BHEL reports strong Q3, NALCO's rare earth play, and spacetech gets funding.

🗓️ Morning, folks! ☀️

Monday wasn’t kind to the markets.

Stocks opened the week on a sour note as earnings let investors down, and the selling only got louder through the day. The Sensex and Nifty both ended around 0.4% lower.

It was mostly red across sectors too, only FMCG and auto managed to stay in the green, and even that was just a sliver.

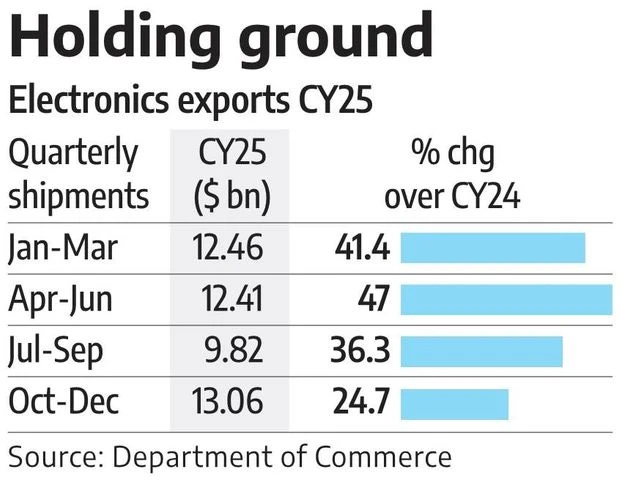

💡 Spotlight: Electronics exports hit the highest in one year ⬆️

India’s electronics exports hit a record $47 billion in 2025, driven mainly by smartphones, which made up nearly 67% of shipments.

iPhones alone accounted for 46% of total electronics exports and nearly 75% of smartphone exports, emerging as the biggest growth driver. Government production-linked incentive and export schemes played a key role in driving this rally.

Let’s hit it! 💪🏻

1 Big Thing: BHEL delivers a strong Q3 💸

State-run defence company BHEL delivered a strong set of Q3 results, but the stock still slipped after the numbers came out.

Here’s what stood out:

Net profit: up 190% YoY at ₹390 cr vs ₹134.70 cr

Revenue: up 16.4% YoY at ₹8,473 cr vs ₹7,277 cr

What’s driving the growth: the power business remained the heavyweight, bringing in ₹6,322.3 crore for the quarter. The industry segment added another ₹2,150.7 crore. Both segments grew versus last year, suggesting order execution is improving and projects are moving faster.

Why did the stock fall: the board approved a ‘short closure’ of its planned new plant in Varanasi, citing the current business environment.

In simple terms, the company is ending the project early and shifting the planned products to its existing factories instead.

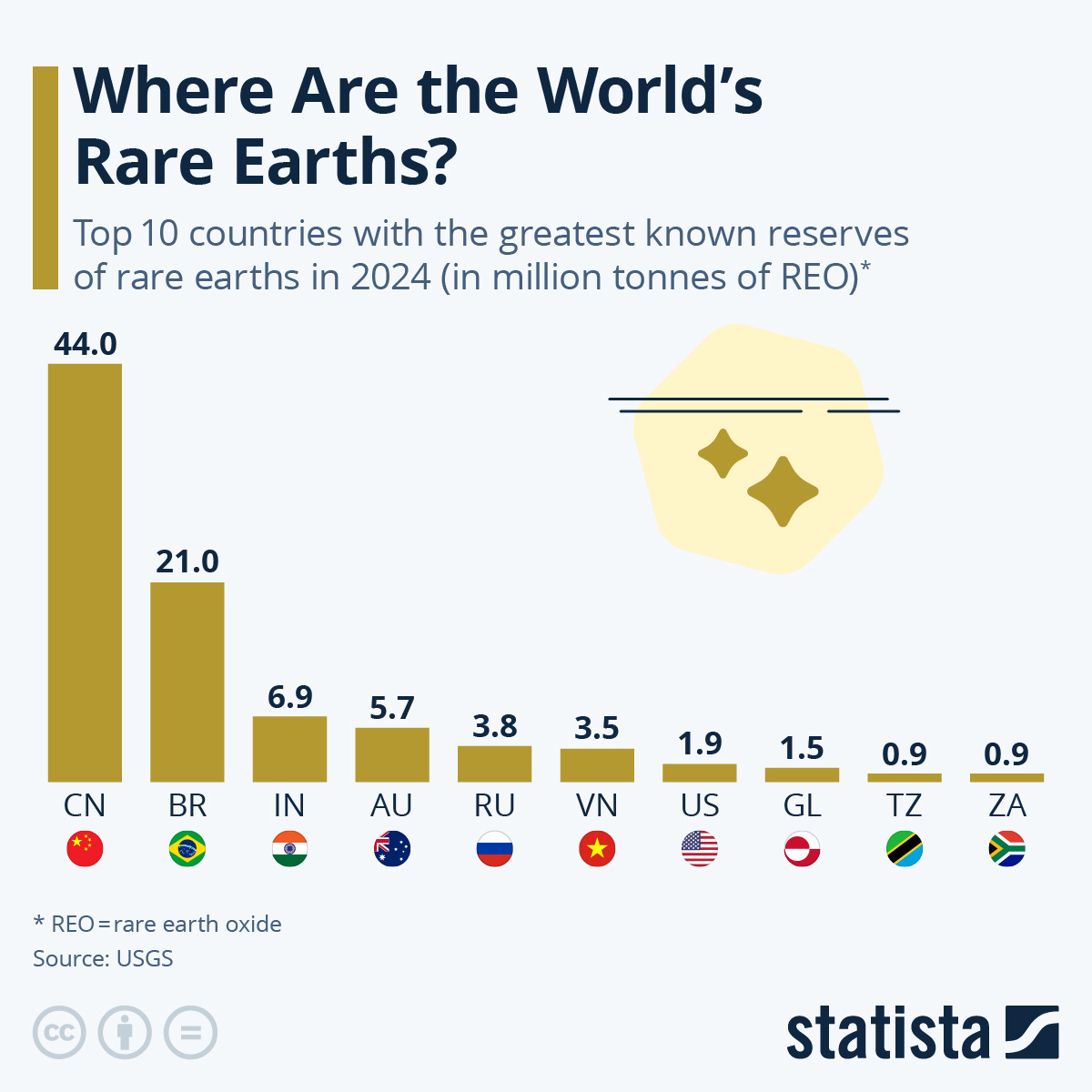

2. NALCO eyes rare earths push 🧲

NALCO is planning to move beyond aluminium and enter the rare earth and critical minerals space.

What’s the plan: the company is exploring bids for rare earth elements, magnesium, and chromite mines in India. At the same time, it is also looking to buy a stake in a lithium mine in Australia through KABIL, a PSU joint venture it is already part of.

If this works, NALCO moves from being a traditional metal producer to a supplier of high-value strategic minerals.

Why it’s important: the future is being shaped by EVs, renewables, defence tech, and electronics, all of which need rare earths and lithium. NALCO wants a piece of this next-generation materials game instead of staying limited to bauxite and alumina.

Additionally, China controls nearly 80% of global rare earth supply today. This gives it massive leverage, especially during trade wars or geopolitical tensions.

3. $1.8B deal brings Taiwan & US together 🤝

Taiwan’s Powerchip is suddenly in the spotlight, after Micron announced its moving to buy one of its chip plants.

What’s happening: Micron has signed a deal to acquire Powerchip’s P5 fabrication site in Tongluo, Miaoli County, for $1.8 billion in cash.

In simple terms, Micron wants to get its hands on a ready-to-run manufacturing space, because building chip capacity from scratch takes years.

Powerchip is one of Taiwan’s key semiconductor foundries, known for making legacy chips (older, widely used chips) as well as memory chips.

For Micron, the prize is clear: more room to make Dynamic random-access Memory (DRAM), the memory used in everything from laptops and servers to smartphones.

Micron says the deal should start boosting its DRAM wafer output from the second half of 2027. This purchase is also part of Micron’s larger growth push worldwide.

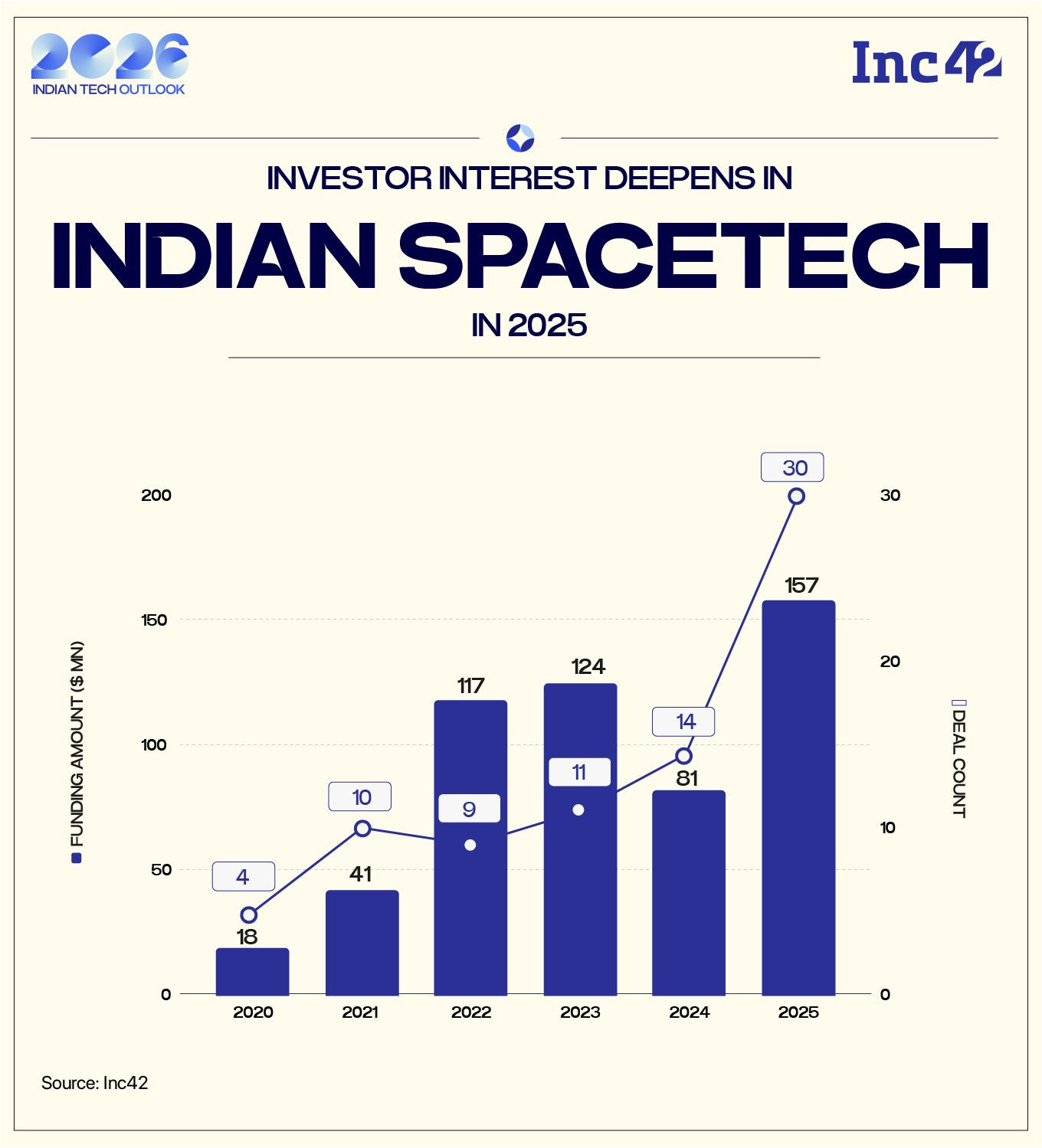

4. Spacetech EtherealX gets $20.5 million 🚀

Space technology company Ethereal Exploration Guild (EtherealX) has raised $20.5 million in Series A funding round.

The Bengaluru-based company aims to cut space travel costs, accelerate scientific research, and drive long-term human progress.

The deets: the company wants to build the first fully reusable medium-lift rocket, Razor Crest Mk-1 that can carry nearly 25 tonnes to low Earth orbit (LEO).

In simple terms, the rocket can send very large or multiple satellites into space in one go, making launches more efficient.

The paint point it’s solving: current costs for private space launches range from $2,600 to over $10,000 per kilogram, depending on the mission. Ethereal aspires to lower that to $500 to $1,000 per kilogram using its specially designed rocket engine system and in-house testing infrastructure.

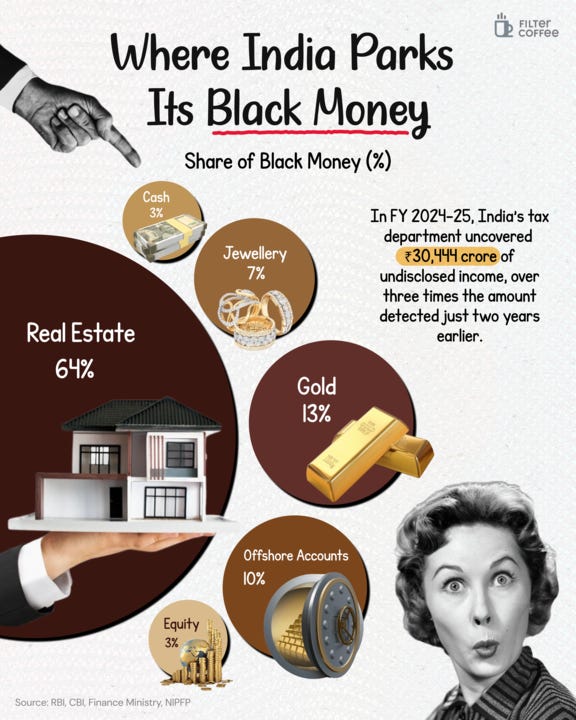

5. What’s India’s favourite parking spot for black money? 👇🏻

If you’re wondering where India’s black money really sits, the answer hasn’t changed much. Real estate accounts for a dominant 64% of black money holdings, making property the go-to asset for parking undisclosed wealth.

Despite tighter scrutiny, data suggests black money is still finding refuge in traditional channels, especially property, highlighting the persistent challenge for enforcement agencies trying to bring hidden wealth into the formal economy.

6. Stock that kept us interested 🚀

1. CG Power bags ₹900 crore export deal ⚡

CG Power bagged a ₹900 crore export order from US-based Tallgrass Integrated Logistics Solutions. This marked its entry into the global data centre space. The stock gained 5% reacting to the update.

FYI, this is the largest single contract in the company’s history.

The deets: the order is for power transformers, which are core equipment used to manage and stabilise electricity inside large data centres.

These transformers are built for high reliability and round-the-clock uptime. This is critical for data centres running cloud services and AI workloads, where even a short power failure can cause major disruptions.

What else are we snackin’ 🍿

📊 Growth upgrade: the IMF raised India’s growth forecast, pegging GDP at 7.3% for FY26 and 6.4% for FY27, citing stronger-than-expected momentum despite moderation ahead.

📉 Crypto jolt: Bitcoin fell 3.6% to below $92,000 after Trump’s new tariff news spooked markets, wiping out $600 million of ‘price will go up’ bets.

📦 Last-mile bet: Shadowfax is all set to hit Dalal Street to fund scale in India’s delivery economy, betting that volume, tech, and operational discipline can finally tame thin logistics margins.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.