Reliance earnings resilience, Maruti's Gujarat expansion, and Snabbit startup shuffle.

🗓️ Morning, folks! ☀️

A roadblock has popped up for the EU–US trade deal, with lawmakers in the European Parliament saying they’ll stop it from moving ahead next week.

The move took place after US President Donald Trump announced an extra 10% tariff on imports from eight European countries after Europe refused to back the Greenland purchase plan.

Now, the EU’s two most powerful political groups, the European People’s Party (EPP) and the Socialists & Democrats (S&D) are pausing the approval process.

Let’s hit it!

1 Big Thing: Reliance shows where India’s growth engines actually are💪🏻

Reliance Industries’ Q3FY26 numbers came in a touch better than expected, even if not everything fired at full throttle.

Numbers to keep an eye on:

- Net profit: ₹18,645 crore (vs ₹18,540 crore YoY)

- Revenue: ₹2.65 lakh crore (vs ₹2.40 lakh crore YoY)

- EBITDA margin: 17.4% (down from 18.3% YoY)

Reliance’s Oil-to-Chemicals business posted ₹1.62 lakh crore in revenue, slightly higher than last quarter’s ₹1.61 lakh crore and up 8.7% from a year ago.

Numbers improved as fuel prices were favourable and sulphur sales brought in more money. However, weak chemical business and higher shipping costs limited the upside.

Jio added more subscribers, powered by offerings built on its tech stack.

Retail revenue rose 9.2% YoY to ₹86,951 crore, while profit edged up 2.7% to ₹3,551 crore.

Quick pulse: Shein booking revenue continued to climb, backed by strong app traction, 6.5 million+ installs, and a wider product range now topping 50,000 options.

Premium brands stayed steady too, helped by festive demand and new launches, including an exclusive tie-up with Fabletics.

2. Waaree Renewables shines in Q3 ☀️

Waaree Renewables Technologies put up a power-packed Q3, profits more than doubled, and revenue climbed sharply from last year.

Breaking it down:

- Net profit up 124.7% YoY at ₹120 crore vs ₹53.4 crore

- Revenue up 136.1% YoY at ₹851.06 crore vs ₹360.3 crore

The company has a big backlog of work, 2.92 GWp worth of projects it has already won but hasn’t started yet. It expects to finish this work over the next 12-15 months.

GWp means gigawatt peak, or the maximum power a solar project can produce under ideal sunlight.

It’s also still hunting for more business. The company says its upcoming bids pipeline is strong at around 29 GWp.

And it’s expanding too. The board has approved a capex budget to set up a 120 MWp solar power park in Buldhana, Maharashtra, as the company looks to scale up faster in India’s booming solar market.

3. Gujarat says hello to Maruti Suzuki 👋

Maruti Suzuki plans to invest ₹35,000 crore in a new Gujarat facility, potentially adding up to 1 million vehicles in annual capacity, with a sharp focus on exports.

Production is expected to begin in FY2029, adding to Maruti’s existing annual capacity of 2.4 million vehicles.

Exports are already doing the heavy lifting. In 2025, Maruti shipped a record 3.95 lakh vehicles overseas, up over 21% year-on-year, and retained its position as India’s largest passenger vehicle exporter for the fifth straight year.

Gujarat’s logistics and port access make it a natural choice as Maruti looks to serve global markets more efficiently.

The expansion points to a broader shift in India’s auto industry, where scale and export competitiveness now matter just as much as domestic demand. For Maruti, this move is about more than adding capacity. It reflects a growing confidence in India as a manufacturing base that can serve global markets over the long run.

4. Snabbit buys Pync 🤝

Quick home services startup Snabbit has brought Pync’s cofounders on board as part of an acquihire, placing them in key operations and business roles.

What they do: Snabbit is a quick-service app that provides on-demand house help for tasks like cleaning, laundry, dishwashing, and ironing within minutes in major Indian cities.

Founded in 2023, Pync started as a car-cleaning subscription and later pivoted to quick home services, operating in Bengaluru and serving 25,000+ households.

That experience is now the real value Snabbit is picking up. By absorbing Pync’s workforce, Snabbit gets an immediate operational boost in Bengaluru, while the incoming leadership adds hands-on experience in scaling a labour-heavy business.

The timing is notable. Snabbit is exploring a $100 million funding round, and moves like this signal to investors that the company understands where real leverage lies.

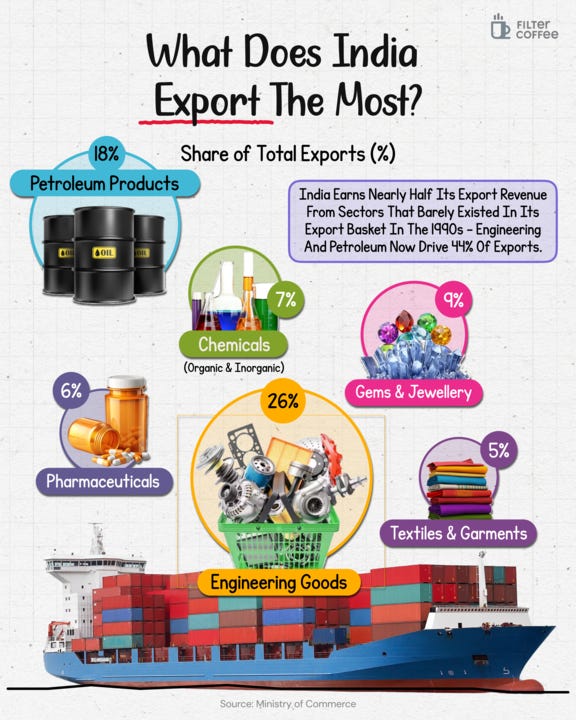

5. Story in Data:What does the world buy from India today? 📈

India’s export story today is very different from what it looked like a few decades ago. Engineering goods now lead the pack, making up 26% of total exports.

Think machinery, auto parts, industrial equipment, the stuff that keeps global factories running.

Behind that, petroleum products contribute 18%, followed by gems and jewellery at 9%, chemicals at 7%, pharmaceuticals at 6%, and textiles and garments at 5%.

The takeaway: sectors that barely existed in India’s export basket in the 1990s now drive nearly half of export revenues. India isn’t just shipping goods anymore, it’s exporting capability.

6. Stocks that kept us interested 🚀

1. ZEN Tech secures ₹404 crore defence order 💰

ZEN Technologies gained more than 8% on Friday after it bagged ₹404 crore order from the Ministry of Defence (MoD).

What’s the deal: the order includes ₹332 crore for Anti-Drone Systems / Counter Unmanned Aerial Systems (C-UAS) and ₹72 crore for training simulators & equipment.

The C-UAS chunk is essentially a full “spot–track–stop” package designed to detect suspicious drones.

Why it matters: anti-drone/Counter-UAS systems because drones have gone from being hobby gadgets to cheap, low-risk weapons and smuggling tools.

These drones are used to drop arms, ammunition, and narcotics, forcing security forces to invest in systems that can detect, track, jam, and neutralise threats safely.

2. L&T bags mega LNG order worth ₹2,500–5,000 crore 🛢️

Larsen & Toubro’s stock edged up after it won a large hydrocarbon project from Petronet LNG. However the stock couldn’t hold up the gains as it ended lower.

All about the deal: the project includes building massive LNG, ethane, and propane storage tanks, along with handling and dispatch facilities.

L&T will build huge tanks to store LNG, ethane, and propane, and set up systems to move these fuels safely to factories that turn them into everyday products like plastics and packaging.

Big theme: Hydrocarbons are central to India’s economy, powering everything from cooking gas and transport fuel to plastics, fertilisers, and everyday packaging that people use daily.

India imports most of its crude oil and a growing share of natural gas, which makes storage, processing, and domestic infrastructure extremely important.

What else are we snackin’ 🍿

🚃 Rail push: BHEL has begun supplying traction transformers for Vande Bharat Sleeper trains, boosting its push into semi-high-speed rail up to 160 kmph.

💵 Billion-dollar battle: Elon Musk wants up to $134 billion from OpenAI and Microsoft, saying OpenAI broke its original promise to stay non-profit.

🇺🇲 Tariff hit: US senators urge President Trump to press India to scrap 30% pulse import duties, saying American pea farmers are losing out.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.