Auto sales soar, Defence tech indigenised, and Disney opens AI.

🗓 Morning, folks! ☀️

India auto sales notch best-ever November as cars, bikes hit records 🚗

India’s auto industry saw a strong YoY growth in November 2025 across Passenger Vehicles (PVs), two-wheelers, and three-wheelers, according to SIAM.

Here’s the quick scorecard:

- Passenger vehicle dispatches up 19% YoY

- Domestic PV sales at 4.1 lakh units, the highest ever for November, up 18.7%

- Two-wheeler sales at 19.4 lakh units, up 21.2%

- Three-wheeler sales at 71,999 units, up 21.3%

- Total production at 29.4 lakh units, vs 24.07 lakh last year

🛣️ On a different note:

This week, we took Filter Coffee off the internet again, this time to Pune, into a part of e-commerce most of us never see.

Every day, India moves ~30 million parcels. Behind that speed are warehouses where sorting, routing, and movement decide whether your order arrives today or tomorrow. Most of these systems were built for a slower era, and they’re now under real strain.

We went inside Unbox Robotics to see how that backbone is being rebuilt. Instead of conveyor belts and endless manual labour, Unbox runs a swarm of modular robots that scan, sort, and reroute parcels inside warehouses.

We spoke to Unbox’s founder, Pramod Ghagde to understand why India’s logistics future won’t be fixed by adding more people, but by redesigning the warehouse itself.

Full story here 👇

1 Big Thing: November inflation softer than expected at 0.71% 📉

India’s retail inflation inched higher in November, with headline CPI at 0.71%, slightly below expectations but up from October’s ultra-low 0.25%.

The headline number rose, but it’s still comfortably low by historical standards, thanks largely to food prices staying in deflation.

What’s brewing: food inflation remained negative for the sixth straight month, coming in at –3.91%. That said, the pace of price drops slowed sharply, signalling that the relief from cheaper food may be easing. Vegetables were still the biggest drag at –22.2%, while pulses stayed in deflation at –15.86%.

The numbers

- Rural inflation up to 0.10% from -0.25%

- Urban inflation rose to 1.40% from 0.88%

- Fuel & light increased to 2.32%

- Housing steady at 2.95% & clothing & footwear: cooled to 1.49%

Why it matters: the data shows inflation is bottoming out, not surging. Food prices are still cushioning households, but the slowdown in deflation hints at rising costs ahead, especially for perishables.

For policymakers, this keeps the inflation narrative calm for now, but the easy gains on prices may be behind us.

2. RRP Defense ties up with Israel’s Meprolight for weapon sights 🇮🇳

RRP Defense has signed a collaboration with Israel-based Meprolight, part of the SK Group to bring next-generation electro-optic and weapon-sight technologies to India.

RRP Defense builds defence electronics and manufacturing capabilities in India. Israel’s Meprolight makes advanced weapon sight and vision systems used by armed forces around the world.

Note: the tie-up aligns with Israel’s shift from simple arms sales to deeper participation in India’s Atmanirbhar defence push.

The deets: the two companies will jointly handle sales, distribution, assembly, testing, and technology integration of Meprolight’s products for the Indian armed forces and law-enforcement agencies.

Meprolight will transfer key technologies to RRP’s Mahape facility, enabling local assembly under the Make in India framework.

This partnership brings critical defence technology closer to home. Advanced weapon optics are essential for modern soldiers to spot targets accurately, operate in low-light conditions, and improve battlefield safety. Until now, much of this equipment was imported.

For India, it also ensures that sensitive military technology stays within the country.

3. Rama Steel’s arm to acquire UAE’s Automech Group for ₹728 crore 🚧

Rama Steel Tube and its arm RST International FZE will jointly acquire UAE-based Automech Group Holding for ₹728 crore.

Rama Steel Tubes focuses on producing structural steel products that support large infrastructure and industrial projects. Whereas, AutoMech Group Holding designs and manufactures advanced metal-based engineering systems for global industrial clients.

The deets: under the deal, RST International FZE is acquiring 78% of Automech’s stake.

Rama Steel Tubes is buying the rest 22% for about ₹157 crore.

The why: this acquisition helps Rama Steel Tubes expand into new regions as per company strategy, earn revenue from more sources, and work more efficiently across its global operations. Overall, the goal is to create long-term, sustainable growth.

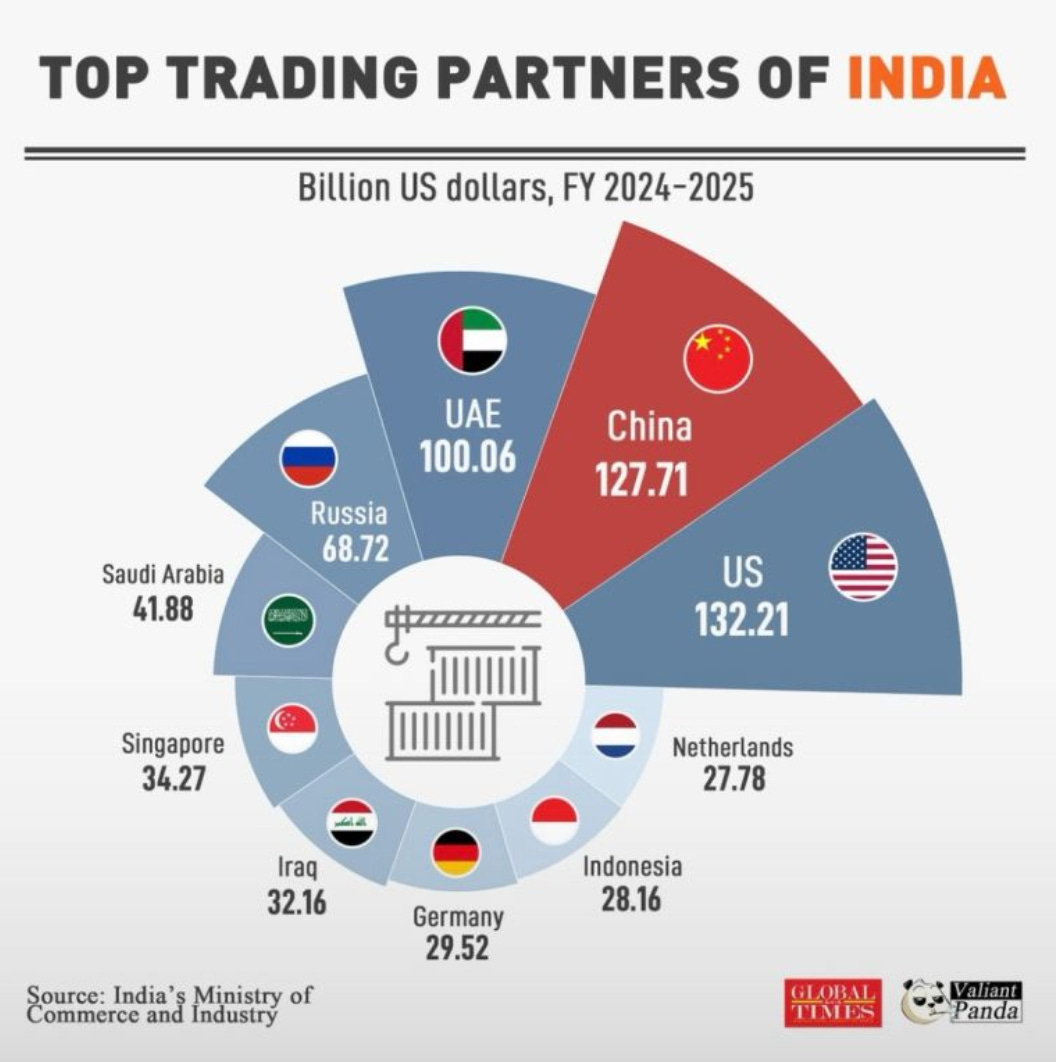

Big theme: India-UAE trade and investment ties have strengthened sharply since the 2022 CEPA agreement, with Indian investments in Dubai rising to $4.1 billion and business activity accelerating across various sectors.

This momentum is visible in the 9,038 new Indian companies registered with the Dubai Chamber in early 2025 up 14.9% year-on-year. With this UAE, is now India’s third-largest trading partner with $100 billion in trade for 2024-25.

While we are on acquisitions,

Cyient has announced that it is acquiring an Abu Dhabi-based technology consulting and digital services company called Abu Dhabi and Gulf Computer Est (ADGCE).

Why this matters: the company said the acquisition will help it expand in key sectors like energy, utilities, transportation, and connectivity.

ADGCE’s strong energy-focused capabilities will boost Cyient’s work in digital transformation, IoT solutions, data-led asset management, and field engineering.

4. Disney opens its universe to ChatGPT & Sora 🎬

Disney is teaming up with OpenAI in a three year, $1 billion deal that will let people use many of its famous characters inside ChatGPT and the video tool Sora.

What’s the deal: for the first time, a big Hollywood studio is opening up its tightly protected worlds at this scale.

Think Mickey Mouse, Marvel heroes and even Star Wars villains like Darth Vader showing up in AI generated clips and images.

The twist is that there are strict limits. The deal only allows short videos of up to 30 seconds, and the tech cannot be used to make full movies or long shows.

At the same time, Disney plans to use OpenAI’s tech behind the scenes. It will build new features for Disney+, give its staff access to ChatGPT, and experiment with fresh interactive experiences for fans.

5. Stocks that kept us interested 🚀

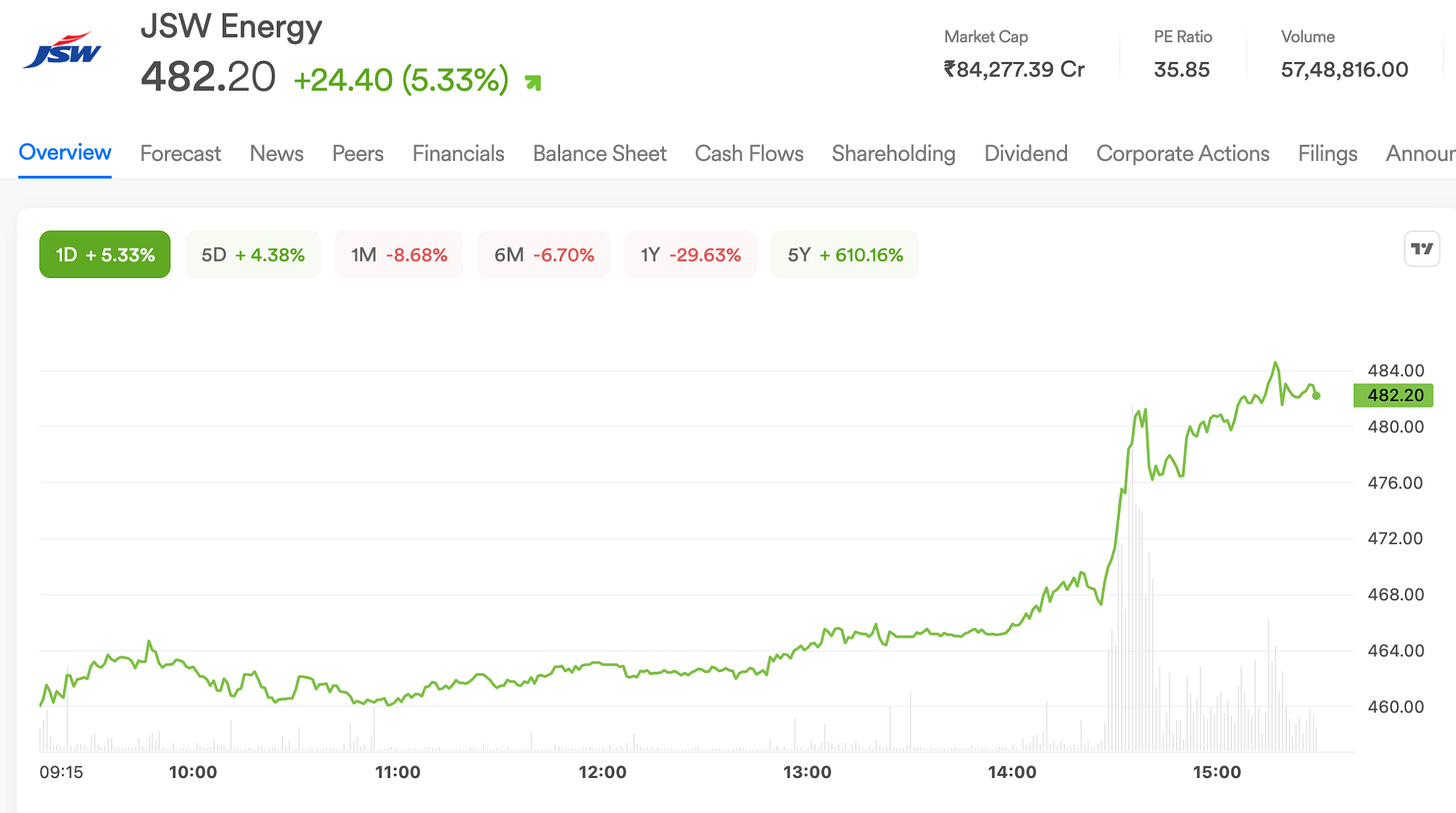

1. JSW arm to supply 400 MW to Karnataka discoms 🔌

JSW Energy’s arm JSW Energy (Utkal) has signed agreements with multiple Karnataka discoms for supply of 400 MW of power, starting April 1, 2026. The stock surged 5% on the back of this news.

400 MW is a huge amount of electricity, enough to power around 8–10 lakh homes at once. JSW Energy will supply this power to Karnataka starting April 1, 2026, helping reduce power shortages.

What this changes: with this new agreement, almost all of JSW Energy’s electricity now has secure long-term buyers. Only 5% of its capacity is unsold, down from 8% earlier.

This makes the company’s future revenues more stable and reduces the risk of relying on short-term market demand.

Looking ahead: moves like these would eventually help the company achieve 30 GW of generation capacity and 40 GWh of energy storage capacity by FY 2030 and carbon neutrality by 2050.

What else are we snackin’ 🍿

Ozempic lands: Novo Nordisk has launched its diabetes and weight-loss drug Ozempic in India, with prices starting at ₹2,200 per week.

Office boom: Brookfield Properties to invest over $1 billion to set up a Global Capability Centre (GCC) facility in Maharashtra.

Silver supremacy: Silver has overtaken Microsoft to become the world’s fifth-largest asset by market value, marking a historic milestone for the metal.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.