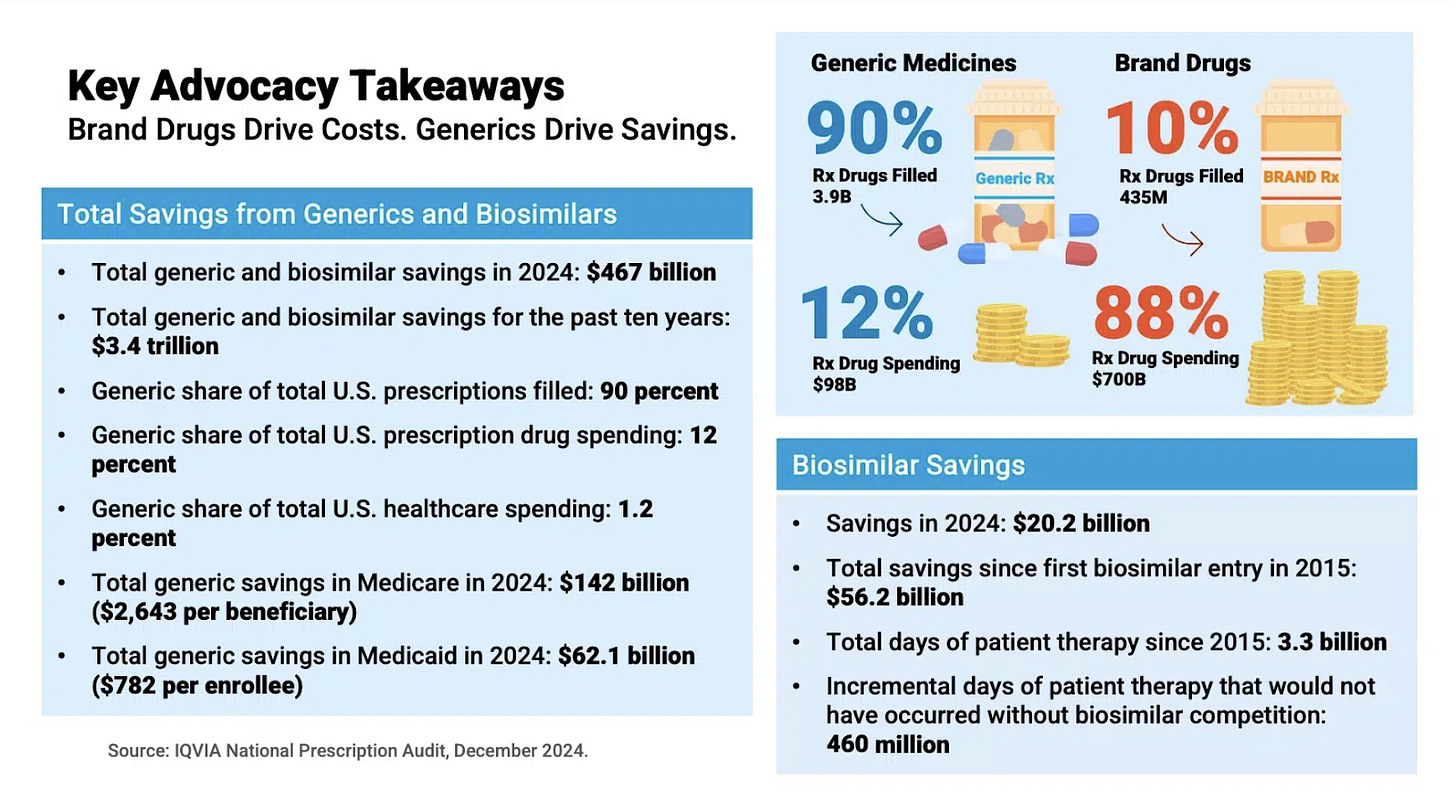

Zoom out: the U.S. biosimilars market is becoming a major force in healthcare. Since 2015, biosimilars have delivered over $56 billion in savings, with $20.2 billion saved in 2024 alone.

High-cost therapies like eye and cancer treatments are leading this shift, which explains why companies like Zydus are scaling up their U.S. biosimilar presence through partnerships.

3. What’s brewing on Venture Street? 💸

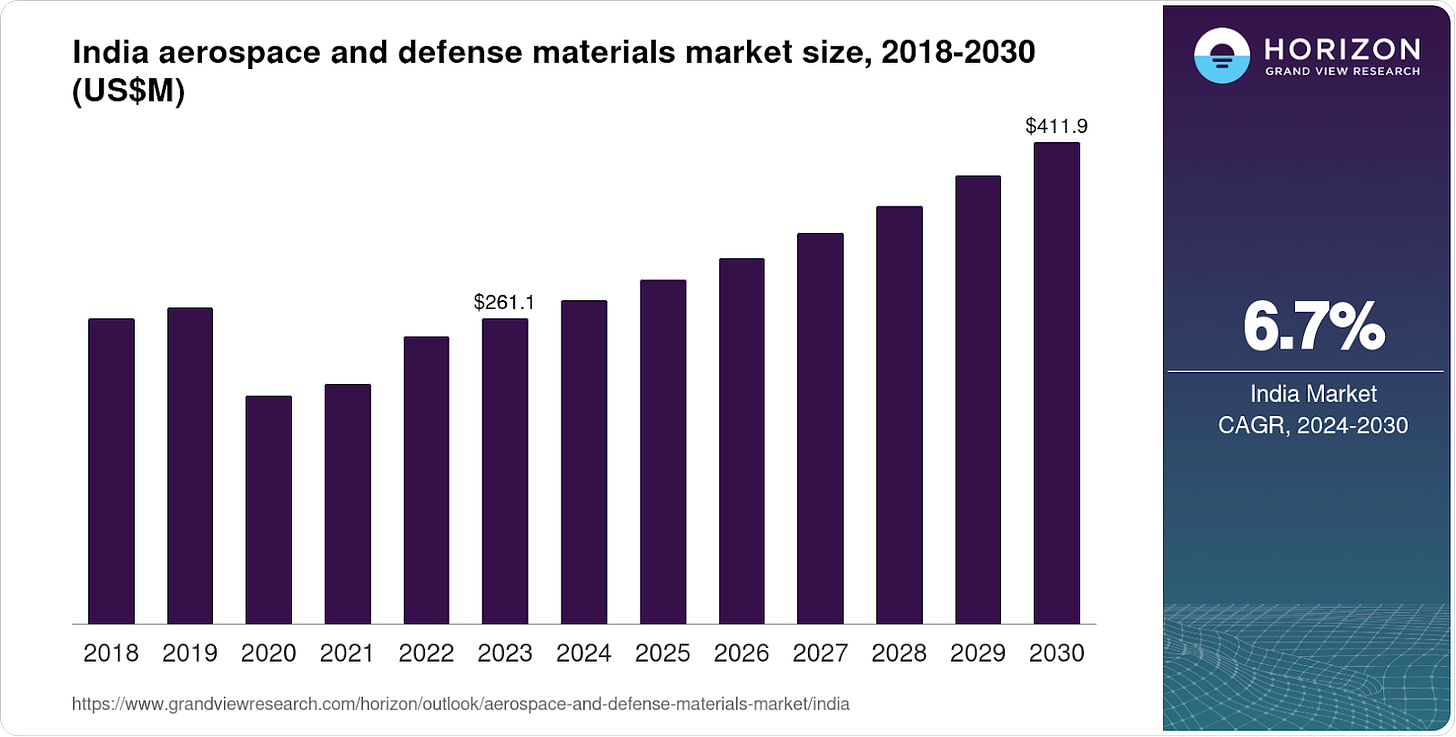

Aerospace and defence tech firm CoreEL Technologies raised $30 million in a Series B round.

CoreEL builds advanced electronic systems for applications across radar, electronic warfare, avionics and MILCOM, serving clients like DRDO, defence PSUs and the Ministry of Defence.

What’s going on: the round was led by ValueQuest Scale Fund, with continued backing from 360 ONE Asset.

The fundraise comes shortly after CoreEL acquired the aerospace and defence systems division of Lekha Wireless. The deal added indigenous intellectual property, proven wireless technologies, and specialised engineering talent to CoreEL’s capabilities.

Zoom out: India’s aerospace and defence materials market is on a steady growth path, expected to reach $412 million by 2030. Driven by a 6.7% annual rate, the expansion reflects rising defence spending.

4. Stocks that kept us interested 🚀

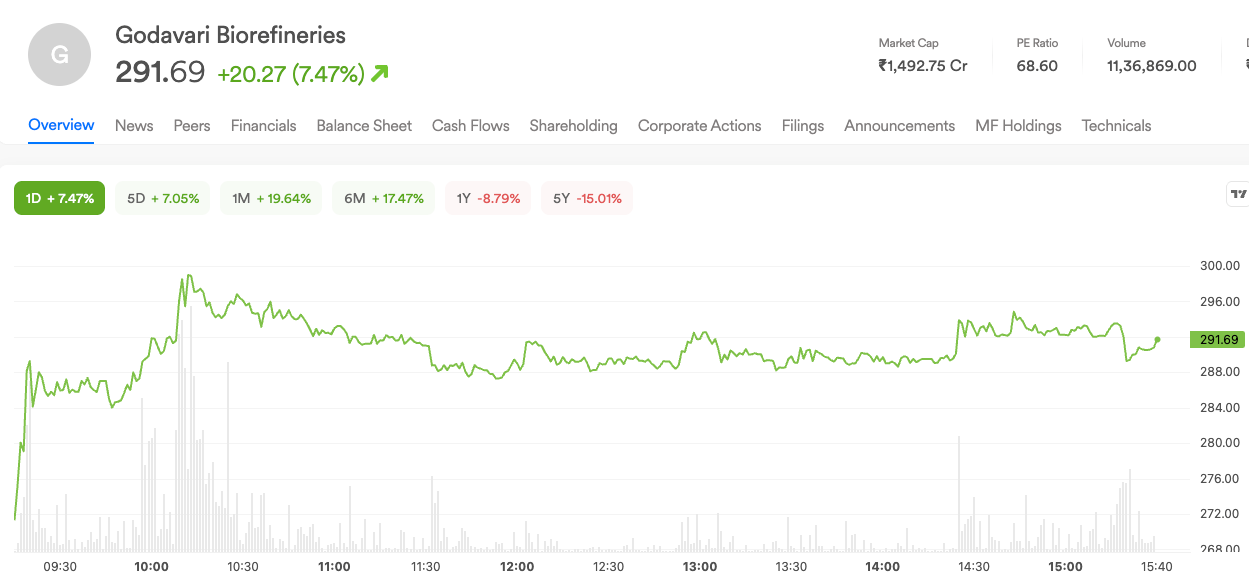

1. Godavari Biorefineries climbs on US expansion plans 🇺🇸

Godavari Biorefineries shares surged over 7% on Wednesday as the company expanded operations in the US with the incorporation of a new subsidiary.

Godavari Biorefineries is in the space of integrated biorefineries specialising in bio-based chemicals, ethanol, sugar, and power production.

Godavari Biorefineries says that the strategic expansion will strengthen its clinical-stage biotechnology presence in the US.

With the new step-down subsidiary, the company will primarily focus on global out-licensing of intellectual properties, and build the network to accelerate the drug-development programme.

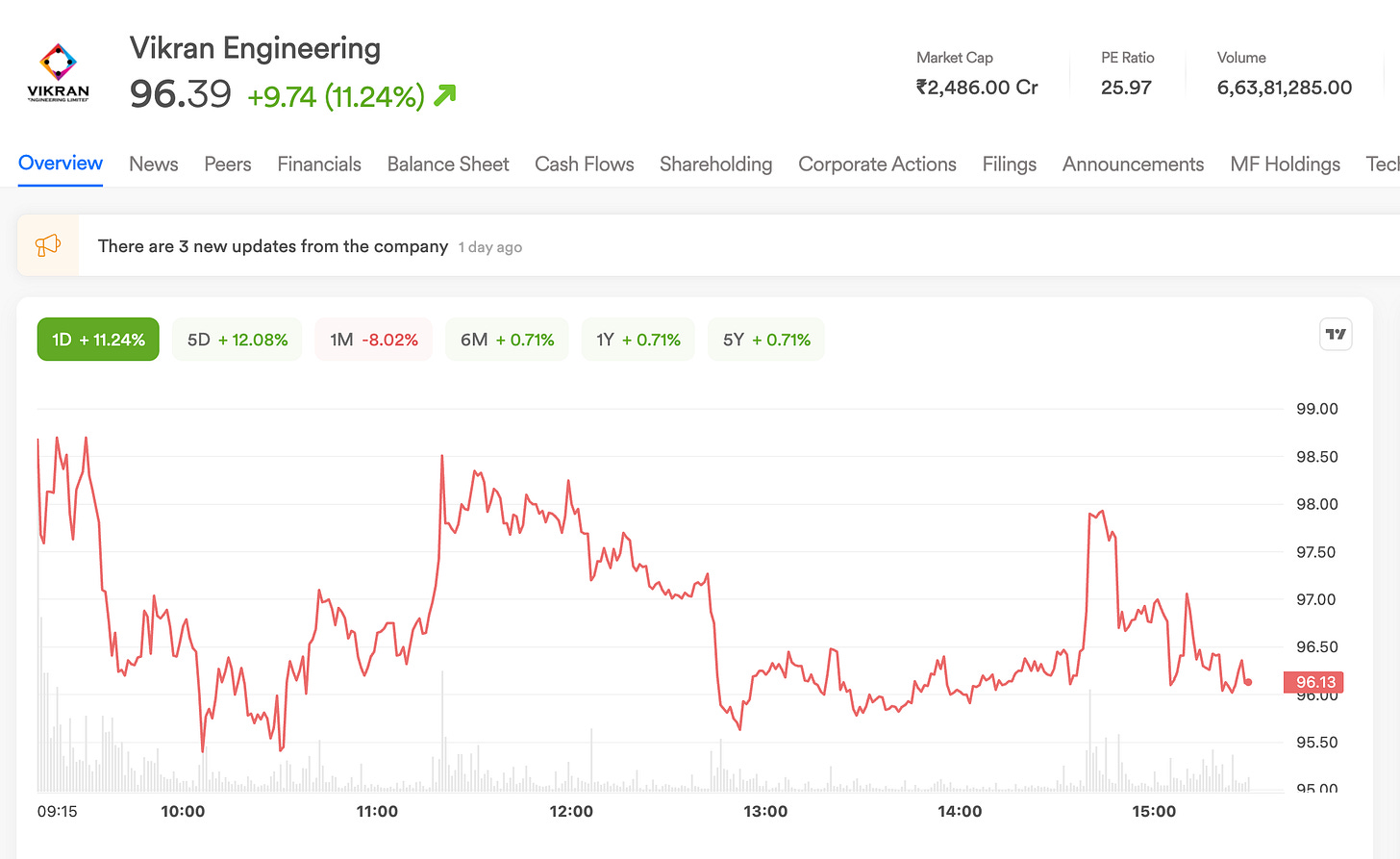

2. Vikran Engineering soars on ₹2,035 crore solar win ☀️

Vikran Engineering secured a major ₹2,035 crore work order from Onix Renewables to develop a 600 MW AC solar power project. The stock jumped 11% in the previous trading session following the news.

For context: Vikran Engineering works on power lines, water supply systems, and railway electrification, handling everything from planning and design to construction and final setup.

What’s happening: the company will design, build, and fully commission solar plants across multiple locations in Maharashtra. The deal also includes the supply of solar panels and inverters.

The ₹2,035 crore order is almost as big as Vikran Engineering’s entire market cap of about ₹2,500 crore, highlighting just how significant this win is for the company.

Not only that, the company has also won a ₹459.20 crore contract from NTPC Renewable Energy to work on a 400 MW solar power project at Chitrakoot-1 in Uttar Pradesh.

Filter Coffee OOO 🎉

This year, we at Filter Coffee have been on a mission: bringing you the latest business news, startup scoops, and more, basically almost every single day!

It’s been a crazy year 2025, so we decided to take a break and unwind! Besides, the biz world is on snooze anyway (long as you’re not looking at the portfolio!).

We’ll be back with the daily starting Thursday, 1st Jan 2026. Until then… we wish you a happy, joyful New Year. Don’t go easy on the sweets or those vodka shots. 🤙 Ciao!

What else are we snackin’ 🍿

✈️ Aviation boost: India has cleared two new airlines after recent IndiGo disruptions, aiming to increase competition and resilience in the aviation sector.

🚀 ISRO success: ISRO ended 2025 strong Wednesday, launching its powerful LVM3 Baahubali rocket to lift America’s heaviest satellite ever from Indian soil.

🤖 Robotics bet: Info Edge’s arm Redstart Labs invested approximately ₹46.8 Crores in Unbox Robotics.

💎 Platinum rally: Platinum hit a record $2,378/oz, surging 162% in 2025 - about twice gold’s gains, driven by geopolitical tensions, a weaker dollar, and tight supply fuel demand.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork next year :)

Hit that 💚 if you liked this issue.