Hydropower projects, Chip expansion, and Haldiram’s global push.

🗓 Morning, folks! ☀️

Indian markets wrapped up a choppy session largely in the red, but the Nifty held firm above the key 25,800 mark, offering some comfort to investors.

IT stocks came to the rescue as TCS and Tech Mahindra climbed nearly 2% each, keeping the IT index in the green ahead of Accenture’s Q1 results. InterGlobe Aviation jumped nearly 3% after its CEO struck an optimistic tone.

💡 Spotlight: India’s November exports jump amid tariff headwinds 🇮🇳

India’s export momentum picked up pace in November, with goods shipments climbing 19% year-on-year to $38.1 billion. The improvement helped shrink the trade deficit to $24.5 billion, a sharp drop from October’s record levels.

A major positive came from the U.S. market, where exports rebounded strongly after two weak months even as tariff pressures lingered.

Key numbers to note:

- Exports to the U.S. rose 22.6% to $6.9 billion

- Total goods and services exports grew 15.5% to $73.9 billion

Let’s hit it!

1 Big Thing: Patel Engineering reboots 144 MW Gongri hydropower project ⚡

Patel Engineering signed a deal with the government of Arunachal Pradesh to restore and develop the 144 MW Gongri Hydropower Project in West Kameng district. This marks a major revival for a project that was earlier terminated.

144 MW Gongri Hydropower can generate enough electricity to power around 1–1.5 lakh average Indian homes at full capacity.

Breaking it down: Gongri is the first hydropower project to be restored under Arunachal Pradesh’s newly notified Hydropower Restoration Policy 2025, following state cabinet approval.

The numbers: the project is estimated to cost around ₹1,700 crore, with construction expected to take about four years.

Location significance: this project is significant because Arunachal Pradesh holds India’s largest untapped hydropower potential, yet many projects there have remained stalled due to terrain, logistics, and policy hurdles.

West Kameng sits in a high-rainfall, high-head river basin, making it naturally suited for efficient hydropower generation.

By reviving a terminated project in this region, the state lowers entry risk for future developers while strengthening local infrastructure and power evacuation from a strategically important border state.

Big theme: India has an installed hydropower capacity of about 47 GW, but its economically exploitable potential is estimated at over 145 GW, meaning nearly two-thirds remains untapped.

2. Cyient expands chip business with $93M Kinetic acquisition 🔌

Cyient Semiconductor is acquiring more than 65% of U.S. analog chip designer Kinetic Technologies for $93 million.

Cyient Semiconductor is Cyient’s specialized unit focused on electronics design and manufacturing. Whereas, Kinetic Technologies builds chips that help electronics process both digital and real-world signals.

What’s going on: chips are tiny brains inside electronics. Digital chips use on/off signals, while analog chips handle real-world signals like sound or light, and mixed-signal chips do both.

For example, your phone uses mixed-signal chips to turn your voice into digital data to send and then back into sound for the listener.

Kinetic is expected to contribute around 6% of Cyient’s FY26 revenues, while opening new opportunities to cross-sell services and attract clients needing advanced chip solutions.

Zoom out: the broader Indian semiconductor market (which includes analog, digital and other chips) was valued at around $45–50 billion recently and could exceed $100 billion by 2030, showing huge internal demand.

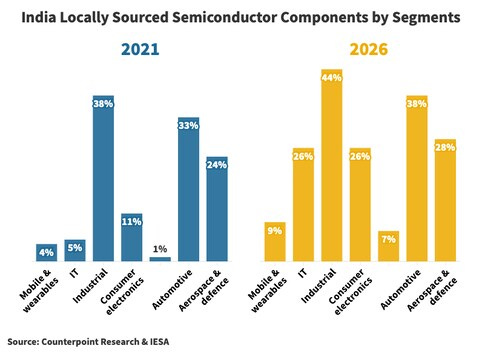

Additionally, India is expected to significantly increase its local sourcing of semiconductor components across all segments by 2026, with the Industrial and Automotive sectors leading at 44% and 38% respectively.

3. KP Group makes a bold energy play in Botswana ⚡

KP Group signed a deal with the Botswana government to work together on large renewable energy projects, including power generation, energy storage, and transmission.

The deets: under the MoU, KP Group and Botswana will jointly develop renewable energy projects worth about $4 billion (₹36,000 crore).

The why: the partnership supports Botswana’s goal of going net-zero by 2030.

The plan also focuses on training and upskilling local youth so they can take part in Botswana’s shift to clean energy.

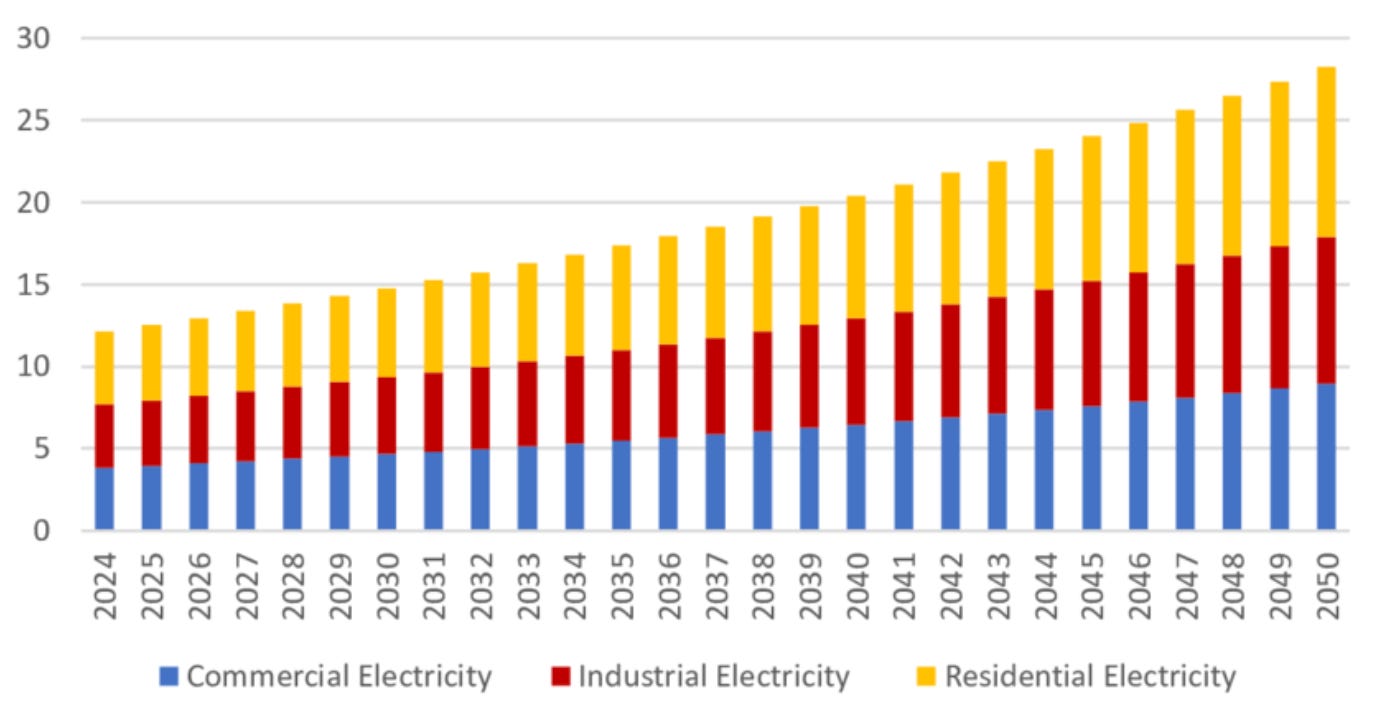

Big picture: Botswana faces power challenge as shortages are cutting up to 1% from its GDP each year, and demand from mining and growing cities is already higher than what the country can produce.

It also struggles with unreliable power, is highly dependent on coal, and must buy costly electricity from neighbours. Projects like these will help the country bridge this energy gap while helping it achieve its net zero goals.

4. Haldiram’s gets backing from L Catterton for global snack ambition 🍿

L Catterton has entered into a strategic partnership with Haldiram’s for an undisclosed amount, giving the iconic Indian snacks brand a global growth ally.

Quick context: L Catterton is a global consumer-focused investor known for scaling household brands.

The deets: the partnership brings L Catterton’s global consumer expertise, operating playbooks, and industry network to Haldiram’s, alongside access to local talent and market insights.

What changes on the ground: the investment will fuel brand building, new product launches, supply chain and distribution optimisation, geographic expansion, and leadership development.

Why it matters: for Haldiram’s, this is about moving from a dominant domestic player to a global packaged snacks brand. For L Catterton, it’s a bet on India’s fast-growing consumer market and a brand with deep cultural recall.

5. Stocks that kept us interested 🚀

1. Antony Waste secures Mumbai management contracts 🗑️

Antony Waste Handling Cell announced that its subsidiary, AG Enviro Infra Projects, has secured two major collection and transportation contracts. The stock gained 16% on the back of this news.

The venture will manage around 1,250 metric tons of municipal waste per day across key Mumbai wards.

The significance: Mumbai produces about 11,000-12,000 metric tons of waste every day, and much of it isn’t properly treated. The city’s main landfills viz. Deonar, Mulund, and Kanjurmarg are already at capacity.

A contract like this can help reduce the waste burden and support the city in improving its ranking in the Swachh Survekshan 2024-25 national sanitation survey.

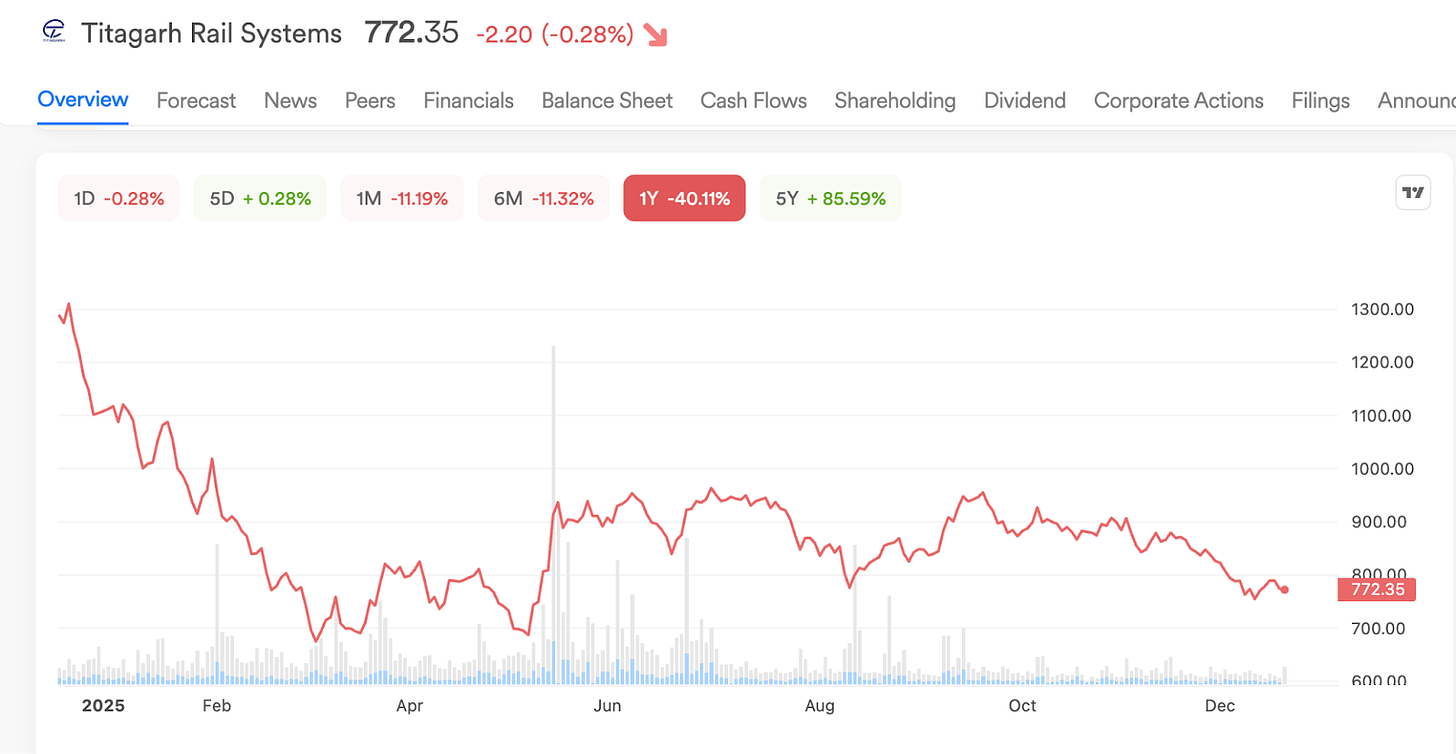

2. Titagarh’s ₹273 cr order signals shift into rail safety🚦

Titagarh Rail Systems bagged order worth ₹273 crore from the Ministry of Railways for 62 Rail Borne Maintenance Vehicles (RBMVs), including training and maintenance support.

What’s the deal: the RBMVs are self-propelled, on-track maintenance machines designed for inspection, repair, and restoration of rail infrastructure.

This marks the company’s entry into the technology-driven, safety-critical rail maintenance segment, moving beyond its traditional rolling stock business.

Why it matters: the vehicles use advanced mechanised systems for track and overhead equipment works, boosting safety, reliability, and operational efficiency.

These vehicles are special trains that fix and maintain railway tracks and overhead wires without stopping rail traffic for long. They inspect tracks for cracks, alignment issues, and wear, repair rails, tighten or replace components, and maintain overhead electric lines.

What else are we snackin’ 🍿

💊 Lupin expands: Lupin’s Philippines and Brazil units signed an exclusive licensing agreement with Italy’s Neopharmed Gentili to market gastro drug Plasil in their markets.

📈 Export boost: India is set to add $2 billion in exports within two years after its trade deal with Oman comes into effect.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.