Retail IPO, Distress sale, and Gold hit a record high.

🗓 Morning, folks.

Global stocks continue to remain volatile, shaken by Trump’s tariff swings.

In India, investors are waiting for more clarity on a potential trade deal. Rumors are, India has agreed to buy Gold from the US.

Back in the U.S., the S&P and Nasdaq bounced back, fueled by hopes of key concessions from the Trump administration.

💡 Spotlight: Gold is having a moment.

Prices surged to a record $3,254/oz as investors piled into safe-haven assets amid growing fears of a trade war and economic slowdown.

India followed suit—gold hit an all-time high of ₹93,940 per 10 grams, powered by global jitters and a softer rupee.

1 Big Thing: Trump spares the chips (for now) 💻

Late Friday, Trump issued a clarification memo on his 125% “reciprocal” tariff plan but it came with a YUGEE asterisk.

The update: over 20 categories of electronic goods have been temporarily exempted, including semiconductors, smartphones, laptops, SD cards, and TVs. That’s a ~$390 billion chunk of U.S. imports, more than $100 billion of it from China.

Why it matters: it’s a partial breather for U.S. tech firms, many of whom manufacture in China and were staring down crushing duties. Apple, for one, had reportedly chartered 600 tons of iPhones in a panic shipment last week.

But don’t get too comfortable. These goods still face:

- A 10% blanket tariff on all imports to the U.S.

- A 20% China-specific tariff that predates the latest round

And soon, a separate semiconductor tariff, expected within a couple of months.

The nuance: “This isn’t a free pass,” Commerce Secretary Howard Lutnick clarified on ABC’s This Week. “These are national security exemptions—we want this stuff made in America.”

Even Beijing nodded at the move, calling it a “small step toward correcting wrongful unilateral action.” But so far, there’s been zero formal engagement between Washington and Chinese officials.

Zoom out: tech may have caught a break, but the tariff chessboard is still live. And the big hit—the semiconductor tariff—is just a few moves away.

While we’re on electronics...⚡️

Apple’s top vendor Foxconn is scouting for a new manufacturing site in Greater Noida, eyeing a 300-acre plot along the Yamuna Expressway, per ET.

The proposed facility could be bigger than its Bengaluru plant and would mark Foxconn’s first footprint in North India.

The move gives Foxconn a stronger hedge in India’s growing electronics manufacturing landscape—especially with Greater Noida as a serious Emerging electronics manufacturing services (EMS) hub alongside Chennai.

2. Good Glamm offloads MissMalini 📉

Another one bites the dust at Good Glamm.

GGG has sold MissMalini Entertainment, its influencer-led media arm, to marketing agency Creativefuel in a distress deal reportedly worth just ₹4 crore.

The deets: MissMalini is a digital lifestyle platform covering celebs, fashion, beauty, and all things pop culture, targeting India's Gen Z and millennial crowd.

As part of the deal, Creativefuel will take over MissMalini’s domain name and social handles, while GGG retains the influencer talent business.

Some backstory: GGG had acquired five business units from MissMalini in 2021—including Girl Tribe, Agent M Creative, and MM Studios.

The buyer, Creativefuel, has been on an acquisition spree. It recently picked up YouTube-first brands like Hasley India and Pataakha, and is building out a portfolio of digital-native media and marketing plays.

Context: the sale is part of a large cleanup at GGG. The group is scrambling to cut losses and offload non-core assets.

It has already sold off Sirona and ScoopWhoop, and is now looking for buyers for Organic Harvest and The Moms Co. The company also laid off 150 employees last April, and saw its CEO exit shortly after.

By the numbers:

- FY23 losses ballooned to ₹917 crore, up 153% from ₹363 crore the previous year

- Revenue hit ₹603 crore, but much of that was acquisition-led

Zoom out: once a D2C darling, Good Glamm is now in deep restructure mode—selling fast, cutting deep, and trying to rewrite its playbook before time runs out.

3. The IPO train keeps rolling 🥳

Amazon-backed More Retail is gearing up for an IPO next year, looking to cash in on India’s growing appetite for grocery and convenience shopping.

The deets: the Mumbai-based supermarket chain operates 775 stores and plans to double that count in five years.

Its hybrid model—where stores double up as fulfillment hubs for Amazon Fresh—has boosted both margins and efficiency.

Why it matters: in FY25, More clocked ₹5,000 crore in gross sales, up 11% YoY, with same-store sales rising 23%.

The company is leaning deeper into e-grocery, with plans to open 500+ new stores across 160 cities in the next 18 months.

Zoom out: India’s e-grocery market has exploded, now worth $6–7 billion, with quick commerce driving nearly two-thirds of online grocery orders.

While we are on fundraises,

Digital health and wellness startup Mosaic Wellness, raised $20 million in a new funding round led by Think Investment.

The deets: the platform runs digital-first health brands for men, women, and kids. Its flagship brand, ManMatters, offers products and services around derma, sexual wellness, hygiene, and nutrition.

In FY24, the company posted a 61.7% revenue jump to ₹333 crore, up from ₹206 crore the previous year.

4. Stocks that kept us interested 🚀

1. Biocon’s big breakthrough

Biocon jumped over 5% after its subsidiary bagged US FDA approval for Jobevne, a cancer drug.

The deets: Biocon is known for it’s biosimilars and oncology drugs, making high-cost treatments more accessible.

Jobevne is a medicine that works like another cancer drug called Bevacizumab. It helps slow down the growth of tumors by blocking the blood flow that helps them grow, kind of like cutting off their food supply.

The approval deepens Biocon’s oncology presence in the US, alongside its other FDA-approved drugs OGIVRI and FULPHILA.

- BHEL bags an agri contract

BHEL signed a 10-year agreement with Italy’s Nuovo Pignone to upgrade old compressors used in India’s fertilizer plants.

The deets: Bharat Heavy Electricals Limited (BHEL) is a government-owned engineering giant that builds heavy-duty equipment like turbines, boilers, and transformers for power, defence, railways, and industrial use.

Under the MoU, BHEL will take the lead on compressor train revamp projects, while Nuovo Pignone will be its official partner with a role.

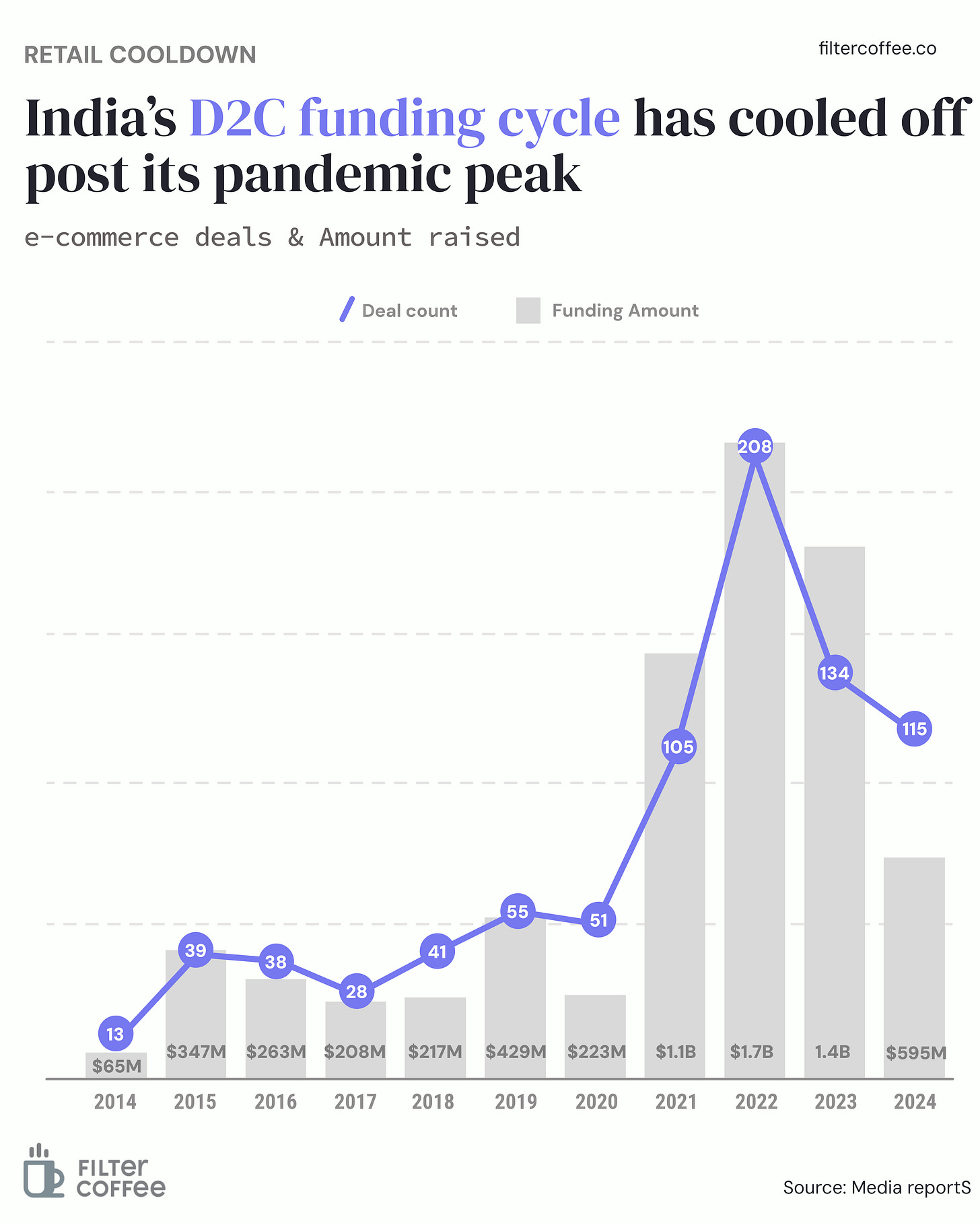

5. Story in data: D2C cooldown 📊

D2C e-commerce was the poster child of India’s startup surge during the pandemic, with capital flooding into online-first beauty, fashion, and wellness brands.

Funding peaked in 2022 at $1.7B across 208 deals. But investor enthusiasm has waned with 2024 tracking just $595M.

Rising costs, growth fatigue, and tougher unit economics have changed the game.

For brands, it’s no longer about scale at all costs—but survival with margins.

What else are we snackin’ 🍿

🤖 AI Lie: Shopping app Nate, once hyped for one-click AI checkout, is under fire after it was revealed to be using manual workers. Its founder now faces fraud charges.

🚗 Booking break: Tesla has paused new orders for its Model S and X in China, as trade tensions between Beijing and Washington escalate.

💸 Payment surge: Mobile transactions in India hit ₹198 lakh crore in H2 2024—up 30% YoY and nearly 15x higher than all debit + credit card spending combined.

🔆 Powering up: NHPC has kicked off commercial ops for 107 MW of its 300 MW solar project in Bikaner, Rajasthan—marking a key step in its green energy push.

🤖 Startup boost: The govt’s new ₹10,000 crore Fund of Funds will focus on backing early-stage startups in AI, new-age tech, and machine building, as part of its next-gen innovation push.

That’s a wrap! Don’t let the Tuesday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.