Auto sales revs up, Hitachi-OpenAI join forces, and India’s data centre eyes IPO.

🗓 Morning, folks! It’s a new week.

💡 Spotlight: Festive GST fuels september auto sales

GST cuts have given the auto industry a much-needed festive spark.

Passenger vehicles raced ahead in September, clocking high single-digit growth in domestic wholesales, while two-wheelers showed a mixed yet promising trend.

Among the winners: Maruti Suzuki kept its crown, Tata Motors roared into a record-breaking second, Mahindra revved up SUVs to clinch third, while Hyundai slipped to fourth despite strong SUV sales.

Two-wheelers also got a festive lift, with some categories zooming into double-digit growth.

1 Big thing: Hitachi-OpenAI tie-up to boost AI and energy tech ⚡

Hitachi shares spiked 10% after the Japanese electronics giant announced a strategic partnership with OpenAI to collaborate on energy, AI, and digital solutions.

The deets: the tie-up covers Hitachi’s power grid operations, cooling gear, storage, and its digital solutions platform - Lumada. The deal aims to blend Hitachi’s industrial muscle with OpenAI’s AI technology.

Why it matters: the deal could boost orders for Hitachi Energy, which already makes up more than 20% of Hitachi’s operating profit. It may also help revive the company’s storage unit, which has been struggling with weak demand, by creating new opportunities to supply AI-driven data storage equipment.

AI-driven energy systems use artificial intelligence to manage electricity smarter, predicting demand, balancing power grids, and cutting waste. It also means computers organize and store huge amounts of data more efficiently, making it faster and cheaper to access and use.

Note: this also comes at a time when OpenAI has planned to open its first India office in New Delhi later this year, with hiring already underway.

Zoom out: in India, the AI + energy + data storage space is still young but scaling fast. Power utilities are adopting AI-driven grid management to cut losses, predict demand, and integrate renewables like solar and wind.

Companies like Jio, Adani, Yotta, and global players are building massive data center campuses across India. This push is set to double India’s capacity to ~2,000 MW by 2026, making it the third-largest market in Asia after China and Japan.

2. Abu Dhabi’s IHC puts $1 billion bet on India’s housing finance 🏠

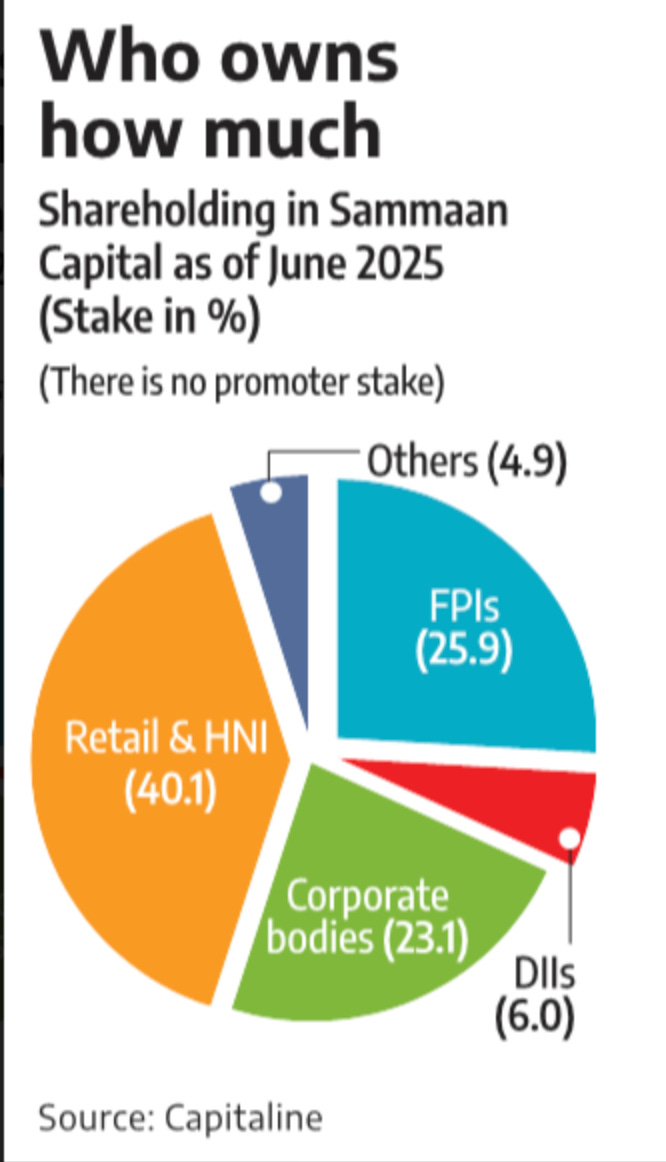

Abu Dhabi’s International Holding Company (IHC) is set to invest ₹8,850 crore (around $1 billion) for a 43.4% stake in Sammaan Capital. However, the stock tumbled 3% in Friday’s trading session.

Sammaan Capital is an upper tier Non-Banking Finance Company (NBFC) that provides home loans, construction finance, and mortgage lending to individuals and developers.

Context: IHC has emerged as a leading holding company in the Middle East and one of the world’s largest investment firms, boasting a market cap of $239.9 billion. In recent years, it has stepped up its India play with marquee bets, including investments in the Adani Group and snack giant Haldiram’s.

Breaking it down: this deal allows the global investor to become the main backer with a 43.4% stake. It’s also IHC’s first big step into India’s financial services sector, and the largest-ever single investment of fresh capital in an NBFC in the country.

What’s in-store for Sammaan: it will help strengthen their affordable housing and mid-market mortgage offerings.

3. Sify Infinit eyes $500m in India’s first data centre IPO 🚀

Sify Infinit Spaces is preparing to file for a $500 million IPO in the next two weeks.

Worth noting: if the process goes through, this could be the first Indian data-centre operator to list on the stock exchanges.

Sify Infinit Spaces runs big data centres that store and manage digital data for companies, apps, and cloud services in India.

The deets: the IPO will include both new and existing shares. Deliberations on the share sale are ongoing and the details could still change.

The raise comes amid a surge in data centre investments, fueled by digital growth, AI, and localisation norms.

Why it matters: India’s demand for data centers is set to more than double over the next three years and an investment of about $10.1 billion will be needed to meet the expansion.

Sify Infinit is among the key local companies operating in India’s data-center space, which also has presence of global players such as NTT Inc. of Japan, Temasek-backed STT Global Data Centres and Carlyle Group-backed Nxtra Data.

4. Unicorns are back 🦄

Our friends at Raise Financial just wrapped up a kickass $120 million (₹1,000 crore) funding round led by Hornbill Capital, with participation from Japan’s MUFG, BeeNext, and a host of other angels pitching in too.

The round values the company at $1.2 billion (₹10,000 crore), a massive leap from its $22 million Series A in 2022 led by Mirae Asset and 3one4 Capital.

The fresh capital will fuel Raise’s next leg of growth, scaling its MTF book, expanding distribution through omnichannel networks, and sharpening its AI stack under Fuzz. All while doubling down on Dhan, its flagship platform that now serves nearly a million active users and continues to redefine India’s brokerage game.

5. Market Bites this week

Why is India’s paint empire slowing after decades of growth?

Every Diwali, as families argue over almond white vs. pearl white, paint companies gear up for their Super Bowl. The festive quarter drives nearly 35% of annual sales, and this year, the stakes are higher than ever.

After two decades of steady growth, India’s ₹70,000 crore paint industry saw its first revenue dip in FY25. Rising home loan costs, early monsoons, and price wars from new entrants like Birla Opus and JSW Paints have shaken up a once-stable market.

Asian Paints and Berger are now defending their turf as conglomerates with deep pockets and distribution muscle storm the gates.

But despite slowing urban demand, the long-term story remains bright. Repainting cycles are shorter, rural sales are strong, and a recent GST cut from 28% to 18% has brightened sentiment, just in time for Diwali’s fresh coat.

Full story here.

6. Stocks that kept us interested 🚀

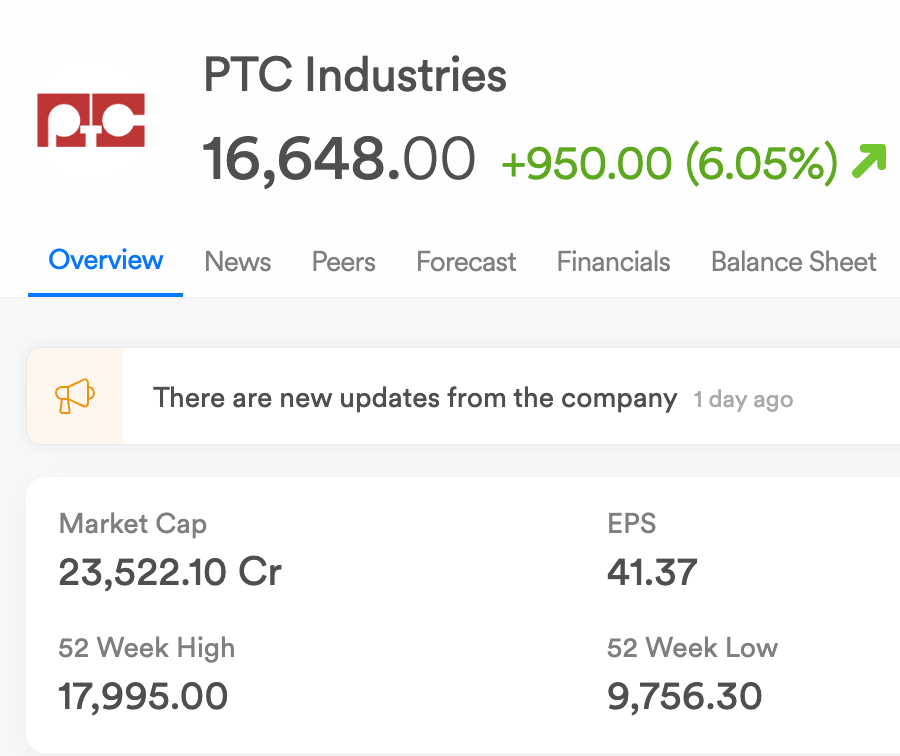

1. PTC- Finland’s Coolbrook join hands for India’s green push 🌱

PTC Industries shares went up 6% after its arm Trac Precision Solutions secured a multi-million-pound partnership with Finland-based Coolbrook.

Coolbrook develops tech that hits 1,700°C, helping cut carbon emissions in tough industries like cement, steel, petrochemicals, and chemicals.

What’s happening: the contract is to supply and cast components for its RotoDynamic Heater (RDH). The technology is designed to electrify high-temperature industrial heating processes and is aimed at reducing global carbon dioxide emissions.

Why it matters: the partnership diversifies Trac’s operations beyond aerospace and power generation into industrial decarbonisation. For Cookbrook, revenues are projected to exceed £10 million annually as Coolbrook expands its customer base.

Big theme: as of 2024, 37% of global energy consumption comes from industry, including chemicals, manufacturing, and pulp and paper. About two-thirds of this is used for heat generation, over 20% of total global demand and a major source of emissions.

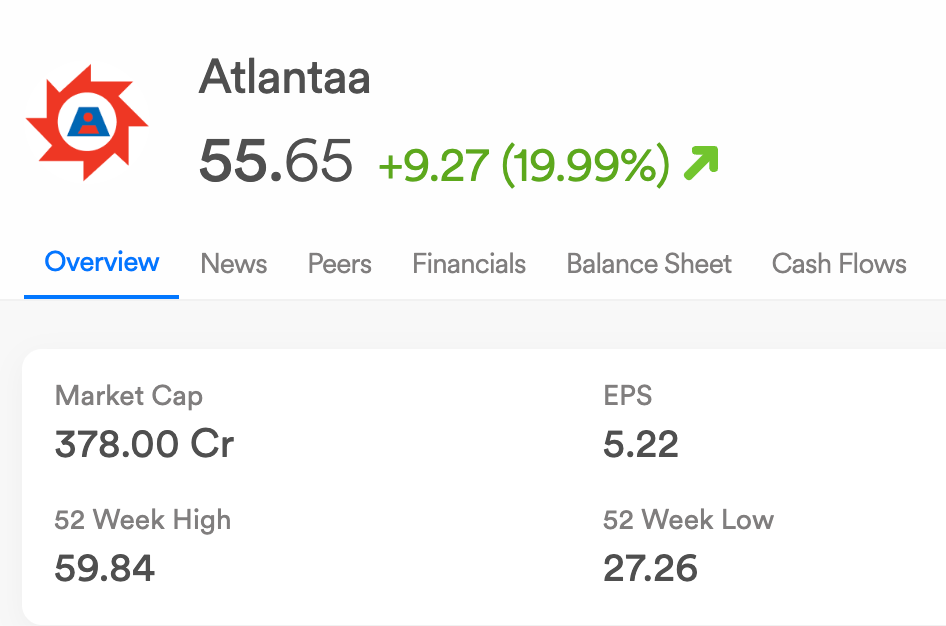

2. Atlantaa surges as IRCON deal tops its market capitalisation ⚡

Atlantaa jumped 20% after bagging a ₹2,485 crore expressway contract from IRCON International.

Atlantaa is a small-cap infrastructure company that builds roads, highways, and bridges on engineering and construction contracts.

Note: this deal is worth nearly 6x its entire market cap of ₹456 crore.

Not stopping there: this is also the fourth straight time the stock has been locked in a 20% upper circuit since September 1. The stock turned positive for the year following Friday’s sharp surge.

The deets: the order is for building part of the Bhandara-Gadchiroli Access Controlled Expressway in Maharashtra.

Atlantaa will construct the BG-03 package, covering the stretch from Sarandi in Bhandara district to Kinhi in Chandrapur.

Why IRCON chose Atlantaa: despite being a small-cap player with no mutual fund backing, Atlantaa has a track record in road construction.

What else are we snackin’ 🍿

💰 Valuation boost: OpenAI hit a $500B valuation after a $6.6B share sale involving top investors, surpassing SpaceX and strengthening Microsoft ties.

💧 Water move: Reliance Consumer enters India’s packaged water game with Campa Sure, a budget brand set to take on Bisleri and Kinley.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.